Hotel Development Financial Model Excel Template

Rated 5.00 out of 5

Fully editable Hotel Development Financial Model Template in Excel, designed to provide a detailed and professional 10-year financial plan tailored for greenhouse farm startups. This pre-built model offers extensive features to streamline financial forecasting, investment analysis, and strategic planning.

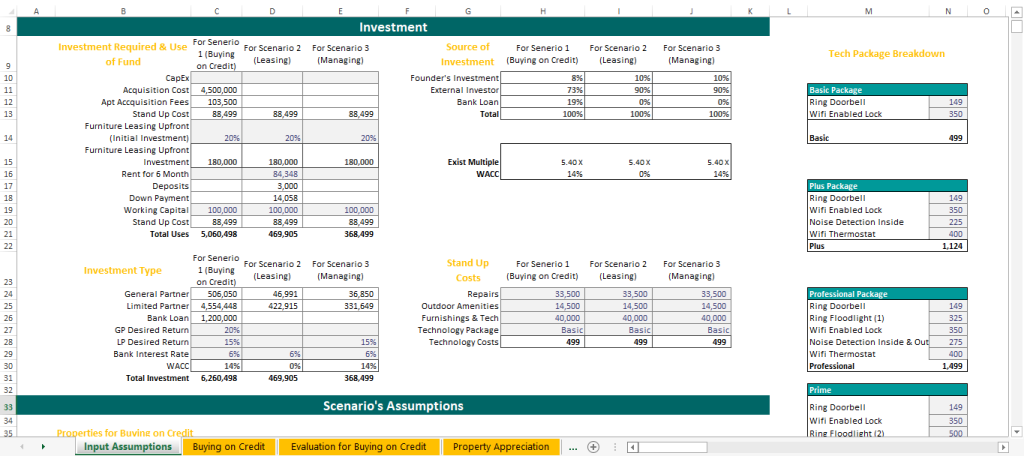

- Detailed Driver’s Assumptions i.e. Investment, Construction Planning, Gantt Chart, Revenue & Cost Assumptions

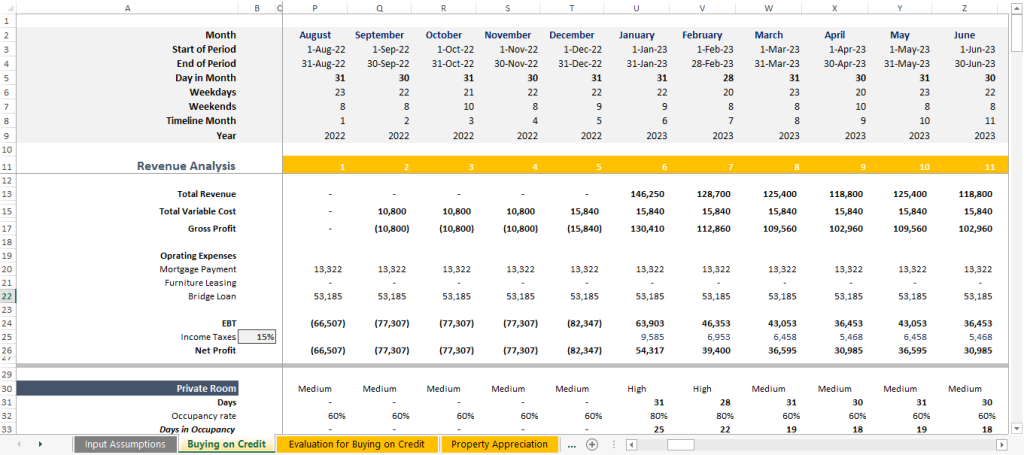

- Upto to 10-Year & Monthly Forecasting Model

- Financial Projections With P&L, Cash Flow, Balance Sheet

- Detailed Headcount, Expenses & CAPEX Planning

- Detailed Valuation i.e. DCF Valuation, EBITDA & Revenue Multiple Valuation, Market Value, Investor Valuation, Pre & Post Money Valuation.

- Breakeven Analysis, NPV, IRR, consolidated and each project

- Sensitivity Analysis, KPIs & Metrics, Burn Rate, Cash Runway

- Fully editable