What is SBA Loans: Complete Overview

- Hammad Hasan

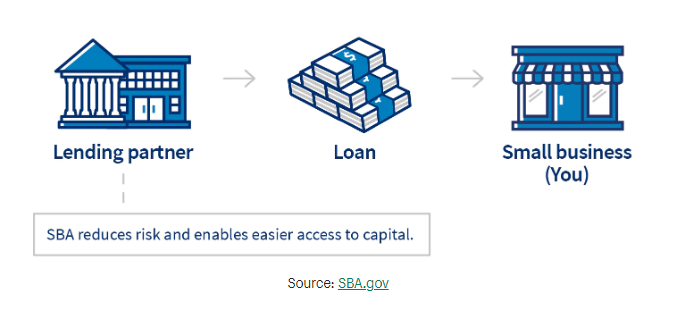

The SBA, or Small Business Administration, Loan is a financial assistance program provided by the U.S.A Small Business Administration. The SBA does not directly lend money to small businesses but rather guarantees a portion of loans offered by participating lenders, such as banks and credit unions. This guarantee reduces the risk for lenders, making it easier for small businesses to obtain funding.

SBA loans are designed to support small businesses that may have difficulty qualifying for traditional loans due to factors such as limited collateral or a short operating history.

These loans can be used for various purposes, including starting a new business, purchasing real estate or equipment, working capital, and refinancing existing debt.

Types of SBA Loans

The SBA offers several loan programs, including:

7(a) Loan Program

This is the primary and most flexible SBA loan program. It provides funding for general business purposes, including working capital, expansion, and equipment purchases.

CDC/504 Loan Program

This program is focused on financing fixed assets such as land, buildings, and machinery. It provides long-term, fixed-rate financing through Certified Development Companies (CDCs) in partnership with private lenders.

Microloan Program

This program offers small loans up to $50,000 to help start-ups and small businesses with short-term needs for working capital, inventory, equipment, and other purposes.

Disaster Loans

These loans are available to businesses affected by natural disasters, providing financial assistance for repairs, property replacement, and working capital.

In September 2021, the SBA Community Advantage Loan was a program offered by the U.S. Small Business Administration to help small businesses in underserved communities gain access to funding. This program was designed to provide loans to businesses that may have difficulty obtaining traditional financing due to factors such as location, economic conditions, or other constraints.

he key features of the SBA Community Advantage Loan program typically included:

Lower Interest Rates: These loans often came with lower interest rates compared to some other commercial loans, making them more affordable for small businesses.

Flexible Use: Borrowers could use the funds for various business purposes, such as working capital, purchasing equipment, refinancing existing debt, or expansion.

Longer Repayment Terms: The loans usually had longer repayment terms than traditional loans, which could help ease the financial burden on small businesses.

Focus on Underserved Communities: The program was particularly targeted at businesses located in underserved areas, which could include rural communities or economically disadvantaged urban neighborhoods.

SBA Guarantees: Like other SBA loan programs, the Community Advantage Loan program involved a partial guarantee by the SBA to lenders, reducing the risk for lenders and potentially making them more willing to lend to small businesses.

SBA loans typically have longer repayment terms, lower interest rates, and more flexible requirements compared to conventional loans. However, the application process can be more involved, and borrowers must meet certain eligibility criteria, such as being a small business based in the United States and demonstrating the ability to repay the loan.

It’s important to note that the specific details and availability of SBA loans may change over time, so it’s advisable to consult the official Small Business Administration website or speak with an SBA-approved lender for the most up-to-date information.

How do SBA loans work:

SBA loans work by providing a government guarantee to lenders, reducing their risk and making it easier for small businesses to obtain financing. Here’s a general overview of how SBA loans work:

Eligibility and Application: Small businesses must meet certain eligibility criteria to qualify for SBA loans. This includes being a for-profit business, operating in the United States, meeting size standards set by the SBA, and demonstrating the ability to repay the loan. The business typically needs to provide documentation such as financial statements, business plans, and tax returns. The application process involves applying through an SBA-approved lender, such as a bank or credit union.

Loan Programs and Types: The SBA offers various loan programs to meet different business needs. The most common is the 7(a) Loan Program, which provides funding for general business purposes. Other programs include the CDC/504 Loan Program for fixed assets, the Microloan Program for smaller loan amounts, and Disaster Loans for businesses affected by natural disasters.

Lender Evaluation: Once the application is submitted, the lender evaluates the business’s creditworthiness and repayment ability. They consider factors such as credit history, cash flow, collateral, and the business owner’s experience. The lender assesses the loan application based on their own criteria as well as SBA guidelines.

SBA Guarantee: If the lender approves the loan but requires additional support, they can seek an SBA guarantee for a portion of the loan. The SBA provides a guarantee ranging from 50% to 85% of the loan amount, depending on the program and loan size. This guarantee helps mitigate the lender’s risk.

Loan Terms and Funding: If approved, the borrower and lender negotiate loan terms, including interest rates, repayment period, and collateral requirements. SBA loans typically offer longer repayment terms compared to conventional loans, ranging from several years to decades. Once the loan terms are finalized, the funds are disbursed to the borrower.

Repayment: Borrowers are responsible for repaying the loan according to the agreed-upon terms. Payments are typically made on a monthly basis and include both principal and interest. Late or missed payments can have consequences, such as penalties and damage to the borrower’s credit.

It’s important to note that while the SBA guarantees a portion of the loan, the borrower remains responsible for repaying the full amount to the lender. The SBA’s role is to facilitate access to capital by reducing the risk for lenders, but it does not directly lend money to small businesses.

The specific details of SBA loans may vary depending on the loan program, lender, and individual circumstances. It’s advisable to consult with an SBA-approved lender or visit the Small Business Administration’s website for comprehensive and up-to-date information on SBA loans.

Pros & Cons of SBA Loans

Pros of SBA Loans:

Lower Interest Rates: SBA loans generally offer lower interest rates compared to conventional loans, making them more affordable for small businesses.

Longer Repayment Terms: SBA loans often have longer repayment terms, which can help reduce monthly payment amounts and improve cash flow.

Access To Capital: SBA loans provide access to capital for small businesses that may have difficulty obtaining financing through traditional channels due to limited collateral or a short operating history.

Flexible Use Of Funds: SBA loans can be used for various purposes, including working capital, purchasing real estate or equipment, and refinancing existing debt.

Guarantees From The SBA: The SBA guarantees a portion of the loan, reducing the risk for lenders and increasing the likelihood of approval for borrowers.

Cons of SBA Loans:

Lengthy Application Process: The application process for SBA loans can be more involved and time-consuming compared to conventional loans. It may require extensive documentation and detailed financial information.

Strict Eligibility Criteria: Borrowers must meet specific eligibility criteria to qualify for SBA loans. This can include being a small business based in the United States, meeting size standards, and demonstrating the ability to repay the loan.

Collateral Requirements: Although SBA loans may require less collateral compared to traditional loans, lenders may still require a personal guarantee and collateral for the loan, which can be a challenge for some small businesses.

Potential For Slower Funding: Due to the additional steps involved in the SBA loan process, the funding timeline can be longer compared to conventional loans. This can be a disadvantage if the business requires immediate capital.

SBA Fees: SBA loans often have fees associated with them, such as guarantee fees, packaging fees, and servicing fees. These fees can increase the overall cost of the loan.

It’s important to carefully consider these pros and cons in the context of your specific business needs and circumstances before deciding to pursue an SBA loan.

SBA Loan Requirements in 2023

The documents and application requirements for an SBA loan 2023 can vary depending on the specific loan program, lender, and the nature of your business. However, here is a list of commonly requested documents and information that may be required during the SBA loan application process:

Business Plan: A detailed business plan that includes information about your business, its products or services, market analysis, marketing strategies, financial projections, and management team.

Personal Background Information: Personal background information for each owner of the business, including resumes, previous business experience, and personal financial statements.

Financial Forecasting: Financial forecasting for the business, including balance sheets, profit and loss statements (income statements), and cash flow statements for the past few years (if available). This may also include interim financial statements for the current year.

Personal Financial Statements: Personal financial statements for each business owner, including personal assets and liabilities, income tax returns, and other supporting documentation to assess personal financial standing.

Tax Returns: Business and personal federal income tax returns for the previous few years.

Bank Statements: Recent bank statements for both personal and business accounts.

Business Legal Documents: Legal documents related to your business, such as articles of incorporation, business licenses, leases, contracts, and any other relevant legal agreements.

Collateral Documentation: Documentation related to collateral that may be required for the loan, such as property appraisals, real estate deeds, equipment valuations, and other supporting documents.

Use of Funds: A detailed explanation of how the loan proceeds will be used within your business.

SBA Forms: Various SBA forms and applications, such as SBA Form 1919 (Borrower Information Form) and SBA Form 413 (Personal Financial Statement), among others. These forms are typically provided by the lender during the application process.

It’s important to note that the specific documentation requirements can vary depending on factors such as the loan program, loan amount, and lender’s policies. It’s advisable to consult with the lender directly or review their application checklist to ensure you have all the necessary documents prepared for your specific SBA loan application.

Which bank Provides SBA Loans In 2023

Many banks and financial institutions across the United States provide SBA loans. Here are some well-known banks that are known to offer SBA loans:

Wells Fargo: Wells Fargo is one of the largest SBA lenders in the country and offers various SBA loan programs, including the 7(a) Loan Program and the CDC/504 Loan Program.

Bank of America: Bank of America is another major lender that offers SBA loans. They provide financing options such as SBA 7(a) loans, SBA 504 loans, and SBA Express loans.

JPMorgan Chase: JPMorgan Chase is a prominent bank that participates in the SBA lending program. They offer SBA 7(a) loans and SBA 504 loans to eligible small businesses.

U.S. Bank: U.S. Bank is a national lender that offers SBA loans to small businesses. They provide financing options such as SBA 7(a) loans, SBA Express loans, and SBA 504 loans.

TD Bank: TD Bank is another institution that offers SBA loans to small businesses. They provide SBA 7(a) loans, SBA Express loans, and other financing options for eligible businesses.

PNC Bank: PNC Bank is known to offer SBA loans, including SBA 7(a) loans and SBA Express loans, to small businesses in need of funding.

These are just a few examples of banks that provide SBA loans. However, it’s important to note that availability and terms may vary from one bank to another, and the list is not exhaustive. It’s recommended to reach out to local community banks, credit unions, and regional banks in your area as they may also offer SBA loans. Additionally, you can visit the Small Business Administration’s website or contact your local SBA district office for a list of SBA-approved lenders in your area.

Factors Which Makes Disqualification from SBA Loans

Several factors can disqualify a business or an individual from obtaining an SBA loan. Here are some common reasons that may result in disqualification:

Insufficient Creditworthiness: If the business owner or the business itself has a poor credit history, including a low credit score, a history of bankruptcies, or outstanding tax liens, it can negatively impact the chances of obtaining an SBA loan.

Inadequate Cash Flow: Lenders typically assess the cash flow of a business to determine its ability to repay the loan. If the business does not generate sufficient cash flow to cover its expenses and debt obligations, it may be deemed ineligible for an SBA loan.

Incomplete or Inaccurate Documentation: Failing to provide accurate and complete documentation required for the loan application can result in disqualification. This includes financial statements, tax returns, personal financial statements, and other supporting documents.

Limited Business History: Some SBA loan programs require businesses to have a certain number of years in operation to be eligible. Startups or businesses with limited operating history may face challenges in obtaining an SBA loan.

Ineligible Business Type: Certain types of businesses are excluded from SBA loan eligibility. This includes businesses involved in speculative activities, lending, investment, gambling, pyramid sales, or those engaged in illegal activities.

Insufficient Collateral: While SBA loans typically require less collateral than traditional loans, providing some form of collateral may still be necessary. If a business lacks adequate collateral to secure the loan, it may be disqualified.

Owner’s Criminal Background: SBA lenders consider the criminal background of business owners during the loan evaluation process. Individuals with a history of felony convictions or certain types of criminal activities may be disqualified from obtaining an SBA loan.

Failure to Meet SBA Size Standards: The SBA has size standards that determine whether a business qualifies as a small business. If a business exceeds the size standards set by the SBA for its industry, it may be ineligible for certain SBA loan programs.

Ineligible Use of Funds: SBA loans have specific allowable uses of funds, and if the requested loan is intended for a purpose that falls outside those guidelines, it may result in disqualification.

It’s important to note that these factors are not exhaustive, and eligibility requirements can vary based on the specific loan program, lender, and individual circumstances. It’s advisable to consult with an SBA-approved lender or the Small Business Administration directly for comprehensive guidance and to determine specific eligibility criteria for the desired SBA loan.

8 Checklists For SBA Loan Approval

While there is no guaranteed way to expedite the SBA loan process or ensure approval, there are steps you can take to potentially speed up the process and increase your chances of obtaining an SBA loan. Here are some tips:

Prepare in Advance: Gather all the necessary documentation and information required for the loan application. This includes financial statements, tax returns, personal financial statements, business plans, and any other supporting documents. Being well-prepared will help streamline the application process.

Choose an Experienced SBA Lender: Work with a lender who has experience and expertise in processing SBA loans. They can guide you through the process, provide insights on eligibility requirements, and help expedite the loan application.

Understand the Loan Programs: Familiarize yourself with the different SBA loan programs and their requirements to determine which one suits your business needs. Understanding the specific program’s guidelines will help you prepare the necessary documents and meet the eligibility criteria more efficiently.

Maintain a Strong Credit Profile: A good credit history and a solid credit score can enhance your chances of approval. Ensure that your personal and business credit profiles are in good standing by making timely payments, managing debt responsibly, and resolving any credit issues.

Provide Complete and Accurate Information: Submitting a comprehensive and error-free loan application can help avoid delays. Double-check all information, financial statements, and supporting documents for accuracy and completeness.

Communicate Proactively: Stay in regular contact with your lender throughout the loan application process. Be responsive to requests for additional information or documentation. Proactive communication can help address any concerns or questions promptly and ensure a smoother process.

Seek Professional Assistance If Needed: Consider working with a financial advisor, accountant, or attorney experienced in SBA loans. They can provide guidance, review your application, and help you present your case in the best possible way.

Explore Other Financing Options: While SBA loans are beneficial, they may not be the fastest option for obtaining funding. Consider alternative financing options, such as traditional bank loans, lines of credit, or other non-SBA loan programs, if speed is a crucial factor for your business.

Remember that the timeline for SBA loan approval and disbursement can still vary based on factors such as the lender’s processing times, loan program, complexity of the application, and current demand for SBA loans. It’s important to remain patient and maintain open communication with your lender throughout the process.

How To Apply For An SBA Loans 2023

To apply for an SBA loan, you can follow these general steps:

Determine Your Eligibility: Review the eligibility criteria for SBA loans, including factors such as business size, industry, and financial standing. Ensure that your business meets the SBA’s requirements for loan eligibility.

Identify The Right Loan Program: Explore the various SBA loan programs available and determine which one best suits your business needs. The most common SBA loan program is the 7(a) Loan Program, but there are others like the CDC/504 Loan Program and the Microloan Program. Each program has specific requirements and allowed uses of funds.

Gather Required Documentation: Prepare the necessary documentation and information required for the loan application. This typically includes business financial statements, personal financial statements, tax returns, business plan, resumes, and any other supporting documents. Refer to the lender’s application checklist or guidance to ensure you have all the required documentation.

Find An SBA-Approved Lender: Locate an SBA-approved lender who participates in the SBA loan program you are interested in. You can find a list of approved lenders on the Small Business Administration’s website or by contacting your local SBA district office.

Complete The Loan Application: Obtain the loan application forms from your chosen lender and complete them accurately and thoroughly. The lender will typically provide you with the necessary application forms, such as SBA Form 1919 (Borrower Information Form) and SBA Form 413 (Personal Financial Statement). Provide all the requested information and attach the required documentation.

Submit The Application: Once you have completed the application, submit it to the lender along with all the required documentation. Ensure that you have provided all the necessary information and signed all required forms.

Await Lender’s Review & Decision: The lender will review your application, assess your creditworthiness, evaluate your business plan, and analyze your financials. They may request additional documentation or clarification during the review process. Be responsive to any inquiries or requests from the lender.

SBA Guarantee Process: If the lender approves your application but requires an SBA guarantee, they will submit the loan package to the SBA for review. The SBA will review the application, assess your creditworthiness, and determine whether to approve the guarantee.

Loan Closing and Disbursement: If your application is approved by both the lender and the SBA, you will proceed to the loan closing process. This involves finalizing the loan terms, signing the loan agreement, and fulfilling any additional requirements. Once the loan is closed, the funds will be disbursed to your business as per the agreed terms.

It’s important to note that the specific process may vary depending on the lender, loan program, and individual circumstances. It’s advisable to consult with the lender directly and follow their specific application instructions and guidance. Additionally, seeking professional assistance from financial advisors or SBA resource partners, such as Small Business Development Centers (SBDCs) or SCORE, can provide valuable guidance and support throughout the application process.

What Kind Of Businesses Or Startups Can Apply For SBA Loans?

The Small Business Administration (SBA) provides loans and financial assistance to a wide range of businesses and startups. While the SBA aims to support small businesses in general, there are certain eligibility criteria and restrictions that businesses must meet to qualify for SBA loans. Here are some key considerations regarding the types of businesses that can apply for SBA loans:

Size Standards: The SBA defines size standards based on the industry and considers factors such as annual revenue, number of employees, or other relevant measures. Generally, businesses must fall within the SBA’s definition of a small business, which can vary by industry.

Legal Structure: SBA loans are typically available to businesses that operate as sole proprietorships, partnerships, limited liability companies (LLCs), corporations, or certain types of nonprofit organizations. Each loan program may have specific requirements regarding the legal structure of the business.

Industry Restrictions: The SBA has guidelines regarding the types of industries that are eligible for loans. While many industries are eligible, some restricted industries may include businesses involved in speculative activities, lending, investment, gambling, pyramid sales, or those engaged in illegal activities. It’s essential to review the SBA’s guidelines or consult with an SBA-approved lender to understand the eligibility of your specific industry.

Startup Businesses: Startups can also apply for SBA loans. However, since startups often have limited operating history, lenders may require additional documentation and a thorough business plan to assess their viability and creditworthiness.

Use of Funds: SBA loans can be used for various purposes, including working capital, purchasing inventory or equipment, acquiring real estate, refinancing debt, or funding expansion. The specific loan program may have certain restrictions on the use of funds, so it’s important to review the guidelines for the chosen loan program.

Creditworthiness: SBA lenders consider the creditworthiness of the business and its owners during the loan evaluation process. While specific credit score requirements may vary, a good credit history is generally advantageous for SBA loan eligibility.

It’s important to note that the eligibility criteria and restrictions may vary depending on the loan program, lender, and individual circumstances. It’s advisable to consult with an SBA-approved lender or review the official Small Business Administration guidelines for comprehensive information on eligibility requirements for the desired SBA loan.

Is It Important To Show Financial Forecast For SBA Loans?

Yes, it is generally important to include a financial forecast or projections when applying for an SBA loan. Financial forecasts provide lenders with an understanding of your business’s expected future financial performance, which helps them assess your creditworthiness and evaluate the feasibility of your loan repayment.

Here’s why including a financial forecast is important for SBA loans:

Demonstrating Repayment Ability: Lenders want to ensure that your business has the capacity to repay the loan. Including a financial forecast allows you to showcase your expected revenue, expenses, and cash flow projections over a specific period, typically three to five years. This information helps lenders evaluate your ability to generate sufficient cash flow to cover loan payments.

Assessing Business Viability: Financial forecasts provide insights into the viability and sustainability of your business. Lenders will review your projections to assess the potential profitability of your business and determine whether it has a realistic chance of success. They will evaluate key financial metrics, such as gross margins, net income, and debt service coverage ratio, to gauge the financial health of your business.

Planning for Growth or Expansion: If you are seeking an SBA loan to fund business expansion or growth initiatives, a financial forecast is crucial. It helps you outline your planned investment, anticipated revenue growth, and the impact of the loan on your financials. Lenders will assess the reasonableness and potential return on investment of your growth plans based on your financial projections.

Supporting Loan Justification: A well-prepared financial forecast can strengthen your loan application by providing a compelling case for the loan. It helps demonstrate how the loan will be used to achieve specific business objectives, such as increasing sales, expanding operations, or improving profitability. This information helps lenders understand the purpose and impact of the loan on your business.

When preparing a financial forecast for an SBA loan application, it’s important to be realistic and provide supporting assumptions and explanations for your projections. If you’re uncertain about financial projections or need assistance, consider consulting with a financial advisor, accountant, or business consultant experienced in creating financial projections.

Including a comprehensive and well-supported financial forecast can enhance your loan application and provide lenders with the confidence they need to consider your business for an SBA loan.