B2B SaaS Financial Model & Valuation Spreadsheet

Fully editable B2B SaaS Financial Model & Valuation Template in Excel, designed to provide a detailed and professional 5-year financial plan tailored for B2B SaaS startups. This pre-built model offers extensive features to streamline financial forecasting, investment analysis, and strategic planning.

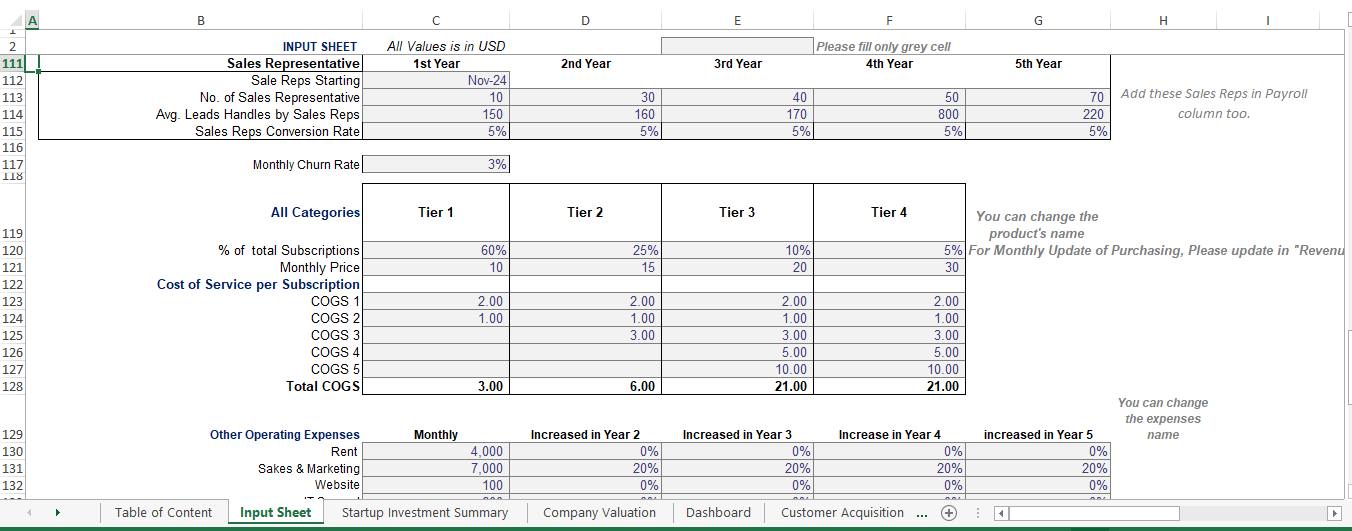

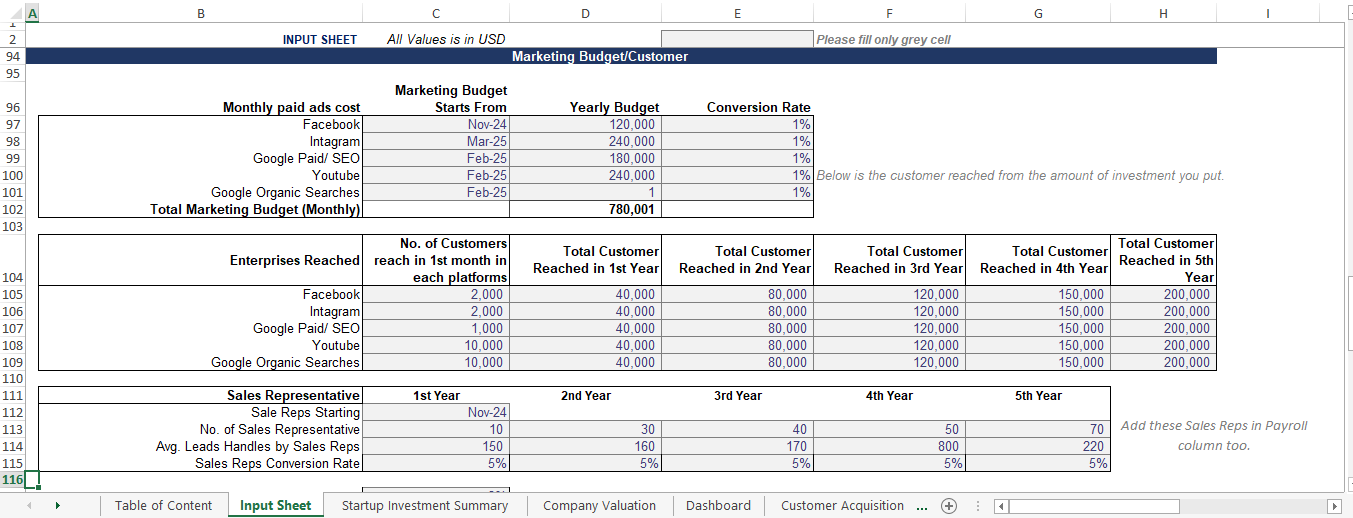

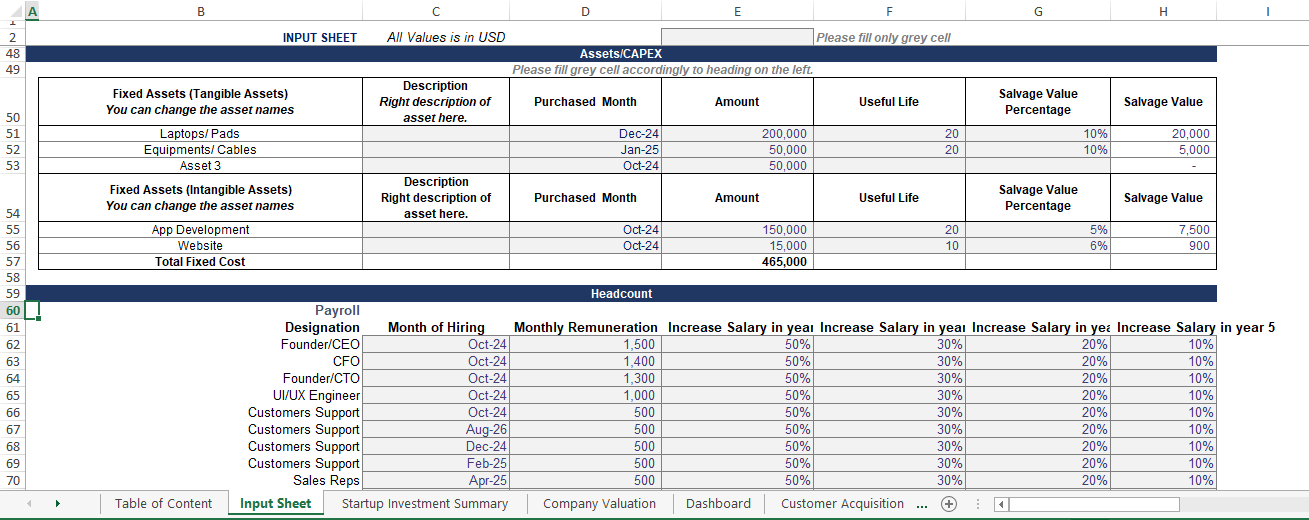

- Detailed Driver’s Assumptions i.e. Investment, Revenue & Cost Assumptions

- Upto to 5 Year Forecasting Model

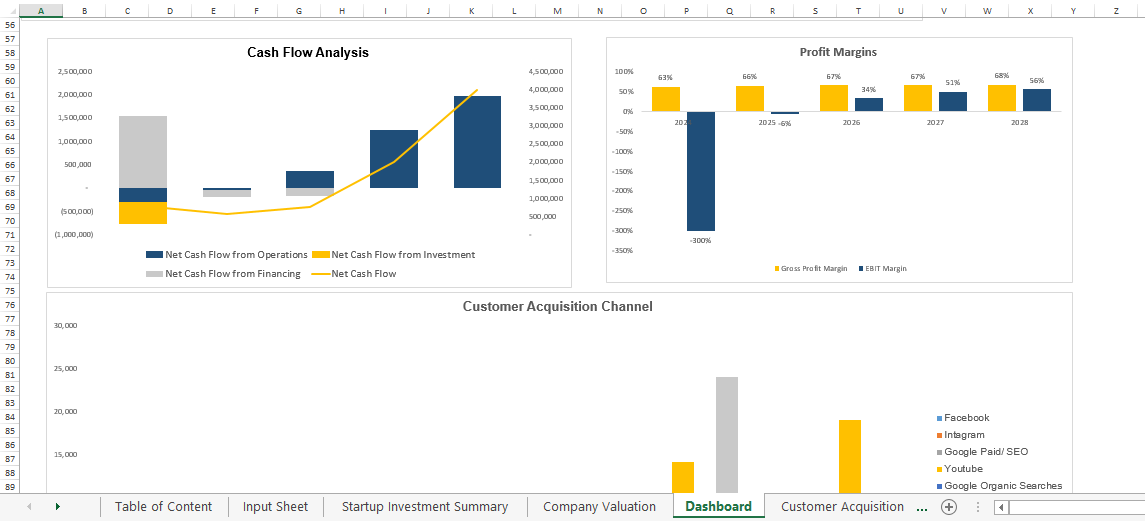

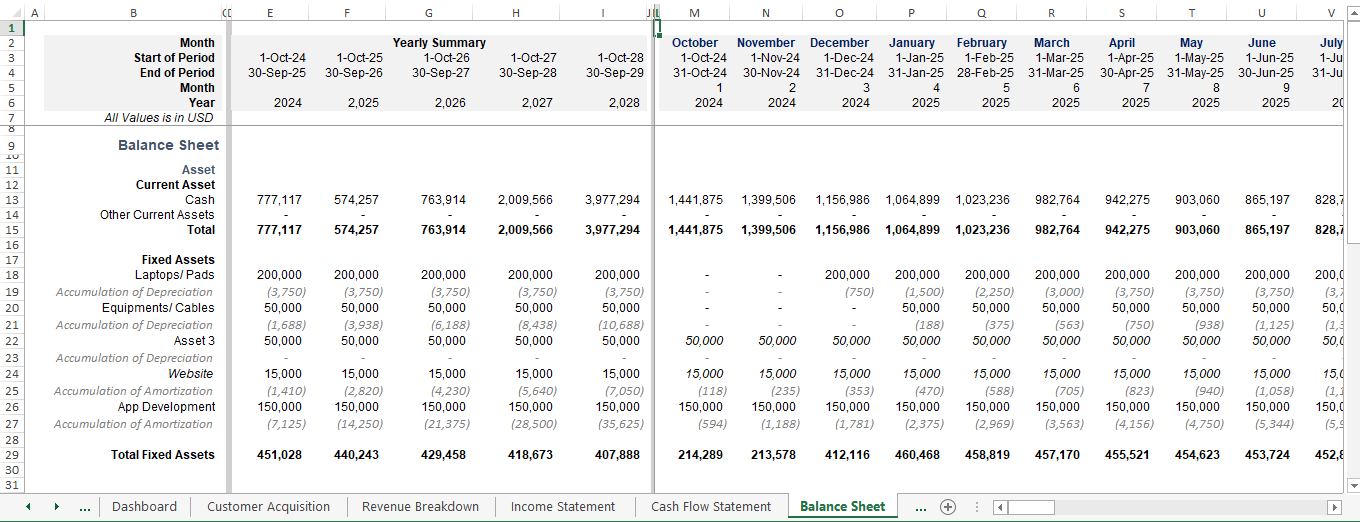

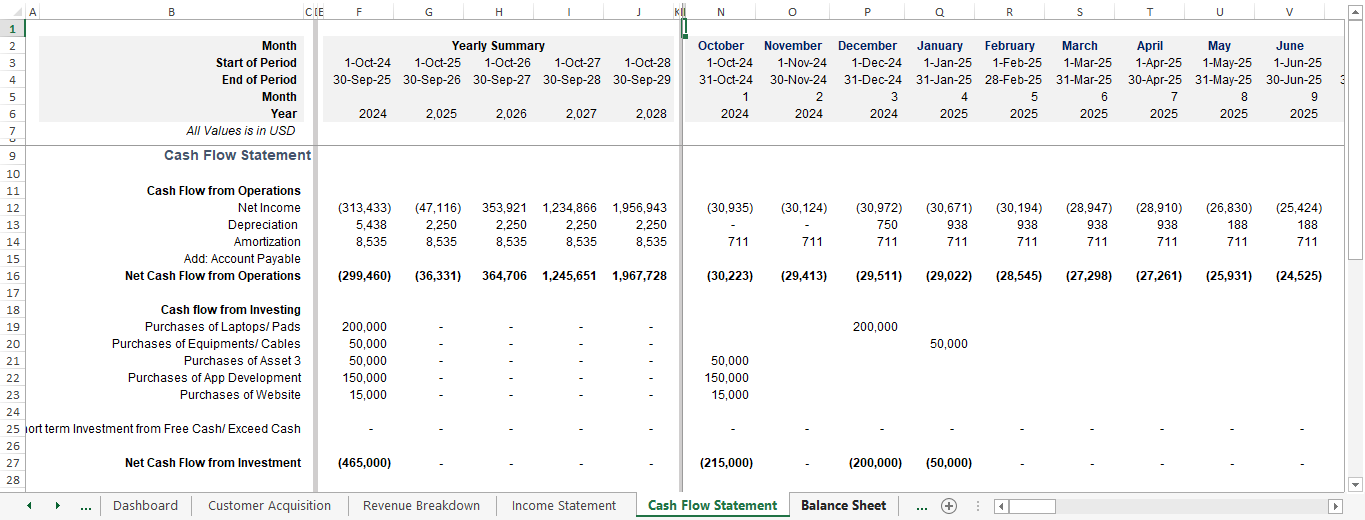

- Financial Projections With P&L, Cash Flow, Balance Sheet

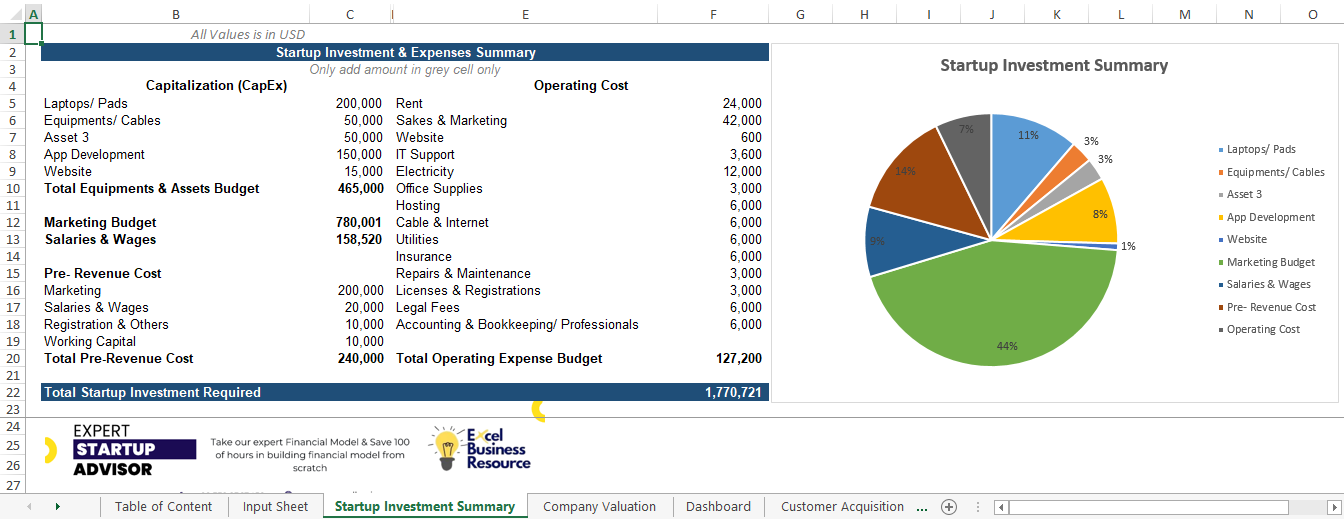

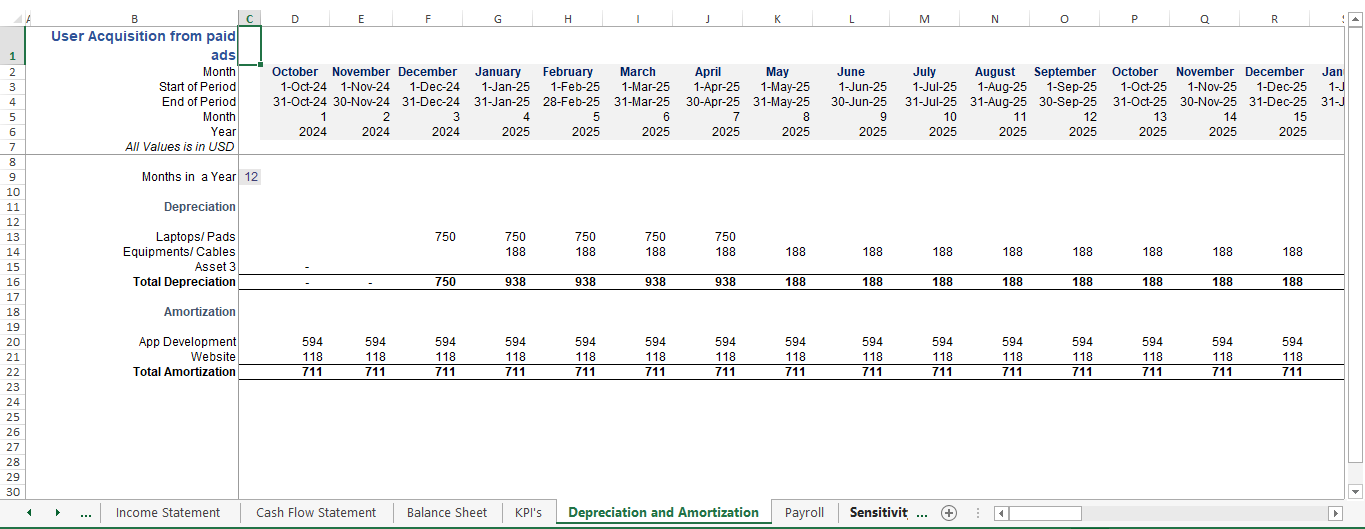

- Detailed Headcount, Expenses & CAPEX Planning

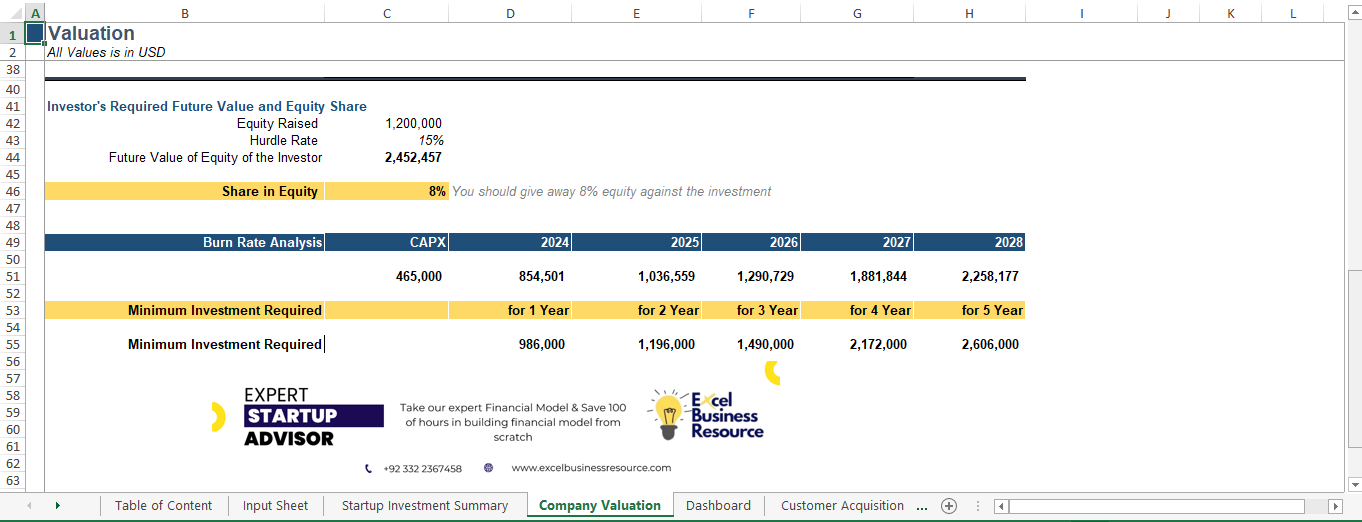

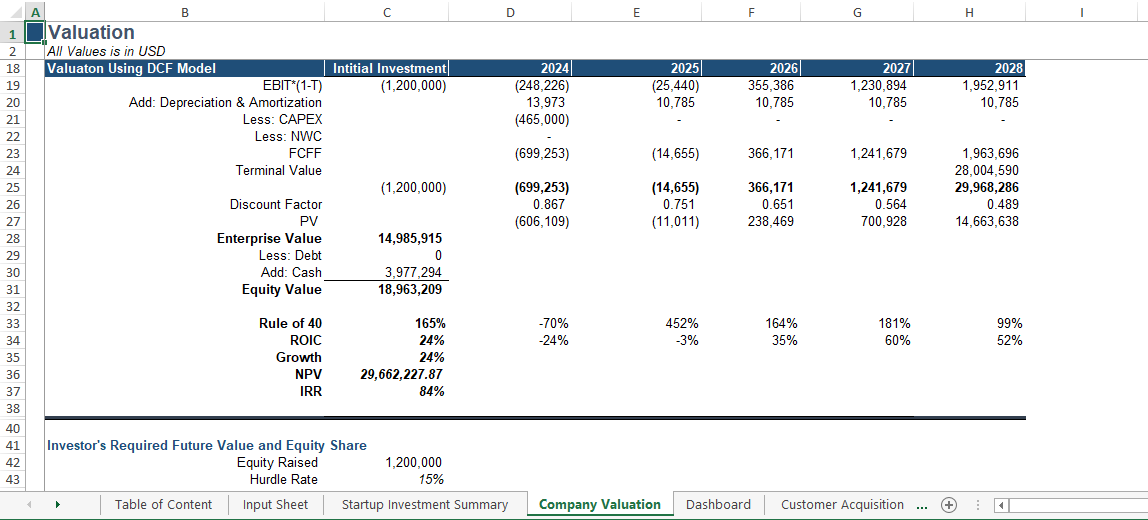

- Advance Valuation i.e. DCF Valuation, EBITDA & Revenue Multiple Valuation, Investor Valuation, Pre & Post Money Valuation.

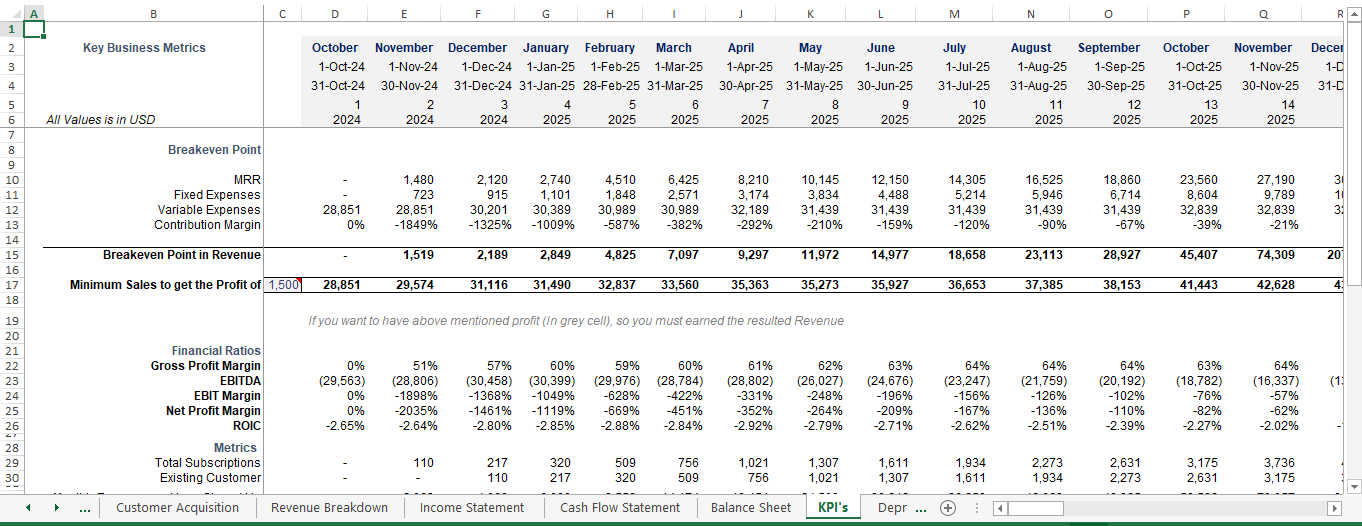

- Breakeven Analysis, NPV, IRR, consolidated and each project

- Sensitivity Analysis, KPIs & Metrics, Burn Rate, Cash Runway

- Fully editable

Why Choose Our B2B SaaS Financial Model & Valuation Spreadsheet

- Save 40 Hours of Manual Work

- 100+ Customized Assumptions

- Advanced Valuation Methods Applied

- In-depth Financial Projections

- Free Supports & Error Corrections

Description

B2B SaaS Financial Model & Valuation Spreadsheet

Download a comprehensive and Founder Ready B2B SaaS Financial Forecasting Template designed specifically for software startups and enterprise platforms. This Ready-to-use Excel model provides a robust 3-statement financial model for software companies, allowing you to project growth, calculate unit economics, and determine company value with precision

MODEL OVERVIEW

This B2B SaaS Revenue Model Excel is a highly versatile tool for preparing a B2B SaaS 5-year financial projection model. It streamlines the complex process of forecasting subscription revenue in Excel by integrating customer acquisition data, payroll, and capital expenditures into a seamless automated system.

Whether you are preparing for SaaS financial model for series A fundraising or conducting SaaS valuation spreadsheet for investor due diligence, this model covers every angle. It includes a dedicated SaaS valuation calculator using both DCF and Industry Multiples to answer the critical question: “How to value a B2B SaaS startup?”

BENEFITS & WHY USE THIS B2B SAAS FORECASTING MODEL

Investor Ready Professionalism: Present your numbers in a format that VCs and Angel Investors expect.

Data-Driven Decisions: Use the SaaS unit economics spreadsheet to track CAC, LTV, and Churn.

Time Saving: Skip the weeks of manual spreadsheet building with this Ready-to-use framework.

Scenario Planning: Use the SaaS pricing sensitivity analysis tool to see how changes in churn or pricing affect your cash runway.

Comprehensive Metrics: Automatically calculates key KPIs like MRR, ARR, and Burn Rate.

KEY OUTPUTS

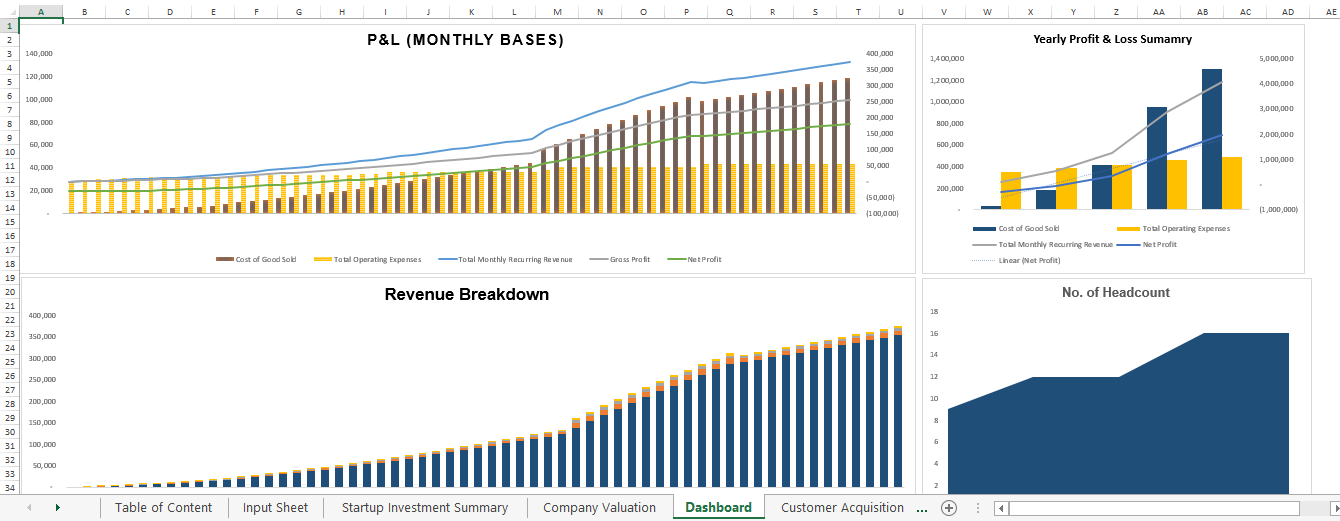

Full 5-Year Financial Statements: Integrated SaaS P&L and Cash Flow Template plus a detailed Balance Sheet.

Interactive Dashboard: A visual powerhouse featuring summarized income statements, cash flow charts, and growth trends.

Valuation Summary: Includes Pre- and Post-money valuation, Revenue Multiples, and EBITDA Multiples.

KPI Tracking: Automatic calculation of SaaS unit economics (CAC, LTV, LTV:CAC, Magic Number).

Sensitivity Analysis: Toggle between Actual, Low, Moderate, and Optimistic scenarios to stress-test your business.

KEY INPUTS

Setup & Investment:

Company Info: Name, Currency, and Business Start Date.

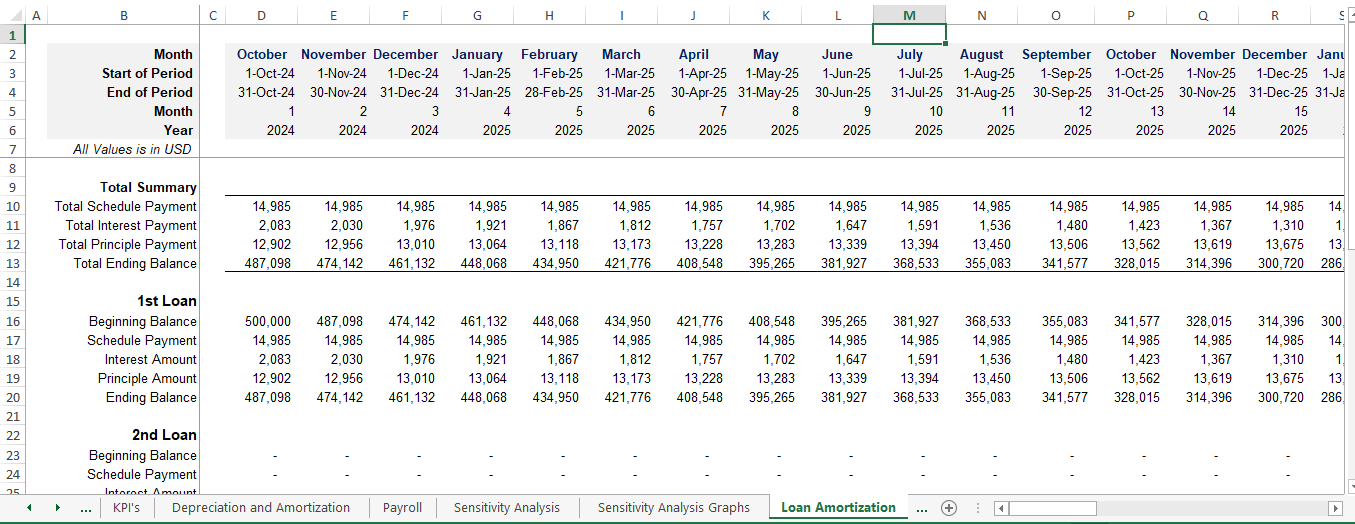

Funding & Loans: Round-based investment tracking and loan amortization schedules.

CapEx & OpEx: Detailed startup investment summary for hardware, software development, and office setup.

Revenue & Growth:

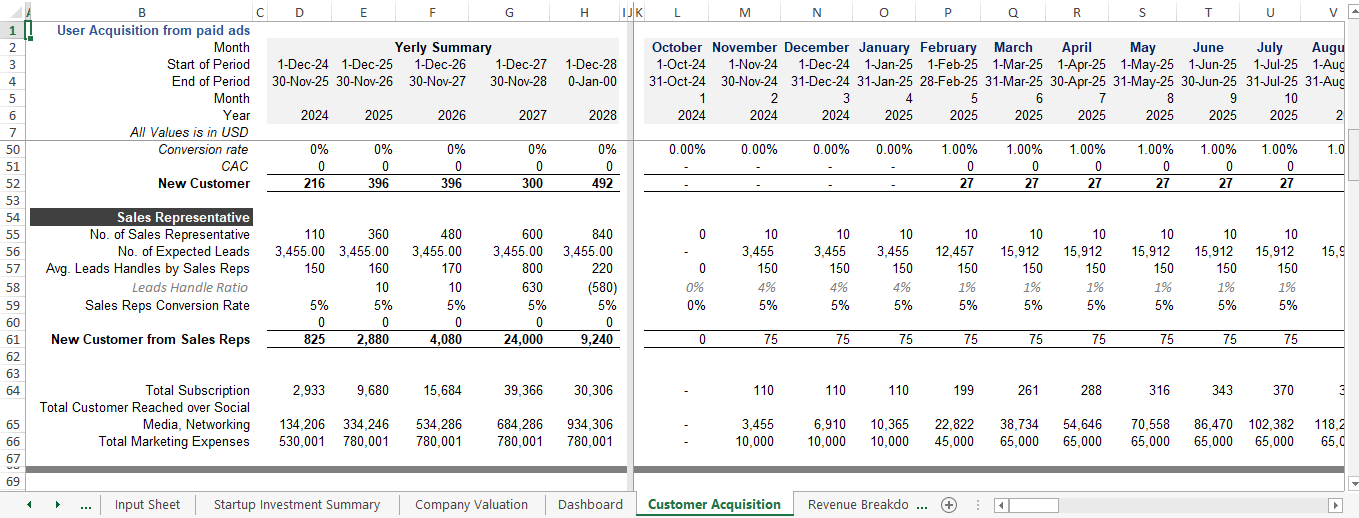

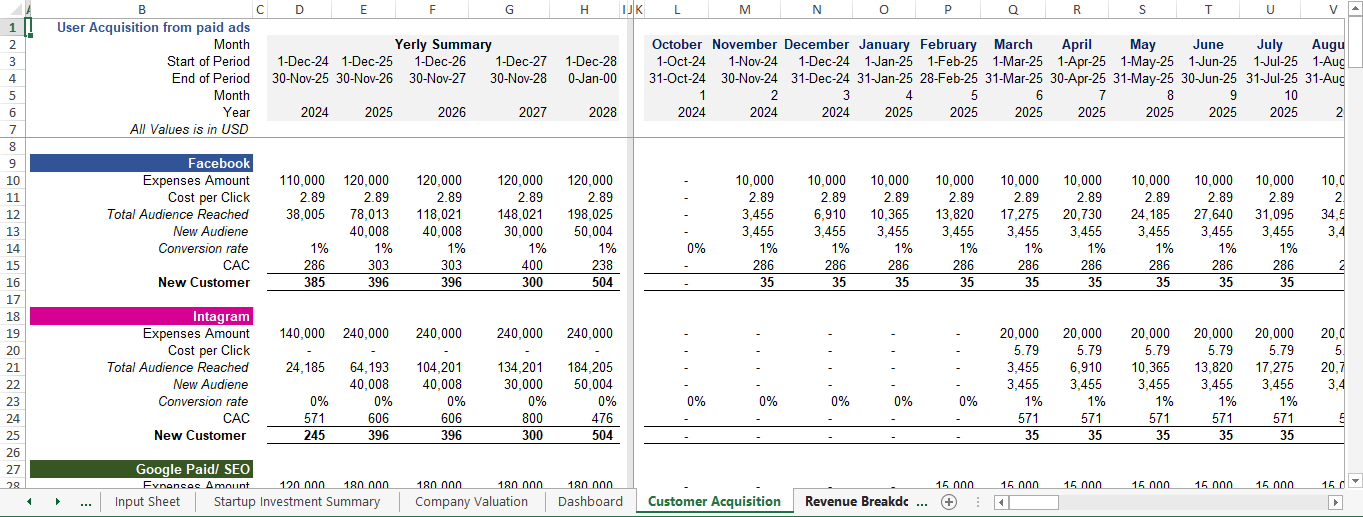

Customer Acquisition: Inputs for Paid Ads (Facebook, Youtube, Google), Organic Search, and Sales Rep performance.

Subscription Tiers: Flexible pricing for up to 4 product tiers (Tier 1 to Tier 4).

Churn & Retention: Monthly churn rate percentage inputs.

Operational Costs:

Payroll: Comprehensive staffing by department with bonus and tax calculations.

Operating Expenses: Rent, Marketing, IT Support, Hosting, and Utilities.

KEY FEATURES OF B2B SaaS Financial Model

Bottom-up Forecasting: Built on granular user acquisition and sales rep conversion data for maximum accuracy.

Automated SaaS Cohort Analysis Template: Tracks customer behavior and revenue flow over time.

Flexible Revenue Model: Supports multi-tier subscription pricing and cost of goods sold (COGS) per user.

Debt & Equity Tracking: Built-in loan amortization and equity ownership percentages.

Industry Benchmarking: Includes a library of industry multiples for AdTech, EdTech, CRM, and Enterprise software to help with accurate valuation.

No Passwords: The model is fully unlocked; Download and modify it to suit your specific business needs.

MODIFICATIONS & SUPPORT

We offer free support and error correction for all our clients. If you need help tailoring this SaaS Startup Budgeting Tool to your specific niche, we are more than happy to assist.

[Download the B2B SaaS Financial Model & Valuation Spreadsheet Now]

Only logged in customers who have purchased this product may leave a review.

Get started with our B2B SaaS Financial Model & Valuation Spreadsheet

Our Financial Modeling Services specialize in

Customized Spreadsheets

Tailored to met your unique financial needs.

Comprehensive Training

Empowering you to use models effectively.

Accurate Projections

Make informed decisions with confidence.

We prepare comprehensive plan to launch and grow startup with

Data-Driven Market Research

Detailed market analysis and SWOT insights

Business Model Canvas

Clear visualization of your business structure

Financial Projections

Valuation and forecasts to showcase your potential

What our clients say about us

Most Frequently Asked Questions (FAQs)

Absolutely! The model is designed with a user-friendly interface, clear instructions, and pre-built formulas to help even those without advanced financial expertise use it effectively.

Yes, the template includes both scenario and sensitivity analysis features. You can evaluate the impact of changes in pricing, demand, costs, and more to make informed decisions.

The template is fully compatible with Microsoft Excel & Google Sheet.

Yes, we offer fully customizable templates to fit your specific business needs. If you require additional changes, we also provide customized services—just contact us to discuss your requirements.

We offer a 7-day 100% money-back guarantee. If you’re not satisfied with the model, simply let us know within this period for a full refund.

If you encounter any errors, we’ll rectify them free of charge. Our commitment is to deliver an error-free and reliable financial model for your business

Yes, our financial models are designed to be versatile and work across various industries and business stages, from startups to established companies. You can easily adapt the inputs to reflect your specific business dynamics.

Absolutely! We provide email support to assist you with any questions or issues you may have while using the financial model.

Related products

-

Sale!

Video Streaming – SVOD Financial Model & Valuation Template

$200.0Original price was: $200.0.$150.0Current price is: $150.0. -

Sale!

Mobile Game Development Financial Model Excel Template

$250.0Original price was: $250.0.$110.0Current price is: $110.0. -

Sale!

EdTech Financial Model & Valuation Template

$180.0Original price was: $180.0.$99.0Current price is: $99.0. -

Sale!

Financial Model Template For AI SaaS Startups

$400.0Original price was: $400.0.$250.0Current price is: $250.0. -

Sale!

Founder Ready Mobile App Financial Model Template

$220.0Original price was: $220.0.$99.0Current price is: $99.0. -

Sale!

Buy Now Pay Later (BNPL) – Fintech Financial Model Template

$350.0Original price was: $350.0.$110.0Current price is: $110.0. -

Sale!

Detailed B2C SaaS Financial Model Template

$250.0Original price was: $250.0.$99.0Current price is: $99.0.

Reviews

There are no reviews yet.