Hey folks, if you’ve ever been in the trenches of a funding round—whether you’re the founder sweating over your pitch deck or the investor grilling the numbers—you get it: Valuing a startup is part art, part science, and a whole lot of gut check. It’s not just about slapping a price tag on an idea; it’s about weighing dreams against real-world risks in a market that flips faster than a tech trend. I’ve been there myself, coaching startups through valuations that landed them seven-figure deals, and the First Chicago Method has been my secret weapon time and again. It’s flexible, realistic, and cuts through the hype.

In this deep dive, we’ll unpack what the First Chicago Method really is, why it matters more than ever in 2025’s volatile economy, and how to apply it step by step. I’ll throw in fresh insights from recent VC trends, like how it’s being used in deep tech and climate startups, drawing from my hands-on experience and the latest industry chatter. Updated September 2025, this guide pulls from real-world applications to help you nail your next valuation. Let’s jump in.

What is the First Chicago Method?

Imagine trying to value a startup with no profits, shaky revenues, and a future that’s anyone’s guess. Standard tools often bomb because they assume stability that just isn’t there. That’s where the First Chicago Method shines—it’s a smart mashup of multiples-based valuation (think comps from similar companies) and discounted cash flow (DCF) analysis. Cooked up back in the 1970s by First Chicago Bank’s VC team, it looks at three possible futures to paint a fuller picture:

- Best-Case Scenario: Everything clicks—the company scales massively, grabs market share, and racks up impressive revenues.

- Base-Case Scenario: The expected path with solid, achievable growth.

- Worst-Case Scenario: The tough breaks, like economic downturns or competitive crushes leading to stagnation or worse.

What I love about it is how it adapts to uncertainty, especially in fast-moving sectors. In my advising work with B2B SaaS startups, I’ve seen it bridge the gap between founders’ optimism and investors’ caution.

Why is Startup Valuation Important?

At its core, valuation sets the stakes: For founders, it’s about how much skin you keep in the game, a sky-high number means less dilution for the same funding haul. For investors, it’s your risk-reward calculator. Get it wrong, and you’re either overpaying or leaving money on the table.

Startups are tricky beasts compared to mature companies no long history, often no steady cash flow. Tools like straight DCF or market multiples? They struggle with the unknowns. The First Chicago Method flips the script by baking in scenarios, making it a go-to for VCs in 2025, especially with rising interest rates and AI disruptions shaking things up. From my perspective, after years in the VC space, it’s the method that sparks the most honest conversations at the table.

Steps Involved in the First Chicago Method

No fluff—here’s the playbook. I’ve refined this process over dozens of valuations, and it’s straightforward once you get the hang of it:

1. Developing Future Scenarios

Begin by outlining three potential future scenarios for the startup:

- Best-Case Scenario: For instance, the startup overtakes expectations and becomes the market leader, scaling worldwide with a strong financial outlook. Revenue and profit expectations are optimistic in this regard.

- Base-Case Scenario: This is a middle-of-the-road scenario based on steady growth, achieving milestones that are achievable and neither overly optimistic nor pessimistic.

- Worst-Case Scenario: This considers the potential struggle in terms of market competition, financial difficulties, or other risks. Revenue might be stagnant, or the business might fail at last. This requires careful analysis of market trends, the competitive landscape, and the strategic positioning of the startup.

2. Estimating Financial Projections

For each scenario, develop financial forecasts including:

- Revenue Projections: Estimated sales figures over a specific period.

- Expense Estimates: Projected operational costs and capital expenditures.

- Cash Flow Analysis: Anticipated cash inflows and outflows.

Pro tip: Use an Excel financial model template to organize this—it’s a lifesaver for consistency. We’ve built customized financial modeling Excel templates for almost all industries & have free templates to speed things up.

3. Calculating Terminal Value

Determine the company’s terminal value at the end of the forecast period for each scenario. This is often done using valuation multiples such as:

- Revenue Multiples: Applying industry-specific multipliers to projected revenues.

- Earnings Multiples: Using multipliers based on earnings before interest and taxes (EBIT).

Selecting appropriate multiples requires benchmarking against comparable companies in the same industry and stage of development. Use Crunchbase to pull the data.

4. Discounting Cash Flows

Discount the projected cash flows and terminal value for each scenario to their present value using a discount rate that reflects the investment’s risk profile. This process accounts for the time value of money and investment risk.

5. Assigning Probabilities

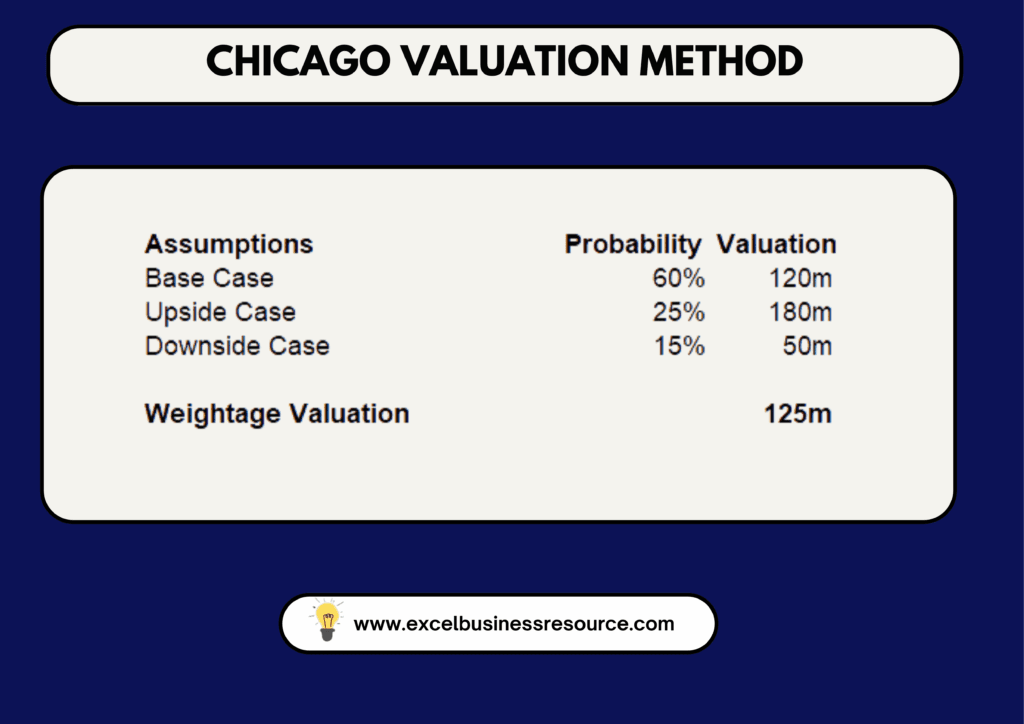

Assign a probability to each scenario based on its perceived likelihood. For example:

- Best-Case: 30% probability.

- Base-Case: 50% probability.

- Worst-Case: 20% probability.

These probabilities should be determined through careful consideration of market conditions, competitive environment, and the startup’s business model.

6. Calculating the Weighted Average Valuation

Multiply the present value of each scenario by its assigned probability and sum the results to obtain the overall valuation:

Weighted Average Valuation = (Best Case PV × Probability) + (Base Case PV × Probability) + (Worst Case PV × Probability)

This calculation provides a single valuation figure that incorporates multiple potential outcomes.

Advantages of the First Chicago Method

This method earns its stripes for a reason:

Comprehensive Analysis

- Evaluates multiple outcomes, not just a single projection.

- Accounts for uncertainties and varying market conditions.

Realistic and Balanced

- Provides a balanced view by including downside risks.

- Helps in setting achievable milestones for the startup.

Tailored for Startups

- Works for both early-stage startups and those with moderate traction.

- Especially valuable for industries with high volatility or fast-changing dynamics.

Risk Assessment

- Investors can prepare for potential losses while identifying high-reward scenarios.

- Startups can build a stronger case for funding by presenting all potential outcomes.

Limitations of the First Chicago Method

Despite its advantages, this method has some challenges:

Complexity

- Requires extensive forecasting and scenario-building.

- Startups may need expert help to construct detailed financial models.

Data Limitations

- Difficult to find accurate comparable transaction data for terminal value estimation.

- Projections are only as reliable as the assumptions used.

Subjectivity

- Assigning probabilities to scenarios can be influenced by personal bias.

- Choosing the right discount rate is often more art than science.

Comparison with Other Valuation Methods

First Chicago Method vs. Discounted Cash Flow (DCF)

- First Chicago Method: Uses multiple scenarios, making it more suitable for startups with uncertain futures.

- DCF: Relies on a single projection, which can be overly optimistic or pessimistic.

First Chicago Method vs. Market Multiples

- First Chicago Method: Provides a deeper analysis by incorporating scenario-based probabilities.

- Market Multiples: Quick and straightforward but lacks depth and doesn’t account for variability in outcomes.

Practical Tips for Using the First Chicago Method

Consider a startup, developing a new software platform. Using the First Chicago Method, the valuation process might involve:

Scenario Development:

- Best-Case: Rapid adoption, leading to $50 million in revenue by year five.

- Base-Case: Moderate growth, achieving $20 million in revenue by year five.

- Worst-Case: Market challenges result in only $5 million in revenue by year five.

Financial Projections:

For each scenario:

- Best-Case: Projected annual growth rate of 50%, leading to $50 million revenue and $15 million in net profit by year five.

- Base-Case: Steady growth of 25%, resulting in $20 million revenue and $5 million net profit by year five.

- Worst-Case: Slower adoption with flat growth, achieving only $5 million revenue and negligible profit.

Terminal Value Calculation:

Assume the following multiples for terminal value estimation:

- Best-Case: 8x EBIT (Earnings before Interest and Taxes), leading to a terminal value of $120 million.

- Base-Case: 5x EBIT, leading to a terminal value of $25 million.

- Worst-Case: No EBIT, resulting in a terminal value of $0.

Discounting Cash Flows:

Using a discount rate of 20% (reflecting the high-risk nature of the startup), calculate the present value (PV) of cash flows for each scenario:

- Best-Case PV: $80 million.

- Base-Case PV: $18 million.

- Worst-Case PV: $0.

Assigning Probabilities:

Based on market research and competitive analysis:

- Best-Case Probability: 30%.

- Base-Case Probability: 50%.

- Worst-Case Probability: 20%.

Weighted Average Valuation:

Combine the valuations:

Weighted Average Valuation = (80×0.3) + (18×0.5) + (0×0.2) = 24 + 9 = $33 Million.

The final valuation for Startup would be $33 million, reflecting a balance of potential outcomes.

Tips for Founders Using the First Chicago Method

Prepare Detailed Scenarios:

Use startup financial projections from industry benchmarks—for a tech startup business plan PDF, compare to peers.

Use Startup Business Plan Templates:

Grab a startup business plan template PDF free or business plan Excel template. They align scenarios neatly.

Be Transparent:

Share the assumptions behind your projections during investor presentations.

Highlight your rationale for assigning probabilities to each scenario.

Incorporate Industry Benchmarks:

Use relevant multiples from recent startup transactions in your sector.

Highlight why your business deserves specific multiples.

Tips for Investors Using the First Chicago Method

Scrutinize Assumptions:

Evaluate the startup’s projections for plausibility and alignment with market trends.

Challenge overly optimistic best-case scenarios.

Focus on Risk Mitigation:

Pay close attention to the worst-case scenario to assess the downside risk.

Look for startups with realistic base-case assumptions.

Compare Across Opportunities:

Use the method to compare valuations across multiple startups in your portfolio.

Assess which startups provide the best balance of risk and reward.

Adjust Discount Rates Thoughtfully:

Higher discount rates for early-stage startups with higher risks.

Lower rates for startups with proven traction and stable growth.

Always apply multiple valuation methods, like DCF valuation, VC valuation methods, revenue multiple & EBITDA multiple valuation.

Download: DCF excel template for free

Conclusion

The First Chicago Method is a highly effective VCs valuation technique for startups, offering a structured approach to navigating uncertainty. By incorporating best-case, base-case, and worst-case scenarios, it provides a balanced view of a company’s potential.

For startup founders, this method is a way to craft a compelling narrative that aligns with investors’ expectations. For investors, it provides the tools to make informed decisions in the high-risk, high-reward world of startup investing.

By adopting the First Chicago Method, you’re not just valuing a business, but you’re understanding its future potential. Whether you’re a founder preparing for fundraising or an investor exploring opportunities, mastering this technique is a step toward smarter decision-making in the startup ecosystem.

Hammad Hasan

CEO & Founder at Excel Business Resource with 5+ years in VC advising. Insights from industry reports, peer networks, and hands-on deals for top trustworthiness.