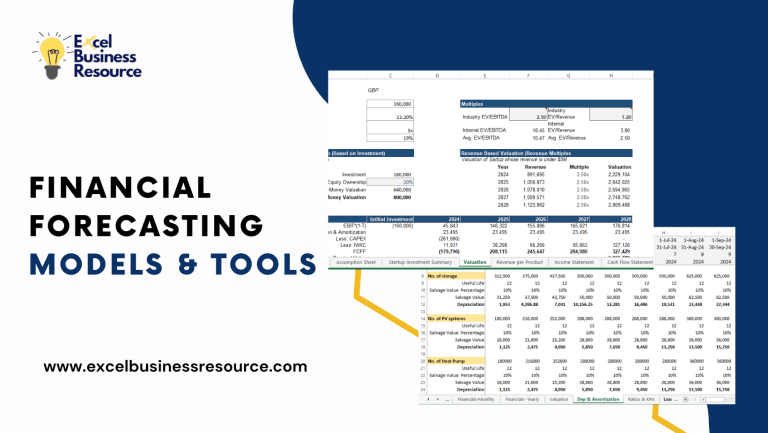

The importance of realistic financial projections for startups cannot be overstated. Imagine you’re an investor considering two promising ventures: one with meticulously crafted, data-driven financial projections and another with overly optimistic, unrealistic projections. Which would you choose to invest in? The answer is evident, and it underscores the critical role that financial projections template play in the decision-making process. Realistic financial forecasting template not only provide a roadmap for a startup’s success but also instill confidence in potential investors. In this article, we will explore factors for realistic financial forecasting model that’s make the difference between securing vital investment and struggling to attract funding for your startup.

Comprehensive Business Plan

Before you can create a realistic financial projection template that resonates with investors, you need to establish a comprehensive business plan. This plan should encompass your startup’s mission, market opportunity, competitive landscape, marketing strategy, and more. It serves as the foundation upon which you’ll base your financial projections.

Market Research & Statistics

Thorough market research & analysis is an essential component of creating realistic financial projections for your startup and is a fundamental step to convince investors of the viability of your business. It involves a comprehensive examination of the market in which your startup intends to operate. A well-executed market analysis provides insights into the dynamics, trends, competition, and customer behavior within the industry. Here’s a look at the some of the imperative data to add in the report based on your business and revenue model.

- Understanding Market Size and Growth

- Identifying Market Trends, Keyword Searching

- Competitive Landscape

- Customer Behavior, demographics, Income Parity

- Purchase Mode, preferred way of Purchasing etc.

- Market Entry Strategy

- Risk Mitigation

Credible Financial Assumptions

Creating a financial projections template for your startup that impresses and convinces investors relies heavily on the use of credible data and well-reasoned assumptions. Financial projections are not a crystal ball that foretells the future but rather a calculated estimation of how your business will perform based on the information available. It’s crucial to use credible data sources and make reasonable assumptions to build projections that stand up to scrutiny.

To create credible financial projections, you need to consider various data sources and assumptions:

- Market Data

- Price & Monthly Sale

- Frequency of Purchasing

- Recurring Revenue or Occasional Revenue

- Seasonality Effect

- Customer Behavior

- Conversion Rates

- Average Transaction Value

- Marketing Costs

Start Conservatively for Financial Growth

While it’s tempting to project rapid, exponential growth, investors tend to favor conservative projections. Show that you have considered potential challenges and risks in your business model. Conservative projections are more likely to inspire confidence because they reflect a careful and well-thought-out approach.

A Clear Revenue Model

In the world of startups, having a clear and well-defined revenue model is a fundamental aspect of building a realistic financial forecasting model. It serves as the blueprint for how your business intends to generate income, and it is a critical factor in convincing investors of your startup’s profitability. A well-structured revenue model not only guides your financial forecasts but also provides a transparent view of how your startup plans to monetize its products or services.

Realistic Expense Projections

Transparent and realistic expense projections are equally important. Investors will want to understand how you plan to allocate funds, covering fixed costs (rent, salaries, utilities), variable costs (marketing, materials, commissions), and other operational expenses. Ensure that your expense estimates align with your business strategy.

Map your Financial Milestone

In the process of formulating comprehensive financial projections, it is imperative to outline your growth strategies and key milestones that you anticipate reaching with your capital investment. These milestones may encompass actions such as expanding your workforce, creating novel products or features, achieving a specific sales revenue increase, or securing a particular market share percentage. By delineating these strategic objectives, you not only provide a clear roadmap for your startup’s development but also offer investors a well-defined vision of your growth trajectory.

Sensitivity Analysis

To instill further confidence in your financial projections, conduct a sensitivity analysis. This involves financial modeling analyze the impact of different scenarios on your startup’s financial performance. Show investors that you’ve considered various possibilities, including best-case, worst-case, and most-likely outcomes.

Cash Flow Management

Investors are keenly interested in your startup’s ability to manage cash flow effectively. Your financial projected statements should include a detailed cash flow statement, which outlines how cash enters and exits your business. Highlight your strategies for managing working capital and addressing any potential cash flow challenges.

Scalability and Growth Plans

Demonstrate your vision for scalability and growth. Investors want to know how you intend to expand your business and capture a larger market share. Outline your plans for increasing operational efficiency, entering new markets, or introducing new products and services.

Regular Updates Financial Statistics

Your financial projections are not static documents. They should evolve and adapt as your startup grows and changes. When presenting your financial projections to investors, assure them that you will provide regular updates and reports on the actual financial performance of your business.

In conclusion, building a realistic financial forecasting model for your startup is an essential step in convincing investors to support your venture. By adhering to these principles, you can create projections that are not only compelling but also founded on solid assumptions and strategies. Transparency, conservatism, and data-backed projections will instill the confidence investors need to commit to your startup’s success. Remember that investors appreciate well-informed entrepreneurs who are prepared for the challenges and opportunities that lie ahead.