When VCs analyze a startup opportunity, they often rely on a detailed financial model to evaluate growth potential and overall economic prospects. The first step VCs take is to find the TAM of a startup. TAM defines the total market size, which offers a good understanding of the startup’s potential to gain a share in this market. In this article, we discuss how VCs assess TAM, why TAM plays a crucial role in startup valuation, and how a founder might best articulate a large market to secure funding.

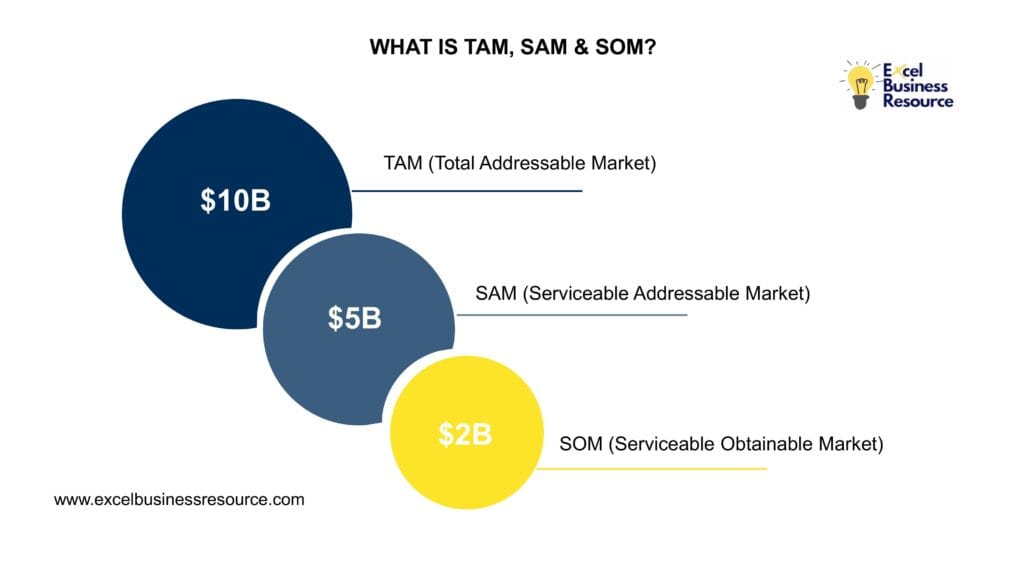

What is TAM, SAM, and SOM?

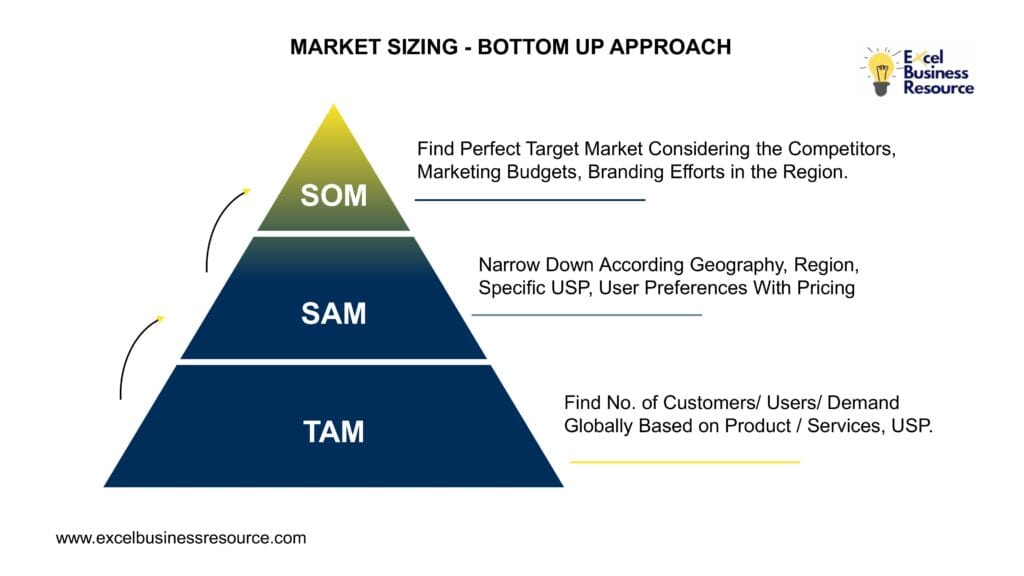

Understanding TAM, SAM, and SOM is crucial for creating a robust financial model for startups, especially when pitching to VCs. Before diving into how VCs evaluate TAM, it’s essential to understand the distinctions between TAM, SAM, and SOM:

TAM (Total Addressable Market):

TAM represents the Total Available Market, the revenue a given product or service can obtain if successfully marketed to 100% of the market targets. It offers a broad industry view in terms of market size.

SAM (Serviceable Available Market):

TAM is minimized to SAM, representing a small segment of the total market a business can effectively reach due to its product or service offering.

SOM (Serviceable Obtainable Market):

SOM then moves the logic of SAM to the perspective that defines the group of customers that the firm can effectively serve in the short run, given certain competitive realities and business limitations.

During early-stage assessments, TAM is more useful in determining how big the market is for the product the startup is creating and how scalable the business is for VCs.

Why TAM is Important for Startup Valuation?

TAM is a critical metric in the startup valuation process and an essential component of startup revenue forecasting for several reasons:

Growth Potential: The VCs invest in startups with a high growth rate. A large TAM means maximizing the demand and generating a more significant value if we perfect our strategies.

Market Demand: A large TAM makes perfect sense regarding demand for the product or service, lowering the risks attached to the merger.

Exit Strategy: It is also noted that companies with big markets offer better opportunities to acquire or attain a well-received IPO, which must meet the VC’s ROI goals.

How Do VCs Calculate TAM?

In industries like SaaS, TAM calculations can be incorporated into tools such as a SaaS revenue forecast model, providing a clearer picture of growth potential. When estimating the Total Addressable Market (TAM), different approaches can be applied depending on the nature of the business, available data, and market conditions. Here’s a detailed explanation of the top methods with improved examples and realistic calculations:

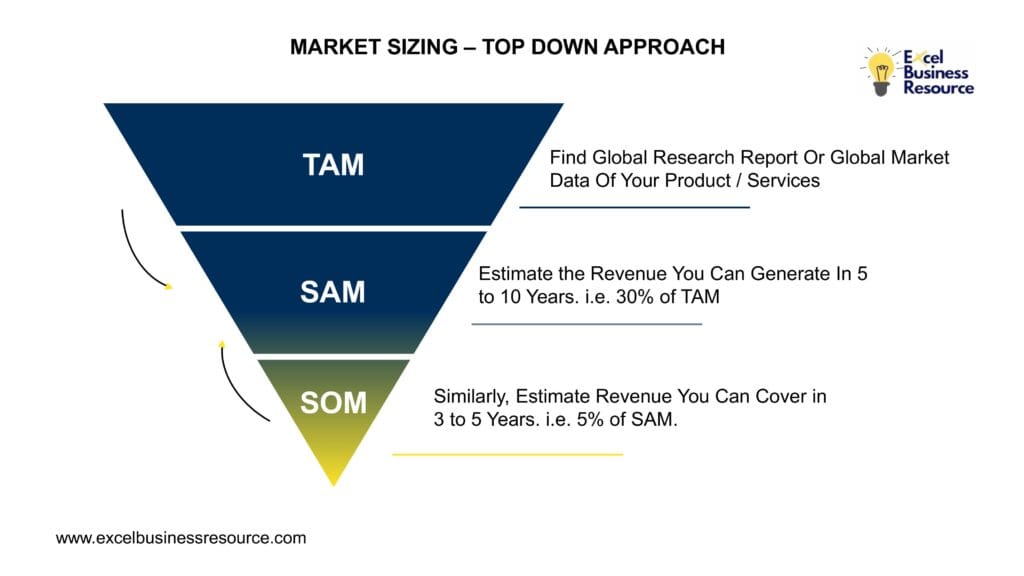

Top-Down Approach

This method begins with a high-level, industry-wide market size and narrows it down based on assumptions and target-specific factors.

- How It Works:

Start with market data from reputable industry reports such as IBISWorld, Statista, or Gartner. Refine the market size based on factors such as geographical reach, niche focus, or specific customer segments.

- Example:

Suppose the global e-learning market is estimated at $300 billion annually. Your startup focuses on corporate compliance training, which constitutes about 10% of the market. This means your TAM would be:

$300 billion × 10% = $30 billion.

- Risks:

Assumptions based on secondary data can overestimate or misrepresent the market size.

This method may not capture market nuances, such as competitive dynamics or emerging trends.

Bottom-Up Approach

This method builds the TAM by analyzing specific inputs such as the price of a product/service and the number of potential customers, leading to more data-driven and reliable estimates.

- How It Works:

Calculate TAM by multiplying the total number of potential customers by the average annual revenue per customer (ARPC).

- Example:

Imagine you’re launching a subscription-based fitness app targeting working professionals in urban areas.

Total target audience: 5 million professionals in your region.

ARPC: $120/year ($10/month subscription fee).

TAM = 5 million × $120 = $600 million/year.

- Advantages:

This method offers a more accurate and granular view of the market.

It can be customized to reflect realistic assumptions about customer acquisition and pricing.

Value-Theory Approach

This method focuses on the perceived value of your product or service and how much customers are willing to pay, making it especially useful for innovative or disruptive products where market data is scarce.

- How It Works:

Estimate TAM based on the value customers derive from your offering and their willingness to pay. This approach works best for creating new market categories or launching revolutionary products.

- Example:

Let’s say your startup develops an AI-powered virtual assistant for busy executives, designed to save 10 hours of administrative work per month. If your target audience values their time at $50/hour and you expect them to pay 20% of that value, your pricing could be:

$50/hour × 10 hours × 20% = $100/month per user.

Target audience: 1 million executives globally.

TAM: 1 million × $100 × 12 months = $1.2 billion/year.

- Advantages:

Ideal for innovative startups with unique offerings.

Helps justify premium pricing and create a compelling value proposition.

- Risks:

Requires thorough research to understand customer behavior and willingness to pay.

Overestimation is possible if customer adoption is slower than expected.

Choosing the Right Market Sizing Approach

- The Top-Down Approach works best for industries with well-documented data but should be paired with other methods to ensure credibility.

- The Bottom-Up Approach is preferred for data-driven startups that have clear customer and pricing information.

- The Value-Theory Approach is indispensable for pioneering products or services that redefine markets.

By using one or combining multiple approaches, startups can present a well-rounded and compelling TAM estimate, helping attract investors and validate their growth potential.

How does TAM affect the valuation of startups?

TAM plays a central role in determining the valuation of a startup, as it reflects the potential market opportunity a business can tap into. Venture capitalists (VCs) use TAM as a lens to assess scalability, revenue potential, and long-term viability. Here’s a deeper look into how TAM influences various valuation methodologies:

Market Multiples

TAM directly affects the revenue multiples assigned to startups, which are a key component of valuation in industries like SaaS, eCommerce, and healthcare tech.

- Example: A SaaS startup targeting a $100 billion market is likely to receive a revenue multiple of 10x or higher, as VCs anticipate significant scaling opportunities. Conversely, a startup in a niche market with a TAM of $1 billion may receive a lower multiple, such as 3x to 5x.

- Rationale: Larger TAMs signal higher growth potential, enabling startups to generate substantial revenues and capture greater market share over time.

Discounted Cash Flow (DCF)

The DCF valuation method relies heavily on future cash flow projections. A high TAM positively influences these projections, ultimately increasing the terminal value.

- Impact on Revenue Projections: Startups operating in a large TAM can model higher revenue growth rates, supported by assumptions of increasing customer acquisition and market penetration.

- Terminal Value Influence: A higher TAM often leads to a more optimistic terminal value, reflecting the potential of the startup to dominate a vast market.

- Example: A clean energy startup with a $50 billion TAM may forecast rapid adoption due to global demand, resulting in significant free cash flow and justifying a premium valuation.

Comparable Analysis

Comparable analysis benchmarks a startup against similar companies in the market. Here, TAM helps VCs contextualize a startup’s position relative to its peers.

- Justification for Premiums: A large TAM can justify a valuation premium, as it indicates the startup operates in a high-demand sector with extensive growth opportunities. For example, an AI-powered healthcare platform with a TAM of $200 billion might be valued more highly than a telehealth startup focused on a $10 billion niche.

- Industry Context: In mature industries, TAM can highlight untapped opportunities. Startups targeting underserved or emerging segments within a large TAM can secure higher valuations.

Assessing Scalability and Risk

A large TAM indicates room for growth and scalability, which VCs value highly when evaluating startups.

- Scalability: Startups with a large TAM demonstrate the ability to scale their business across different regions, customer segments, or use cases. For instance, a fintech startup targeting a $1 trillion TAM in digital payments could potentially expand globally and serve diverse industries.

- Risk Mitigation: A startup with a large TAM reduces the perceived risk for VCs, as even modest market penetration can yield significant revenues. However, a small TAM may signal limited growth potential, increasing the perceived risk of failure.

TAM as a Measure of Long-Term Viability

TAM is not just about immediate growth but also reflects the long-term viability of the startup. Markets with a high TAM often indicate sustained demand over time, which aligns with VCs’ preference for durable business models.

- Exit Strategy Influence: Startups in large TAM markets are more likely to attract strategic acquisitions or achieve successful IPOs, as they promise continued growth and high returns for investors.

- Examples:

Positive Example: A logistics platform targeting the global eCommerce market (TAM: $5 trillion) can expect significant M&A interest or IPO potential due to widespread market demand.

Negative Example: A boutique product targeting a niche audience with a TAM of $100 million might struggle to attract investors due to limited scalability and exit options.

Tips for Founders For Presenting TAM to VCs

Founders must present a well-researched and credible TAM to convince VCs of their startup’s potential:

- Use Reliable Data Sources

Support the TAM figure with other market research reports, surveys, and case in point so that it sports credibility.

- Show Your Work

Enumerate and describe in detail how the TAM is arrived at, integrating it with a financial model for startups to provide a comprehensive view.

- Highlight Assumptions

The estimated TAM figures should be validated to acknowledge the assumptions underpinning their computation and justify why they were made.

- Segment Your Market

TAM should be divided into smaller parts to prove the awareness of the market segmentation and client requirements.

Why TAM needs to align with Business Strategy.

Ensure your TAM is closely linked with your business strategy and results-based revenue targets. That leads to funding issues, which can cause red flags to be raised by VCs where estimates are either too high or too low.

Some of the errors you are likely to make as a founder when calculating TAM include the following.

Overestimating TAM can lead to inflated figures, which misalign with realistic projections in a free financial model template or a professional model.

Neglecting SAM and SOM: Mixing up TAM, SAM, and SOM sometimes gives a wrong impression of our financial projections.

Relying Solely on Top-Down Data: This is because top-down estimation does not receive bottom-up validation; therefore, it lacks credibility.

Ignoring Competition: Porous market shares do not consider competitiveness and industry impediments.

Conclusion

TAM stands for Total Addressable Market and holds arguably the most significant part of a startup’s valuation and the primary method of attracting venture investments. When evaluating the information VCs provide on TAM, founders must learn how to decode how they reason and tell stories around this variable to make funding for their startups more conceivable. TAM mixed with SAM and SOM gives an actual and methodical market size compatible with the startup’s business model. As this paper has illustrated, an adequately executed TAM reduces the risk of failure. It can distinguish between attaining sustainable growth and going up in smoke through waste.