Building a SaaS financial model template is essential for understanding the economic health and growth potential of a SaaS startups. These excel based models are designed to provide detailed insights into key metrics, enabling founders and decision-makers to make data-driven decisions that forecast revenue, optimize performance, analyze CAC, secure funding, and drive scalability. In this guide, we’ll walk you through the critical components and steps required to build a robust and customizable SaaS financial model that aligns with your business goals.

Why SaaS Financial Models Are Crucial for SaaS Startups

A SaaS financial model is a dynamic, Excel-based tool designed for startups and established SaaS businesses to forecast and optimize their financial performance. This model goes beyond merely tracking numbers; it acts as a strategic blueprint to structure revenue and costs effectively, enabling businesses to achieve their goals. By addressing key challenges like recurring revenue, high customer acquisition costs, and scalability, a SaaS financial model provides the insights needed to navigate the complexities of the SaaS industry successfully.

Therefore, we dive into why a SaaS forecasting model is essential and how it benefits startups in this competitive industry.

- Accurate Revenue Forecasting

SaaS business model is critical to forecast, as they rely heavily on recurring revenue, making accurate forecasting essential for long-term success. Customized SaaS revenue forecasting model provides a detailed analysis of Monthly Recurring Revenue (MRR) and Annual Recurring Revenue (ARR). Startups can project revenue growth from new customer acquisitions, expansions (upsells), and existing customer retention. This allows founders to understand whether their SaaS pricing strategies and customer acquisition efforts align with their financial goals.

For instance, by forecasting revenue streams separately (freemium conversions, premium subscriptions, or enterprise contracts), startups can evaluate which strategies are most effective and focus on scalable and profitable revenue channels.

- Understanding Customer Metrics

Key customer metrics such as Customer Acquisition Cost (CAC) and Customer Lifetime Value (CLTV) are vital to understanding and analyzing the profitability of a SaaS startup. The startup financial model helps calculate these metrics, enabling startups to:

Determine how much they can afford to spend on acquiring new customers.

Evaluate the long-term value of each customer segment.

Analyze the CLTV-to-CAC ratio to ensure sustainable growth.

By leveraging these insights, SaaS startups can fine-tune their marketing strategies, optimize customer retention programs, and improve overall profitability.

- Effective Cash Flow Management

Cash flow is often a significant challenge for startups, particularly in the SaaS industry, where upfront customer acquisition costs are high, and revenue is recognized incrementally over time. A SaaS financial model provides a clear picture of cash inflows and outflows, helping startups:

Monitor their burn rate and runway.

Plan for critical funding milestones, such as Investment series A or B rounds.

Avoid cash shortages by anticipating operational expenses.

Read More: Top Startup Funding Sources to Fuel Business Growth

Therefore, the SaaS forecasting model helps in effective cash flow management, ensuring that startups have the liquidity needed to sustain operations and invest in growth initiatives.

- Enhancing Investor Confidence

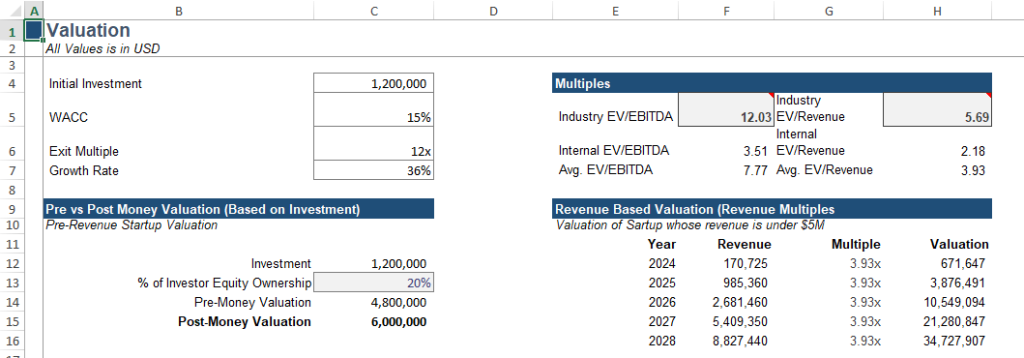

For SaaS startups seeking external funding, a detailed SaaS startup financial model is indispensable for Startup Valuation. Venture capitalists (VCs) and investors require a clear, data-driven roadmap to assess a startup’s growth potential and economic health. A SaaS financial model demonstrates the following:

Revenue growth projections: Shows how quickly the business can scale and generate profits.

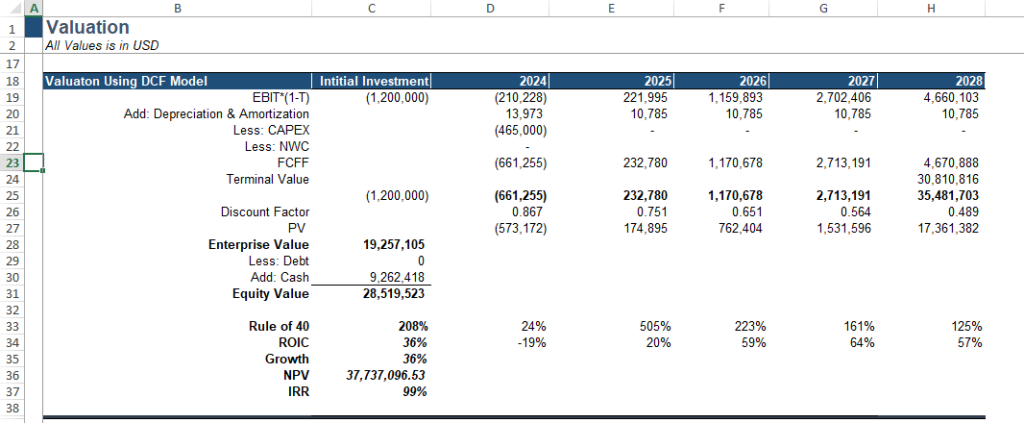

SaaS valuation & metrics: such as EBITDA multiples or Discounted Cash Flow (DCF) valuation.

CAC and CLTV ratios: Highlights whether the startup has a sustainable customer acquisition strategy.

Path to profitability: Lays out when and how the business will break even and deliver returns.

Additionally, the SAAS forecasting model allows startups to calculate their cash runway, the time before their current cash reserves run out—and adjust their burn rate accordingly. Through these insights, founders can pivot their strategies to extend the runway, optimize expenses, or secure additional funding. Presenting this level of foresight to investors instils confidence and positions the startup as a viable investment opportunity.

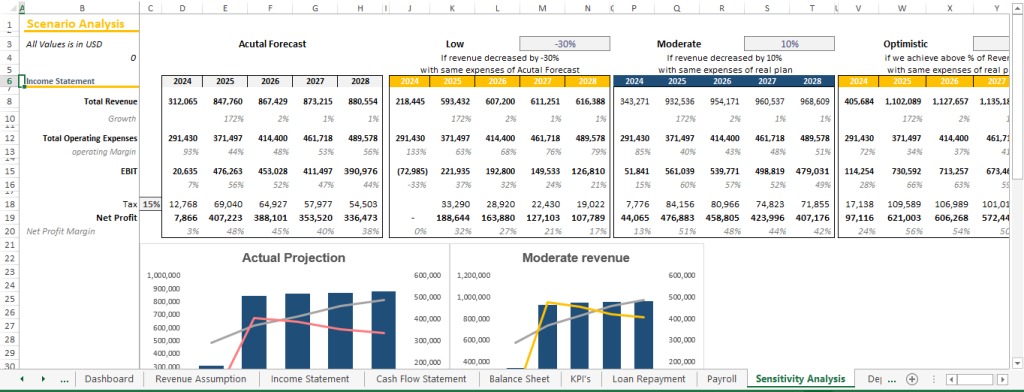

- Scenario Planning and Risk Mitigation

SaaS startups operate in a volatile market where customer preferences and competitive dynamics can change rapidly. A SaaS projection model allows startups to prepare for different scenarios, such as:

Best-case scenario: Aggressive growth in customer acquisition and revenue.

Base-case scenario: Moderate growth aligned with industry benchmarks.

Worst-case scenario: High churn rates and lower-than-expected revenue.

By running these scenarios, startups can identify potential risks and develop contingency plans. For example, if a worst-case scenario reveals cash flow challenges, the startup can proactively adjust marketing spend or renegotiate supplier contracts.

By running these scenarios, startups can identify potential risks and develop contingency plans. For example, if a worst-case scenario reveals cash flow challenges, the startup can proactively adjust marketing spend or renegotiate supplier contracts.

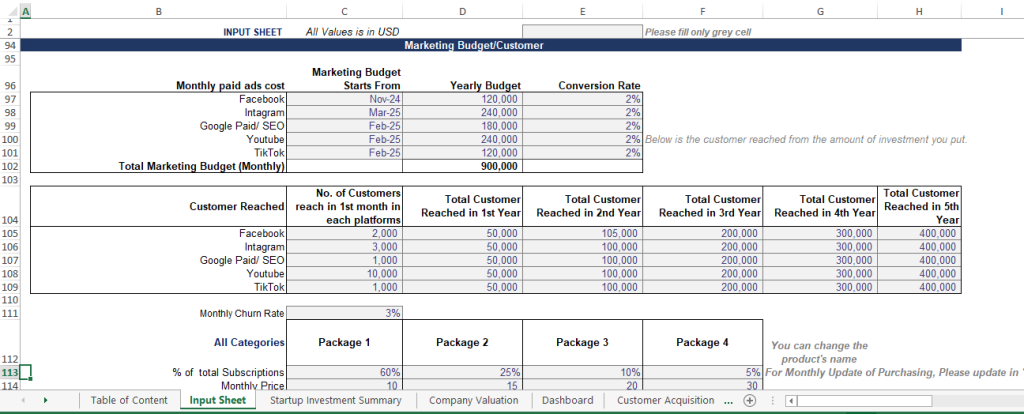

- Optimizing Pricing and Sales Strategies

SaaS pricing is one of the most critical decisions for a SaaS startup. A financial model helps analyze the financial impact of different pricing strategies, such as tiered pricing, usage-based models, or freemium offerings.

If you want soft start, you can build a basic saas pricing model template in excel. By understanding the relationship between pricing, customer acquisition, and retention, startups can:

Identify price points that maximize customer value and revenue.

Test the impact of promotional campaigns or discounts.

Optimize sales strategies to target the most profitable customer segments.

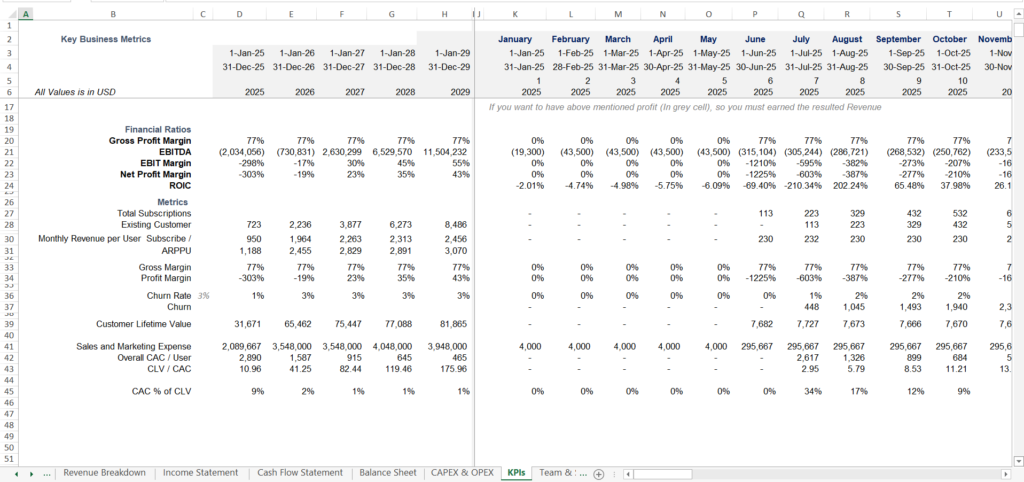

- Tracking Key Performance Indicators (KPIs)

SaaS startups need to monitor specific KPIs to gauge their health and performance. An advanced SasS financial model provides a centralized framework to track and analyze critical metrics, such as:

Churn rate and its impact on recurring revenue.

Net Revenue Retention (NRR), which measures growth from existing customers.

Gross and net profit margins, helping assess operational efficiency.

Tracking these KPIs allows startups to make data-driven decisions and address issues promptly.

- Guiding Growth and Expansion Plans

SaaS startups often aim for rapid growth, whether by expanding into new markets or launching additional products. A financial model provides the insights needed to assess the feasibility and economic implications of these plans. For example:

It can simulate the costs and returns of entering a new geographical market.

It can evaluate the profitability of new product lines or features.

It helps identify when and where to reinvest profits to fuel growth.

This level of planning ensures that growth efforts are strategic and sustainable.

- Supporting Operational Efficiency

A SaaS financial model template goes beyond forecasting; it helps startups identify inefficiencies in their operations. For instance:

Startups can reduce hosting or support expenses by analyzing the cost of goods sold (COGS).

Sales and marketing efficiency can be improved by reallocating budgets based on CAC trends.

Administrative costs can be streamlined by automating processes or renegotiating vendor contracts.

Operational efficiency not only improves margins but also positions the startup for long-term success.

- Long-Term Strategic Vision

Finally, a financial model is a strategic tool that aligns short-term actions with long-term goals. It provides a roadmap for achieving milestones such as breakeven points, profitability, or IPO readiness. Offering a clear financial trajectory enables founders to stay focused on their mission while adapting to market changes.

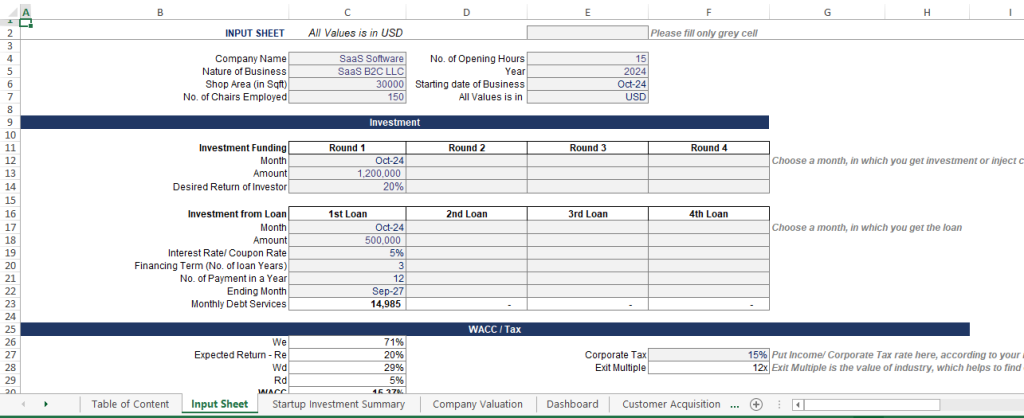

Step-by-Step Process to Build a SaaS Financial Model

Building a SaaS financial model can seem complex, but when you break it down into logical steps, it becomes manageable and insightful. Whether you’re a founder, financial analyst, or investor, having a robust SaaS financial projection template is crucial for understanding your business’s financial health and potential. Let me guide you step-by-step through the process.

Start with Revenue Drivers

The first thing you need to do in your SaaS sales forecast template is define how your business generates revenue. This involves identifying subscription plans (e.g., Basic, Pro, Enterprise), estimating how many customers you can acquire each month, and accounting for additional revenue from upsells and cross-sells. By forecasting these, you’ll calculate critical metrics like Monthly Recurring Revenue (MRR) and Annual Recurring Revenue (ARR). These numbers serve as the backbone of your SaaS financial model, helping you visualize your growth trajectory.

Factor in Marketing and Sales Costs

Once you know how revenue will flow, it’s time to figure out how much you’ll spend to get those customers. In your SaaS financial projection template, calculate your Customer Acquisition Cost (CAC), which is the total marketing and sales spend divided by the number of customers acquired. Keep an eye on efficiency—CAC should ideally be no more than one-third of your revenue per customer. Don’t forget to include salaries, commissions, and bonuses for your sales team here. This part of the model ensures you’re aligning your revenue expectations with realistic acquisition costs.

Analyze Customer Metrics

Next, focus on customer-related metrics in your SaaS financial model template excel, such as churn rate, retention rate, and Customer Lifetime Value (CLTV). These metrics are critical for understanding whether your business can sustain itself. Churn rate tells you how many customers you’re losing, while retention rate shows the percentage of customers sticking around. CLTV, which is ARPU (average revenue per user) multiplied by customer lifespan, shows the value of a customer over time. These insights are vital for optimizing your pricing strategy and predicting long-term profitability.

Project Operating Expenses

Operating expenses (OPEX) are the backbone of your cost structure. In your SaaS startup financial model, break down these costs into categories like Research and Development (R&D), General and Administrative (G&A), and Customer Support. R&D includes software development and engineering, G&A covers office expenses and salaries for management, while Customer Support involves tools and teams that assist users. By forecasting OPEX, you get a clear picture of how operational efficiency will impact your bottom line.

Plan Headcount and Payroll

People are a major cost for any SaaS startup, so your financial model needs a detailed headcount and payroll plan. Estimate how many employees you’ll need across different functions, such as sales, marketing, engineering, and administration. Include their salaries, benefits, and expected hiring timelines. This ensures that your growth is scalable while keeping your costs under control.

Include Capital Expenditures (CapEx)

Your SaaS financial projection template should also account for capital expenditures. This is especially important if your SaaS startup relies heavily on infrastructure. Include costs like software development, servers, and third-party tools. Although these expenses might not occur monthly, they impact cash flow and need to be factored into your planning.

Account for Deferred Revenue

If you collect upfront payments for services delivered over time, you need to include deferred revenue in your model. This ensures that revenue is recognized accurately over the service period, giving you a true picture of your cash inflows and financial health. Deferred revenue is a critical element in creating a reliable SaaS financial model template excel.

Conduct Scenario Analysis

One of the most insightful aspects of a SaaS startup forecasting model is scenario analysis. Here, you create multiple versions of your financial projections—base case, upside, and downside scenarios. For example, what happens if customer acquisition costs rise unexpectedly? Or if churn rates drop? By modeling different possibilities, you’ll be prepared for uncertainties and better equipped to make strategic decisions.

Perform Valuation Analysis

Valuation is where your financial model truly shines. Use techniques like Discounted Cash Flow (DCF) and calculate metrics such as EV/Revenue and EV/EBITDA. Including Net Present Value (NPV) and Internal Rate of Return (IRR) will help you showcase the investment potential of your SaaS startup. A solid valuation framework not only attracts investors but also helps you understand your company’s worth.

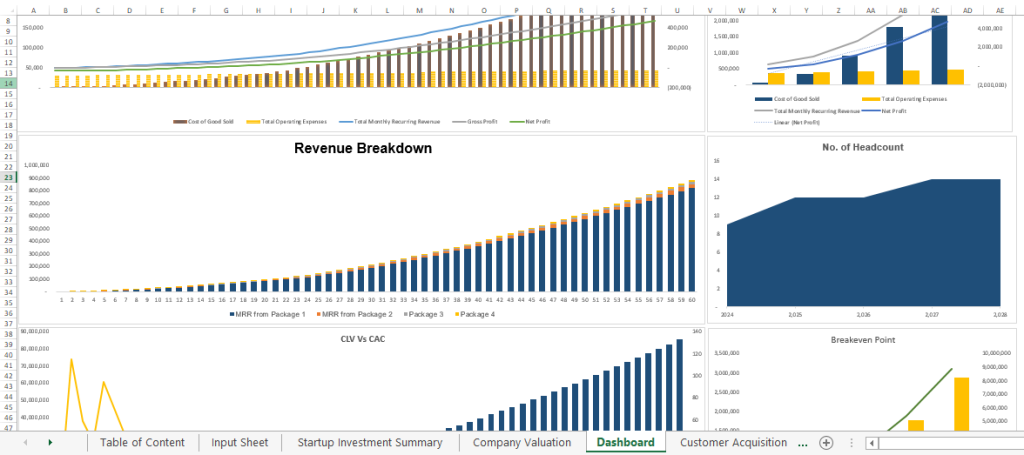

Create Dashboards and Visualizations

Finally, your SaaS financial projection template should include visual representations of key insights. Dashboards with graphs for MRR/ARR growth, CAC vs. CLTV comparisons, and burn rate projections make the data easy to interpret. These visual tools enhance decision-making and make your financial model presentation-ready for stakeholders.

Why This Process Matters

By incorporating these components, your SaaS financial model becomes a comprehensive roadmap for financial planning and growth. It allows you to assess metrics like burn rate and cash runway, while also providing a solid foundation for SaaS valuation discussions with investors. With a detailed and actionable model in place, you’ll be better equipped to scale your SaaS startup and secure the funding you need.

How to Get Started with Custom SaaS Financial Models

EBR’s SaaS financial models are designed to be more than spreadsheets; they are intuitive, customizable, and deeply analytical tools that cater to the unique needs of SaaS businesses.

As financial modeling consultant, our models make it easy to understand and act on complex data with user-friendly dashboards featuring visualizations of key metrics like net revenue retention (NRR), gross margins, and operational efficiency.

Built to impress investors, they highlight critical metrics like the CLTV-to-CAC ratio and demonstrate clear paths to ROI, positioning businesses to secure the funding they need.

Tailored to specific industries such as EdTech, HealthTech, and B2B SaaS, these models deliver precision and relevance.

Some SaaS Financial Models are;

B2B SaaS Financial Model Template

Video Streaming Financial Model Template

AI Startup Financial Model

Healthcare AI Financial Model

Checkout our more excel based financial modeling templates of different industries.

Whether you are a startup or an established SaaS company, you will need to create a financial model for investment raising, optimizing operations, and valuation. Our models provide comprehensive solutions for revenue forecasting, cost management, and SaaS valuation, helping you navigate the industry’s complexities with confidence and clarity.