- How do I do startup valuation?

- How venture capitalists (VCs) value my startup? Because if I able to understand VC valuation methods, I will understand the VC mind.

- What valuation method would be best to use for my startup at particular stage of startup?

- How do to valuation of pre-revenue startup?

Almost all founders must have these questions in mind when they are pursuing a startup and raising investment. Indeed, these are essential questions because understanding a startup’s valuation is a crucial step for entrepreneurs, investors, and stakeholders. Whether you’re raising capital or assessing potential investments, accurately valuing a startup can provide the foundation for strategic decisions. Below, we delve deep into the most effective methods and key considerations for startup valuation.

What is Startup Valuation?

Startup valuation refers to determining the worth of a pre-revenue startup or early-stage company. Unlike established businesses, startups often need revenues, profits, or tangible assets, making traditional valuation methods less effective. Instead, startup valuations focus on factors like growth potential, team and execution, market trends, and the competitive landscape.

What Are Key Factors Influencing Startup Valuation?

Startup valuations depend on several variables, including:

- Market Potential: The size and scalability of the target market.

- Revenue and Growth Rate: Early-stage revenue generation and year-over-year growth.

- Team and Expertise: The experience, skill set, and cohesion of the founding team.

- Competitive Landscape: Positioning and differentiation in the industry.

- Intellectual Property: Patents or proprietary technology that provide a competitive edge.

How to Calculate Startup Valuation

Startup valuation is not a science with universal formulas or rules; it is more about psychology, as each founder and venture capitalist (VC) perceives it differently. Therefore, startup valuation methods help all stakeholders reach a common valuation based on the influencing factors explained above.

The following are the most common valuation methods,

Note: Not all valuation methods apply to all startups, but methods vary based on the stage of startup, market size, type of investor preference, industry, and all. Therefore, use only some valuation methods. Similarly, don’t use only 1 method,

The best way to incorporate atleast 2 to 4 most relevant valuation methods is to find the balance or average valuation figure.

1. Berkus Valuation Method

The Berkus Valuation Method is a widely recognized approach designed to value early-stage startups that are at the pre-revenue stage or lack historical financial data. The Berkus method starts with the assumption that the $20 million in revenue will be earned within the first five years by the startup. It assigns a monetary value to key qualitative success factors, aiming to estimate how well-prepared the business is for future growth. Developed by angel investor Dave Berkus, the method evaluates five components, each valued up to $500,000 or $1 million (depending on the Investor’s preference).

The Five Components:

Sound Idea (Basic Value): The foundational business concept or idea. Is it innovative? Does it address a real problem? A strong idea with clear potential is a crucial starting point.

Prototype (Reducing Technology Risk): If the startup has developed a prototype or minimum viable product (MVP), it reduces technology-related uncertainties, signaling progress toward feasibility.

Quality of the Management Team (Reducing Execution Risk): A competent and experienced management team increases the likelihood of successful execution, addressing operational and strategic risks.

Strategic Relationships (Reducing Market Risk): Established partnerships, contracts, or market access through networks contribute significantly to reducing market-entry risks.

Product Rollout or Early Revenue (Reducing Production Risk): Initial sales or market traction serve as proof that customers are interested and that the product is operationally viable.

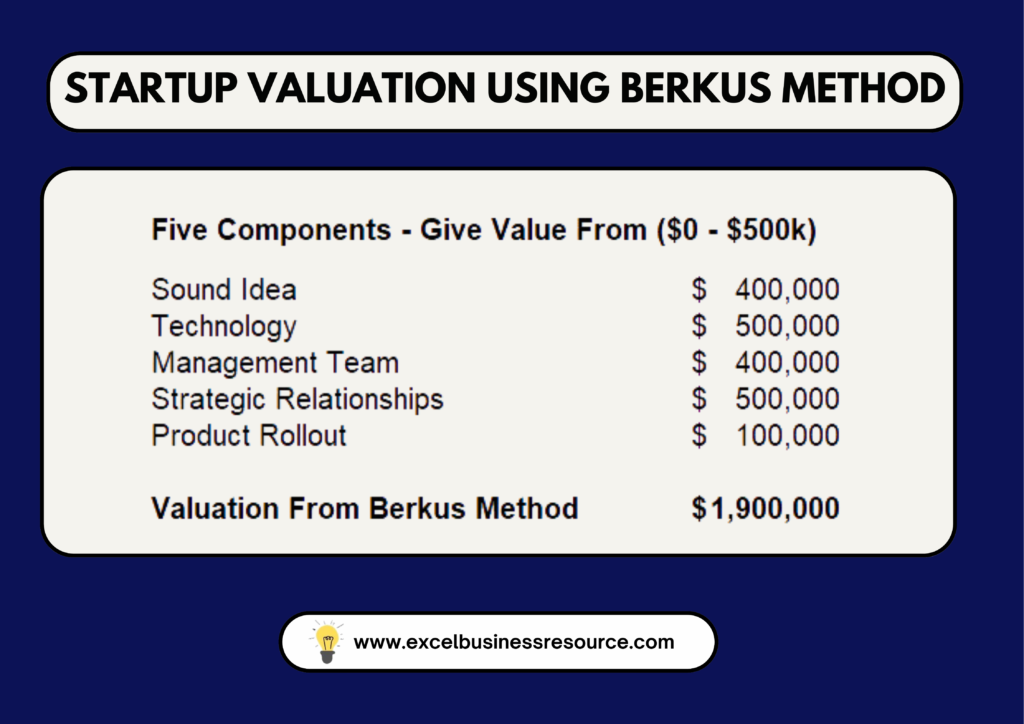

Real-Life Example of Berkus Method Valuation:

Imagine a health-tech startup developing a wearable device for remote cardiac monitoring:

Sound Idea: The startup tackles a growing global concern: preventative heart health. Investors assigned $400,000 to address this high-demand area.

Technology: They have developed a working technology or prototype tested in clinical trials, earning another $500,000.

Management Team: The team includes a cardiologist and a wearable tech engineer valued at $400,000.

Strategic Relationships: Early collaborations with three local hospitals to test and deploy the devices add $300,000.

Product Rollout: Initial sales to beta users generate $100,000, contributing to a valuation of $1.8 million.

The calculation would include 0.4 + 0.5 + 0.4 + 0.3 + 0.2 = $1.9 million.

Berkus valuation method expects a startup to hit a $1.9 million valuation in 5 years. Therefore, the next step involves assessing the capacity of the discussed value drivers to propel the startup’s worth to the desired target.

2. The Scorecard Valuation Method

The Scorecard Valuation Method is one of the most popular ways investors assess early-stage startups or pre-revenue startups, especially when financial history or revenue is minimal. The method aims to create a comprehensive valuation by comparing a startup’s qualitative and quantitative strengths to similar ventures within the same industry and region. It adjusts a startup’s valuation based on a weighted score applied to critical success factors, ensuring a realistic and customized outcome.

How Does It Work?

Identify the Average Pre-Money Valuation: Begin by researching the average pre-money valuation of startups in the target industry and geographic region. Sources include PitchBook, CB Insights, or Crunchbase, which provide insights into funding trends and comparable valuations.

Evaluate Key Factors: Each critical aspect of the startup is weighted based on its significance to success. These factors include the management team, market size, product quality, competitive Environment, marketing strategy, and additional investment needs.

Apply Weights and Ratings: Assign a rating (percentage) to each factor to reflect the startup’s performance compared to industry standards. Multiply these ratings by the assigned weights to calculate the adjusted valuation.

Key Factors and Their Importance

Strength of the Management Team (weightage – 30%): A startup’s management team is crucial because their expertise and leadership determine the success of execution. Experienced founders and managers inspire confidence in investors.

Size of the Market Opportunity (weightage – 25%): A larger, untapped market offers immense potential for scaling and profitability. Startups addressing major pain points in growing sectors receive higher scores.

Product/Technology (weightage – 15%): A product’s defensibility, uniqueness, and alignment with market needs influence valuation. A technologically innovative solution with intellectual property protection scores better.

Competitive Environment (weightage – 10%): A startup’s position relative to competitors and barriers to entry significantly affect its long-term viability.

Marketing/Sales Strategy (weightage – 10%): A strong go-to-market strategy and demonstrated traction (e.g., beta users or early adopters) show that the startup can capture and grow its customer base.

Need for Additional Investment (weightage – 10%): Startups requiring lower capital to scale generally have higher valuations due to reduced dilution risks and faster profitability.

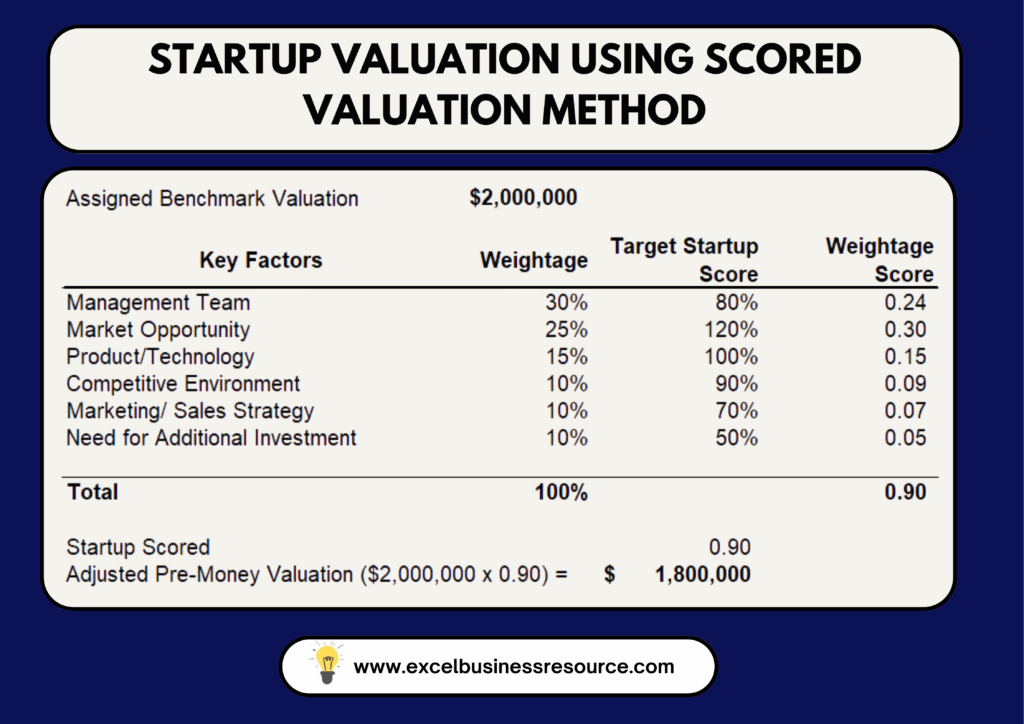

Example of an EdTech Startup Valuation Using Scored Valuation Method

Let’s analyze an EdTech startup targeting rural education in Southeast Asia. Assume the average pre-money valuation for EdTech startups in this region is $2 million:

Next step is to give weightage on each factor and sum up.

- Management Team: Experienced team with a history of exits scores is 80%, therefore (30% x 80%).

- Market Opportunity: A large underserved market scores is 120%, therefore (25% x 120%).

- Product/Technology: An innovative e-learning platform scores 100%, therefore (15% x 100%).

- Competitive Environment: Moderate competition scores 90%, therefore (10% x 90%).

- Marketing/Sales Strategy: Needs refinement, scoring 70%, therefore (10% x 70%).

- Need for Additional Investment: Requires minimal funding, scoring 50%, therefore (10% x 50%).

Startup Scored: 0.90

Adjusted Valuation = $2M (base) x 0.9 = $1.8 million.

This approach ensures a balanced valuation reflecting the startup’s strengths and market position.

3. Venture Capital (VC) Method

The Venture Capital (VC) Method is another prominent startup valuation technique. Investors widely use it to evaluate potential returns based on a startup’s projected exit value. It emphasizes the importance of future profitability and aligns the startup’s present-day valuation with the Investor’s return on investment (ROI) goals.

Exit Value: The expected value of the company at the time of a sale, merger, or IPO.

Required ROI: The desired multiple of the initial investment, accounting for the risk of startup investments.

How Does It Work?

Estimate the Exit Value: Forecast the company’s worth at a specific time (e.g., 5-7 years). This is often based on projected revenue or earnings multiplied by industry-standard valuation multiples. Data sources like CB Insights or public company benchmarks provide industry multiples.

Determine the Expected ROI: ROI expectations vary with risk levels. For example, early-stage startups may need to deliver 10x ROI due to higher uncertainty, while later-stage startups may require only 3-5x ROI.

Calculate the Post-Money Valuation: Divide the estimated exit value by the required ROI to determine the company’s worth after receiving the investment.

Calculate the Pre-Money Valuation: Subtract the investment amount from the post-money valuation to find the startup’s current value before funding.

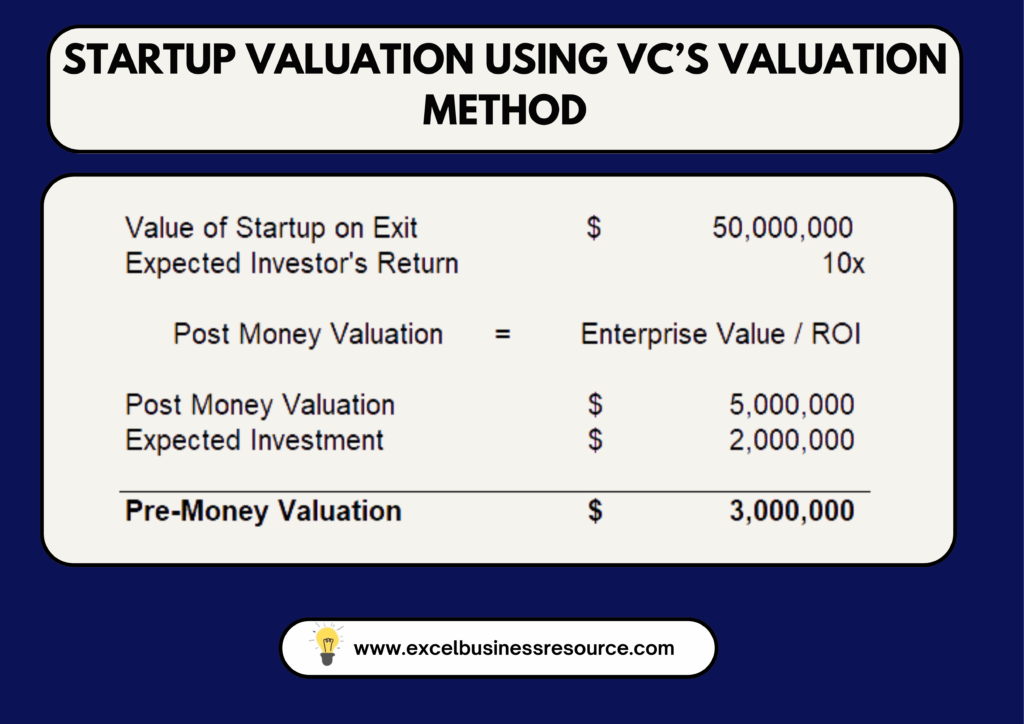

Example: A FinTech Startup Valuation Using VC Valuation Method

Suppose a FinTech startup projects an exit value of $50 million in five years. An investor plans to invest $2 million, expecting a 10x ROI:

Exit Value = $50 million (based on projected revenue of $10M and a 5x revenue multiple).

Post-Money Valuation = Exit Value / ROI = $50M / 10 = $5M.

Pre-Money Valuation = Post-Money Valuation – Investment = $5M – $2M = $3M.

In this case, the startup is currently valued at $3 million before the $2 million investment.

Why Use VC Valuation Method:

The VC valuation method clarifies for investors how much they should invest to achieve their targeted returns. It also helps entrepreneurs understand the level of equity dilution required to secure funding.

Limitations of VC Valuation Method:

While insightful, the VC Method relies heavily on assumptions about future performance, which can be uncertain. Therefore, investors often combine this approach with others, such as the Scorecard Method, to validate their estimates.

4. Pre-Money and Post-Money Valuation

Pre-money and Post-Money Valuation are essential concepts in startup fundraising, as they define the company’s worth before and after receiving investment. This is the primary use for the pre-revenue stage.

Understanding Pre-Money and Post-Money Valuations

Pre-Money Valuation: The valuation of a company before a new round of funding. It reflects the intrinsic value of the business based on factors such as market size, product potential, and financial performance.

Post-Money Valuation: The valuation of a company after the investment is received. It’s calculated by adding the investment amount to the pre-money valuation, providing the updated company value.

Key Formulas

Post-Money Valuation = Pre-Money Valuation + Investment Amount.

Investor Ownership = Investment Amount / Post-Money Valuation.

Real-Life Example

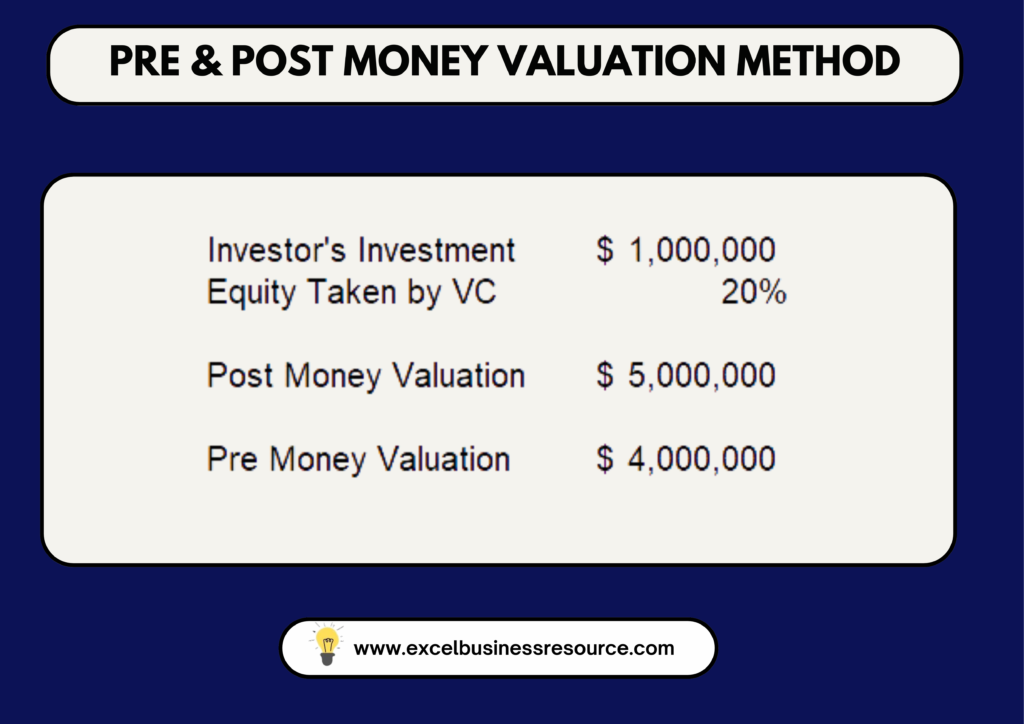

Let’s say a pre-revenue SaaS startup is raising investment without a valuation. It secures an investment of $1 million from venture capitalists against 20% equity in the startup.

Therefore;

Investment: $1 million

Equity Taken by VCs: 20%

Post Money Valuation: $1M / 2% = $5 million

Pre Revenue Valuation: $5 million – $1 million = $4 million

In this way, it’s easily analyze the pre & post-money valuation.

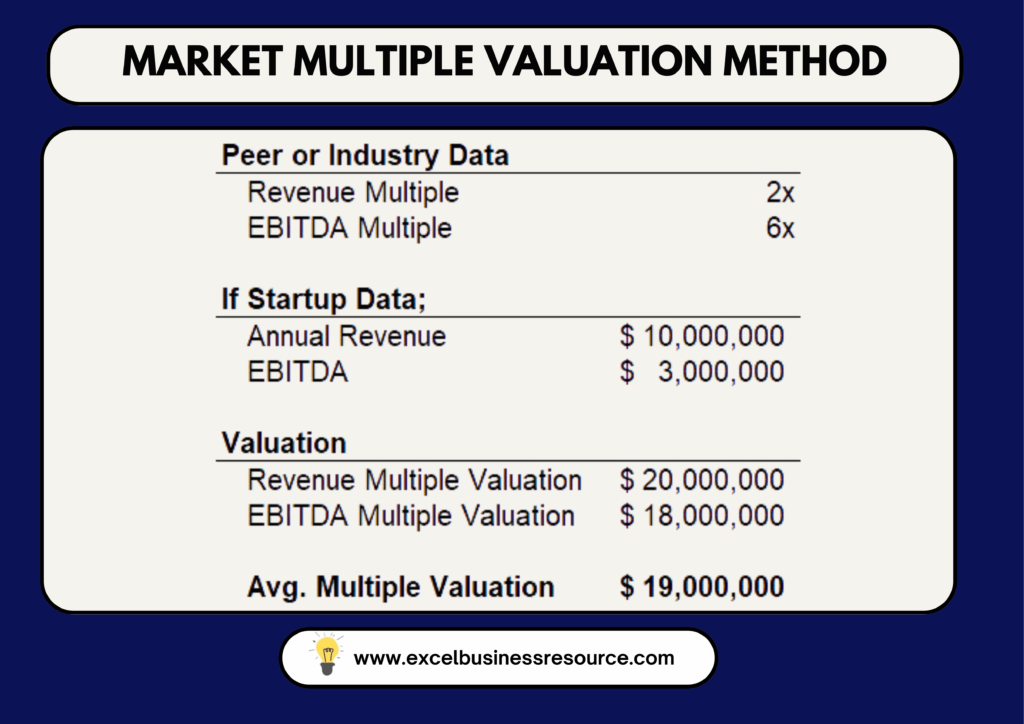

5. Market Multiple Approach

The Market Multiple Approach also called comparable valuation, is one of the most straightforward valuation methods. It relies on comparisons with similar companies in the industry. It’s particularly effective for startups or businesses with sufficient financial metrics, as it leverages market benchmarks to estimate value.

This market multiple approach is also used by Shark Investors in Shark Tank Series for startup valuation.

Purpose of the Market Multiple Approach

The method’s primary objective is to value a business relative to its peers, ensuring that the valuation aligns with industry norms and current market conditions. It’s widely used in sectors where financial metrics (like revenue or EBITDA) provide a clear basis for comparison.

How Does It Work?

Select an Industry-Standard Multiple: Determine the relevant valuation multiple based on the target company’s business model. Common multiples include:

Revenue Multiple: Often used for high-growth startups, especially in tech or SaaS.

EBITDA Multiple: Common in more mature companies with steady earnings.

Identify Financial Metrics; Gather the peer startup’s financial data, such as revenue multiple (EV/Revenue) & EBITDA multiple (EV/EBITDA)

Apply the Multiple: Multiply the financial metric by the industry-standard multiple to calculate the company’s valuation.

Choosing the Right Multiple For Valuation

The choice of multiple depends on the industry and the company’s stage of growth. For instance:

Early-stage companies often rely on Revenue Multiples because profitability (EBITDA) might still need to be realized.

Mature companies with consistent cash flow often favor EBITDA Multiples, reflecting operational efficiency.

Why This Approach Is Powerful

The Market Multiple Approach ensures that the valuation reflects current market dynamics and aligns with the industry’s valuation benchmarks. It also provides an easy way to compare potential investments or acquisitions. However, it’s important to note that this method works best when there are sufficient data on comparable companies in the market.

Challenges

Data Dependence: Finding reliable multiples and comparable companies can be difficult in private startups or niche industries.

It is simplistic and doesn’t account for unique factors like a company’s intellectual property, growth trajectory, or market position.

6. Discounted Cash Flow (DCF) Method

The Discounted Cash Flow (DCF) Valuation Method is one of the most comprehensive valuation techniques, often used by startups and established businesses alike. It calculates the present value of expected future cash flows, adjusted for risk and the time value of money. The DCF method is particularly useful when reliable projections for future revenue and costs are available.

Why DCF Matters

Time Value of Money: Money today is worth more than the same amount in the future due to its earning potential.

Risk Adjustment: DCF accounts for uncertainties by discounting future cash flows at a rate reflecting the investment’s risk.

Intrinsic Value: It estimates a company’s true worth, independent of market speculation or temporary trends.

How Does DCF Valuation Work?

Forecast Free Cash Flows (FCFs): Estimate the company’s cash flows over a specific period, usually 5–10 years. These are the cash flows left after accounting for operating costs, taxes, and necessary investments.

Calculate the Terminal Value: Beyond the forecasted period, the terminal value estimates the company’s worth into perpetuity using a growth rate or market multiple.

Discount to Present Value: Use a discount rate (commonly the Weighted Average Cost of Capital, WACC) to bring future cash flows to their present value.

Add It All Together: Combine the present values of forecasted cash flows and the terminal value to determine the total valuation.

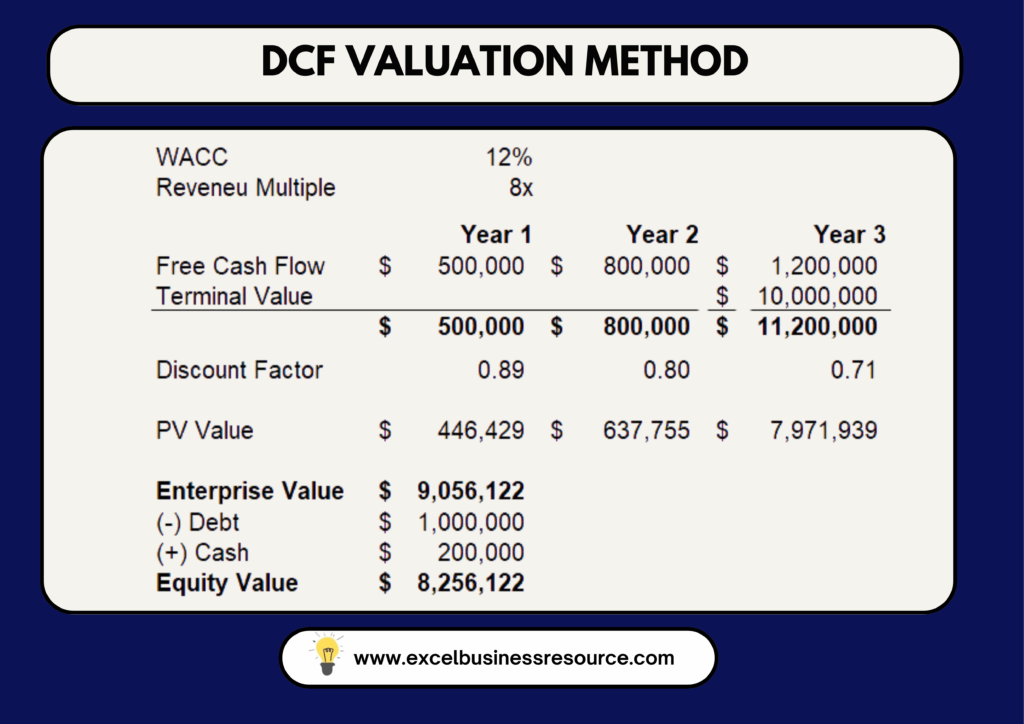

Real-Life Example For DCF Valaution: A SaaS Startup

Imagine a SaaS startup forecasting the following free cash flows:

Year 1: $500,000

Year 2: $800,000

Year 3: $1.2 million

The terminal value is estimated at $10 million. The discount rate (WACC) is 12%.

Discount Back All Future Cash Flows

Present Value (PV) of Year 1 = $500,000 / (1 + 0.12)^1 = $446,429

PV of Year 2 = $800,000 / (1 + 0.12)^2 = $637,755

PV of Year 3 = $1,200,000 / (1 + 0.12)^3 = $854,136

Discount Back The Terminal Value To Present Value

PV of Terminal Value = $10M / (1 + 0.12)^3 = $7.12M

Total Valuation

Total DCF Valuation = $446,429 + $637,755 + $854,136 + $7.12M = $9.06 million.

Strengths and Challenges

Strengths: Provides a detailed valuation based on intrinsic factors.

Challenges: Highly sensitive to assumptions like growth rates and discount rates, requiring careful analysis.

7. Risk Factor Summation Method

The Risk Factor Summation Method evaluates a startup by adjusting its base valuation based on identified risks and opportunities. It’s particularly effective for early-stage startups or pre-revenue stage startup with limited financial history.

Why Use Risk Factor Summation Method?

Qualitative Focus: Incorporates non-financial factors such as market size, competition, and management strength.

Adjustable: Each identified risk either increases or decreases the valuation, offering flexibility.

How Risk Factor Summation Method Works

Start with a Base Valuation: Use a comparable company’s valuation or industry average as a starting point.

Identify Key Risk Factors: Evaluate up to 12 areas, including:

- Management

- Stage of the business

- Legislation/Political risk

- Manufacturing risk

- Sales and marketing risk

- Funding/capital raising risk

- Competition risk

- Technology risk

- Litigation risk

- International risk

- Reputation risk

- Potential lucrative exit

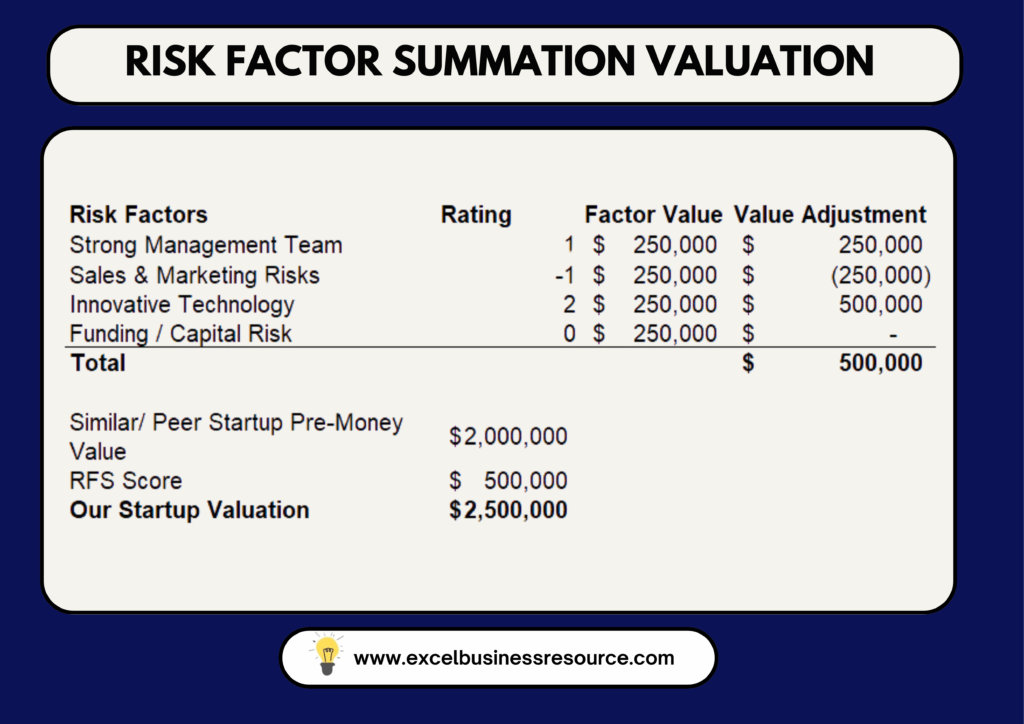

Assign Risk Scores: Rate each factor as positive (+$250,000), neutral ($0), or negative (-$250,000).

Adjust the Base Valuation: Sum all adjustments to modify the base valuation.

Real-Life Example Of RFS Method:

A health-tech startup has a base valuation of $2 million. Risk factor evaluations yield the following adjustments:

Strong management team: +$250,000

Sales & Marketing Risks: -$250,000

Innovative technology: +$500,000

Funding / Capital Risk: Neutral ($0)

Final Valuation = $2M + $250K – $250K + $500K + $0 = $2.5 million.

Strengths and Challenges

Strengths: Simple and adaptable, particularly for startups in diverse industries.

Challenges: Subjective; requires experienced evaluators to rate risks accurately.

8. Cost-to-Duplicate Method

The Cost-to-Duplicate Method estimates a company’s valuation by determining how much it would cost to recreate the business from scratch. It’s ideal for startups with tangible assets, intellectual property, or early-stage ventures.

Purpose of Cost-to-Duplicate

Fair Valuation: Especially useful when future projections are uncertain.

Asset-Focused: Reflects the company’s tangible and intangible assets.

How Cost To Duplicate Method Works

List All Assets: Identify tangible and intangible assets, including physical infrastructure, intellectual property, and brand value.

Calculate the Replacement Cost: Estimate the cost of acquiring or creating each asset.

Sum It Up: Add up all replacement costs to determine the valuation.

Real-Life Example Of Cost To Duplicate Method: A Hardware Startup

A hardware company designs and manufactures IoT devices. Its assets include:

Proprietary Software: Development cost of $500,000

Manufacturing Facility: Equipment worth $1 million

Brand Development: Marketing spend of $300,000

Total Valuation = $500,000 + $1,000,000 + $300,000 = $1.8 million.

Strengths and Challenges

Strengths: It provides a straightforward valuation based on real costs

incurred. A challenge is that it ignores future growth potential and relies on accurate cost estimation.

Best Practices for Startup Valuation

Founders can do valuation itself, but it’s better to engage financial modeling consultant, and financial modeling outsourcing services. They can give you eagle eye view on your startup’s worth. Moreover they are expert startups, can help you in correcting revenue model and industry specific data of valuation.

Moreover, you can save 100 of hours by just purchasing the custom financial model templates for startups, specific to your revenue model & stage of startup, in which you only need to put your assumptions, and the whole custom built excel model get you a valuation. It will not give you a valuation, but detail from customer acquisition, financial statements, KPIs, breakeven, working capital, cash runway & run rate analysis, CapEx & investment requirements, sensitivity analysis & equity giveaway analysis.

Conclusion

Startup valuation is both an art and a science. It requires both qualitative insights and quantitative analysis. By selecting the appropriate valuation methods and considering key influencing factors, entrepreneurs and investors can give greater clarity and confidence & approach strategic planning.

FAQs: How to Do Valuation of a Startup