In the dynamic landscape of startups, efficient financial planning is paramount for success. However, creating comprehensive financial forecasting models from scratch can be daunting, especially for entrepreneurs juggling multiple responsibilities. This is where financial modeling Excel templates come to the rescue. They offer ready-made solutions tailored to specific industries, enabling startups to streamline their planning processes and make informed decisions. Let’s delve into the benefits of utilizing these templates across various sectors.

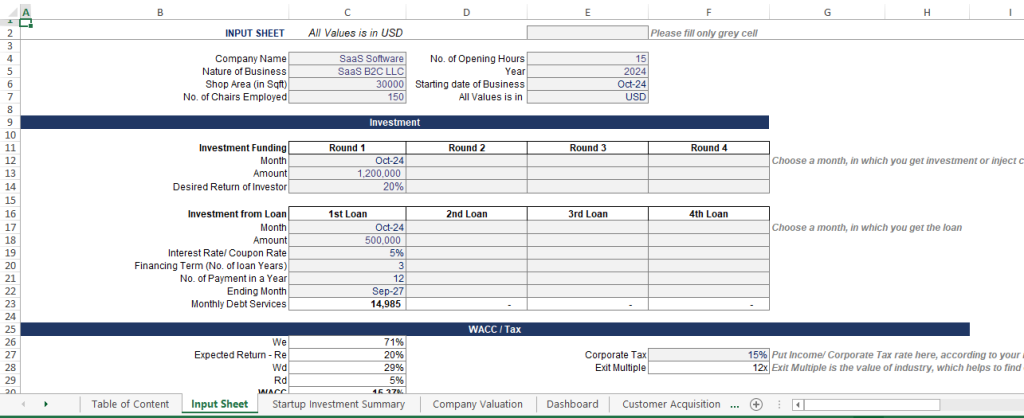

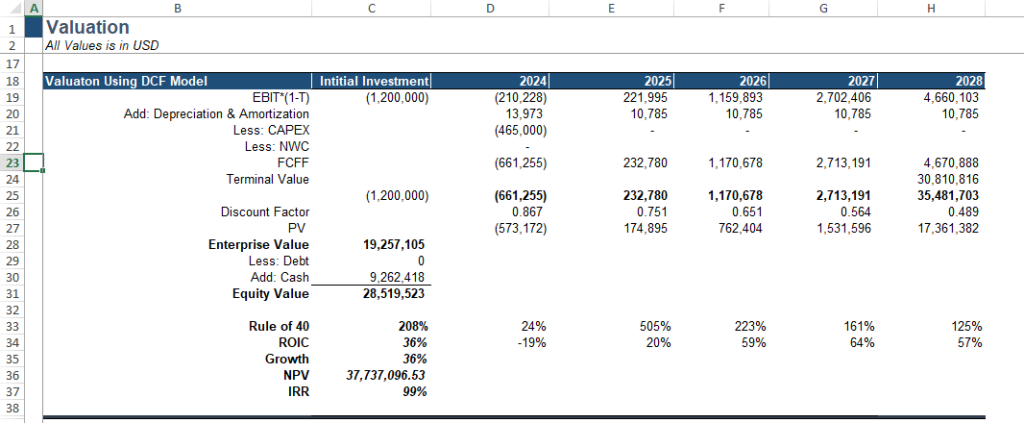

Software as a Service (SaaS) businesses operate on unique revenue models, with considerations such as subscription plans, churn rates, and customer acquisition costs. The SaaS financial model template provides a structured framework to forecast revenue streams, track expenses, and project cash flows accurately. By inputting key metrics specific to your SaaS venture, you can gain insights into profitability, pricing strategies, and growth trajectories.

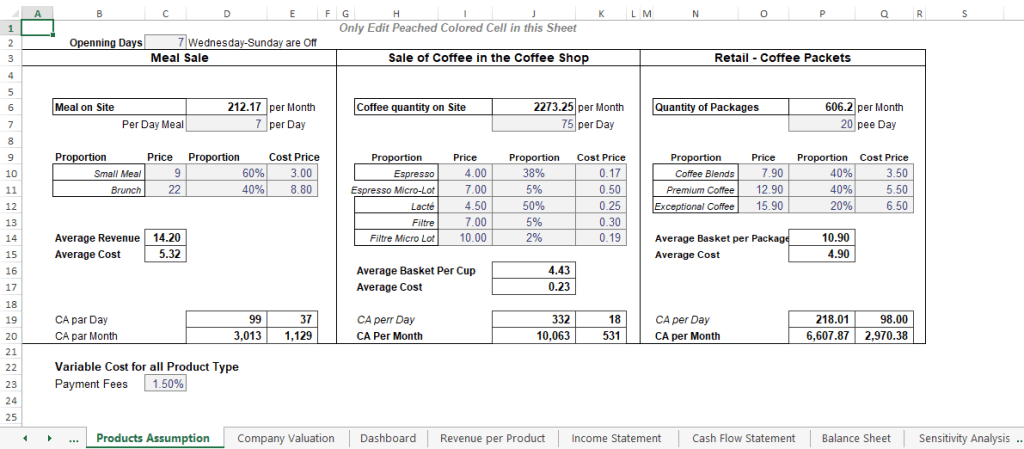

Restaurants face complex financial challenges, from managing inventory and labor costs to predicting seasonal fluctuations in revenue. The restaurant financial model template simplifies these complexities by integrating variables like menu pricing, table turnover rates, and food cost percentages. Whether you’re planning to open a new eatery or optimizing an existing one, this template empowers you to analyze profitability, assess break-even points, and fine-tune operational efficiencies.

Ecommerce ventures thrive on data-driven decision-making, encompassing aspects like sales projections, marketing expenses, and inventory management. The ecommerce financial model template caters to these needs by offering customizable tools to forecast sales volumes, evaluate marketing ROI, and optimize inventory levels. By leveraging this template, startups can devise strategies to maximize revenue, minimize costs, and capitalize on market opportunities in the digital realm.

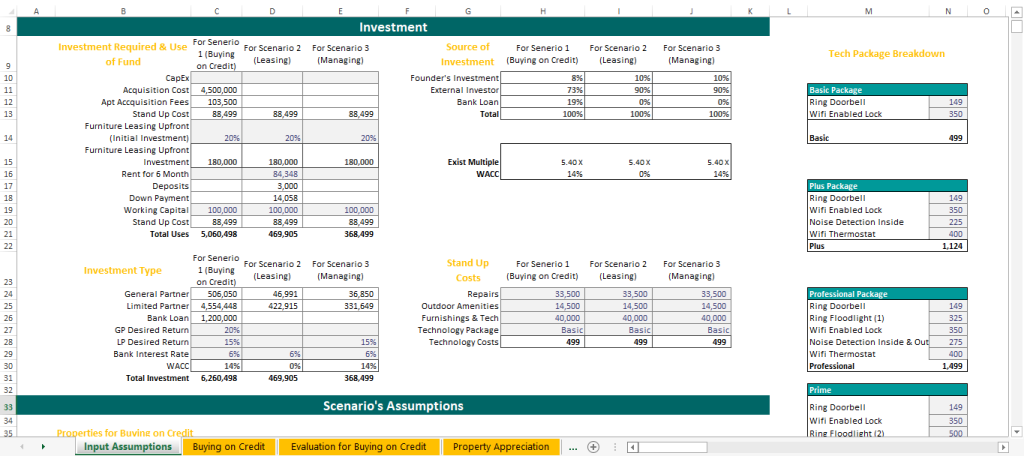

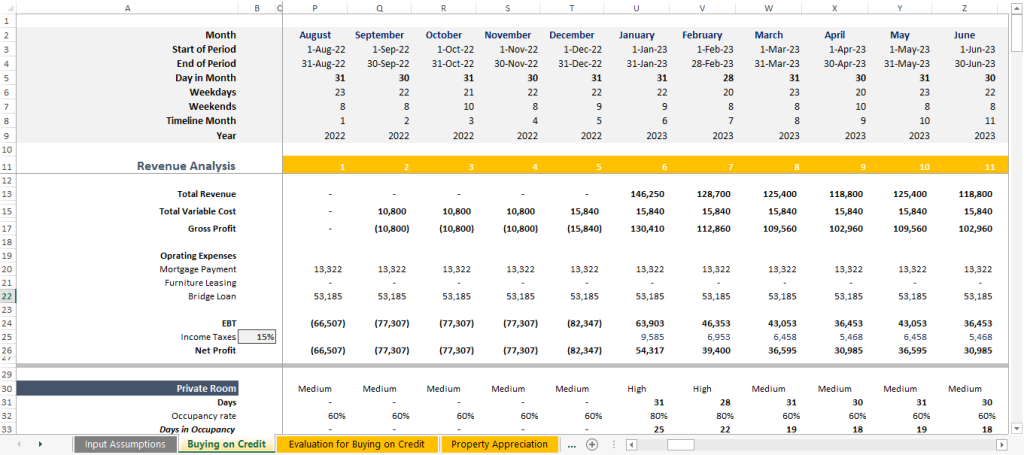

Real estate ventures demand meticulous financial planning, encompassing property acquisition, construction costs, rental income, and property management expenses. The real estate financial model template provides a comprehensive framework to analyze cash flows, calculate return on investment (ROI), and assess the feasibility of real estate projects. Whether you’re involved in residential development, commercial leasing, or property flipping, this template facilitates informed decision-making and risk management.

How These Templates Benefit Startups:

- Time-Saving: By leveraging pre-built Excel templates, startups can expedite the financial modeling process, saving valuable time and resources.

- Accuracy: These templates are meticulously designed to incorporate industry-specific variables, ensuring accuracy in financial projections and analysis.

- Decision Support: With detailed insights into revenue drivers, cost structures, and profitability metrics, startups can make informed decisions to steer their businesses in the right direction.

- Investor Confidence: Presenting well-structured financial models instills confidence in investors, showcasing a thorough understanding of the business landscape and growth potential.

Are you ready to take your startup’s financial planning to the next level? Download our industry-specific financial model templates today and unlock the power of data-driven decision-making. Whether you’re launching a SaaS platform, opening a restaurant, venturing into ecommerce, or investing in real estate, these templates serve as invaluable tools to chart your path to success. Empower your startup with the right financial insights and propel it towards sustainable growth. Let’s embark on this journey together. Download now and pave the way for a prosperous future!