Battery Manufacturing Financial Model Template

Fully editable Battery Manufacturing Financial Model Template in Excel, designed to provide a detailed and professional 5-year financial plan tailored for battery manufacturing startups. This pre-built model offers extensive features to streamline financial forecasting, investment analysis, and strategic planning.

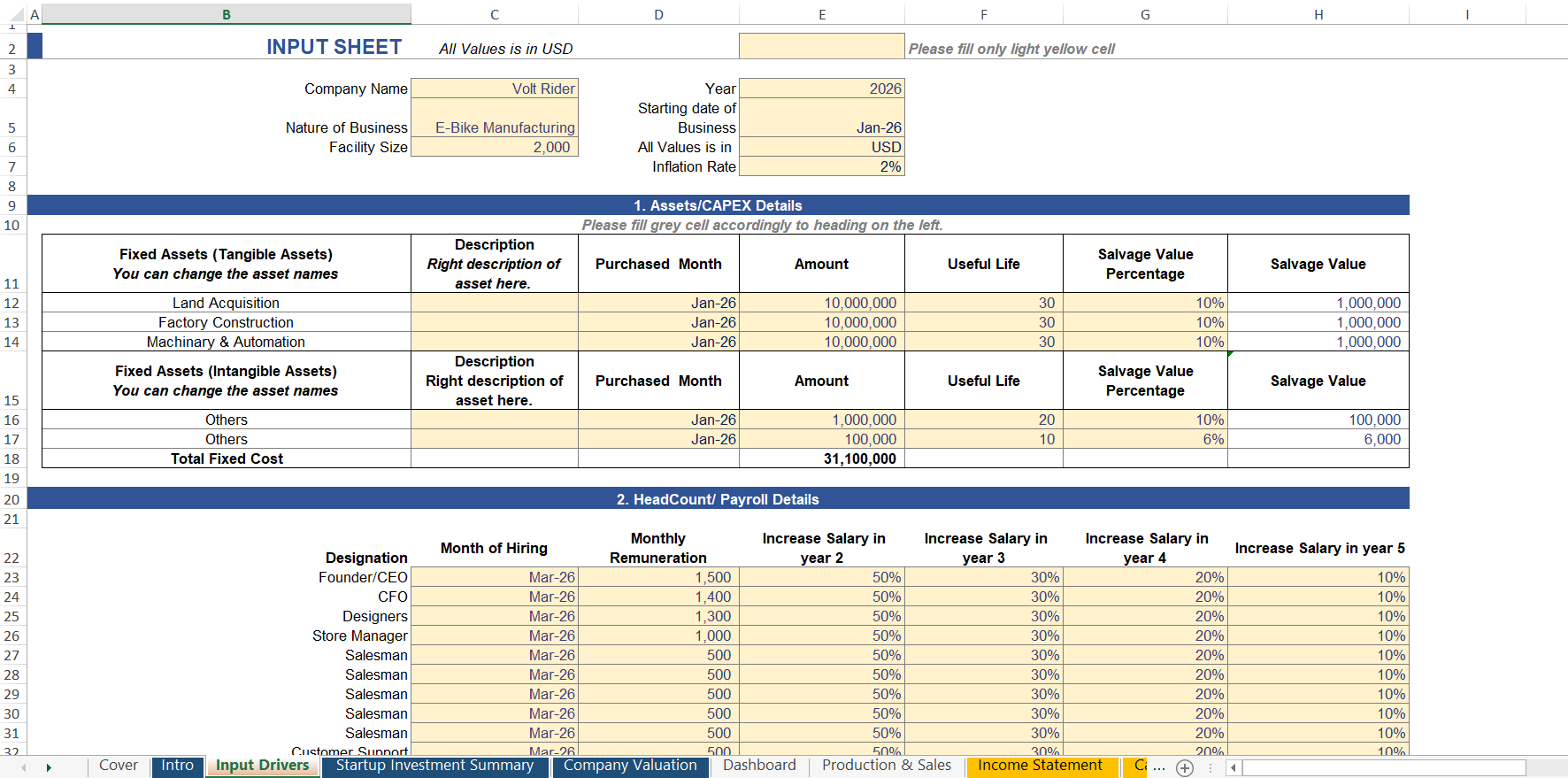

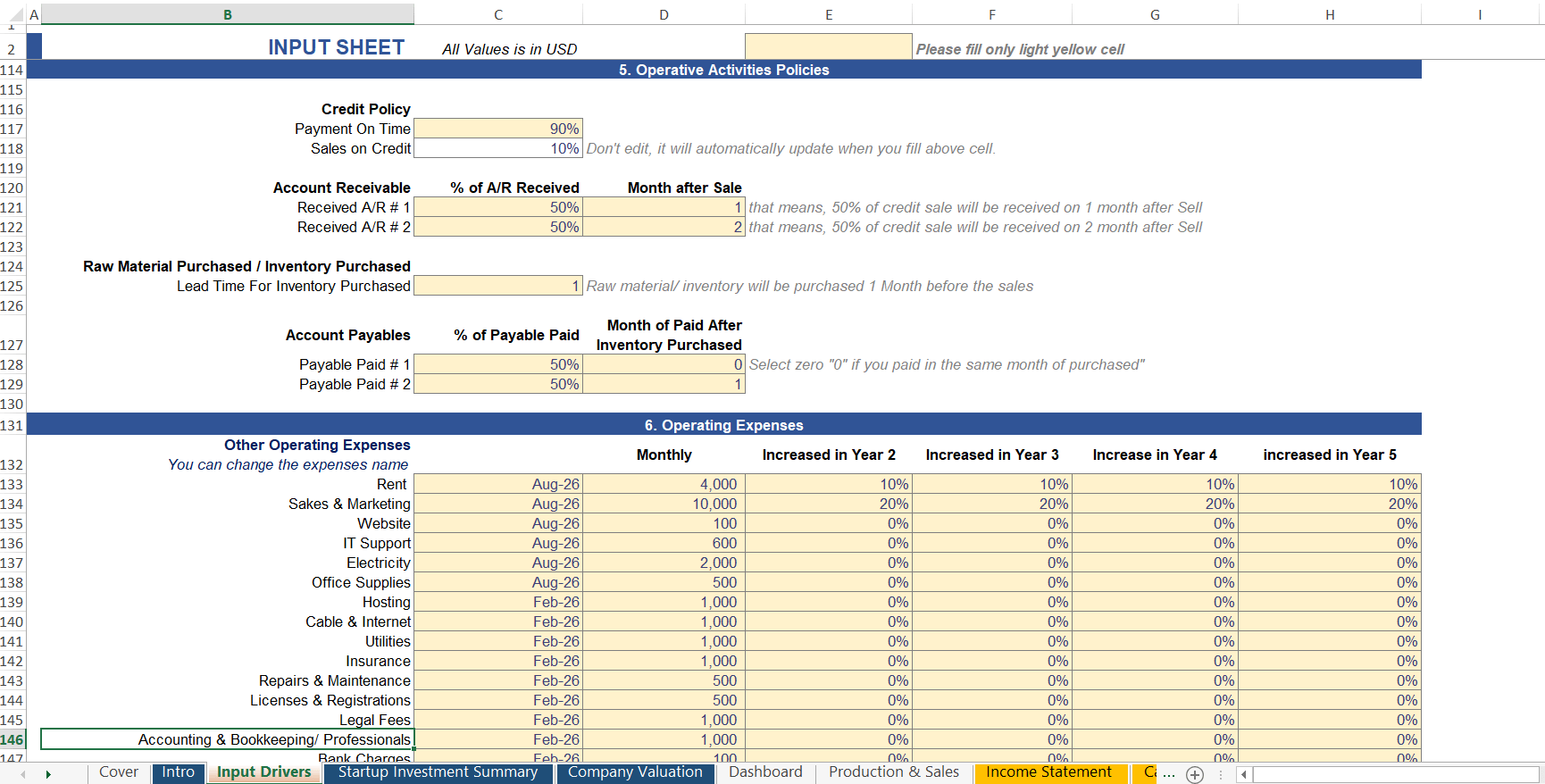

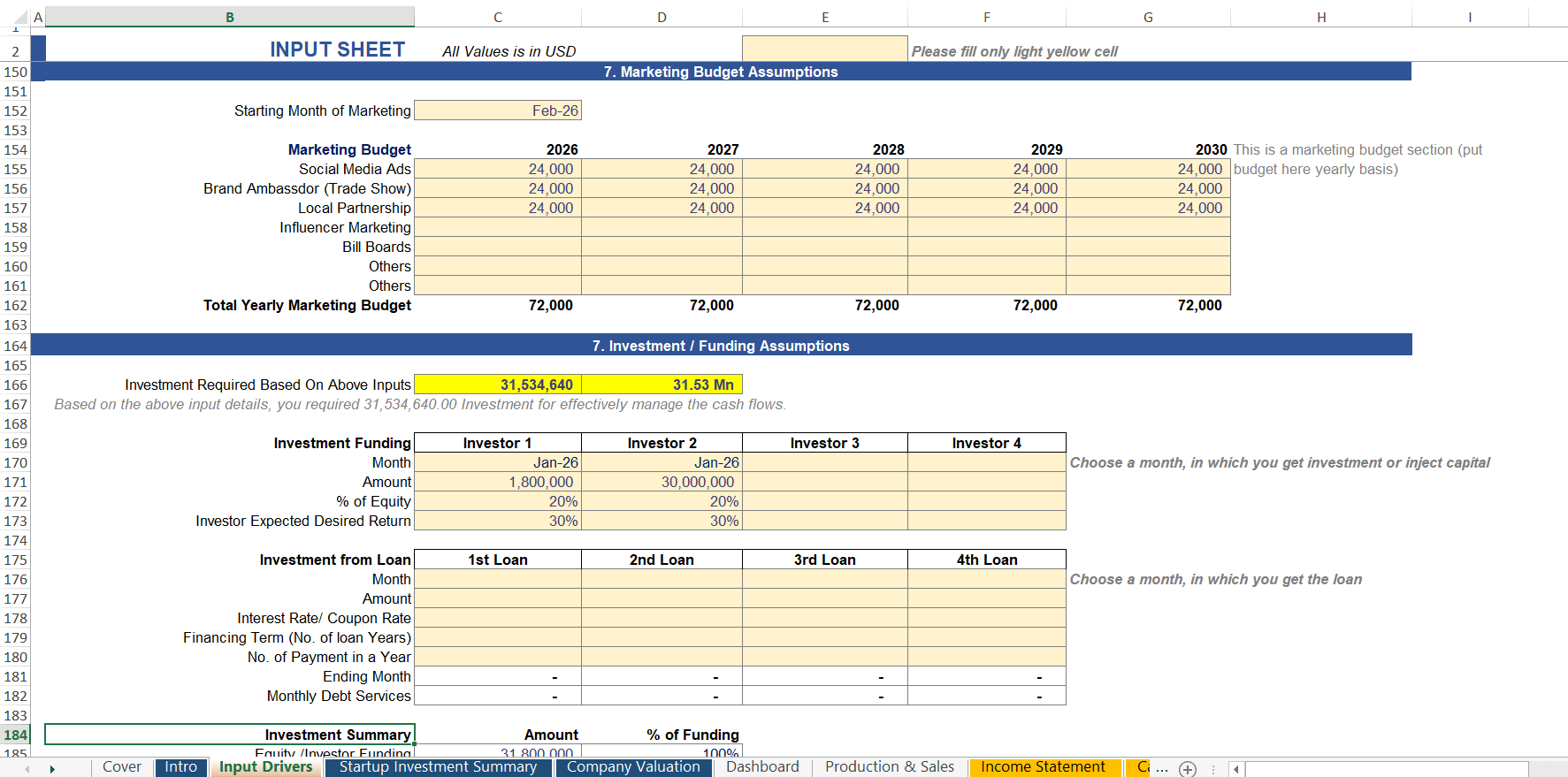

- Detailed Driver’s Assumptions i.e. Investment, R&D, Revenue & Cost Assumptions

- Upto to 5-Year Forecasting Model

- Financial Projections With P&L, Cash Flow, Balance Sheet

- Detailed Headcount, Expenses & CAPEX Planning

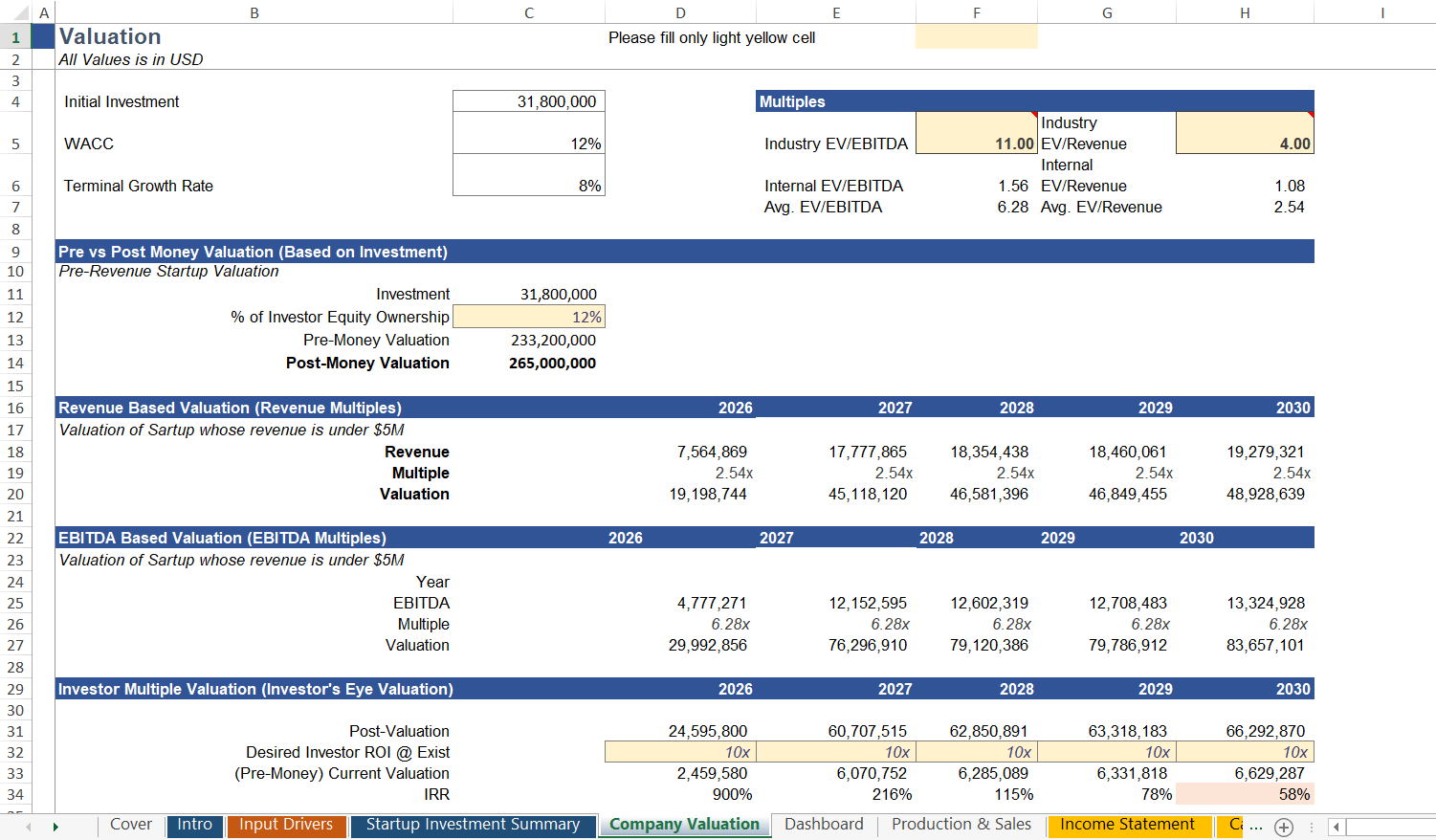

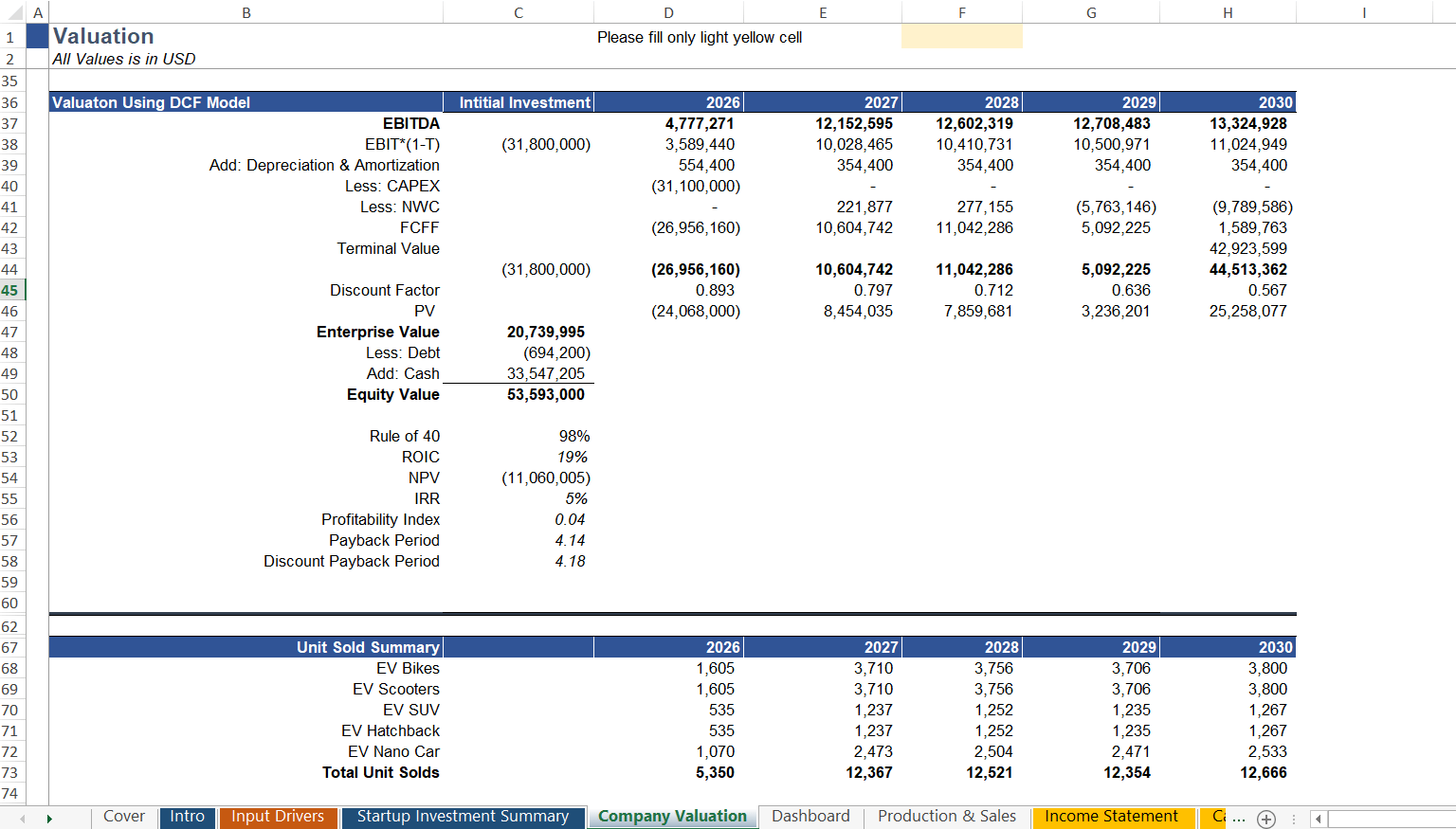

- Detailed Valuation i.e. DCF Valuation, EV/R&D Valuation, EBITDA & Revenue Multiple Valuation, Investor Valuation, Pre & Post Money Valuation.

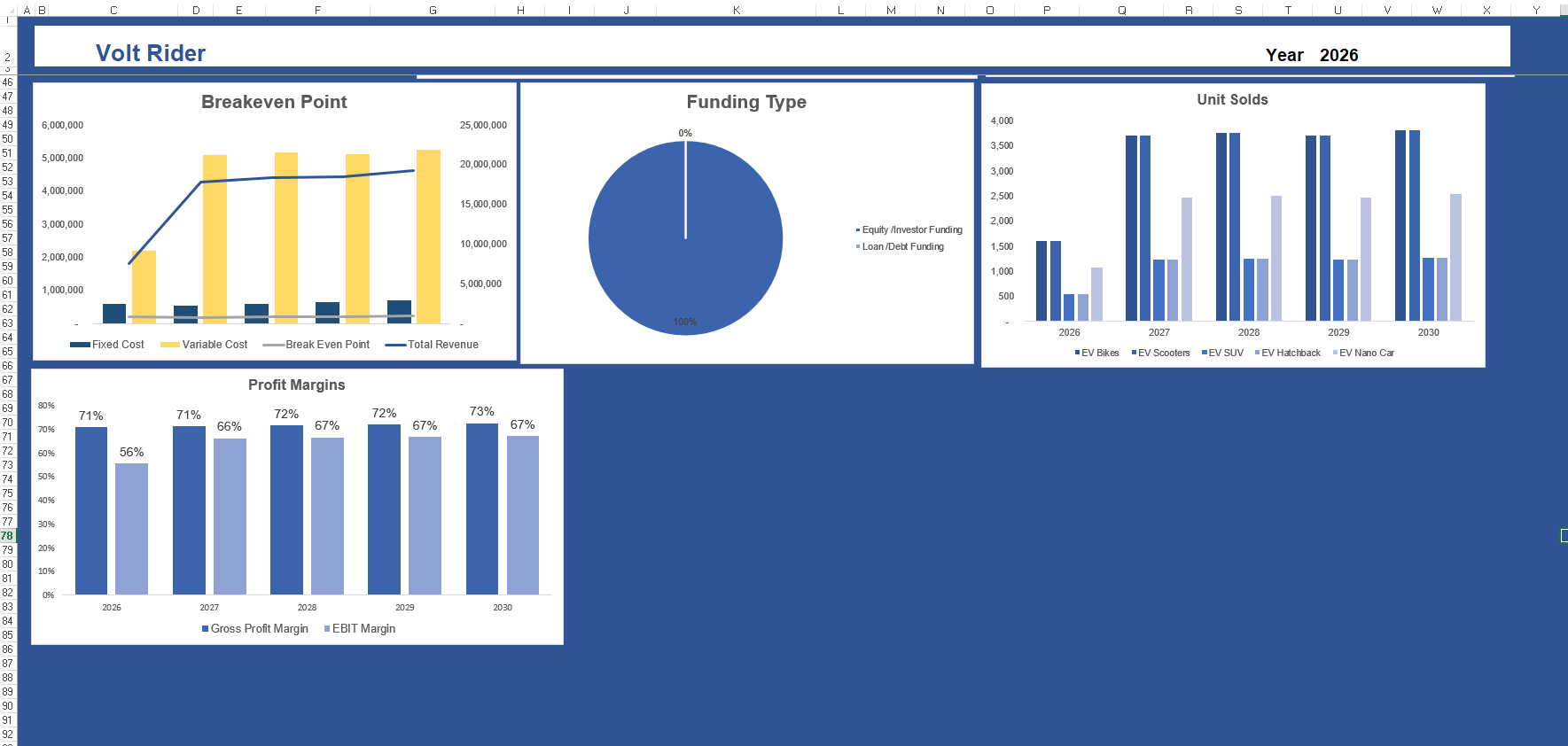

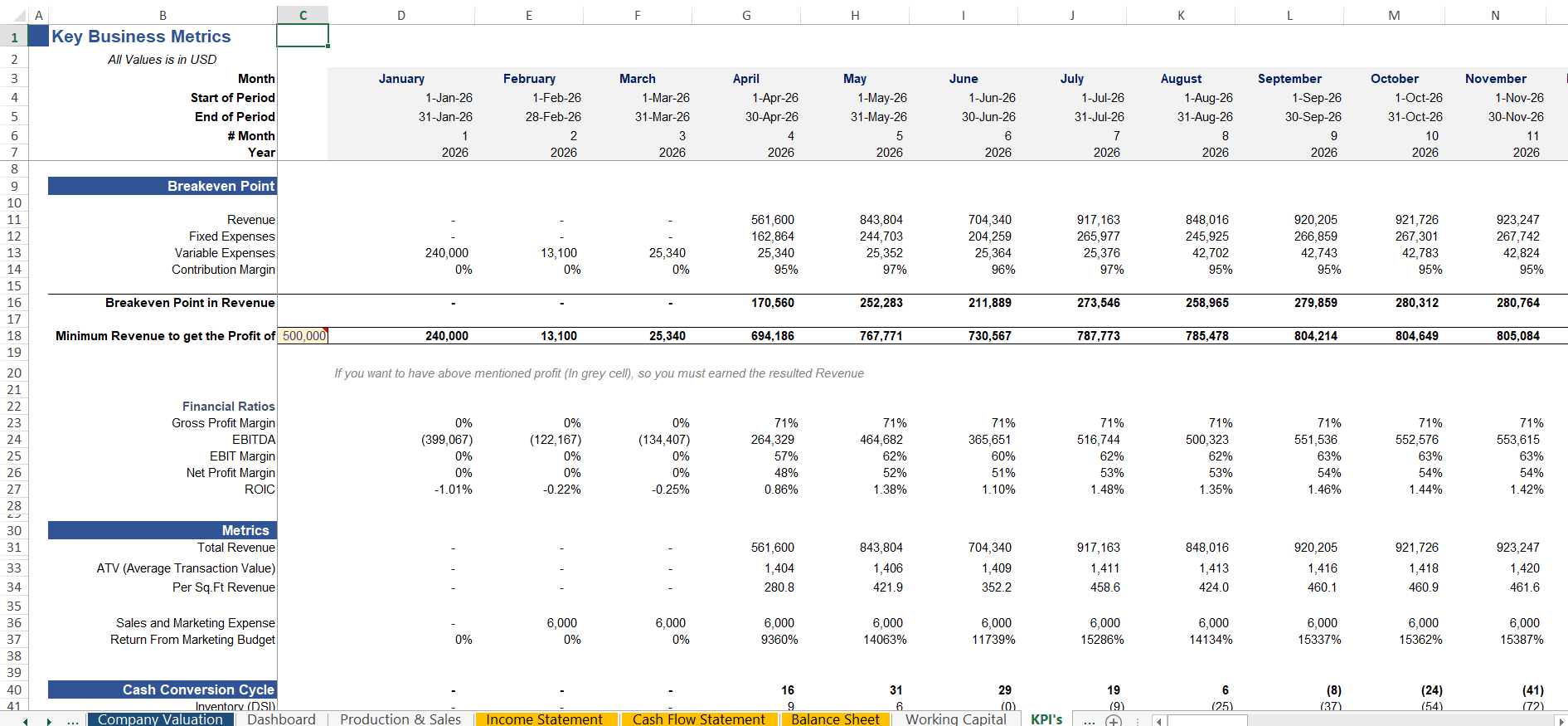

- Breakeven Analysis, NPV, IRR, consolidated and each project

- Sensitivity Analysis, KPIs & Metrics, Burn Rate, Cash Runway

- Fully editable

Why Choose Our Battery Manufacturing Financial Model Template

- Save 40 Hours of Manual Work

- 100+ Customized Assumptions

- Advanced Valuation Methods Applied

- In-depth Financial Projections

- Free Supports & Error Corrections

Description

Battery Manufacturing Financial Model Template: The Ultimate Investor-Ready Excel Tool

Download the industry-leading Battery Manufacturing Financial Model—a professional, Ready-to-use Excel framework meticulously built for the high-stakes world of energy storage and lithium-ion production. Whether you’re engineering solid-state breakthroughs, scaling a Gigafactory, or focused on phosphate-based (LFP) chemistries, this Automobile Manufacturing financial forecasting model provides the technical depth required to navigate complex unit economics and volatile raw material markets.

This is more than a simple spreadsheet; it is a sophisticated Investment Analysis of Automobile Manufacturing that converts technical specifications into a clear, investor-ready financial roadmap.

MODEL OVERVIEW

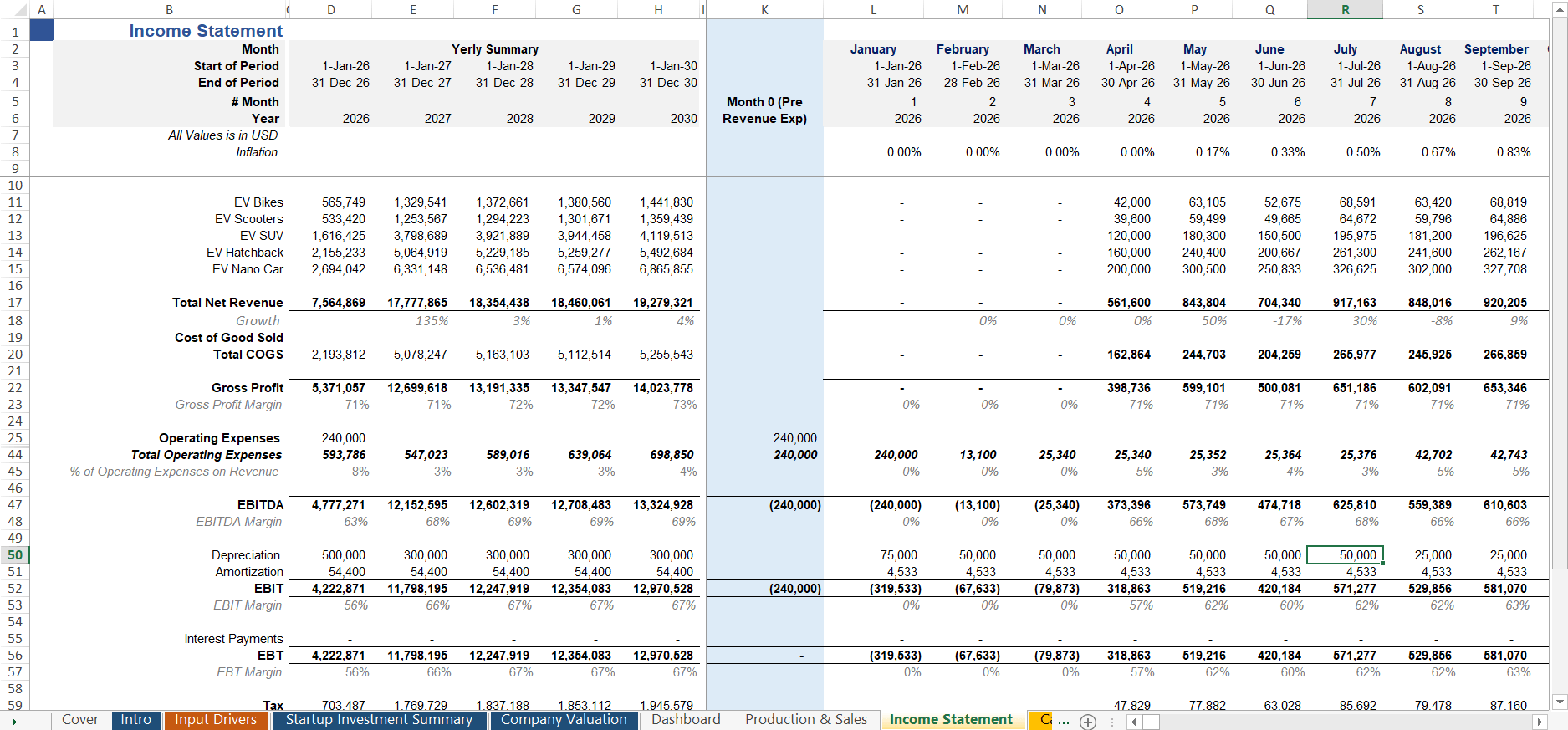

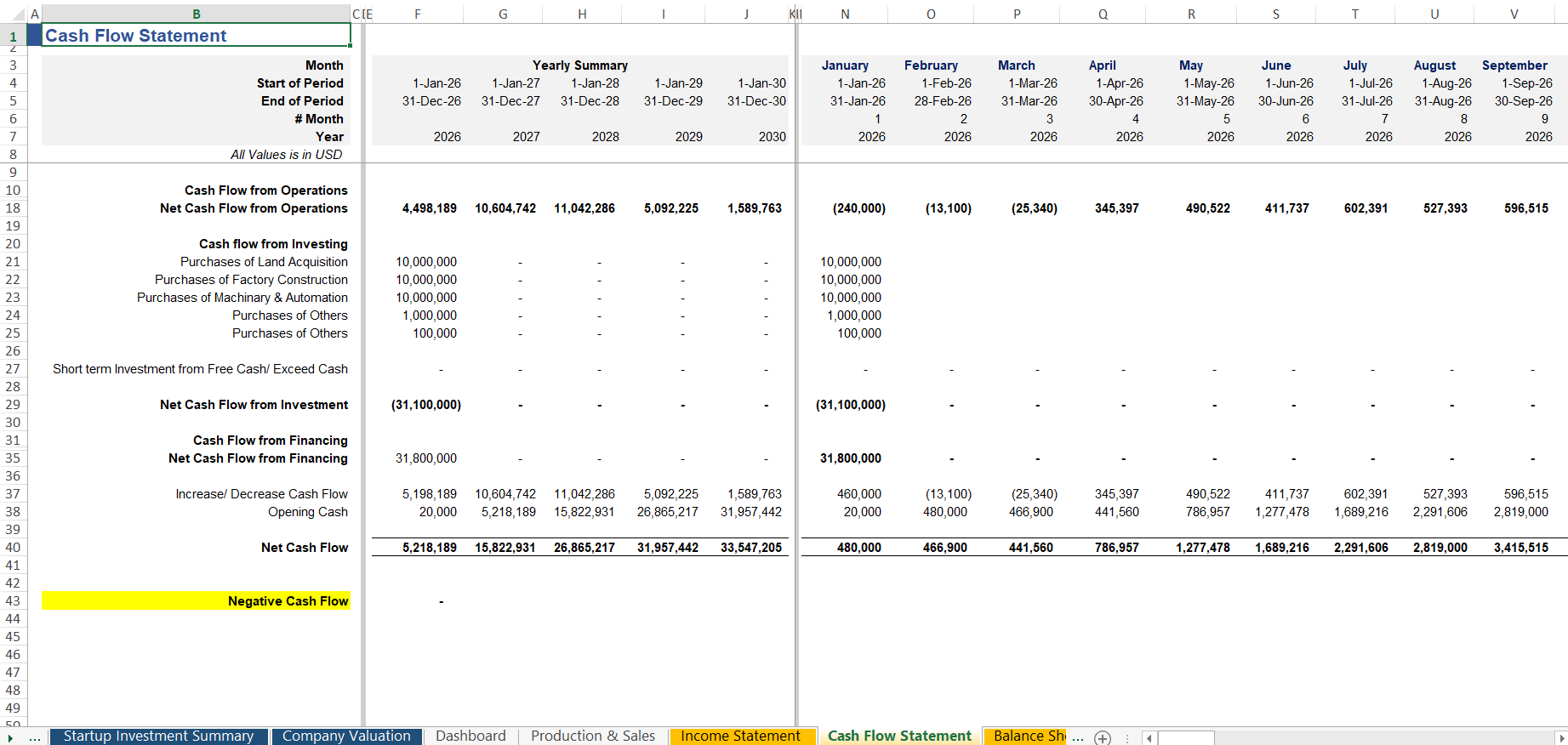

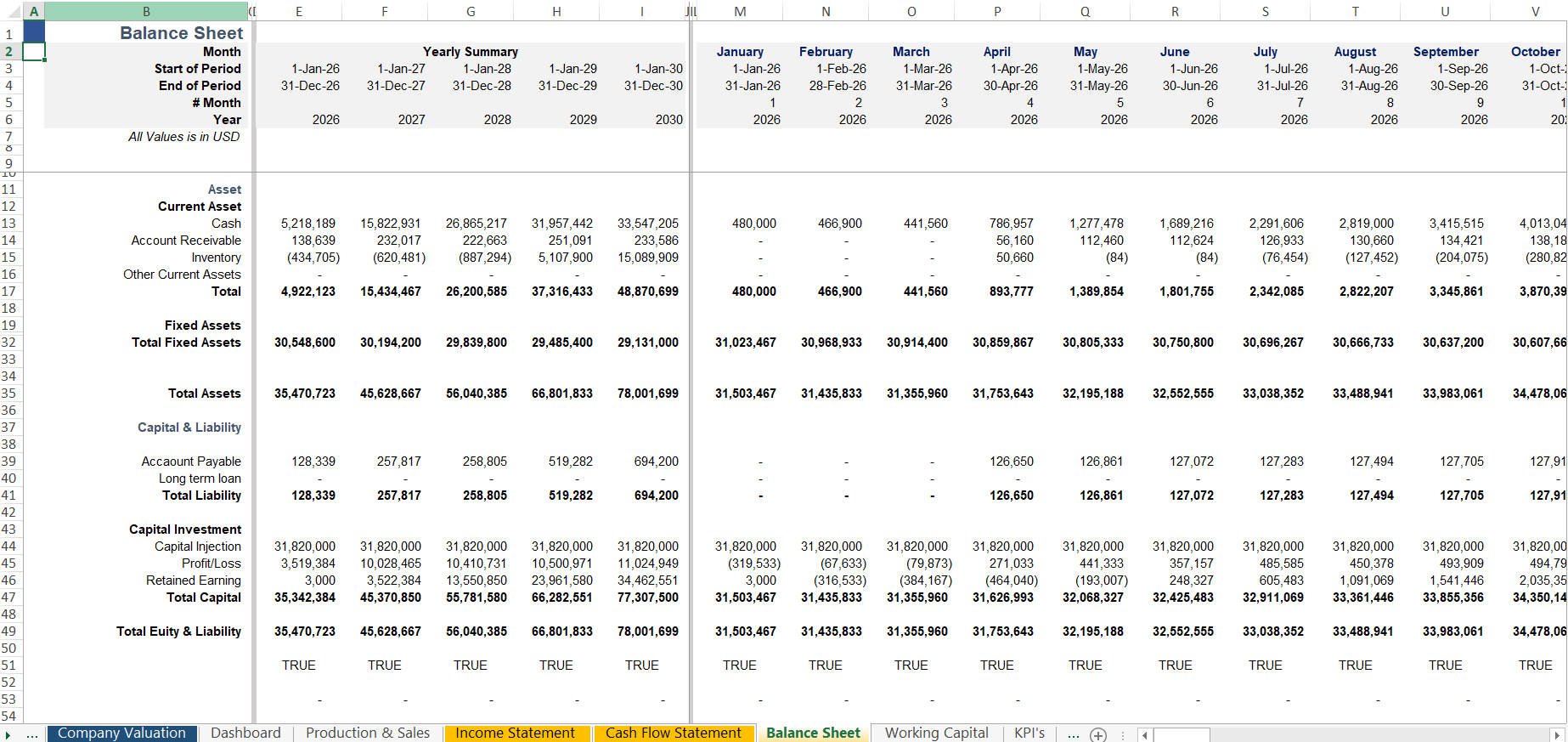

The Battery Manufacturing Financial Model is a dynamic, 3-statement projection tool (Income Statement, Balance Sheet, and Cash Flow) designed specifically for the capital-intensive nature of electrochemical cell production. It bridges the gap between factory floor engineering and C-suite financial strategy.

MODEL OVERVIEW

The Battery Manufacturing Financial Model is a dynamic, 3-statement projection tool (Income Statement, Balance Sheet, and Cash Flow) designed specifically for the capital-intensive nature of electrochemical cell production. It bridges the gap between factory floor engineering and C-suite financial strategy.

This model follows elite financial standards. It features an automated Valuation of Automobile Manufacturing, detailed CapEx scheduling, and a robust Financial Forecasting Model of Automobile Manufacturing Companies architecture that allows for instant “what-if” scenario testing.his model follows elite financial standards. It features an automated Valuation of Automobile Manufacturing, detailed CapEx scheduling, and a robust Financial Forecasting Model of Automobile Manufacturing Companies architecture that allows for instant “what-if” scenario testing.

KEY TABS & SYSTEM ARCHITECTURE

Our Founder-Ready template is organized into 16+ semantically linked tabs for a fluid, professional user experience:

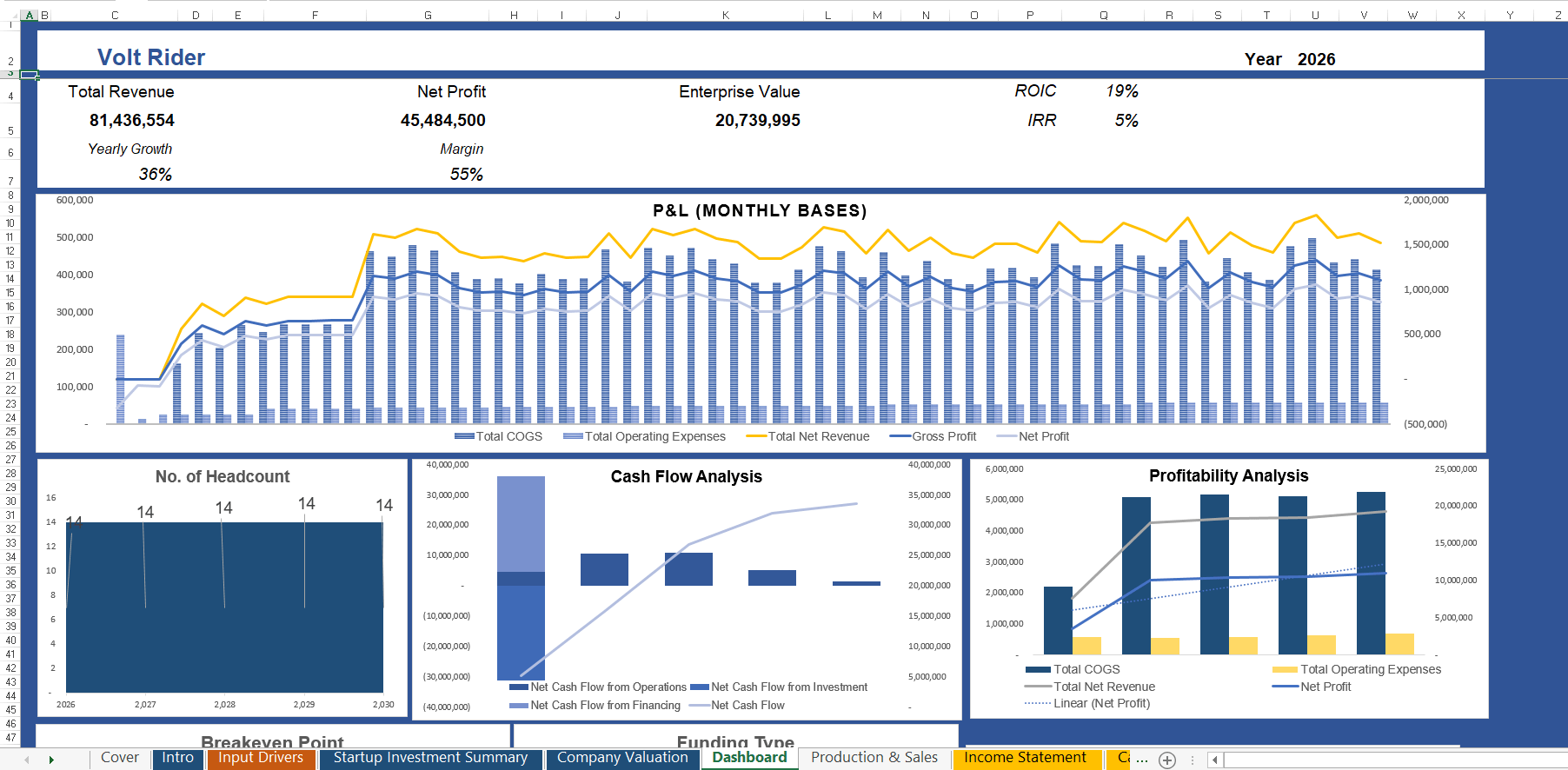

Executive Dashboard: A visual command center featuring automated charts for production throughput, EBITDA margins, cash runway, and unit cost deflation.

Input Drivers: The “Engine Room” where you define battery chemistry specs, kWh capacity, raw material costs (Lithium, Nickel, Cobalt), and factory shift patterns.

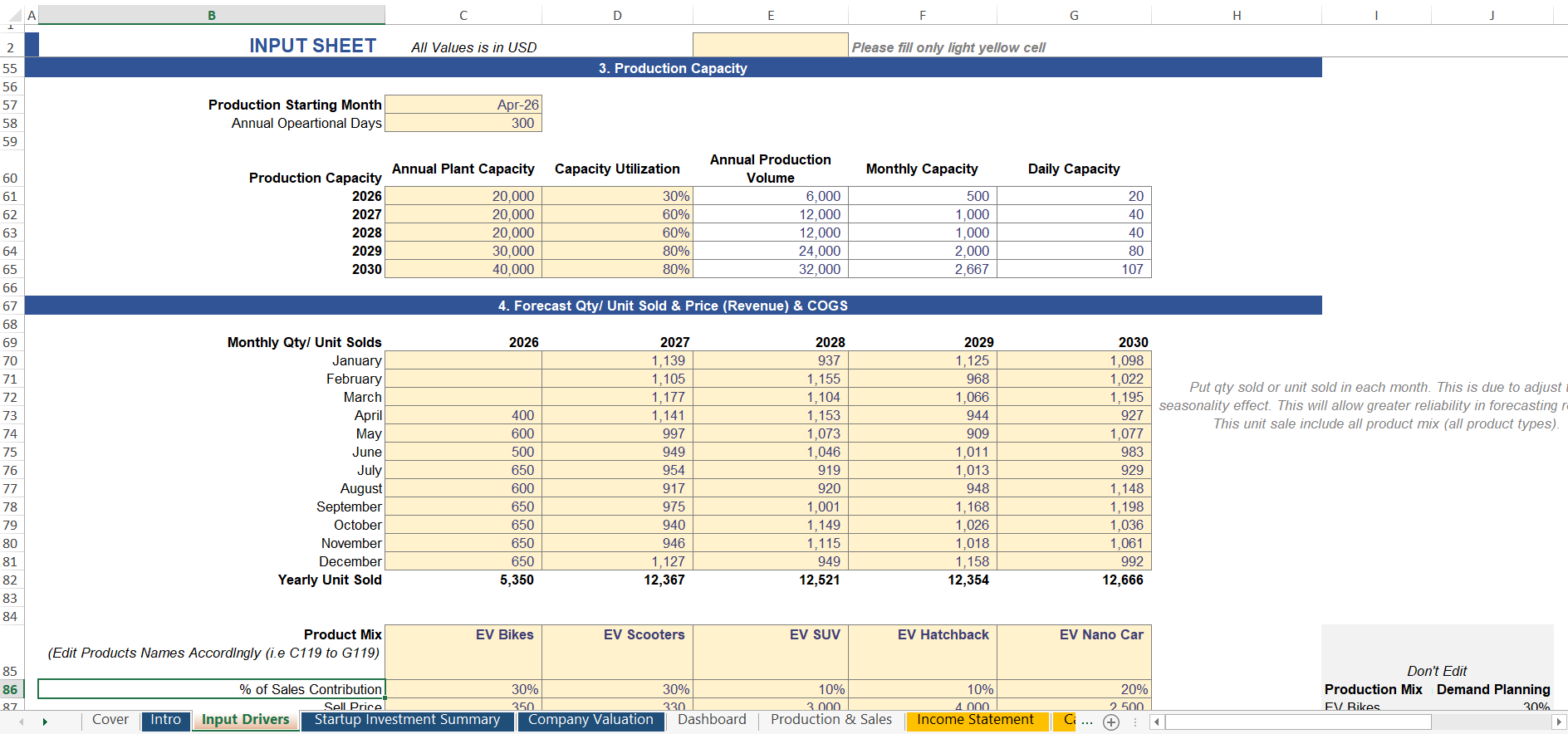

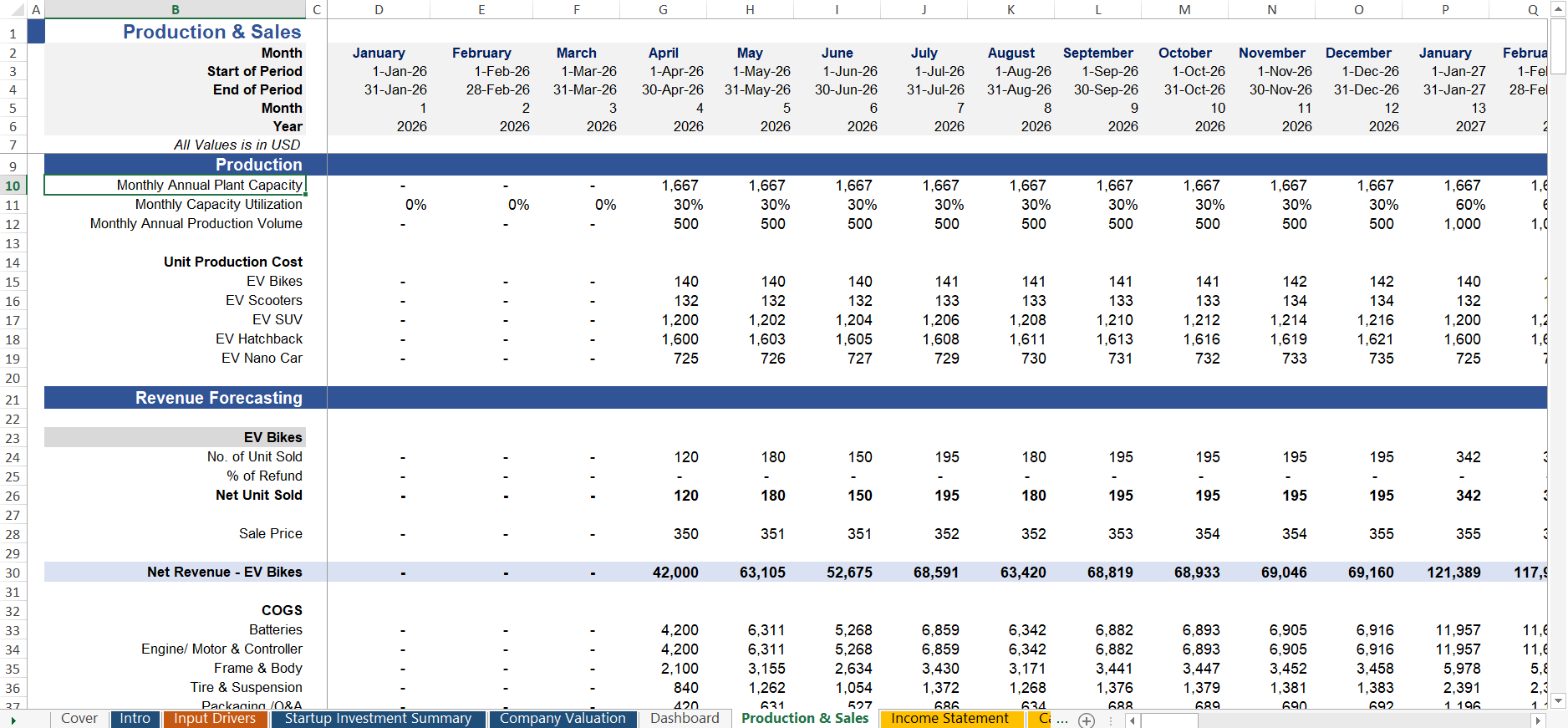

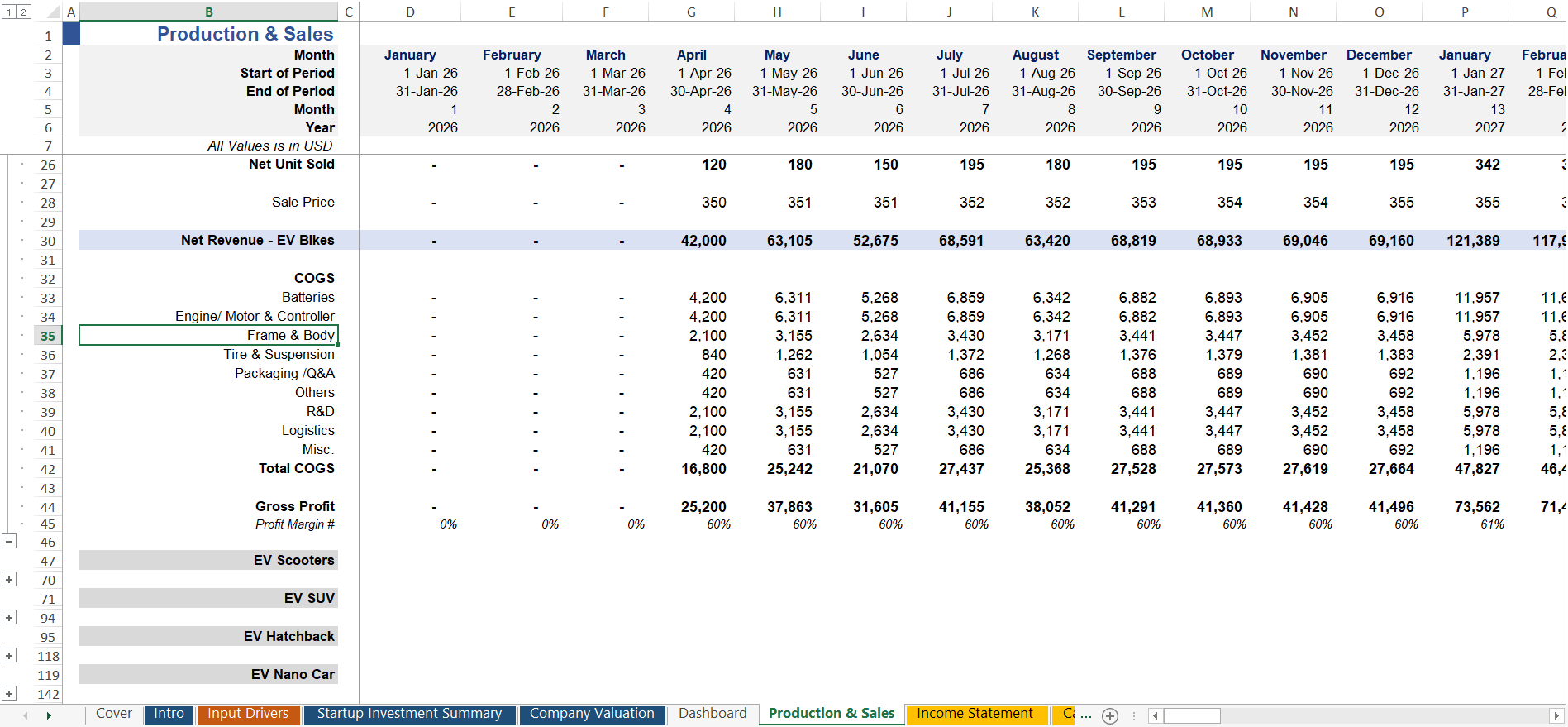

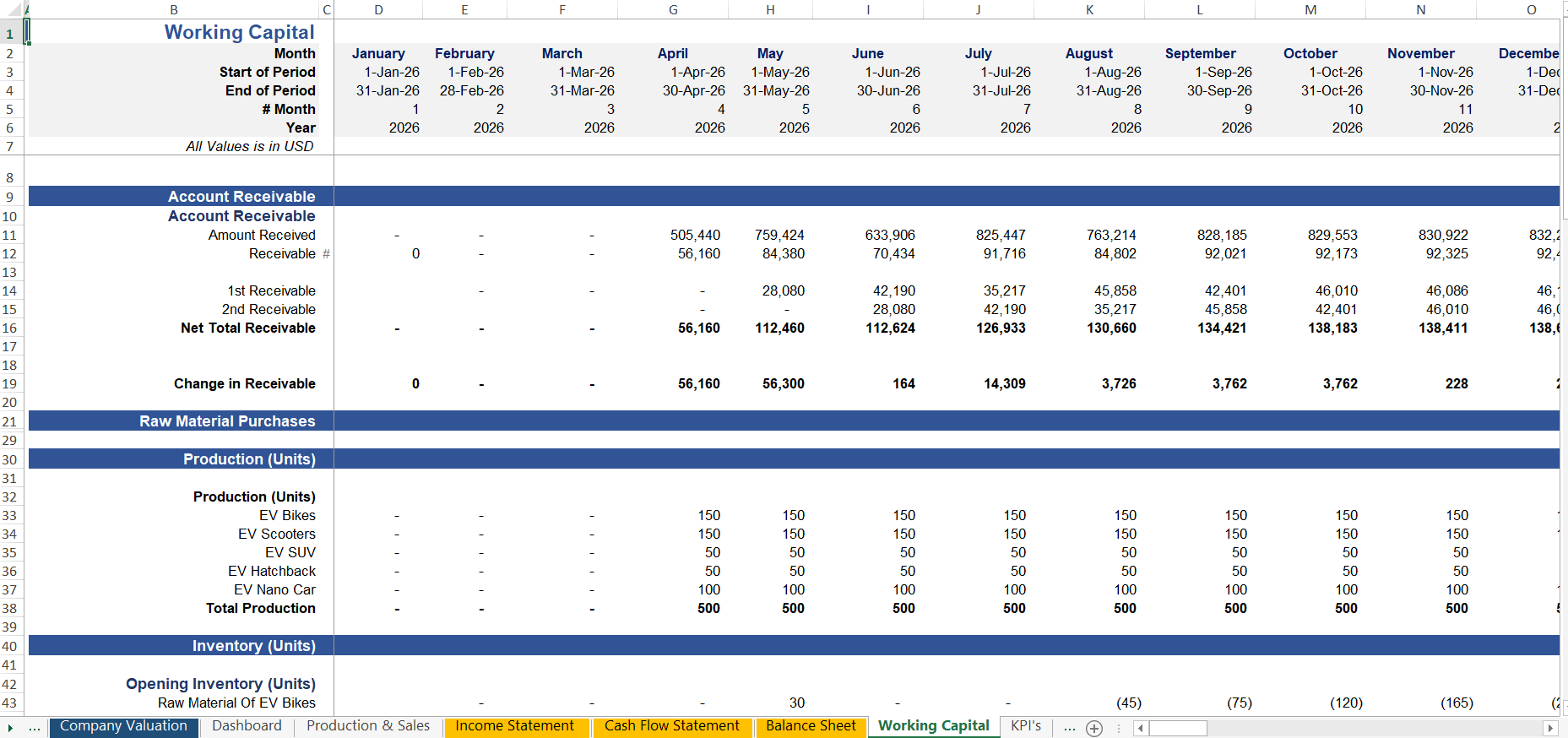

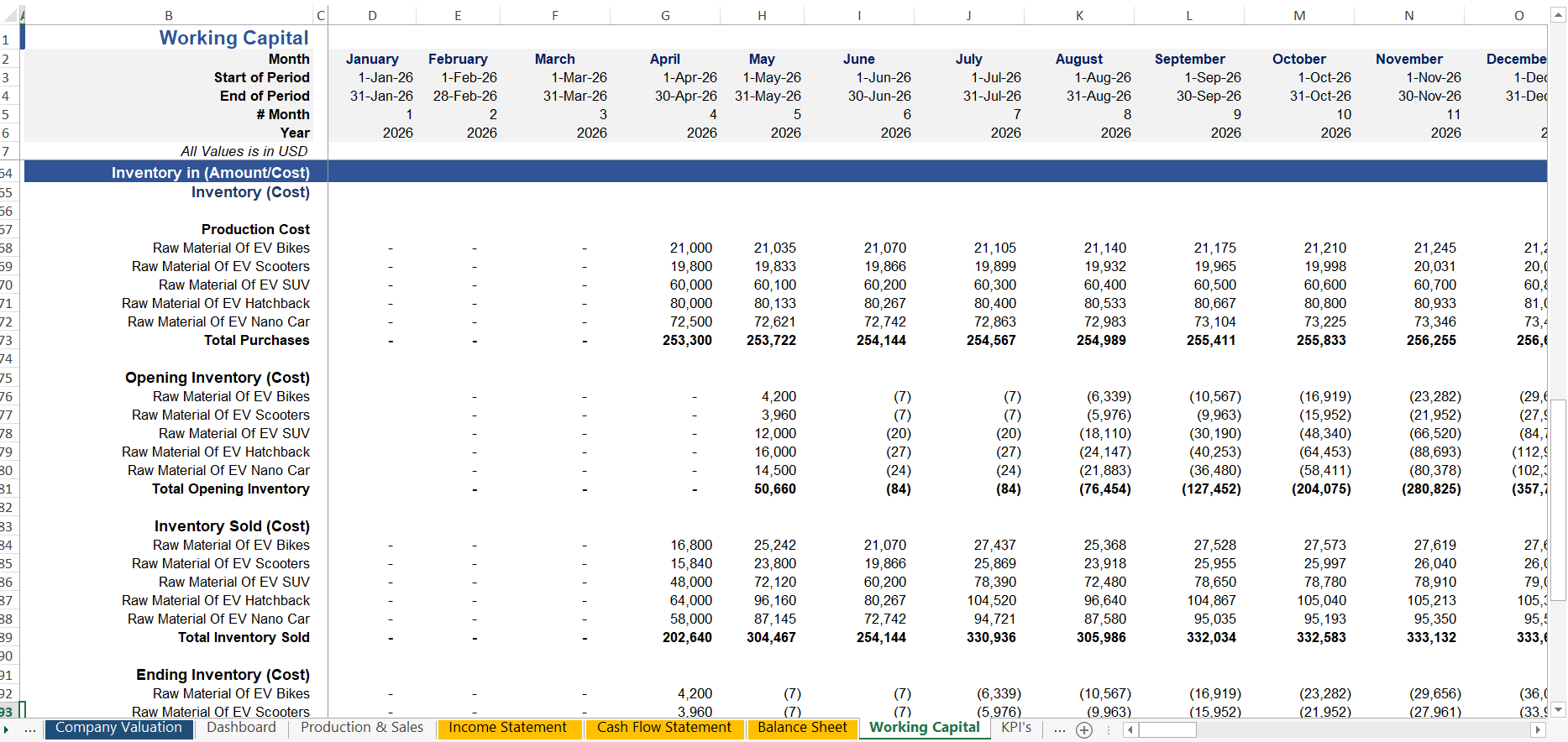

Production & Sales Logic: Tracks cell production versus pack assembly, including waste percentages (yield) and inventory lead times.

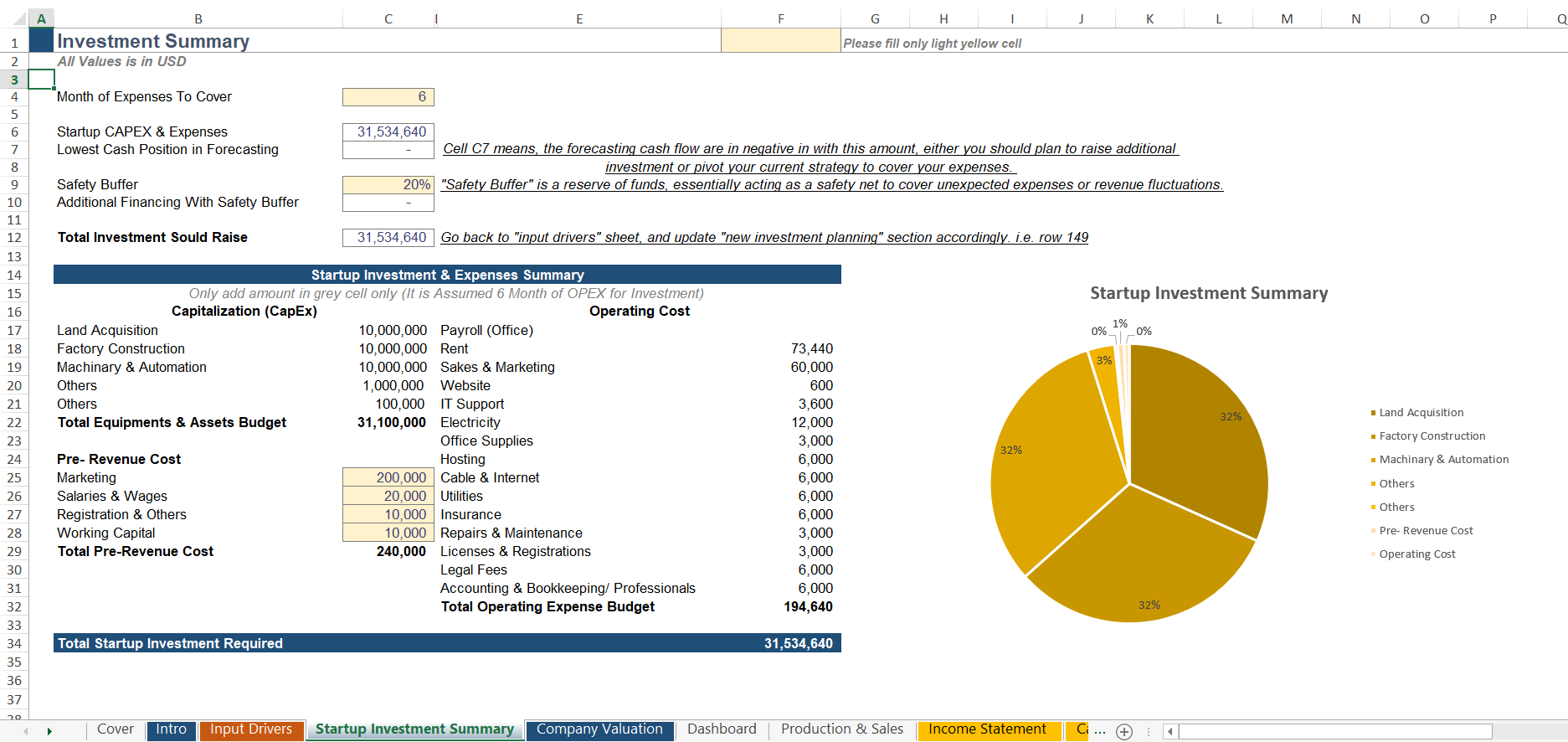

Startup Investment Summary: A granular map of your Capital Expenditure (CapEx), covering cleanroom construction, electrode coating machines, and electrolyte filling stations.

3-Statement Forecast: Fully integrated, monthly, and yearly financial statements that update instantly with any input change.

Company Valuation: Professional-grade DCF analysis, WACC calculations, and exit multiples based on current energy-sector benchmarks.

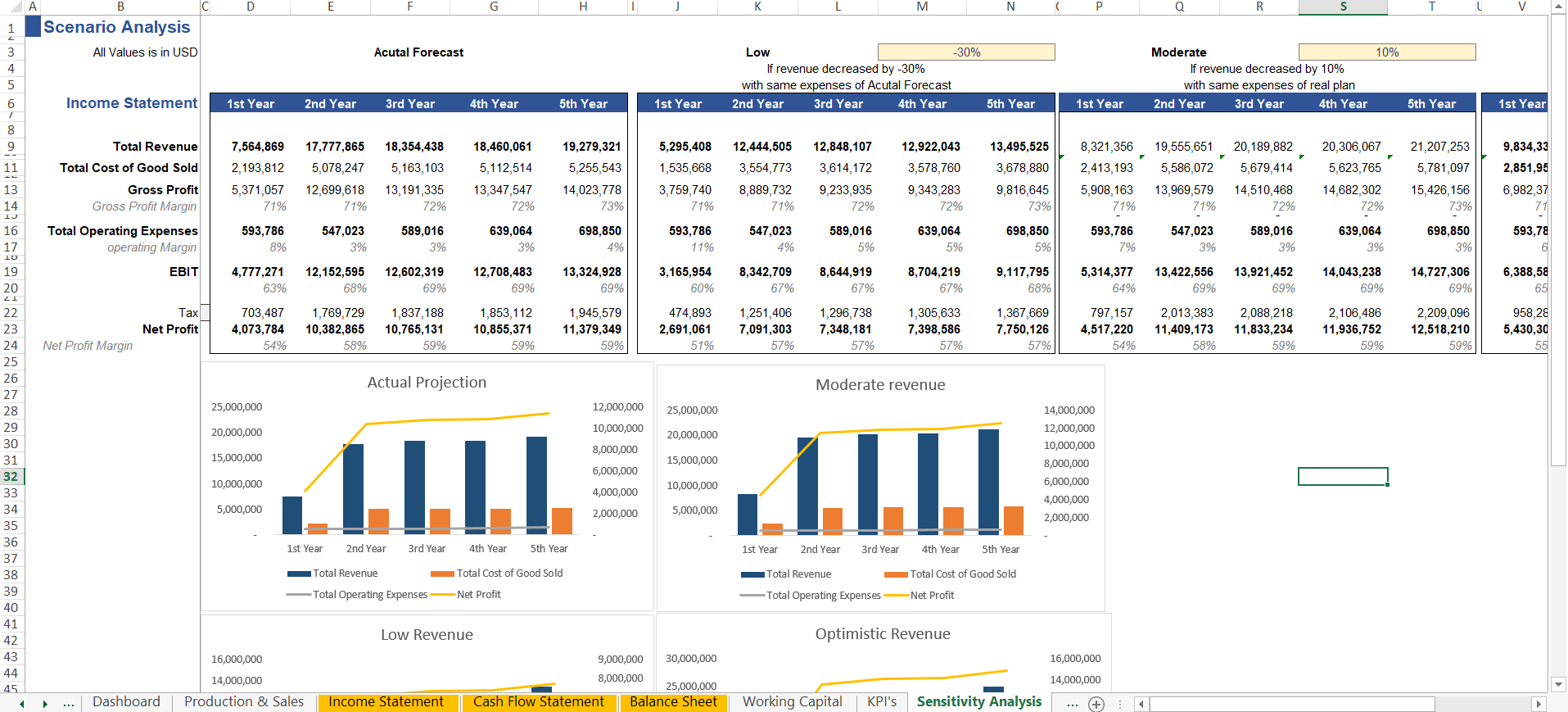

Sensitivity Analysis: Stress-test your business against 20% swings in raw material costs or manufacturing delays.

REVENUE MODELS & SMART VARIABLE INPUTS

This Battery manufacturing financial model utilizes a bottom-up methodology, ensuring your projections are grounded in operational reality—a critical factor during any investment appraisal of Automobile Manufacturing.

Strategic Variable Inputs:

Cost per kWh: Define your target manufacturing cost and track its decline as you scale production.

Factory Efficiency: Input plant utilization rates, downtime for maintenance, and automation-to-labor ratios.

BOM (Bill of Materials): Granular tracking of active materials, separators, and casing components.

R&D Amortization: Track the ongoing investment required to maintain a technological edge in cell density.

Revenue Streams:

Direct OEM Supply: Volume-based contracts with EV manufacturers.

BTM (Behind-the-Meter) Storage: Revenue from residential or commercial energy storage systems (ESS).

Grid-Scale Solutions: Project-based revenue for utility-level storage.

WHY FOUNDERS & INVESTORS TRUST THIS MODEL

In the battery sector, precision determines survival. A generic template cannot account for the “Cash Valley of Death” typical of factory ramp-ups.

For Founders: This serves as a rigorous Business plan for automobile manufacturing, pinpointing your exact break-even volume and maximum funding requirement.

For Investors: It provides an investor-ready audit trail. Every formula is transparent, allowing for deep-dive due diligence on unit margins and material sensitivity.

Operational Clarity: Coordinate your production ramp with your marketing spend to ensure you don’t burn through capital before reaching “Steady State” production.

STRATEGIC GUIDE: WRITING A BATTERY MANUFACTURING BUSINESS PLAN FOR INVESTMENT

To secure high-ticket investment in the battery space, your financial model must be backed by a narrative that proves technical defensibility. Leverage this model in your plan as follows:

Technical Advantage: Don’t just say you’re better—use the “Input Drivers” to show how your specific chemistry leads to a lower cost-per-kWh than industry averages.

The Scale-Up Roadmap: Use the “Startup Investment” tab to detail the phases of your factory expansion (Pilot Line vs. Mass Production).

Supply Chain Resiliency: Reference the “Working Capital” tab to show you’ve accounted for long lead times in raw material sourcing.

Unit Economics: Investors prioritize Contribution Margin. Use the “Income Statement” to prove your BOM leaves room for profit even if material prices spike.

Exit Strategy: Utilize the Valuation of Automobile Manufacturing tab to present potential ROI through acquisition or IPO based on current market multiples.

KEY FEATURES

100% Editable: No hidden formulas; adapt the logic to your specific cell format (Cylindrical, Prismatic, or Pouch).

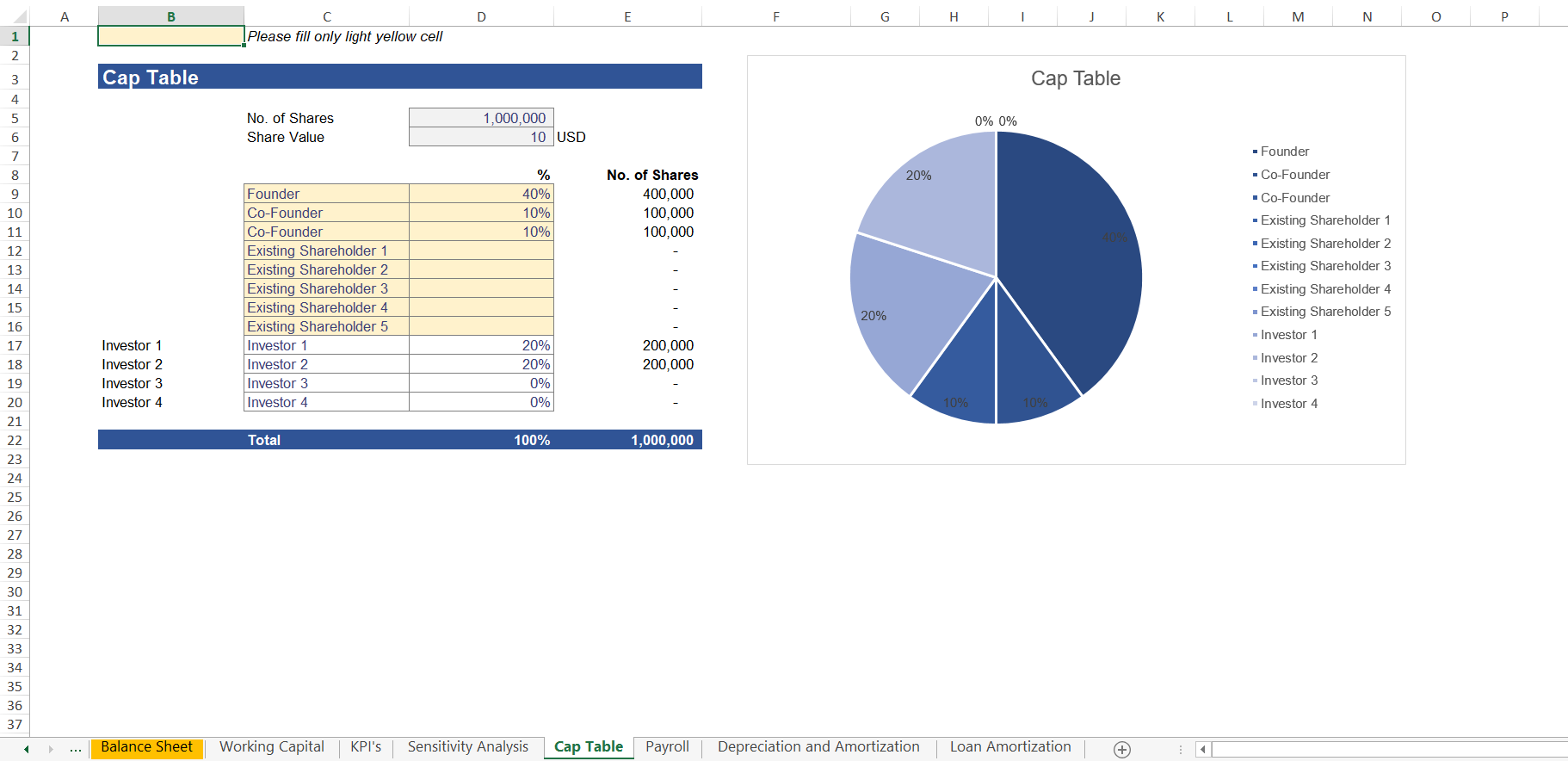

Integrated Cap Table: Plan equity distribution for founders and early-stage investors.

Loan Amortization: Built-in schedules for heavy machinery financing and government green-energy loans.

Global Tax Support: Fully adjustable for regional manufacturing subsidies and corporate tax rates.

Download the Battery Manufacturing Financial Model today—the financial engine that powers your energy startup from the lab to the production line.

MODIFICATIONS & SUPPORT

We offer free support and error correction for our models. Our specialized team is available to help you customize the production logic or integrate specific supply chain variables into your forecast.

Only logged in customers who have purchased this product may leave a review.

Get started with our Battery Manufacturing Financial Model Template

Our Financial Modeling Services specialize in

Customized Spreadsheets

Tailored to met your unique financial needs.

Comprehensive Training

Empowering you to use models effectively.

Accurate Projections

Make informed decisions with confidence.

We prepare comprehensive plan to launch and grow startup with

Data-Driven Market Research

Detailed market analysis and SWOT insights

Business Model Canvas

Clear visualization of your business structure

Financial Projections

Valuation and forecasts to showcase your potential

What our clients say about us

Most Frequently Asked Questions (FAQs)

Absolutely! The model is designed with a user-friendly interface, clear instructions, and pre-built formulas to help even those without advanced financial expertise use it effectively.

Yes, the template includes both scenario and sensitivity analysis features. You can evaluate the impact of changes in pricing, demand, costs, and more to make informed decisions.

The template is fully compatible with Microsoft Excel & Google Sheet.

Yes, we offer fully customizable templates to fit your specific business needs. If you require additional changes, we also provide customized services—just contact us to discuss your requirements.

We offer a 7-day 100% money-back guarantee. If you’re not satisfied with the model, simply let us know within this period for a full refund.

If you encounter any errors, we’ll rectify them free of charge. Our commitment is to deliver an error-free and reliable financial model for your business

Yes, our financial models are designed to be versatile and work across various industries and business stages, from startups to established companies. You can easily adapt the inputs to reflect your specific business dynamics.

Absolutely! We provide email support to assist you with any questions or issues you may have while using the financial model.

Related products

-

Sale!

Electric Vehicle (EV) Manufacturing Financial Model Template

$250.0Original price was: $250.0.$110.0Current price is: $110.0. -

Sale!

Startup Manufacturing Financial Model Excel Template

$250.0Original price was: $250.0.$110.0Current price is: $110.0. -

Sale!

Automobile Manufacturing Financial Model Template

$250.0Original price was: $250.0.$110.0Current price is: $110.0.

Reviews

There are no reviews yet.