EV Charging Station Financial Model Excel Template

Fully editable EV Charging Station Financial Model Excel Template in Excel, designed to provide a detailed and professional 5-year financial plan tailored for EV Charging Station Startups. This pre-built model offers extensive features to streamline financial forecasting, investment analysis, and strategic planning.

- Detailed Driver’s Assumptions i.e. Investment, Revenue & Cost Assumptions

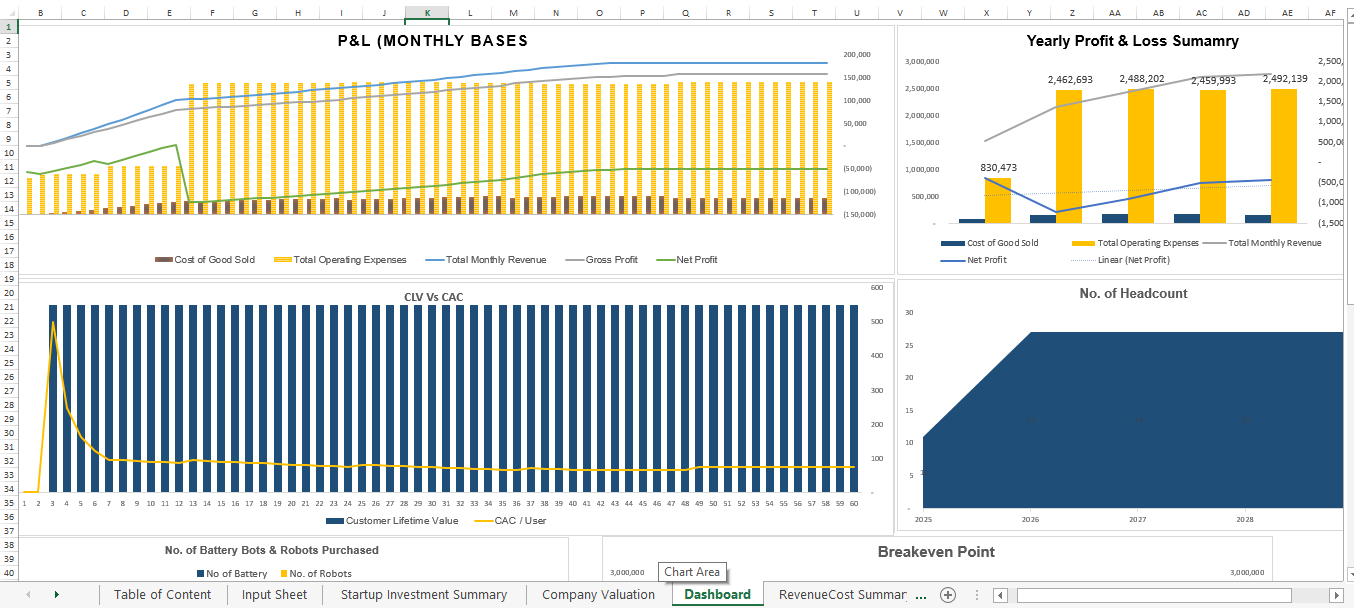

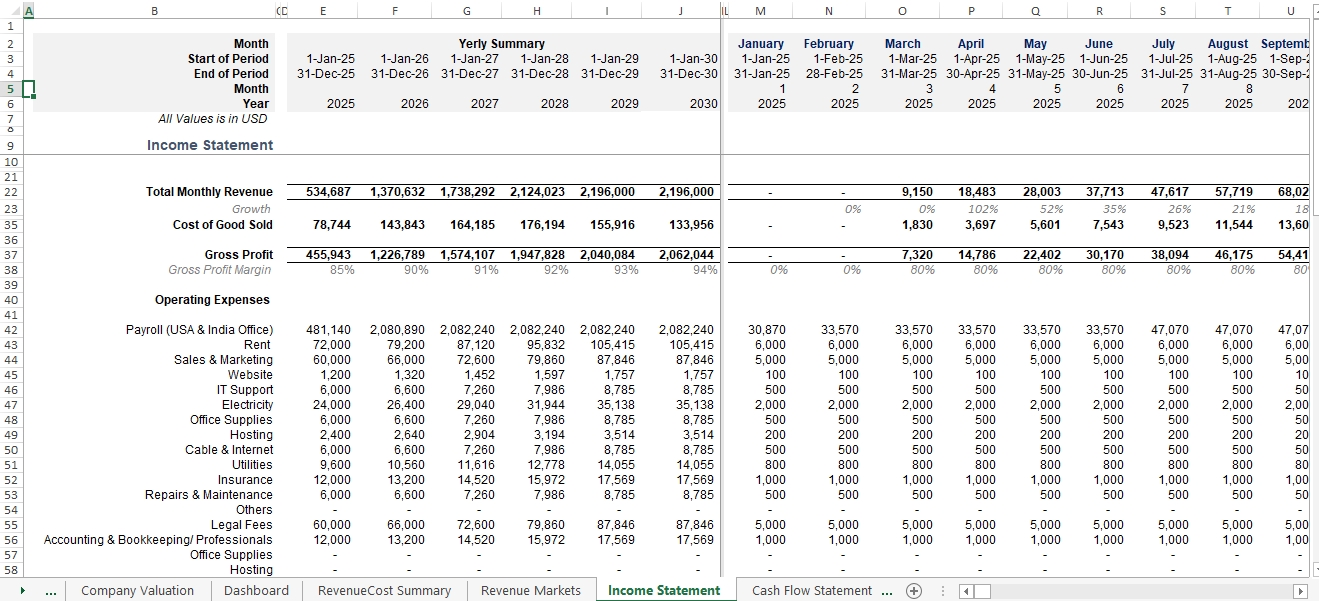

- Upto to 5-Year Forecasting Model

- Financial Projections With P&L, Cash Flow, Balance Sheet

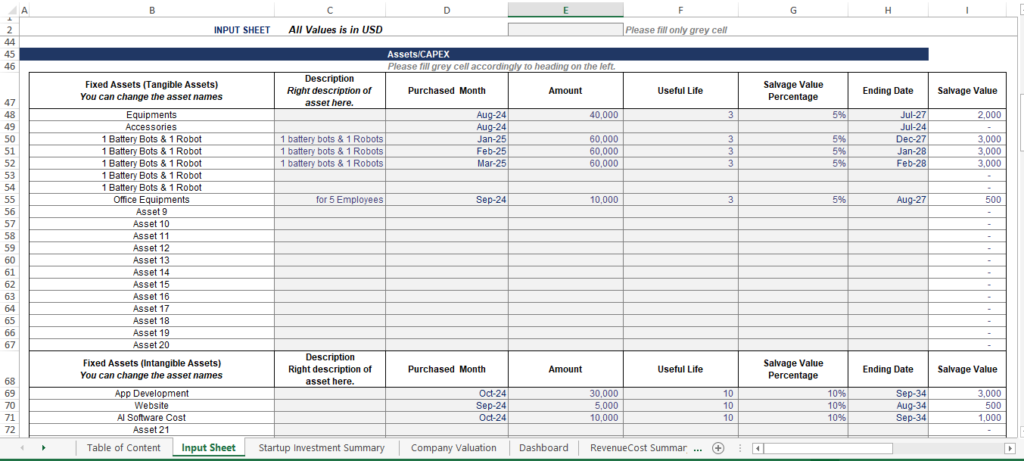

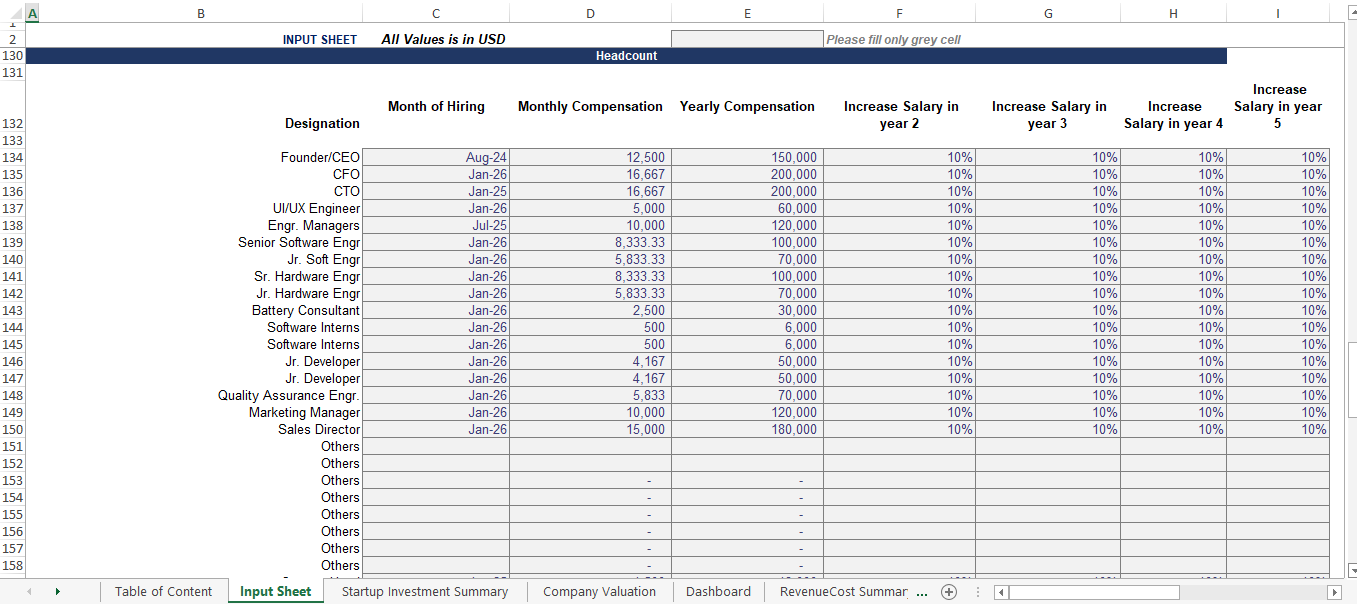

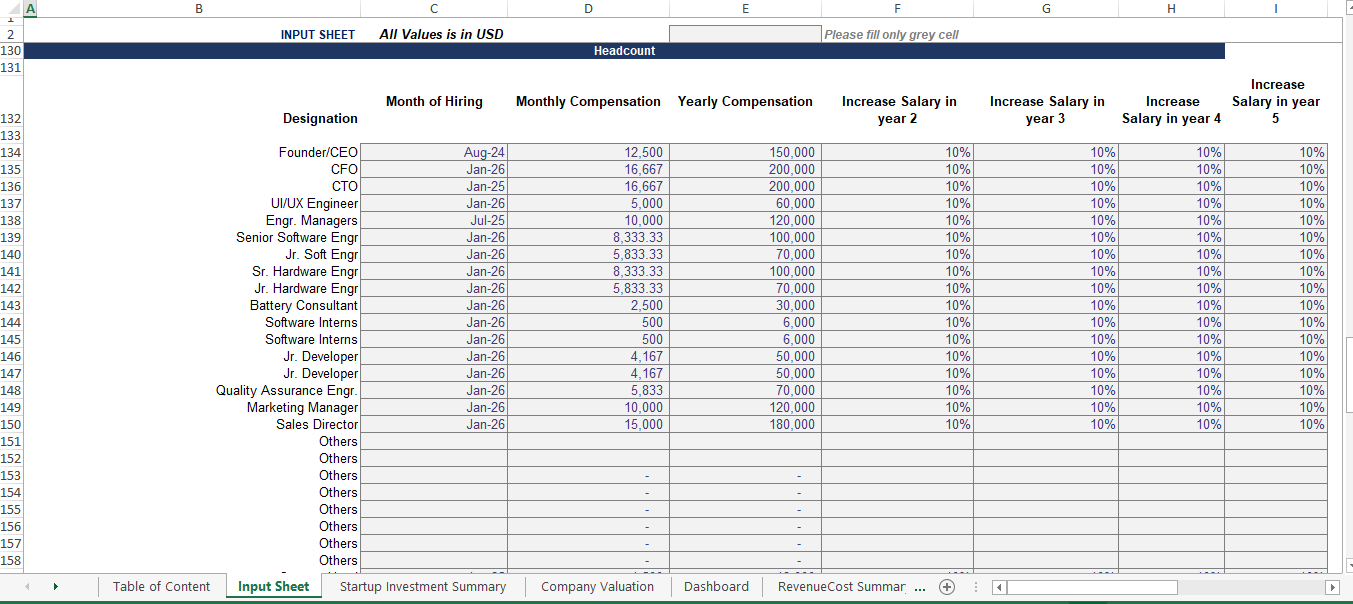

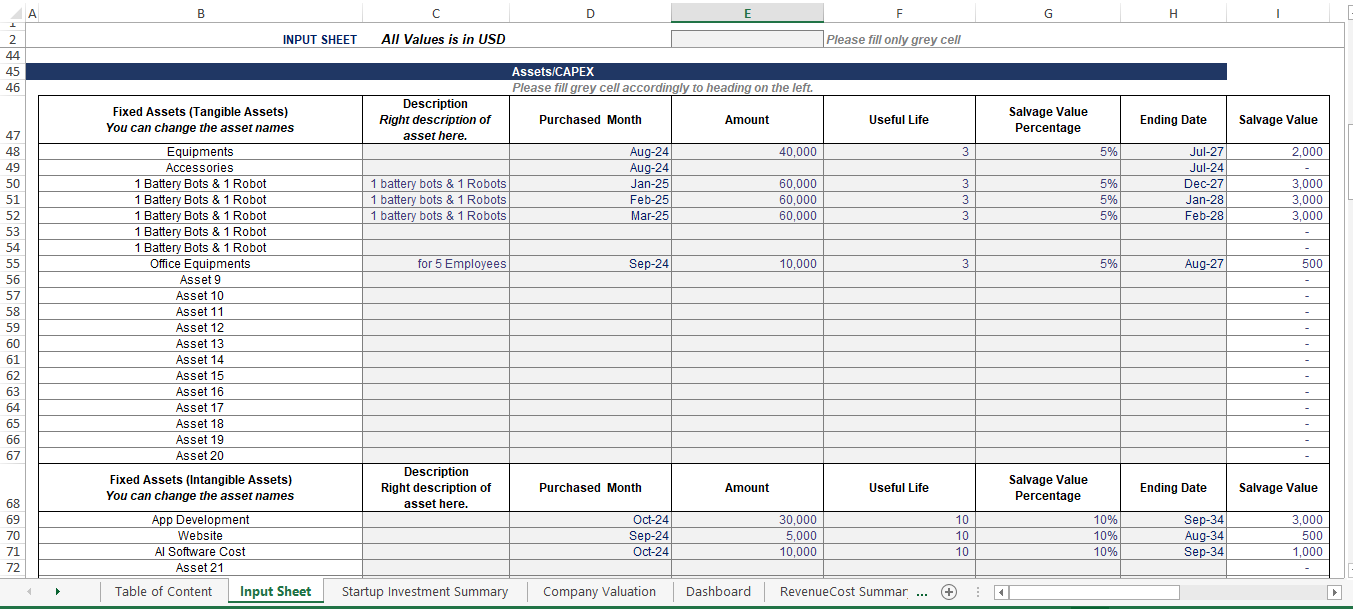

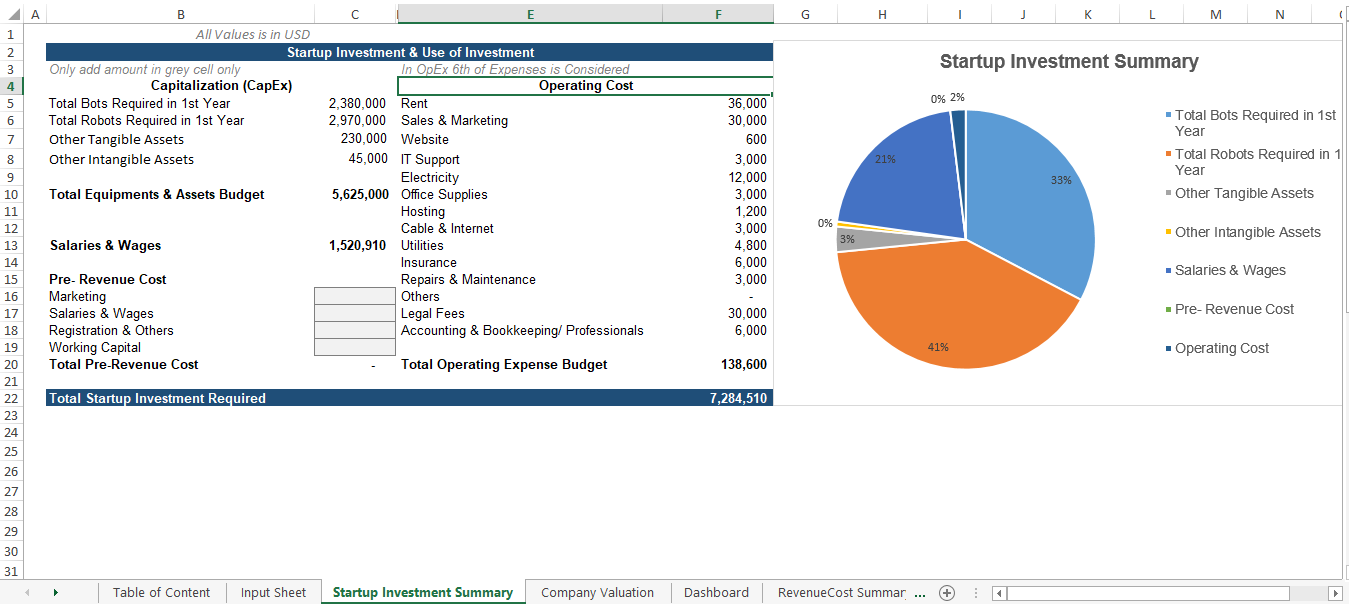

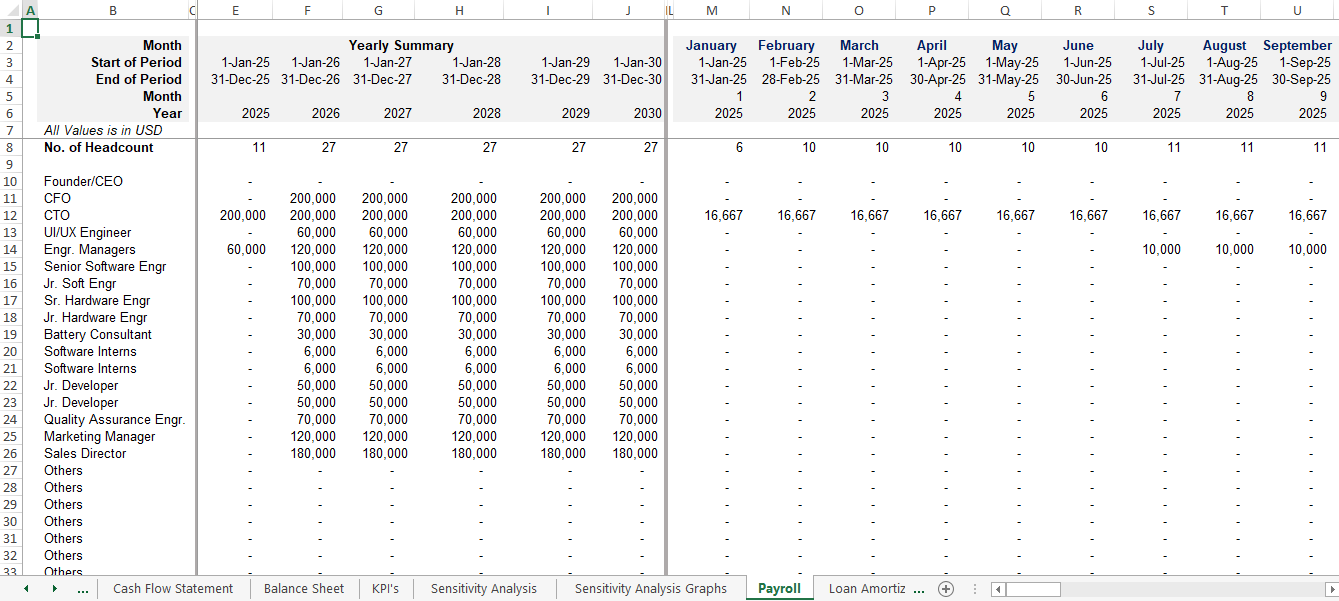

- Detailed Headcount, Expenses & CAPEX Planning

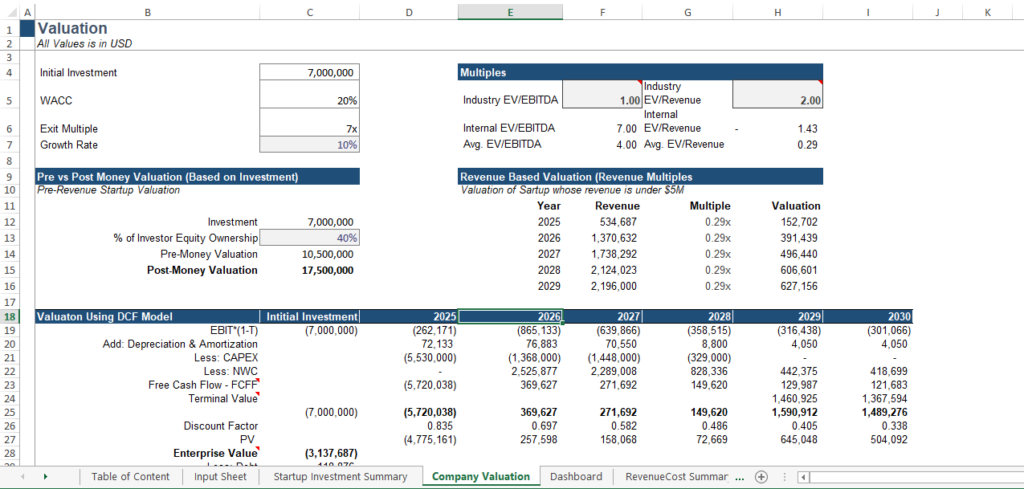

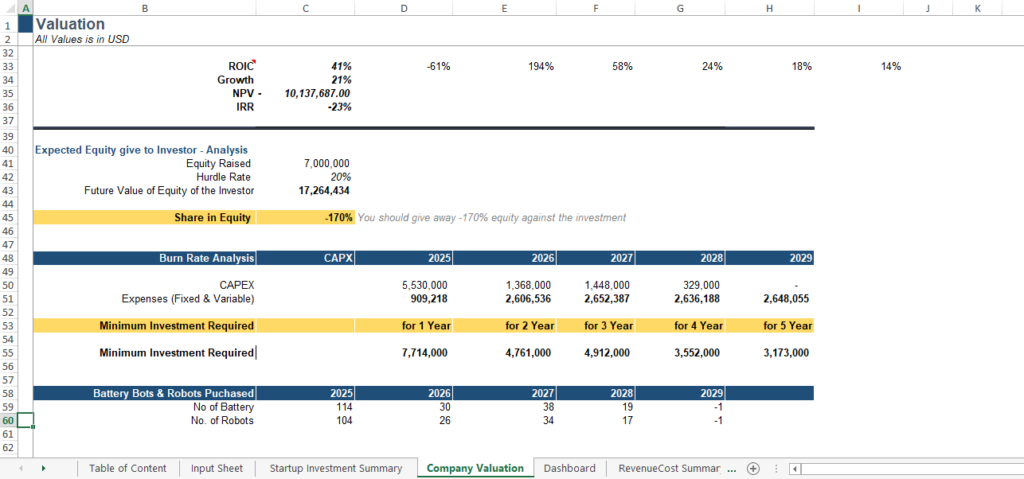

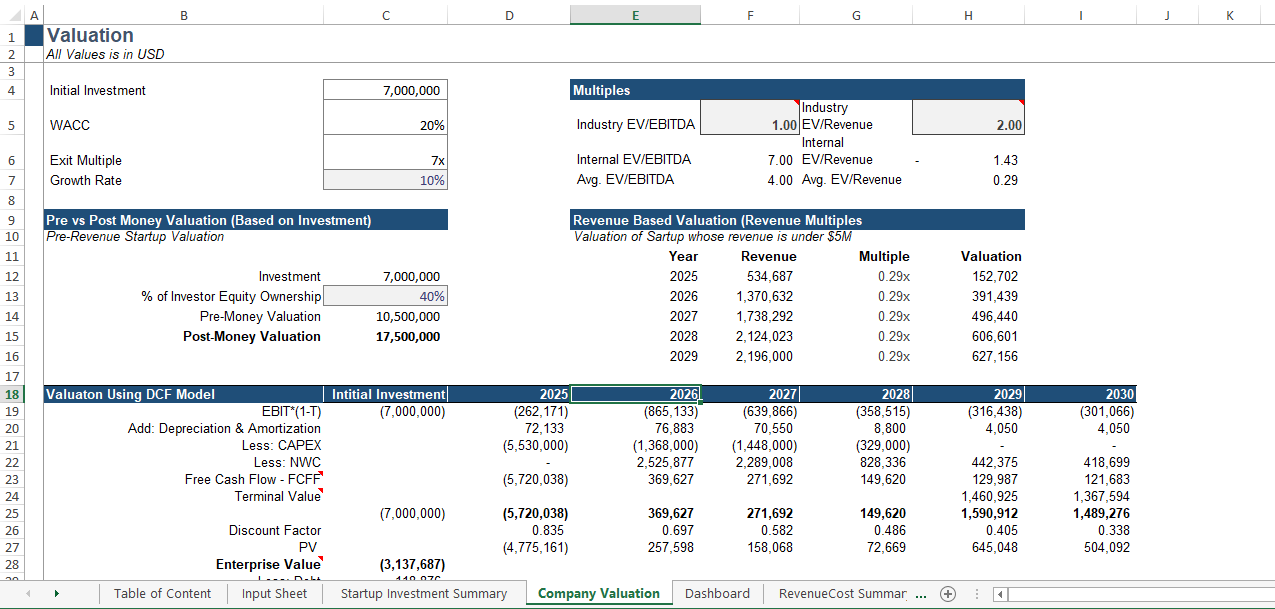

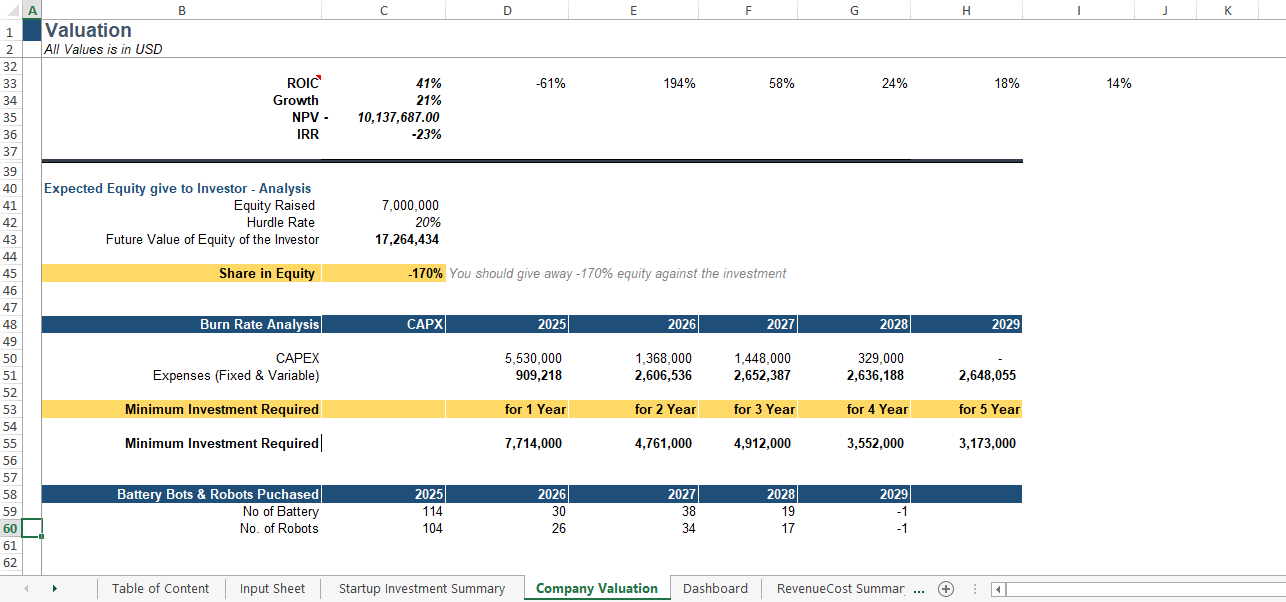

- Detailed Valuation i.e. DCF Valuation, EBITDA & Revenue Multiple Valuation, Investor Valuation, Pre & Post Money Valuation.

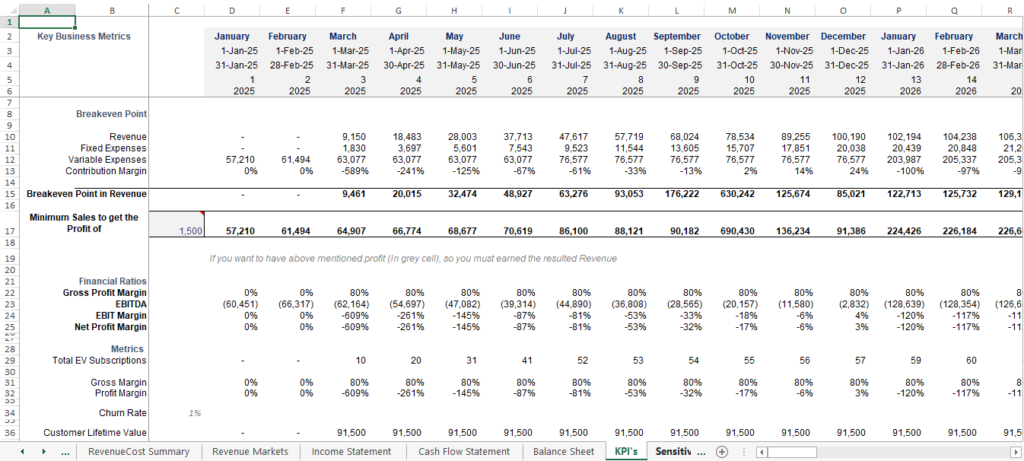

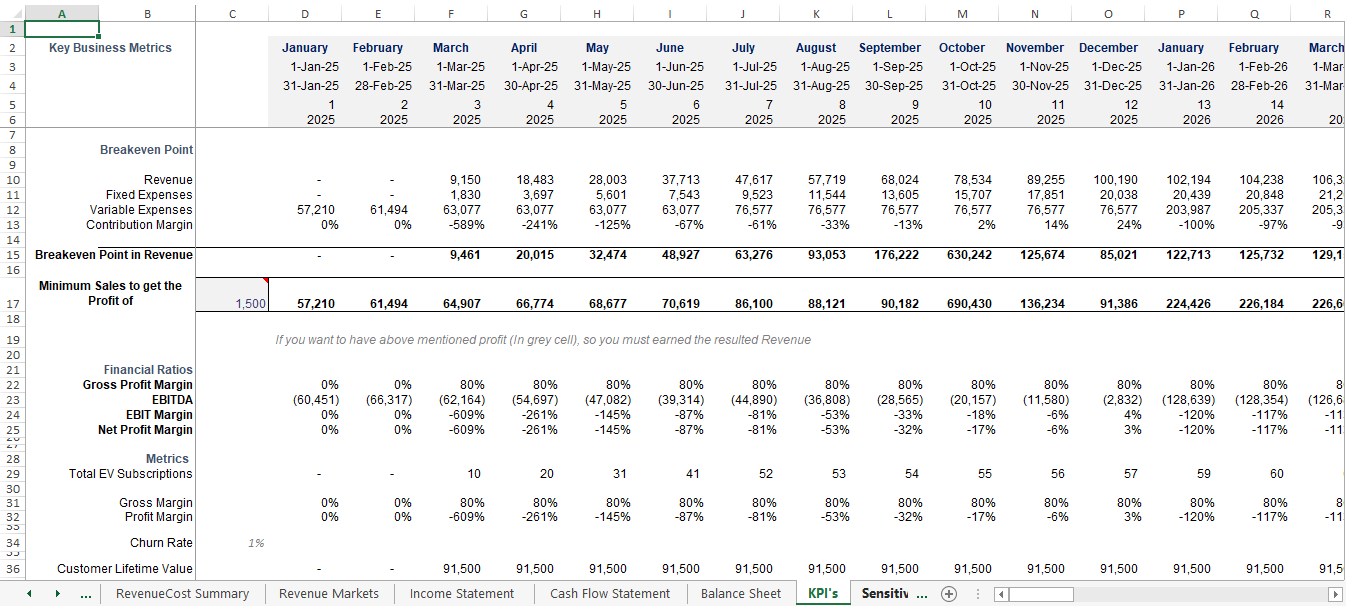

- Breakeven Analysis, ROIC, NPV, IRR, Rule of 40, Equity Giveaway Analysis

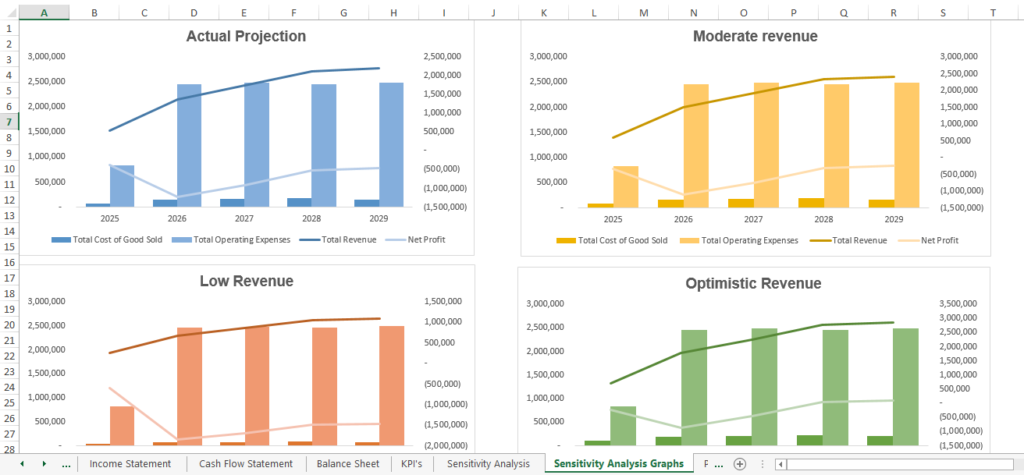

- Sensitivity Analysis, KPIs & Metrics, Burn Rate, Cash Runway

- Fully editable

Why Choose Our EV Charging Station Financial Model Excel Template

- Save 40 Hours of Manual Work

- 100+ Customized Assumptions

- Advanced Valuation Methods Applied

- In-depth Financial Projections

- Free Supports & Error Corrections

Description

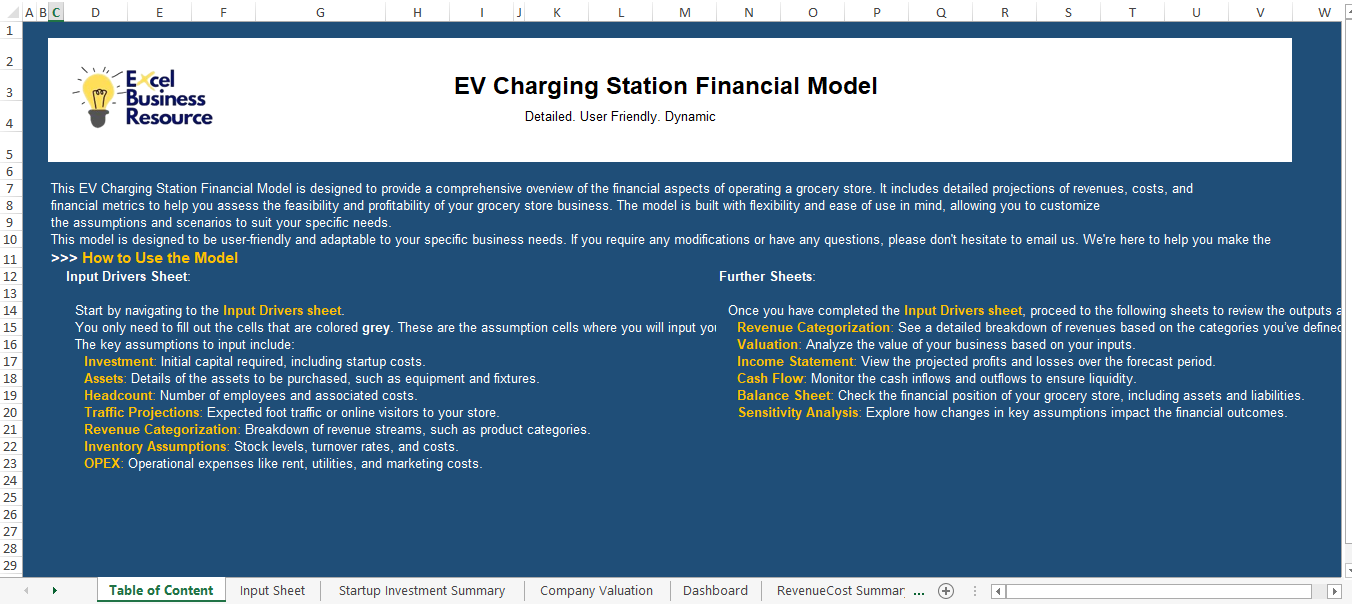

EV Charging Station Financial Model Excel Template

The EV Charging Station Financial Model Excel Template is a comprehensive and easy to use tool designed to help entrepreneurs, startup founders, investors, and Venture Capitalist (VCs) build a robust financial model for electric vehicle (EV) charging stations. This model covers every aspect of financial forecasting, from revenue projections to detailed cash flow analysis, offering a complete overview of the financial viability and profitability of your EV charging station project.

Whether you’re planning a single station or a network of EV charging stations, this financial model template provides you with the clarity and insights needed to make informed decisions, attract investment, and manage business growth effectively.

What's Included in this Comprehensive EV Charging Station Forecasting Model:

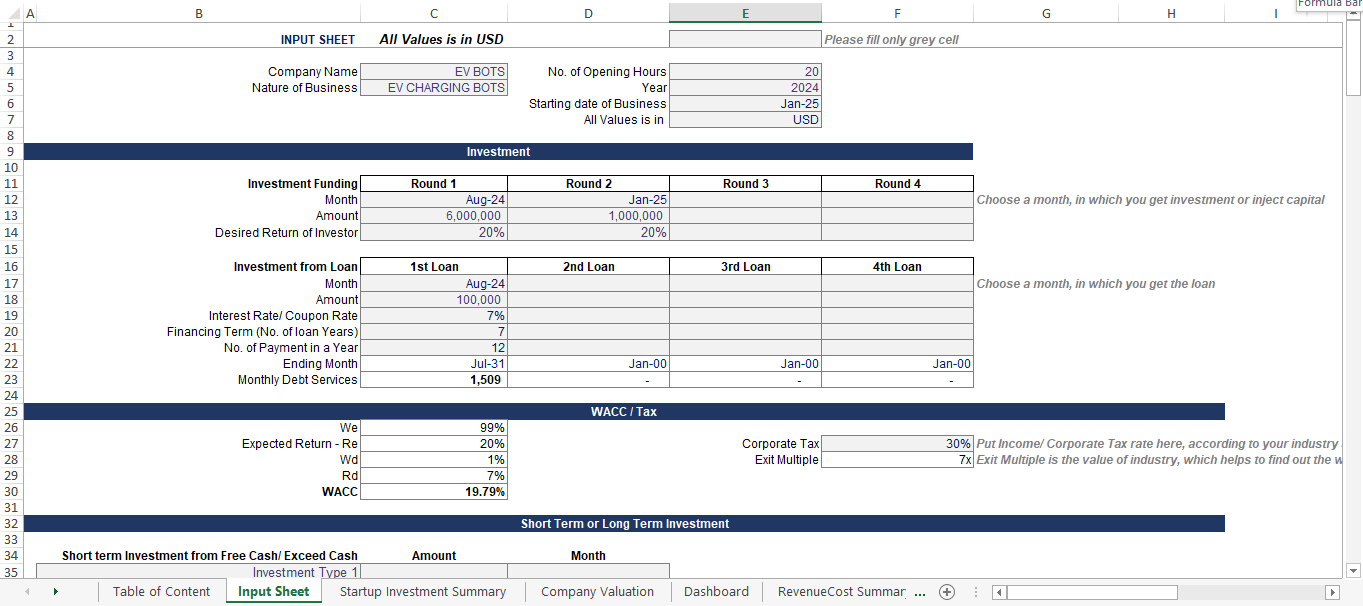

Input Drivers:

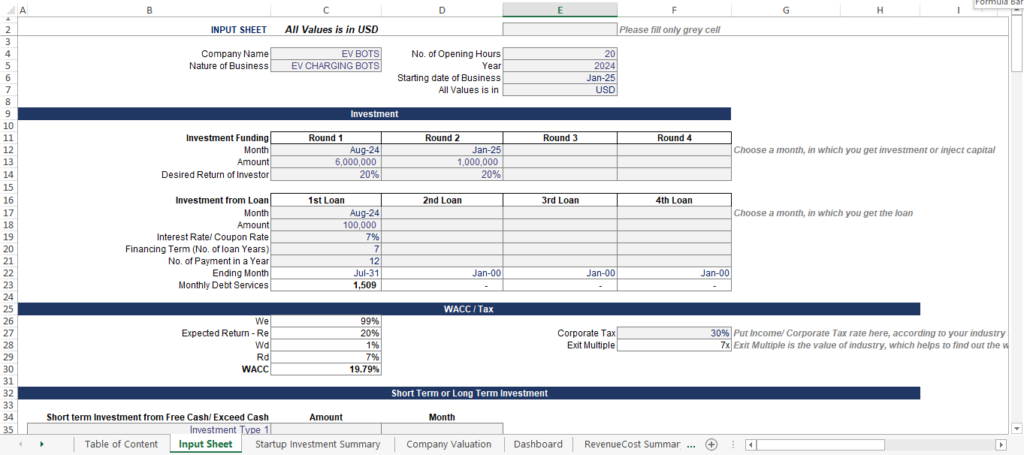

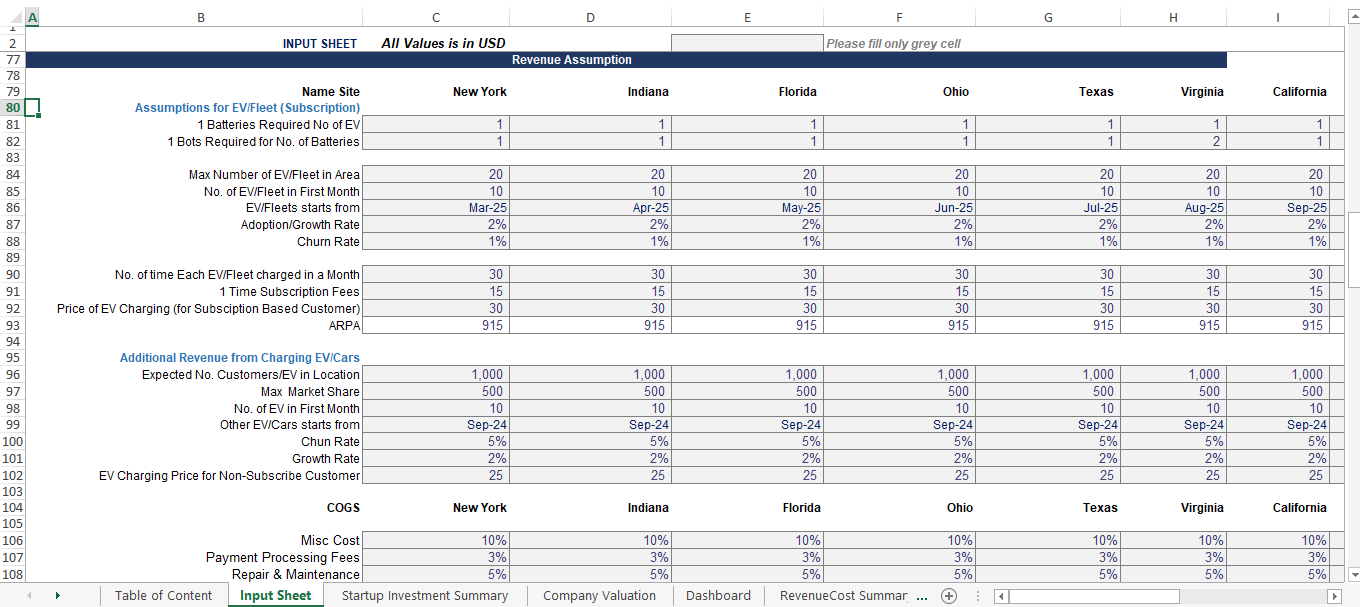

In the EV charging financial model, there is an input driver’s sheet, in which you can put all the variables to driver the financial forecasting model. It has equity investment and loan options, CapEx and OpEx options, Revenue variables, headcount and marketing drivers. The model consider expansion into new regions and markets (10 sites to add), forecasting revenue from increased station count and new customer acquisition.

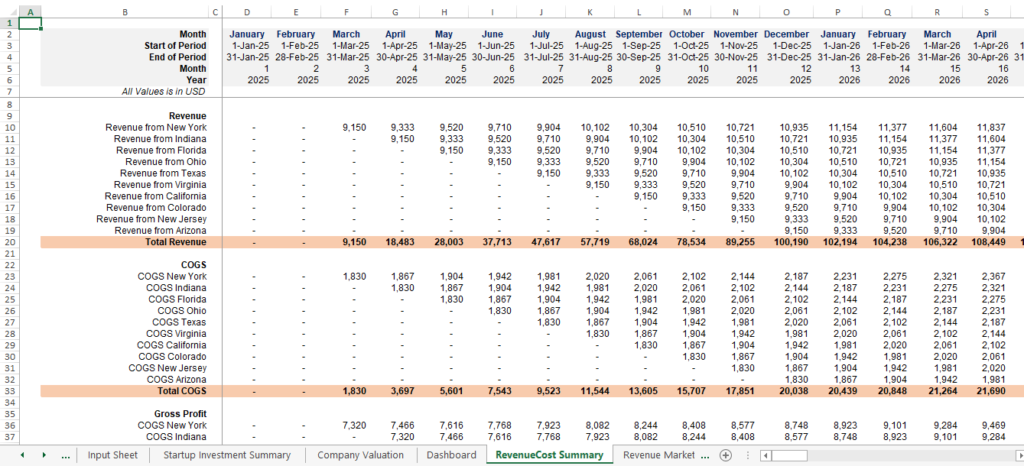

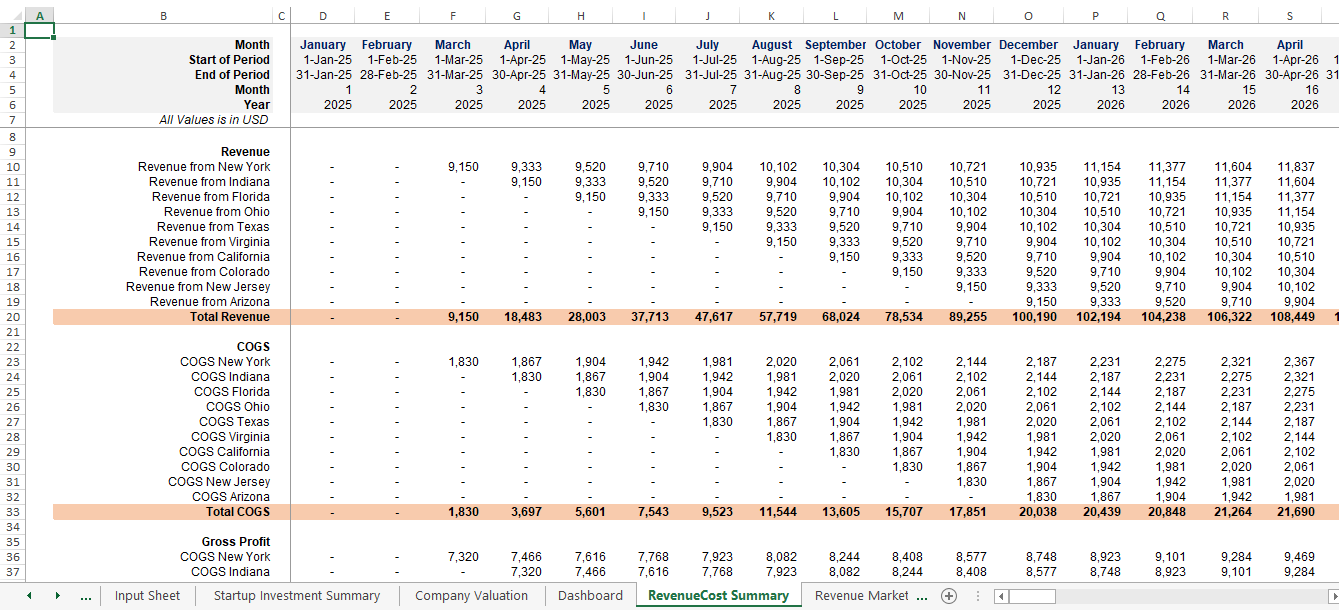

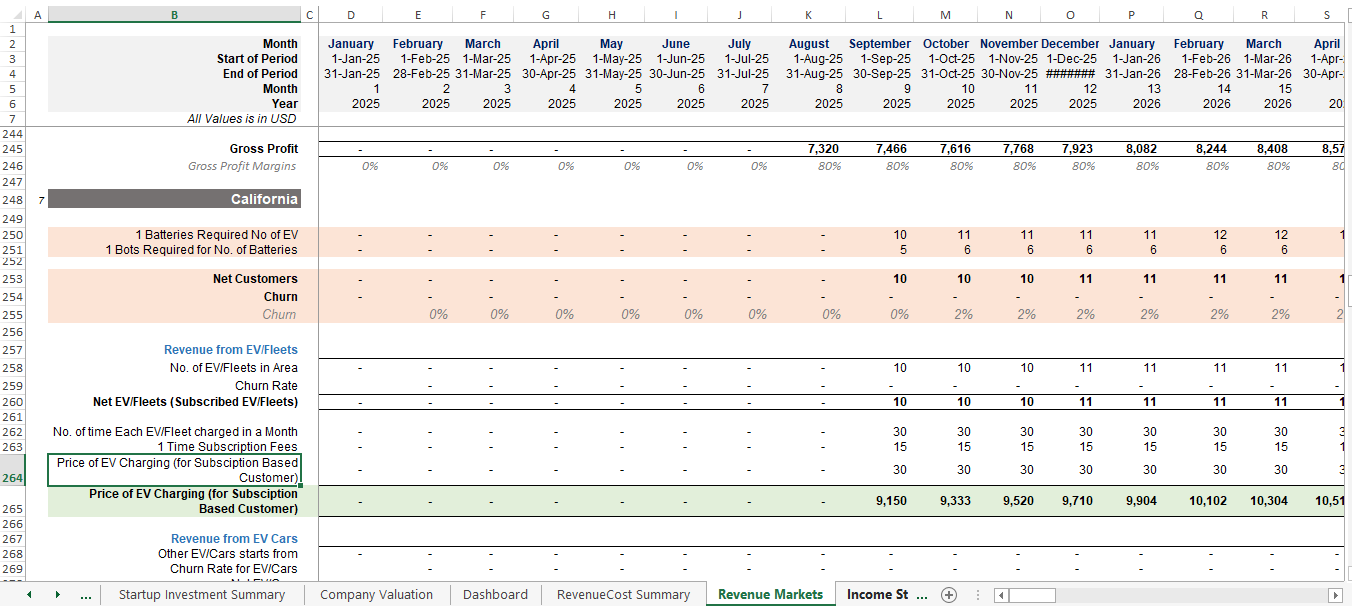

Revenue Projections:

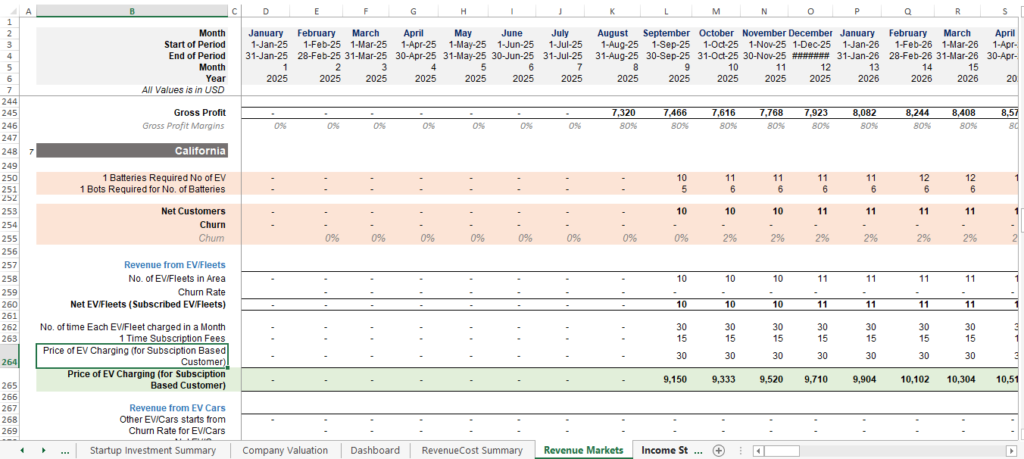

Revenue forecasting streams based on different types of charging sessions, also incorporate various cities to add and variable rates depending on peak and off-peak hours.

There are 2 types of revenue model, B2B & B2C. i.e.

- B2B: Contract freight forwards, delivery companies to charge their vehicle on daily basis.

- B2C: Offer Charging to general vehicles around the area.

For B2B, there can be recurring revenue from customers opting for subscription models, with varying pricing tiers offering benefits like unlimited charging or discounted rates.

Also revenue is calculated as per individual charging location, factoring in expected daily usage, station capacity, and geographic location.

Expense Analysis:

- Electricity Consumption: Accurately calculate electricity usage based on projected charging sessions, station capacity, and local energy prices. Include projections for future changes in electricity rates and renewable energy sourcing.

- Maintenance & Repairs: Break down costs for routine station maintenance, including cleaning, parts replacement, and potential upgrades. Include warranties and any scheduled overhauls.

- Insurance: Estimate insurance premiums based on the number of stations, potential liabilities, and coverage for equipment damage, theft, or environmental hazards.

- Personnel Expenses: Account for operational staffing costs, including station monitoring, customer service, and technical support. Include additional personnel for expansion and projected salary increases.

- Lease & Property Costs: Include any costs associated with leasing land or property for station installation, as well as taxes and local regulatory fees.

- Software & Technology: Detail costs for charging station software, customer interface systems, and backend management tools, including any third-party service fees for remote monitoring.

Profitability Analysis & KPIs:

- Net Profit: Calculate your station’s profitability by subtracting total expenses from total revenues, showing the overall net profit over the life of the project.

- Gross Margins: Evaluate gross margins for different revenue streams (charging fees, subscriptions, and advertising) to understand where the most profitability lies.

- Return on Investment (ROI): Calculate the ROI based on total capital invested versus projected profits, giving investors a clear view of potential returns.

- Payback Period: Identify the length of time required to recoup the initial investment, providing insight into how soon the business will become self-sustaining.

CLTV: Analyzed customer lifetime value based on the avg. price, frequency and other factors.

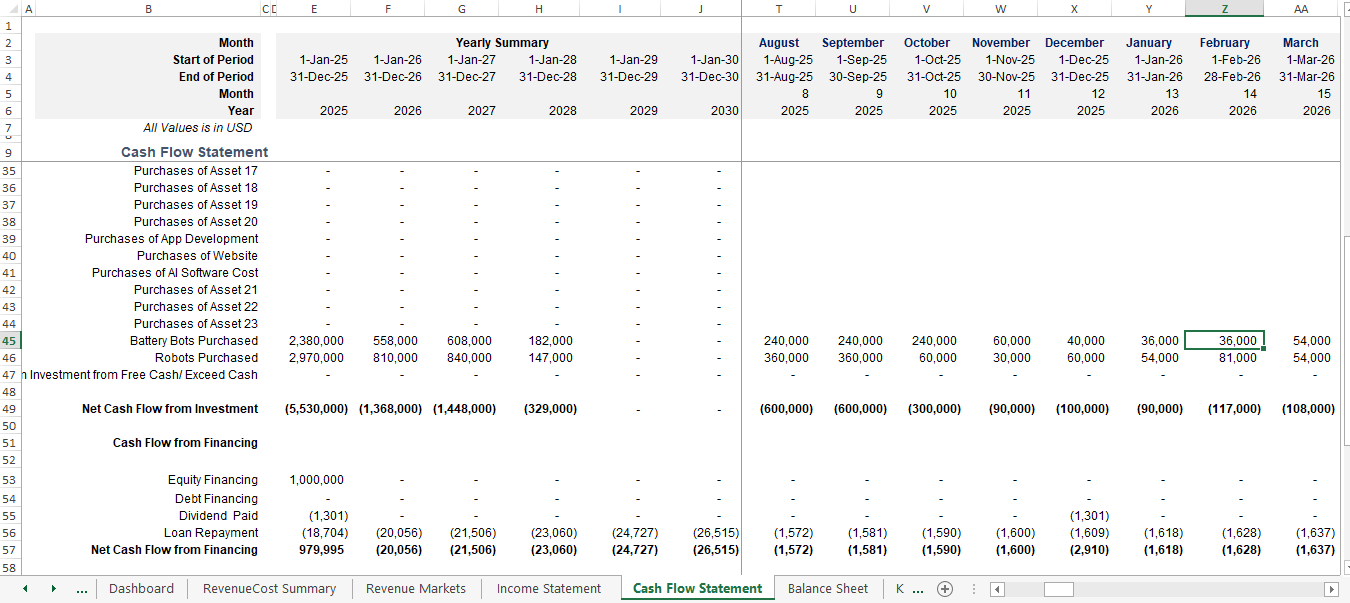

Cash Flow Analysis

- Monthly & Annual Cash Flow Projections: Detail the projected inflows from charging revenues, subscriptions, and other income streams, along with outflows like electricity costs, maintenance, and personnel expenses.

- Working Capital Requirements: Assess how much working capital is needed to keep the business running smoothly, factoring in delays between payments received and outgoing operational costs.

- Debt Service & Loan Repayments: Include projected loan repayments and interest expenses if external financing is used for startup or expansion costs.

- Cash Flow Variability: Account for fluctuations in cash flow due to seasonality, customer usage patterns, or unexpected expenses, ensuring liquidity throughout the year.

Valuation:

- DCF Valuation: Performed DCF valuation, analyze Enterprise value, equity value.

- EV/EBITDA & Revenue Multiple Valuation: Investor often value through EV.EBITDA Multiple valuation, because it is an CAPEX intensive business, therefore it needs to analyze EBITDA margins.

- Net Present Value (NPV): Calculate the present value of future cash flows, discounting them by a pre-determined rate to determine the feasibility and attractiveness of the investment.

- Internal Rate of Return (IRR): Assess the IRR, which shows the rate of return at which the net present value equals zero, offering insight into the project’s profitability compared to alternative investment options.

- Payback Period: Highlight how quickly the initial investment will be recovered, providing a key metric for assessing financial risk.

- Profitability Index (PI): Provide a profitability index ratio (NPV divided by the initial investment), allowing investors to gauge the return per unit of investment.

- Burn Rate: Analyzed burn rate (i.e. how capital is been consumed on monthly and yearly basis). This is important to analyze the cash runway, i.e. reserved and future requirements.

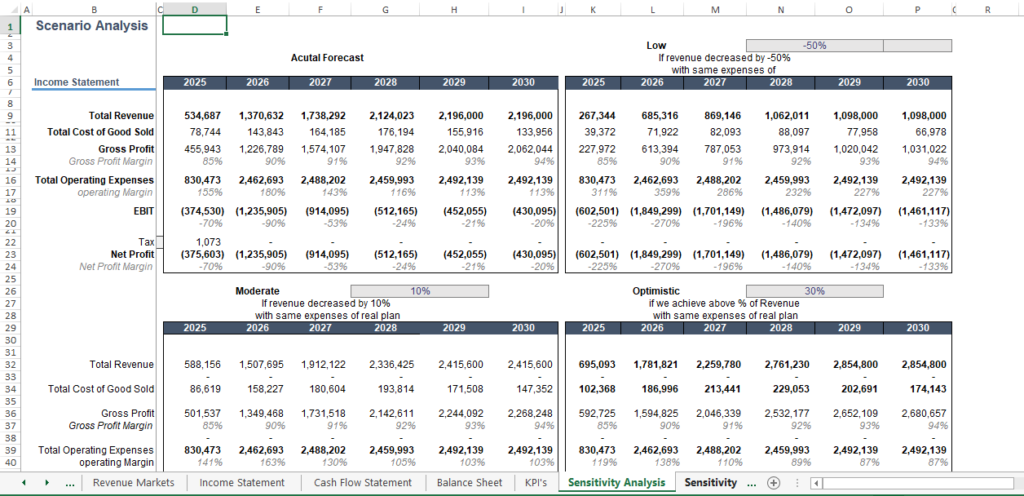

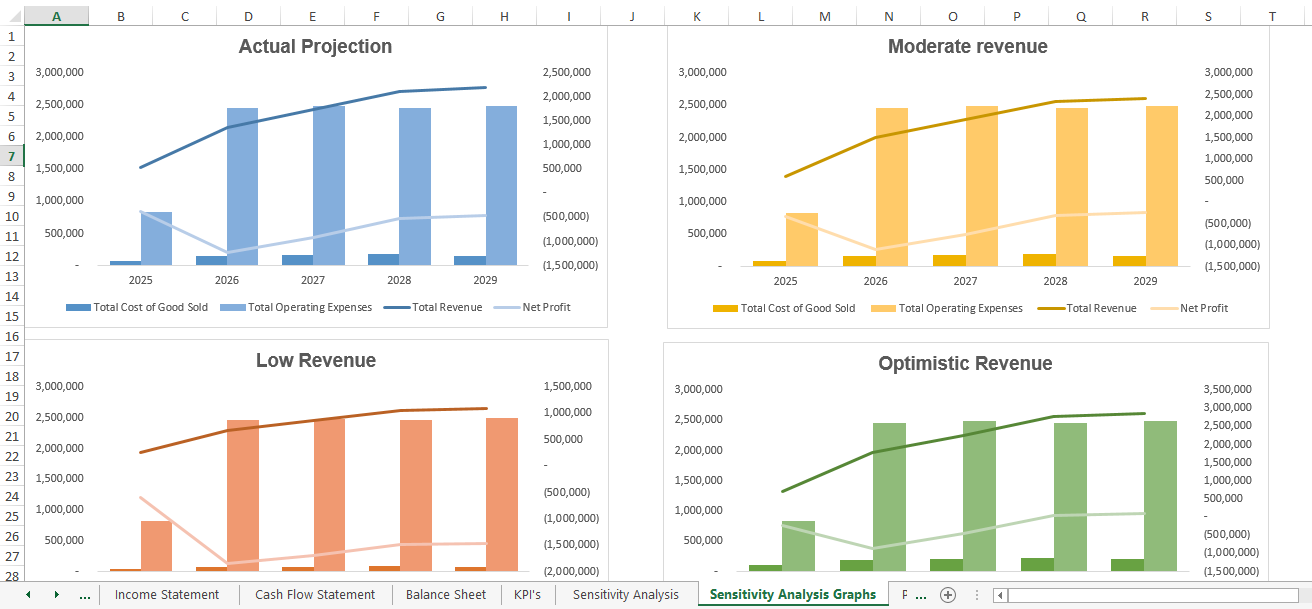

Scenario Analysis:

- Base Case Scenario: Outline the most realistic assumptions for revenue, expenses, and profitability based on market trends and current data.

- Optimistic Scenario: Model a scenario where customer demand, charging prices, and station utilization exceed expectations, projecting higher profitability.

- Pessimistic Scenario: Explore the potential downsides, such as lower-than-expected customer demand, rising energy costs, or regulatory hurdles, and assess their impact on cash flow and profitability.

- Expansion & Growth Scenarios: Include projections for the impact of scaling operations, such as expanding the number of stations, entering new markets, or implementing new revenue streams like fleet partnerships or subscription upgrades.

Benefits of Using the EV Charging Station Financial Projection Template:

Clarity & Structure:

This projection template offers a clear, structured approach to financial modeling, allowing you to easily input data and generate projections without needing advanced financial expertise.

Decision-Making Insights:

This excel template helps in data-driven decisions by evaluating the financial performance of your EV charging station, including profitability, cash flow sustainability, and growth potential, which can be incorporate in your Business Plan.

Comprehensive Analysis:

Gain a full financial picture, including revenue potential, operating costs, investment returns, capital expenditure, forecast working capital requirements, and risk assessments. This model helps you ensure the long-term financial success of your project.

Perfect for SBA Loans & VCs:

Present compelling forecasting model is perfect for your SBA loan financials requirements and potential Venture Capitalist (VCs) financial requirements with detailed projections, ROI analysis, and scenario testing that demonstrate the viability of your business.

Scalability:

Whether you’re planning one station or a large network, the model is easily scalable, allowing you to adapt the financial forecast to multiple locations and markets.

Time-Saving:

Save countless hours of manual calculations and spreadsheet building by using a pre-built, ready-to-use template that streamlines the financial modeling process.

Learn More: Why Realistic Financial Forecasting Model is essential for your startups: The Tremendous Importance of Financial Model for Startup Success

Only logged in customers who have purchased this product may leave a review.

Get started with our EV Charging Station Financial Model Excel Template

Our Financial Modeling Services specialize in

Customized Spreadsheets

Tailored to met your unique financial needs.

Comprehensive Training

Empowering you to use models effectively.

Accurate Projections

Make informed decisions with confidence.

We prepare comprehensive plan to launch and grow startup with

Data-Driven Market Research

Detailed market analysis and SWOT insights

Business Model Canvas

Clear visualization of your business structure

Financial Projections

Valuation and forecasts to showcase your potential

What our clients say about us

Most Frequently Asked Questions (FAQs)

Absolutely! The model is designed with a user-friendly interface, clear instructions, and pre-built formulas to help even those without advanced financial expertise use it effectively.

Yes, the template includes both scenario and sensitivity analysis features. You can evaluate the impact of changes in pricing, demand, costs, and more to make informed decisions.

The template is fully compatible with Microsoft Excel & Google Sheet.

Yes, we offer fully customizable templates to fit your specific business needs. If you require additional changes, we also provide customized services—just contact us to discuss your requirements.

We offer a 7-day 100% money-back guarantee. If you’re not satisfied with the model, simply let us know within this period for a full refund.

If you encounter any errors, we’ll rectify them free of charge. Our commitment is to deliver an error-free and reliable financial model for your business

Yes, our financial models are designed to be versatile and work across various industries and business stages, from startups to established companies. You can easily adapt the inputs to reflect your specific business dynamics.

Absolutely! We provide email support to assist you with any questions or issues you may have while using the financial model.

Related products

-

Sale!

Car Wash Financial Model Template

$150.0Original price was: $150.0.$95.0Current price is: $95.0. -

Sale!

Coworking Space Financial Model (Dynamic 3-Statement-Model)

Rated 5.00 out of 5$130.0Original price was: $130.0.$95.0Current price is: $95.0. -

Sale!

Mobile Game Development Financial Model Excel Template

$250.0Original price was: $250.0.$110.0Current price is: $110.0. -

Sale!

Veterinary Clinic Financial Model Template

$250.0Original price was: $250.0.$99.0Current price is: $99.0. -

Sale!

Marketplace Financial Model Template

$250.0Original price was: $250.0.$99.0Current price is: $99.0. -

Sale!

Buy Now Pay Later (BNPL) – Fintech Financial Model Template

$350.0Original price was: $350.0.$110.0Current price is: $110.0. -

Sale!

Gym Financial Model Excel Template

$300.0Original price was: $300.0.$110.0Current price is: $110.0. -

Sale!

Video Streaming – SVOD Financial Model & Valuation Template

$200.0Original price was: $200.0.$150.0Current price is: $150.0.

Reviews

There are no reviews yet.