Every startup founder must deal with the cap table in their entrepreneurship journey. Indeed it is very confusing to understand the purpose and more difficult to build it accurately. It outlines the ownership structure of a company, impacting everything from pricing future fundraising rounds to managing ownership dilution and determining who has the authority to approve major decisions, detailing who owns what percentage of the company’s equity. Accurate cap tables are vital to due diligence because they help potential investors or venture capitalists decide whether or not to invest in your startup.

This comprehensive guide will highlight capitalization tables, their relevance, incorporation into an Excel financial model, and the strong reason why investors and venture capitalists (VCs) scrutinize them.

What is a Capitalization Table?

A capitalization table is essentially a spreadsheet or table that shows a company’s equity structure. It lists all the securities that a company has issued, including common shares, preferred shares, warrants, options, and convertible securities, along with the percentage of ownership each entity holds. This table also displays the cost of these securities, any possible dilution that occurred, and the effects of these ownership stakes in varying financing arrangements.

Key Elements of a Capitalization Table

- Equity Owners:

- Founders: Original owners of the firm in most cases; common shares.

- Employees: May hold options, employee stock ownership plan (ESOP) or restricted stock units (RSUs) as part of their compensation package.

- Investors: Includes angel investors, venture capitalists, and other external investors who have purchased equity in the company.

- Types of Equity:

- Common Stock: Typically held by founders and employees. These shares represent basic ownership and are usually the last to receive dividends or liquidation proceeds.

- Preferred Stock: Often held by investors. Preferred stockholders typically receive dividends and liquidation proceeds before common stockholders and may have other preferential rights.

- Options and Warrants: Instruments that give holders the right to purchase stock at a predetermined price, often used as incentives for employees or investors.

- Convertible Securities: Debt or equity that can be converted into a different type of security, usually common stock, at a later date.

- Valuation and Ownership Percentage:

- Pre-Money and Post-Money Valuation: Indicates the company’s valuation before and after a funding round.

- Ownership Percentage: Represents the percentage of total equity that each holder owns, both before and after potential dilution.

- Dilution Scenarios:

- Impact of New Financing Rounds: Shows how new investment rounds affect existing shareholders’ ownership percentages.

- Option Pool Allocation: Illustrates how setting aside equity for future employees affects current ownership stakes.

Who can use Capitalization Table?

- Founders and Startups:

- Decision-Making Tool: Founders, early stages of startups & SMBs use the cap table to make informed decisions about issuing new shares, allocating options, and preparing for future funding rounds. This allows them to determine how different events are likely to impact ownership and control.

- Dilution planning: Based on the cap table, you can forecast how the addition of fresh investors will dilute your ownership stakes and what you ought to do about it.

- Investors and Venture Capitalists:

- Evaluating Investment: Investors use the cap table to assess the risks and rewards of investing in a company. They analyze the distribution of equity, potential dilution, and the terms of existing securities to understand their future return on investment.

- Negotiating Terms: VCs often negotiate the terms of their investment based on the current cap table. They may seek preferred shares, anti-dilution protections, or control provisions that influence the cap table’s future structure.

- Legal and Financial Advisors:

- Compliance and Reporting: Legal teams use the cap table to ensure the company complies with securities laws and regulations. Financial advisors use it for financial modeling, tax planning, and preparing for mergers and acquisitions.

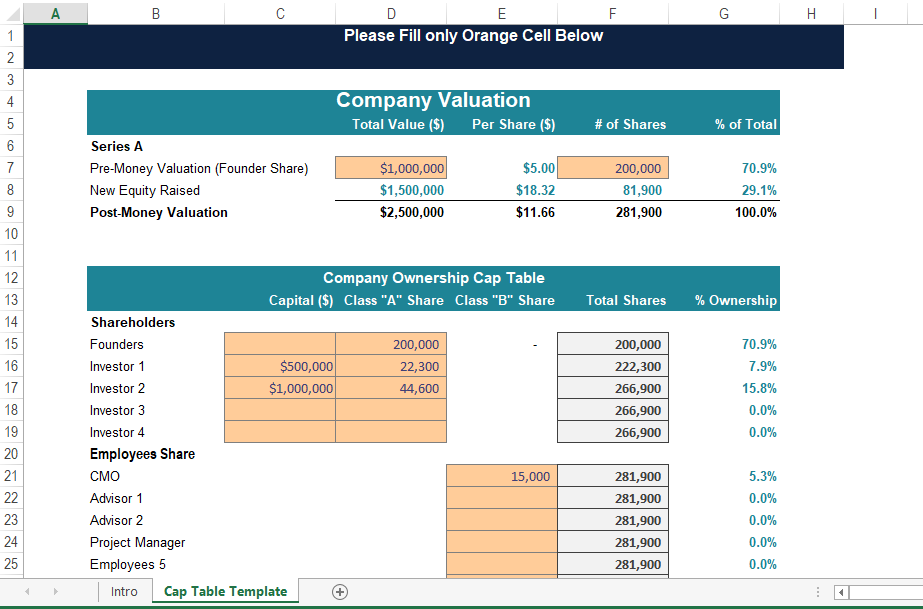

Kickstart your startup or SMB with a free cap table template from Excel Business Resource. It’s a great starting point for understanding your company’s ownership structure.

Why is a Capitalization table important?

- Ownership Clarity: The cap table provides a clear snapshot of who owns what in the company, which is essential for internal decision-making and external reporting. It ensures that all parties understand their stakes and the potential impact of future financing.

- Preparing for Fundraising: Before entering a new funding round, the cap table helps founders and management evaluate the potential dilution and structure of the deal. It also aids in negotiating terms with new investors.

- Management of Employee Equity: Startups engaging employees by equity-based compensation require the cap table to track options, vesting schedules, and overall ownership effects.

- Mergers and Acquisitions: In the event of a sale or acquisition, the cap table would determine how the proceeds were to be split among shareholders. This is very important to ensure a proper disbursement of one’s fair share based on percentage ownership.

Building a Capitalization Table in a Startup Financial Model

Preparation of cap table in a startup financial model is extremely important and requires many rigorous steps to be accurate and rather flexible. This is how you do it:

- List All Securities:

Record all kinds of equity issued by the company in the form of common stock, preferred stock, stocks options, warrants, or convertible securities in some other form. This will form an entire picture of equity structure.

- Input shareholder data:

Record all the equity holders name, number of shares or units owned by them, and the cost they paid for each security. This will form the basis of your cap table.

- Calculate ownership percentages:

Take all the shareholder data and calculate, based on the number of outstanding shares, the percent equity owned by each person. This is always a necessary step to understand how equity gets distributed in your company.

- Add Valuation Data:

Always include pre-money and post-money valuations for each funding round. These would be important to consider how the valuations dilute the ownership percentages when fundraising.

- Model Different Types of Dilution Scenarios:

Other diluting scenarios should be modelled. At least, these should include the effect of new rounds of financing, the use of option pools, or the exercise of options and warrants. The process educates stakeholders on how ownership might shift depending on the situation.

- Dynamic Updates:

The final thing is that your cap table should be live, meaning that it automatically updates whenever you change the inputs-including adding new investments or option grants. This will make it fast to review how any changes to the cap table will affect the current situation.

Why Investors and VCs Examine Capitalization Tables

Investors and venture capitalists closely scrutinize cap tables because these represent critical information that can make or unmake an investor’s choice of investment. Here’s a detailed analysis on why they take cap tables seriously.

- Control and Power Explanation

- Determination of Ownership Structure: Cap tables detail equity distribution among founders, investors, employees, and many other stakeholders. This information is very useful to determine who holds the majority of shares and, by extension, the most control over company decisions.

- Measuring Impact: Investors-most notably VCs-will look at the cap table and try to figure out how much equity they might be able to secure for themselves and what sort of impact that equity will give them. They want to see that their investment will position them with a large enough percentage of equity so that they get an impact on decisions in the business-both at its long-term direction as well as big operating expenditures or future rounds.

- Measuring Risk and Reward

- Potential Return on Investment (ROI): From the cap table, investors can calculate how much percentage ownership they will get and compare it with others. This allows them to estimate a possible return based on future valuation of the company and how quickly it is growing.

- Risk of Dilution: A cap table can also be used by investors to gauge the dilutive risk in subsequent funding rounds. The higher the capital raised, the more dilutive such an event will be for existing shareholders’ equity. Finding out the current ownership structure helps investors to make better predictions about exactly what such funding will do to them.

- Bargaining in Investment Terms

- Protecting Investment Interests: Cap tables significantly help in negotiations. Investors apply them to develop terms safeguarding their investments, for instance, anti-dilution clauses, liquidation preferences or rights accompanying preferred shares.

- Informed Decision Making: The apparent ownership structure provides a vital understanding that investors can use to bargain more. They can even suggest terms of how they would preserve and enhance value if the company goes out for another round of funding, merges or gets acquired.

- Exit Planning

- Exit Scenario Anticipation: Most investors dream of an exit that comes with a return in the form of sale or merger or IPO. The cap table plays an important role in the planning of exits by showing who is going to receive what percent of the exit proceeds.

- Stake Protection: As investors want protection for their equity stake in any form of exit, a cap table will give them a clear idea about their potential payout and a basis for negotiation of terms that maximize the return on their exit.

Grow your startup with Excel Business Resource

Just like an organized cap table is important for your startup’s financial foundation, similarly, selecting the right advisor is crucial for driving your business forward.

That’s where we come in. At Excel Business Resource, we provide a comprehensive range of services tailored to the unique challenges of your growing startup.

Our Financial Forecasting & Valuation Models are designed to cater to the important need of the startups, ensuring you stay ahead at every stage of growth.

Conclusion

A good cap table is an essential tool that any startup, more so when raising external funds, needs to have. To start with, it gives one a clear view of ownership. This might help in analysing dilution and supports strategic decision-making. For investors and venture capitalists, a cap table is among the most important tools in terms of assessing the value of their investment and making sure that the latter does not compromise the former’s interests. A detailed cap table must be added to a startup financial forecasting model to gain market trust. Adding a detailed cap table is not only a best practice but a necessity in a financial forecasting model to be built to gain trust by the markets.