Every successful business, from the local coffee shop to a multi-billion-dollar tech company, began with a single person who had a great idea. But here’s the truth: an idea, no matter how brilliant, is just a wish until you turn it into a Business Plan. This plan isn’t a tedious report; it’s the blueprint, instruction manual, and strategic roadmap that transforms your abstract dream into a concrete, measurable path to success.

Many people mistakenly believe a business plan is only a boring requirement for getting a bank loan. That couldn’t be further from the truth. An expert-level plan is your company’s constant health check, your strategic compass, and your most powerful tool for convincing others—investors, partners, or future employees—that your vision is real, sustainable, and worth betting on.

Therefore, If you look for Startup Consultancy Services or searching for a robust Startup Business Plan Template, understanding this strategic depth is your first crucial step.

Why do you need a strong business plan?

The main reason you need a thorough plan is simple: to stop guessing and start knowing. Its significance boils down to three powerful points:

- It Validates Your Idea (The Insurance Policy)

Writing a business plan forces you to do the hard research before you spend serious money. You’ll be challenged to figure out if your target market is actually big enough (the “Total Addressable Market”) and who your competitors truly are. It is much cheaper and faster to catch a flawed assumption on paper than it is to launch your product and realize no one wants it. The plan is your due diligence—it tests the strength and viability of your idea under realistic pressure.

- It Secures Funding (The Trust Document)

Whether you’re talking to a bank or a Venture Capitalist (VC), your business plan is their window into your world. A clear, well-researched plan demonstrates that you are a serious leader who understands the numbers and the risks. When a professional Business Plan Consultant develops this document, their focus is on making it robust enough to withstand intense financial scrutiny.

- It Provides Focus and Alignment (The Company Compass)

Once your business is running, it’s incredibly easy to get distracted by “shiny object syndrome” or new opportunities. The business plan serves as your north star. It ensures that every department marketing, sales, operations is working toward the same core goals and metrics. It’s the foundational document you use to hire new employees, explaining not just their job, but the overall mission they are joining.

So as an expert business consultant, I would recommend going with the professionals who offer Business Plan Consulting Services, because alignment is often the first critical deliverable by them.

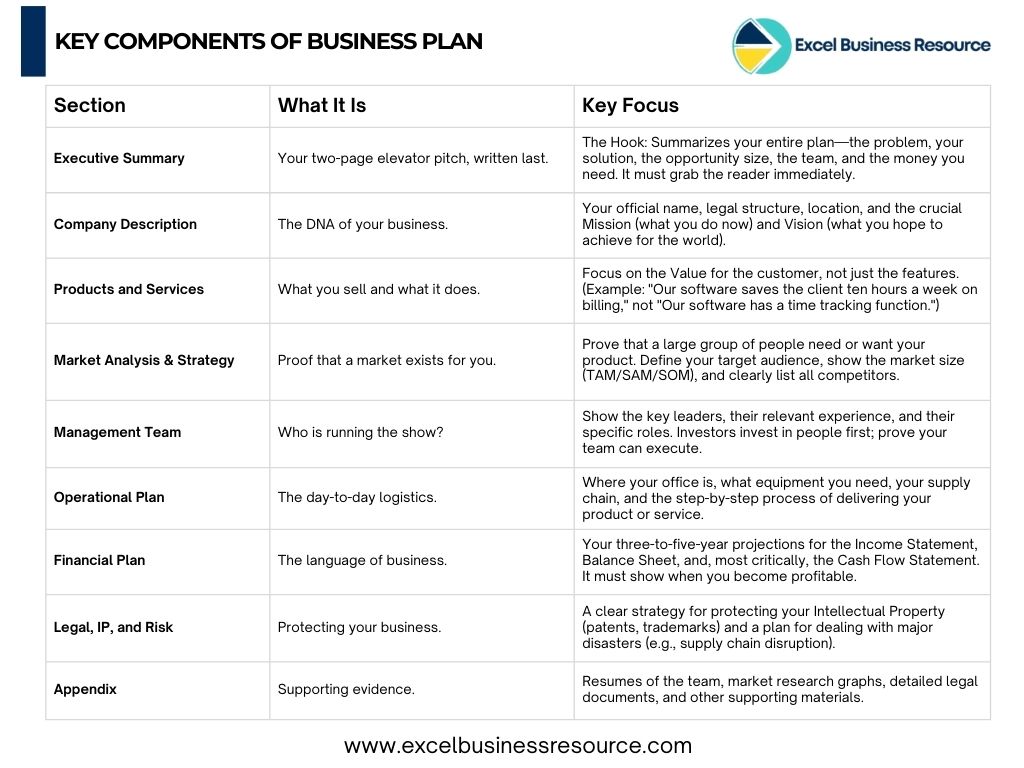

The Essential Components of a Winning Business Plan

A successful plan is structured like a well-written story, starting with a powerful summary and ending with facts and figures. Here are the core chapters you must include:

Core Document Sections

Writing a business plan is often the biggest hurdle for any entrepreneur, but you don’t have to do it alone. ExcelBusinessResource.com can save you over 100 hours of stressful work by handling the heavy lifting for you. If you need something fast and professional, you can jump-start your progress with our investor ready financial model template available right on our website. For those with a unique vision, we offer exclusively customized financial models and business plans built from scratch by our industry experts. From tech startups to retail shops, our team knows exactly what it takes to make your plan stand out, giving you a polished, professional result without the headache of doing it yourself.

The Crucial SWOT Analysis

The Market Analysis section must include a SWOT Analysis (Strengths, Weaknesses, Opportunities, Threats).

- Strengths and Weaknesses are Internal factors (e.g., strong team expertise, lack of capital).

- Opportunities and Threats are External factors (e.g., a growing market trend, new government regulation).

This analysis validates your strategy and highlights your true competitive edge.

The Two Pillars Of Attraction In Business Plan

For early-stage companies, there are two modern tools that complement the traditional plan:

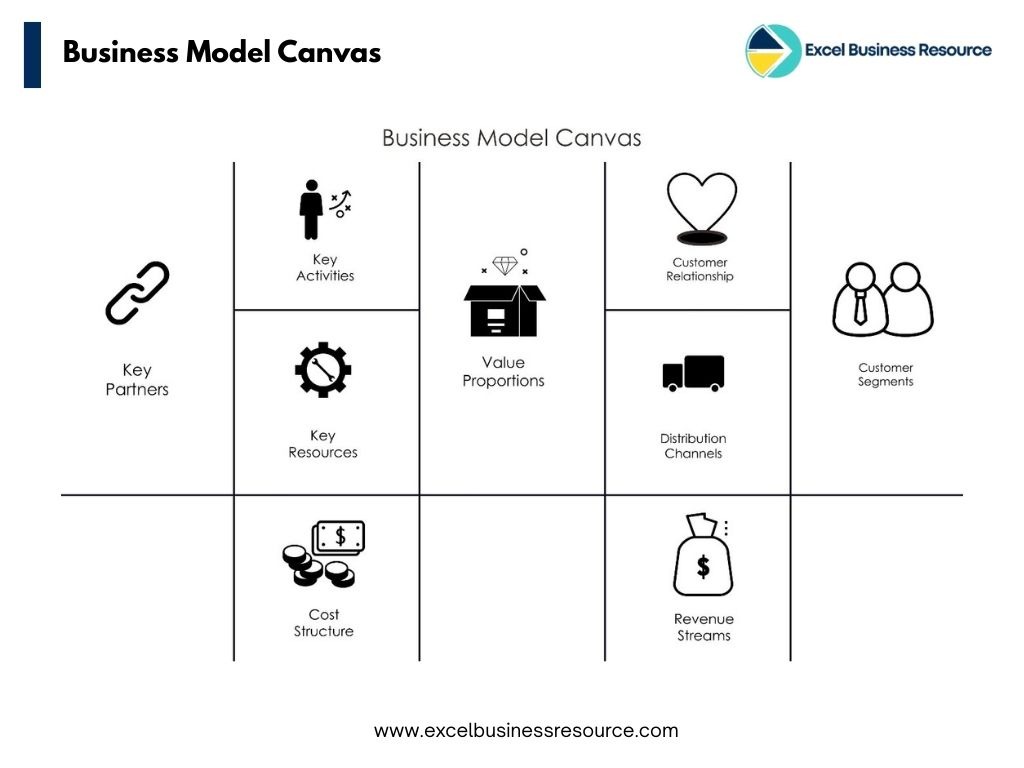

- The Business Model Canvas (The One-Page Strategy)

The Business Model Canvas is an invaluable strategic tool. It’s a single, visual page that maps out all the crucial elements of your business model. It’s fantastic for quick planning, idea testing, and team communication.

It breaks the business into nine simple blocks:

- Customer Segments: Who are you serving?

- Value Propositions: What problem do you solve for them?

- Channels: How do you reach them?

- Customer Relationships: How do you interact with them?

- Revenue Streams: How do you make money?

- Key Resources: What essential assets do you need?

- Key Activities: What crucial things must your company do?

- Key Partnerships: Who can help you leverage resources and reduce risk?

- Cost Structure: What are your biggest expenses?

- Formatting and Presentation (Making It Readable)

An expert plan isn’t just about content; it’s about delivery. A thick, poorly formatted document will be ignored.

- Clarity is King: Use short paragraphs and clear headings. Avoid excessive jargon.

- Visual Appeal: Integrate graphs and charts to simplify complex data, especially in your Financial and Market Analysis sections.

Targeted Versions: Always create a two-page Executive Summary and a 15-slide Presentation Deck based on the main document. The full plan is for due diligence, the others are for pitching.

What Makes a Business Plan "Investor-Ready"?

An Investor-Ready Business Plan goes beyond just being complete—it establishes trust and transparency. Investors are looking for three things that generic plans often miss:

- The Assumptions Table: This is the secret handshake. You must create a separate, detailed table listing every single assumption that drove your financial projections (e.g., “We assume customer churn will be 4% per month”). Showing your homework builds massive credibility.

- A Credible Exit Strategy: Investors need to know how they will get their money back, plus a profit. Your plan must name potential companies that might acquire you in five to seven years and explain why.

- Focus on Unit Economics: Investors want proof that for every dollar you spend to acquire a customer, you make back much more than a dollar over that customer’s lifespan (High LTV relative to CAC).

Mistakes to avoid in a business plan

A business plan can fail for reasons that have nothing to do with the idea itself. As an entrepreneur, you must avoid these critical pitfalls:

- Mistake 1: Wishful Thinking (Ignoring Data): The biggest mistake is letting optimism run wild. The plan should be based on what the market data shows. Avoid guessing revenue; base it on realistic industry benchmarks.

- Mistake 2: Writing It as a One-Time Chore: Many entrepreneurs write the plan only to get the money, then never look at it again. Avoid letting the plan gather dust. It must be a “living document,” updated at least quarterly.

- Mistake 3: Underestimating the Costs: Almost every startup underestimates how much time and money the sales process will take. Be conservative with revenue and liberal with expenses.

- Mistake 4: Hiding Weaknesses: Investors are smart. Instead of glossing over challenges, state the risk clearly and then immediately present your plan for mitigating that risk. This demonstrates leadership and foresight.

Conclusion

A business plan is not an obstacle; it’s a launchpad. It serves as a comprehensive operational guide, a clear statement of your competitive edge, and a powerful financial forecasting tool. It moves you from being an “idea-haver” to a “data-driven business leader.” Whether you’re using a free Startup Business Plan Template or engaging with Business Plan Consulting Services, the depth of your research and the clarity of your assumptions will be the difference between a plan that gathers dust and a plan that attracts serious capital.