BESS plays a crucial role in the global energy transition. As renewable sources like solar and wind expand, their intermittency increases the need for reliable energy storage to balance supply and demand. As a result, investors view BESS as both a key solution for grid stability and a promising opportunity in the growing clean energy sector.

As renewable energy imbalances increase, BESS provides both financial and sustainability benefits. Therefore, investors and developers need a clear understanding of costs and profitability timelines to make informed decisions.

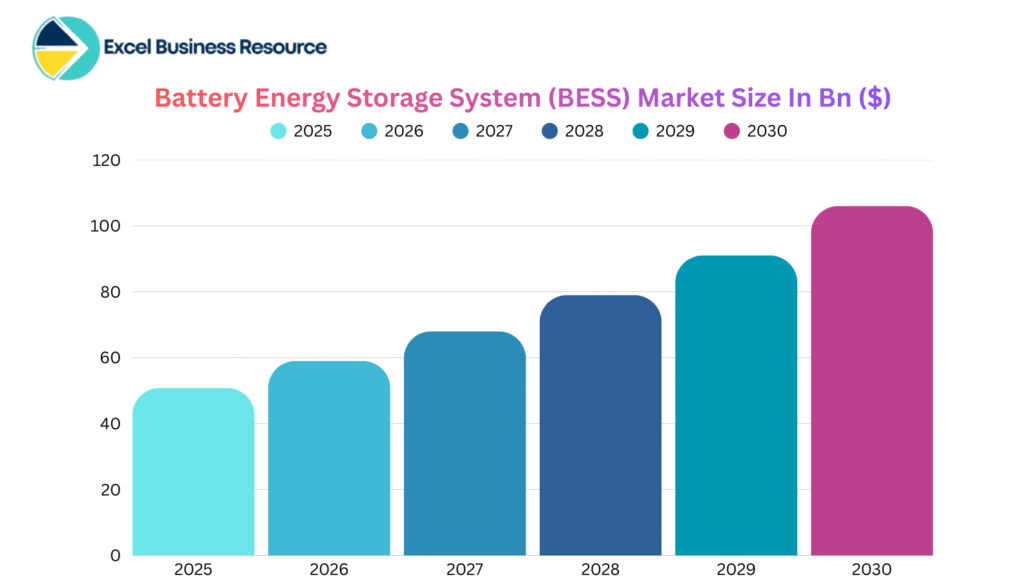

BESS Market Overview: A Rapidly Growing Sector

The BESS market is expanding rapidly due to technological advancements and supportive policies. The global market is expected to reach $50.8 billion in 2025 and exceed $106 billion by 2030, with a CAGR of approximately 15.8%. This growth is driven by the increasing use of lithium-ion batteries in renewable and grid modernization projects worldwide.

Governments and private investors are deploying BESS to balance peak loads, enhance grid reliability, and support decarbonization. This sustained demand confirms BESS as a central component of the future energy landscape.

Why BESS Is a Strong Investment Opportunity

Battery Energy Storage Systems (BESS) are increasingly attractive investments due to combined economic, technological, and regulatory advantages.

The rapid rise of renewable energy, especially solar and wind, has created a pressing need for storage solutions to balance supply and demand. Without energy storage, the intermittent nature of renewables can lead to grid instability and wasted generation, making BESS essential for reliable, clean power.

Grid operators increasingly rely on BESS for services such as frequency regulation, voltage support, and peak shaving. These functions improve network reliability and create additional revenue opportunities for storage providers.

Battery costs have decreased significantly due to advances in cell chemistry, mass production, and supply chain improvements. Lower capital expenditures make BESS projects more financially attractive, particularly for large-scale deployments.

Governments worldwide are rolling out incentives, tariffs, and supportive policy frameworks to accelerate the adoption of BESS. These measures help offset upfront costs and boost returns, making it easier for investors to justify and secure funding for new projects.

These factors create a strong investment case, aligning environmental sustainability with financial returns. As BESS installations increase globally, especially in China, the US, and Australia, investors are realizing faster paybacks and long-term value.

Collectively, these drivers position BESS as a forward-looking investment for those seeking to benefit from the clean energy transition while supporting grid stability and profitability.

Detailed Cost Breakdown of Building a BESS

Building a Battery Energy Storage System (BESS) involves several significant cost components, each contributing to the overall project expense. Here’s a detailed breakdown to help understand what influences these costs and how they vary:

Capex (Capital Expenditure):

This is the upfront cost to physically build the system, including batteries (cells), power conversion systems (PCS), inverters, battery management systems (BMS), thermal management, civil works, installation, land acquisition, and safety systems. Globally, typical costs range from $400 to $600 per kWh, with an average of $580 per kWh, depending on project size and location.

Cost per kWh and MWh:

As projects scale from residential to utility-scale, per-unit costs typically decrease due to economies of scale and improved installation efficiency. Larger systems (over 100 MWh) often achieve lower costs per kWh.

Opex (Operational Expenditure):

Ongoing costs include maintenance, labour, periodic battery replacements, insurance, and software monitoring. Effective management of these expenses is essential to maintain system performance and longevity.

Technology Variations:

Battery chemistries differ in cost and lifecycle. batteries typically offer longer cycle life and lower costs than nickel-manganese-cobalt. Flow batteries have higher upfront costs but may offer longer lifespans, reducing long-term replacement expenses. geographic region. In the USA and Japan, higher labour and material costs tend to elevate total system costs, whereas parts of Asia and the Middle East benefit from lower input expenses, making projects more affordable in those regions.

Cost Breakdown of Building a BESS

Capital Cost (per kWh)

$400 – $600 (average ~$580)

Varies by project size, technology, and region

Total Installed Cost

$6,000 – $23,000 for smaller systems; $30,000+ for larger

Based on system size and complexity

Ongoing Costs (per year)

Maintenance, insurance, replacements, monitoring

Critical for system longevity

Technology Impact

Longer lifespans with flow batteries; cheaper chemistries

Influences initial investment and total cost of ownership

Regional Influence

Higher in US and Japan; lower in Asia and Middle East

Cost-effectiveness depends on local labor/material prices

Understanding these cost components and regional differences enables investors and developers to plan accurately, optimize designs, and create realistic financial models for successful projects.

Expected Timeline for Profitability Of BESS

The average payback period for BESS projects ranges from 5 to 11 years, depending on system size, technology, and market conditions. Profitability depends on revenue streams such as energy arbitrage, capacity payments, and ancillary services. Improving operational efficiency and reducing costs can accelerate returns.

Small-scale behind-the-meter systems tend to reach profitability faster due to demand charge reduction benefits, while utility-scale projects benefit from larger capacity payments and multiple revenue stacking opportunities. Internal rates of return (IRR) typically fall between 8% and 15%, with some projects exceeding this range through innovative revenue optimization strategies.

Revenue Models for BESS

Battery Energy Storage Systems (BESS) now serve as dynamic assets capable of generating multiple revenue streams. By combining these revenue models, investors and operators can enhance returns and improve project financial viability.

Energy Arbitrage:

This is the classic BESS revenue stream—charging batteries when electricity prices are low (often overnight or during periods of excess renewable generation) and discharging when prices spike (typically during peak demand hours). With energy prices volatile, this model offers reliable short-term profits.

Capacity Payments:

Many grid operators pay for guaranteed power availability, especially during high-demand periods or when the grid is stressed. By reserving capacity, BESS operators can secure steady, predictable income regardless of actual energy traded.

Ancillary Services:

BESS are uniquely suited to provide fast-response grid support, including frequency regulation, spinning reserve, and voltage control. These services are essential for grid stability and can command premium rates, especially in markets with high renewable penetration. BESS can slash expensive peak demand charges by supplying power during high-usage periods, directly lowering monthly electricity bills.

Renewable Energy Shifting:

Pairing BESS with solar or wind farms enables excess energy to be stored and dispatched as needed, maximising renewable energy use and reducing curtailment.

Behind-the-Meter Savings:

Onsite BESS installations help businesses and homeowners reduce grid reliance, lower energy costs, and participate in local incentive programs for self-generation.

Microgrid Backup Value:

In microgrid applications, BESS provide backup power during grid outages, supporting critical infrastructure and adding value in disaster-prone or remote areas.

The real power comes from “revenue stacking” combining several of these streams to maximise asset utilisation and profitability. For example, a utility-scale BESS might earn money from energy trading, capacity payments, and ancillary services simultaneously, dramatically improving ROI and investment valuation.

Key Risks and Challenges

Despite their potential, BESS investments face risks such as:

- Battery degradation requires eventual cell replacement.

- Market price volatility is affecting revenue predictability.

- Policy uncertainty can alter incentive structures.

- High upfront capital costs and replacement expenses.

- Safety challenges, including thermal runaway and fire hazards, requiring stringent risk management.

- Identifying and mitigating these risks is essential for stable investment returns.

Take Control of Your Battery Storage Investment

To maximize the potential of your Battery Energy Storage System (BESS) investment, it is essential to use a professional, comprehensive startup financial forecasting model. This model goes beyond basic calculations by capturing the complex interactions among revenue streams, battery degradation, operational costs, and capital expenditures, providing clear financial visibility.

A high-quality BESS financial forecasting model calculates key metrics, including Net Present Value (NPV), Internal Rate of Return (IRR), Return on Investment (ROI), Debt Service Coverage Ratio (DSCR), cash runway, payback period, and detailed cash flow forecasts. manual estimations, these models incorporate detailed assumptions about capacity payments, energy arbitrage, ancillary services revenues, and lifecycle costs, giving you precise, dynamic projections.

They also support scenario and sensitivity analyses, allowing you to test assumptions, explore various market conditions, and make informed strategic decisions based on data.

Whether you are a developer, investor, EPC firm, or consultant, this robust tool provides a strategic advantage.

Download our professionally built Battery Energy Storage System (BESS) Financial Model Template to generate detailed financial projections, evaluate various revenue models, conduct comprehensive scenario analysis, and deliver thorough investment appraisals.

Download:

Founder Ready DCF Valuation Template

Startup Cost Calculation Template

Therefore, equip yourself with the right financial blueprint to maximize the profitability and success of your Battery Energy Storage investment. In this fast-evolving market, data-driven decisions are essential.

If you’re looking for expert support in your BESS investment journey, our financial modeling consultant and startup advisory services are designed to help you every step of the way. We specialize in financial planning and analysis, providing robust models and actionable insights tailored to your unique needs. Our startup consultancy services empower founders and investors to make informed decisions, optimize financial strategies, and confidently present to stakeholders. Whether you’re building your first financial model or seeking a comprehensive review, our team is here to ensure your project is set up for long-term success.

We hope this article has provided clear and actionable insights to help you confidently consider investing in a Battery Energy Storage System (BESS) project. From understanding the potential returns and payback timelines to identifying the essential documents—like a BESS business plan, financial projection model, pitch deck, and company profile. This guide is designed to equip you with the knowledge needed to navigate the investment landscape and make informed decisions. Whether you’re exploring opportunities for market entry, seeking funding, or building a robust strategy, the information here will help clarify your path toward a successful and profitable BESS venture.