Building a financial model for a biotech startup is no ordinary task. Unlike traditional software or service businesses, biotech ventures navigate a landscape defined by extreme volatility, decade-long development cycles, and binary outcomes. You aren’t just tracking monthly recurring revenue; you are forecasting the financial viability of scientific breakthroughs.

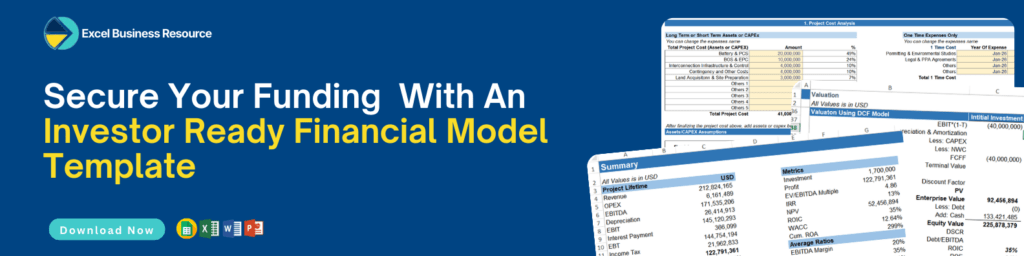

To attract savvy venture capitalists and navigate the “Valley of Death,” your financial model must be robust, industry-specific, and dynamic. Below is an in-depth exploration of the five critical components every biotech startup financial model must include, as featured in the Excel Business Resource (EBR)’s Biotech Financial Forecasting Model Template.

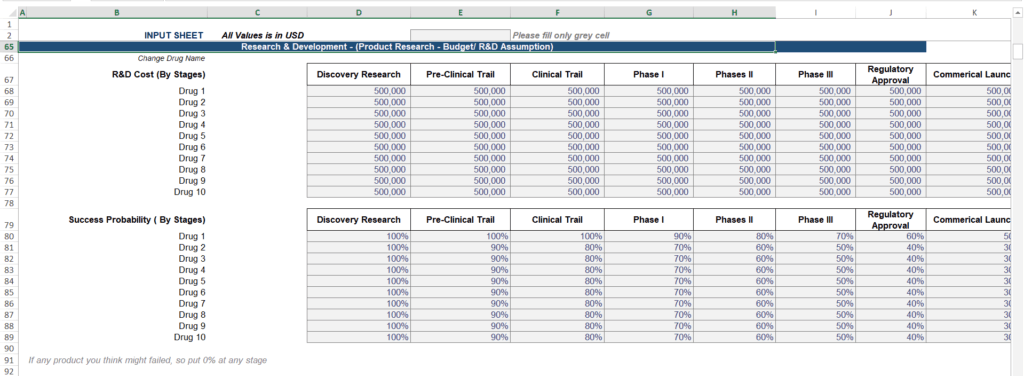

1. Clinical Trial Cost Simulations with Phase-Specific Detail

Clinical trials are the backbone of biotech success but also the single largest cost driver for any life sciences company. A generic “R&D” line item in a spreadsheet is insufficient for an industry where a single Phase 3 trial can cost tens of millions of dollars.

Your model must simulate expenses across the entire development lifecycle—Discovery, Preclinical, Phase 1, Phase 2, and Phase 3.

Why Phase-Specific Detail Matters:

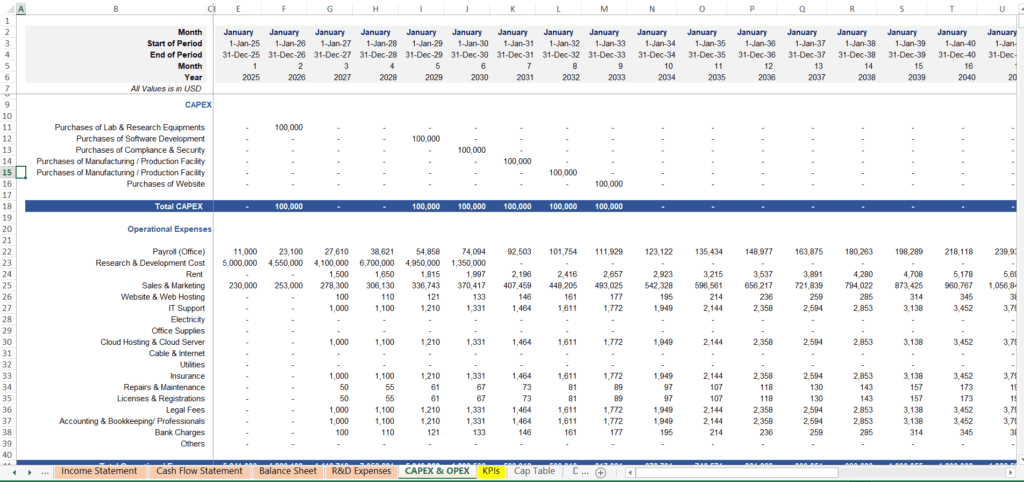

- Accurate Phase-Wise Cost Inputs: Every stage has different cost profiles, from lab equipment in discovery to massive patient recruitment efforts in Phase 3.

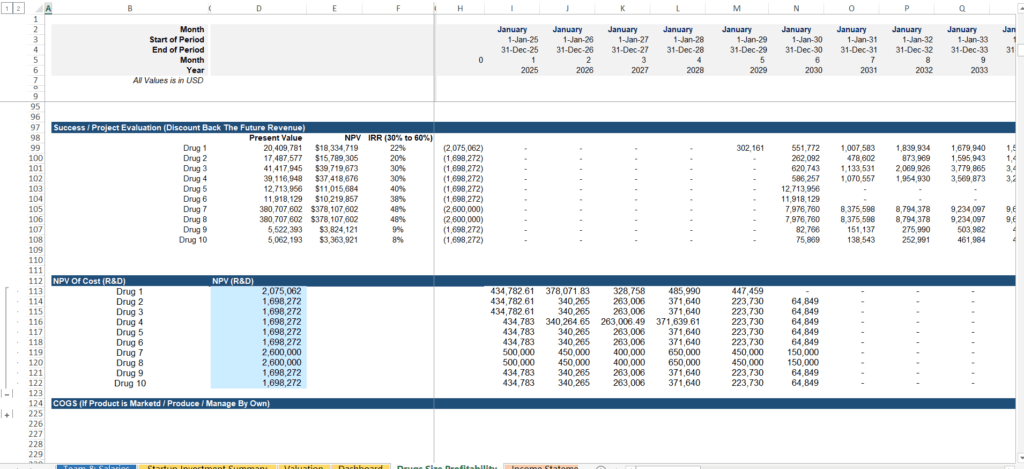

- Success Probability Adjustments (rNPV): Since most drugs fail during trials, your model must weigh projected revenues by the statistical probability of trial success at each stage. This is known as Risk-Adjusted Net Present Value (rNPV).

- Multi-Drug Pipeline Support: Most successful startups don’t rely on a single “hero” molecule. Your model must manage simultaneous trials across a diverse pipeline to show investors you are mitigating risk.

Our biotech financial model automates these calculations, enabling you to forecast trial costs precisely and assess financial viability at each development stage. This reduces manual errors and saves you over 40 hours compared to building from scratch.

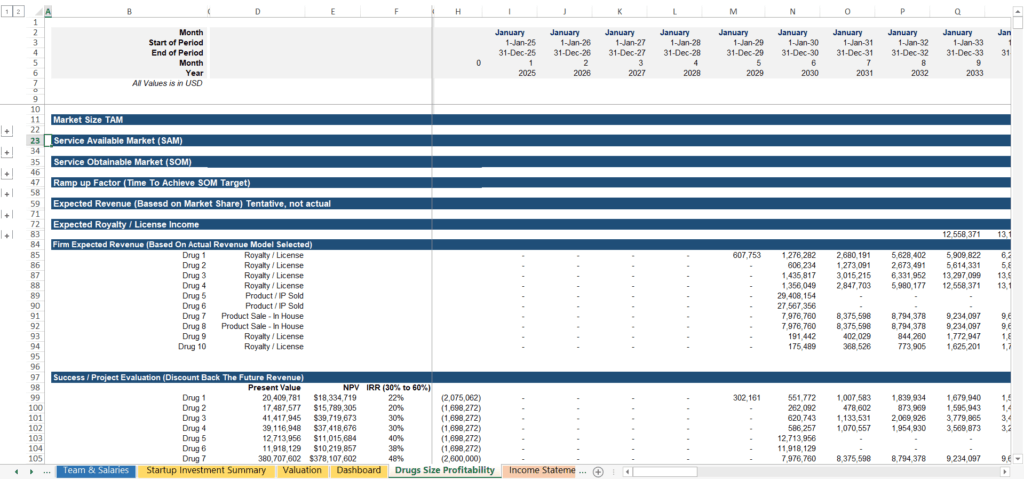

2. Patent Valuation Modules with Licensing and Exit Scenarios

In the biotech world, your intellectual property (IP) is often your most valuable—and sometimes your only asset in the early stages. A standard financial model focuses on cash flow, but a biotech model must focus on Asset Valuation.

Critical IP Modeling Features:

- Royalty and Licensing Projections: Many startups choose to license their drug to “Big Pharma” rather than selling it themselves. Your model should project revenue based on customizable royalty rates and milestone payments.

- Exit Value Calculators: Investors want to know the “end game.” Use industry-standard multiples to estimate what the company or specific patent portfolio would be worth in an acquisition.

- Scenario Analysis (Buy vs. Build): You need the ability to compare the financial outcomes of a licensing deal versus an outright sale or internal commercialization.

Our template’s patent valuation module consolidates these complex inputs into clear investor-ready outputs, helping you demonstrate the true value of your IP portfolio.

3. Milestone-Based Funding Trackers Aligned with R&D Progress

Biotech funding is rarely a single “Series A” check that lasts forever. Capital is typically raised in stages tied directly to clinical milestones. If you hit a Phase 2 endpoint, you unlock the next round of capital.

Tracking the Flow of Capital:

- Capital Raises Linked to Progress: Your model should show exactly when you will need more cash based on trial phases and regulatory (FDA/EMA) approval timelines.

- Equity Dilution Tracking: As you take on more investors through various rounds, it is vital to track how founder and early-investor equity is diluted.

- Investor Return Metrics: Beyond simple profit, your model must calculate the Internal Rate of Return (IRR) and preferred returns to show investors exactly what they stand to gain.

A transparent milestone tracker makes investor conversations smoother and builds credibility by showing you understand the capital-intensive nature of the industry.

4. Risk-Adjusted Sensitivity and Scenario Analysis

In biotech, uncertainty isn’t just a possibility; it’s a guarantee. A “Base Case” scenario is never enough. Investors will ask: “What happens if the FDA delays our Phase 2 start by six months?” or “What if our market penetration is 5% lower than expected?”

Essential “What-If” Capabilities:

- Stress-Testing Cash Flow: Model the impact of clinical trial failures or unexpected delays on your “runway”.

- Variable Pricing Assumptions: As healthcare policy changes, your ability to adjust pricing and market adoption assumptions is critical.

- Regulatory Setbacks: Simulate the financial fallout of a “Complete Response Letter” (CRL) or other regulatory hurdles.

Using built-in sensitivity tools allows you to identify risks early and plan contingencies before they become crises.

5. Commercialization Ramp-Up and Cost of Goods Sold (COGS) Modeling

If you are one of the few who reach the finish line of drug approval, the challenge shifts from science to logistics. Forecasting the commercialization phase requires a completely different set of assumptions.

Preparing for Market Launch:

- Market Adoption Curves: Drugs do not sell out on day one. You must project how quickly doctors will prescribe and patients will adopt the treatment.

- Cost of Goods Sold (COGS): You must estimate the costs of manufacturing, quality control, and the complex cold-chain supply requirements often found in biologics.

- CAPEX Investment Alignment: Ensure your Capital Expenditure (CAPEX) such as building production facilities is perfectly timed with your launch schedule to avoid burning cash too early.

Our model’s commercialization engine integrates these factors, giving you a realistic picture of post-approval financial performance.

Why Choose EBR Biotech Financial Forecasting Model?

Building a model with this level of sophistication from scratch can take over 40 hours of expert-level Excel work. The Excel Business Resource (EBR) template is designed to give you that time back so you can focus on the science.

- User-Friendly & Customizable: Tailored to fit the unique needs of your specific startup.

- Benchmarked Data: Pre-loaded with biotech industry benchmarks to ensure your forecasts are grounded in reality.

- Investor-Ready Outputs: Get instant access to professional valuations, cap tables, and cash flow charts that speak the language of VCs.

Don’t waste time reinventing the wheel. Whether you are developing a new therapeutic, a medical clinic, or even a veterinary practice, we have the specialized models you need to succeed.

[Download the Biotech Financial Forecasting Model Today]

Following are other medical services related financial models.

Yes. Beyond providing a standalone template, EBR offers custom financial modeling services tailored to your specific needs. If you already have an existing model, our team can take on the project to perform professional amendments, integrating our specialized biotech modules directly into your current workbook. This ensures your existing data remains intact while gaining industry-specific accuracy in areas like clinical trial simulations or patent valuations.

The model incorporates "Success Probability Adjustments" to weight your projected revenues based on trial outcomes. This allows you to simulate financial viability across every stage from Discovery through Phase 3 reflecting the statistical likelihood of reaching the next milestone.

Yes. The model includes "Multi-drug pipeline support," allowing you to manage and forecast simultaneous trials. This feature is essential for companies tracking expenses and development timelines for up to 10 different drugs at once.

The model features a milestone-based funding tracker that links capital raises directly to your R&D progress and regulatory approvals. It automatically tracks founder and investor equity dilution across multiple rounds and calculates key return metrics like IRR.

The framework is highly user-friendly and fully customizable to fit unique startup needs. While optimized for biotech and pharma, the logic for CAPEX, OPEX, and milestone funding is versatile. We also offer dedicated separate templates for Medical Clinics and Veterinary Clinics.

Yes, EBR provides professional services to develop comprehensive, investor-friendly business plans specifically for the biotech industry. Unlike general business plans, a biotech-specific plan must focus on the scientific roadmap, regulatory milestones, and risk-adjusted valuations. We combine our specialized biotech financial forecasting model with strategic narrative writing to showcase your drug pipeline, patent strength, and commercial potential in a format that sophisticated venture capitalists expect.

A standard business plan usually focuses on immediate customer acquisition and monthly revenue, but a biotech business plan is centered around R&D milestones and regulatory timelines. Because biotech ventures face high upfront costs and no revenue for years, the plan must include a robust financial forecasting model that accounts for:

- Clinical Trial Timelines: Detailed projections for Discovery, Pre-clinical, and Phases 1–3.

- Success Probabilities: Adjusting financial expectations based on the statistical likelihood of a drug passing each stage.

- Intellectual Property (IP) Strategy: A clear roadmap for patent valuation, licensing, or royalty income.

Milestone-Based Funding: A capital-raising strategy that triggers new investment rounds only when specific scientific goals are met.