Making wise financial decisions is essential to any organization’s success and longevity in the corporate world of today. A crucial instrument in this procedure is financial modeling. But is a financial modeling consultant really necessary for your company? Let’s examine the priceless advantages they offer as we dig deeper into this issue.

Understanding Financial Modeling

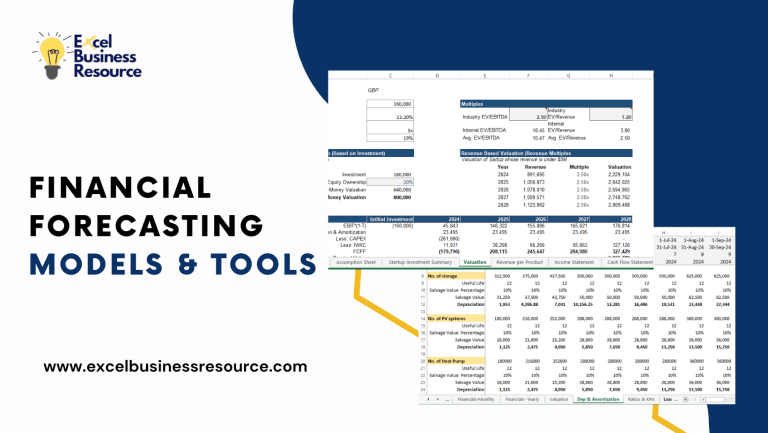

Financial modeling is the art of creating mathematical representations of a company’s financial performance. These models serve as strategic guides, helping businesses forecast future scenarios, make investment decisions, and allocate resources effectively. A financial modeling consultant is akin to a financial architect, meticulously crafting and analyzing these complex models to drive informed decision-making.

Duties and Services of a Financial Modeling Consultant

- Risk Management: By identifying and monitoring risks, consultants help businesses mitigate financial uncertainties and make sound risk-adjusted decisions.

- Budgeting and Planning: Consultants collaborate with internal teams to develop budgets and track financial progress, ensuring alignment with organizational goals and strategies.

- Deal Assessment: Consultants evaluate potential mergers, acquisitions, and investments by forecasting returns and risks, providing crucial insights for strategic decision-making.

- Mentorship and Training: Through education and training programs, consultants empower employees with financial modeling techniques, fostering a culture of financial literacy within the organization.

- Data Analysis: Consultants analyze financial data to identify trends, opportunities, and areas for improvement, enabling businesses to make data-driven decisions.

- Relationship Building: Consultants cultivate strong relationships with clients, fostering collaboration and trust while ensuring alignment with financial objectives.

- Decision Support: By offering financial advice and guidance, consultants assist businesses in developing strategic initiatives and solving complex financial challenges.

- Financial Models: Consultants create comprehensive financial models encompassing income statements, balance sheets, cash flow statements, and more, providing a holistic view of the company’s financial health.

Who Hires a Consultant?

Financial modeling consultants cater to a diverse range of clients, including:

- Corporations: Seeking strategic decision-making support, budgeting assistance, and capital allocation planning.

- Professionals: Individuals in need of personal financial planning, investment guidance, and retirement strategies.

- Startups and Non-Profit Organizations: Requiring financial modeling for fundraising projections, growth strategy planning, and risk assessment.

- Financial Institutions: Including banks, private equity, and venture capital firms, for deal analysis, valuation, and investment evaluation.

Working with a Financial Modeling Consultant

Engaging with a consultant involves collaborative discussions to understand the business’s objectives, industry dynamics, and financial requirements. Consultants then develop tailored financial models, incorporating feedback and ensuring completeness and functionality.

Skills to Look for in a Financial Modeling Consultant

When selecting a consultant, consider their expertise in:

- Data Analysis and Risk Assessment

- Knowledge of Accounting and Specific Industries

- Financial Calculations and Problem-Solving

- Proficiency in Required Software

Better Decision-Making with a Financial Modeling Consultant

To sum it up, financial modeling experts are essential in helping companies make decisions that will lead to long-term success. Their proficiency in financial analysis, risk mitigation, and strategy planning enables firms to confidently navigate intricate situations and make well-informed decisions that lead to success.

Working with a financial modeling expert could provide your company the competitive edge it needs to meet its financial objectives if you want to succeed in the highly competitive business environment of today.