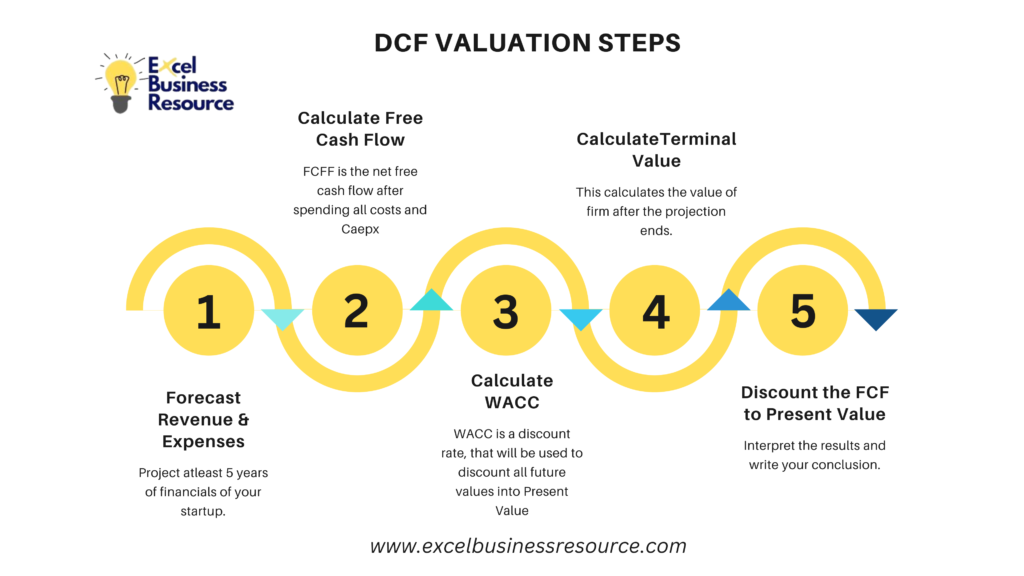

Valuing a startup can be challenging, but the Discounted Cash Flow (DCF) model can provide a structured approach to determining its worth. The DCF method focuses on the future cash flows a business is expected to generate and discounts them back to their present value, making it a highly reliable tool for assessing both startups and established businesses. Here’s a detailed guide on how to value a startup using this powerful DCF model.

Understanding the Discounted Cash Flow Model (DCF Model)

The Discounted Cash Flow (DCF) method is a valuation approach used to estimate the value of an investment based on its expected future cash flows. For startups, it works on the principle that the value of the business today is the sum of all its future cash flows, discounted back to the present using an appropriate discount rate.

The key components of a DCF model are:

- Projected Free Cash Flows: Estimating the future free cash flows a startup will generate.

- Discount Rate: A rate used to discount future cash flows to their present value.

- Terminal Value: The value of the startup at the end of the projection period.

Each of these components is critical in calculating an accurate valuation for a startup.

Note: Free Cash Flow (FCF) is not the same as net profit. Free cash flow is the cash a company generates after minus all operating and capital expenditure.

We recommend starting with our expertly designed Excel template to streamline your valuation process. Our model is dynamically built, making it incredibly easy to use. Simply input key variables such as revenue projections, growth rates, discount rates, or WACC, and watch as the model calculates your startup’s valuation using the DCF method.

Downlaod Free: DCF Model Template Excel Sheet

This tool empowers you to confidently analyze your business’s value, saving time and ensuring accuracy while focusing on what truly matters: growing your venture. It takes the guesswork out of valuations and unlocks insights that drive impactful decisions.

Step 1: Project Future Free Cash Flows

The first step in valuing a startup using a DCF model is projecting the business’s future free cash flows atleast of 5 years. Startups especially in their early stages, may doesn’t have a consistent history of cash flows, making projections tricky. Therefore it is essential to project financial carefully for realistic startup valuation.

Following steps can help guide the process:

Forecast Revenue: Begin it by forecasting revenues for at least five consecutive years. For startups, this usually involves assessing the market size, product adoption rates, and the startup’s ability to scale. Break down revenues by product lines or services and factor in potential growth rates based on market data.

Read: Master SaaS Revenue Forecasting Step by Step Guide

Cost Estimation: Estimate both variable and fixed costs. These include operating expenses such as salaries, marketing, rent, and technology costs. Keep in mind that startup cost structures can change dramatically as they grow.

Operating Cash Flow: Once you have your revenue and cost estimates, subtract operating expenses and taxes to get the startup’s operating cash flow. It is a critical input for the DCF model.

Determine EBITA:

Calculating your operating cash flow is essential to determine your startup’s EBITDA (Earnings Before Interest, Taxes, Depreciation & Amortization). EBITDA is a critical metric needed for performing a Discounted Cash Flow (DCF) Valuation, as it reflects the company’s operational profitability before accounting for financial and non-cash expenses.

Read more: Why EBITDA is important for startup valuation.

Forecast Capital Expenditure (CapEx):

Once you’ve estimated the EBITDA of each year for 5 years, identify the necessary future capital expenditures (CapEx) for growth or maintenance, i.e., software development, technology upgrade, equipment or machinery purchase, and vehicles. Accurately forecasting CapEx is crucial to ensuring sustainable growth.

Calculate Working Capital Requirements:

Evaluate your startup’s working capital needs to account for the short-term operational funding required to run the business. This includes managing the balance between current assets and liabilities, ensuring liquidity, and effectively supporting day-to-day operations.

Working capital formula = Current Assets – Current Liabilities.

Read more: Why understanding working capital is vital for your startup’s success.

Calculate Free Cash Flow

After calculating the above figures, you will get free cash flow, i.e. cash available after spending all business costs and CAPEX, and working capital,

Free Cash Flow = EBITDA – Taxes – CAPEX – Change in Working Capital

Step 2: Determine the Discount Rate

The discount rate is essential for determining the present value of the startup’s future cash flows. The most common rate used is the Weighted Average Cost of Capital (WACC), which reflects the required return by both equity and debt investors. However, for startups, it’s crucial to consider higher risk, and hence, the discount rate may need to be adjusted.

Risk Premium: Startups are riskier investments than established companies, so a higher discount rate is generally used. The expected range would be from 12% to 25% or higher, depending on the industry, stage of the startup, and market conditions.

Cost of Equity and Debt: The WACC typically includes the cost of equity, which is the return expected by investors, and the cost of debt, which is the interest rate on loans. For startups, the cost of equity is often higher due to riskier growth prospects.

Adjustments for Early-Stage Startups: In the case of very early-stage startups, investors might use a higher discount rate to account for uncertainty in cash flow projections and the high potential for failure.

Step 3: Calculate the Terminal Value

The terminal value is a crucial part of the DCF model, especially for startups, since much of their value comes from long-term growth prospects. The terminal value estimates the business’s worth at the end of the projection period, usually 5-10 years into the future. There are two common methods to calculate terminal value:

Gordon Growth Model (Perpetuity Growth Method):

This method assumes that the startup will continue to grow at a constant rate forever. The terminal value is calculated using the following formula:

Terminal Value = Final Year’s Cash Flow × (1 + Growth Rate) / (Discount Rate – Growth Rate)

In this method, it’s critical to choose a realistic growth rate for the business post-projection. For most startups, a long-term growth rate of 2% to 3% is typical.

Exit Multiple Method:

This approach uses an industry-specific multiple, such as a revenue or EBITDA multiple, to determine the terminal value. For example, if similar companies are valued at 8x EBITDA, you can apply this multiple to the startup’s expected EBITDA in the final projected year.

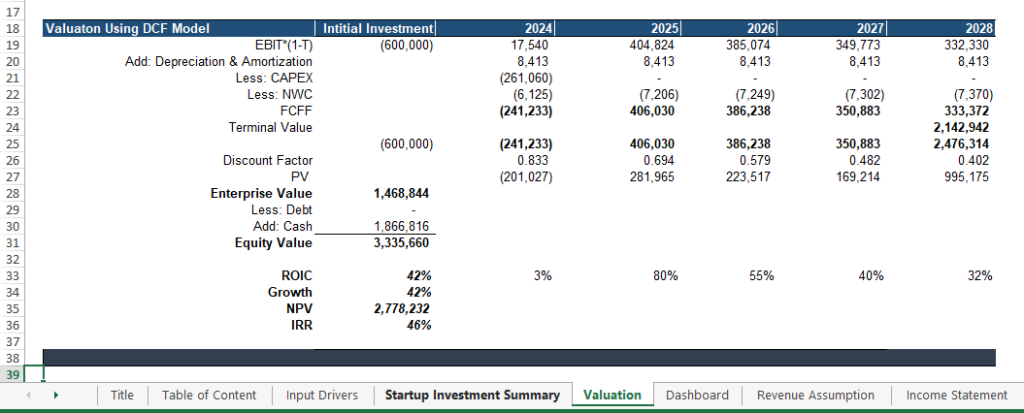

Step 4: Calculate the Present Value of Cash Flows

Now you have projected free cash flows, select a discount rate, and determined the terminal value, you can calculate the present value (PV) of the startup’s cash flows. Here’s how to do it:

Discount Future Cash Flows: Use the discount rate to bring all future cash flows back to the present value, using the following formula for each year’s cash flow:

PV of Cash Flow = Cash Flow / (1 + Discount Rate) ^ Year

Calculate this for each year of the projection.

Discount the Terminal Value: Similarly, discount the terminal value to its present value using the same discount rate.

Sum the Present Values: The startup’s final value is the sum of the projected cash flow present values and the discounted terminal value. This sum represents the startup’s enterprise value.

Step 5: Adjust for Debt and Cash

Once the enterprise value (EV) is calculated, the last step is to adjust for debt and cash on the startup’s balance sheet to determine the equity value.

Add Cash: Startups may have cash reserves that contribute to their overall value, so add any excess cash to the enterprise value.

Subtract Debt: Conversely, if the startup has any outstanding debts, subtract these from the enterprise value to arrive at the equity value.

The resulting figure is the equity value, which represents the value of the startup attributable to its shareholders.

Pros and Cons of Startup Valuation Using the DCF Model

Pros of DCF for Startup Valuation

Future-Oriented: DCF focuses on the business’s future cash flows, making it particularly useful for startups with significant growth potential.

Intrinsic Value: Unlike relative valuation methods, DCF calculates a company’s intrinsic value based on projected cash flows independent of market volatility or comparable companies.

Customizable Inputs: The model allows for detailed adjustments to reflect unique startup aspects, such as growth rates, risk factors, and cash flow timing.

Long-Term Perspective: Captures the value of long-term opportunities, particularly for startups in innovative industries.

Scenario Analysis: Facilitates sensitivity analysis to understand how changes in assumptions (e.g., discount rates, growth rates) affect valuation.

Cons of DCF for Startup Valuation

High Dependence on Assumptions: Startups often need more stable historical data, making assumptions about growth rates, expenses, and market conditions speculative and prone to errors.

Difficult to Estimate Discount Rate: The appropriate discount rate (WACC) is challenging to determine for startups, given their higher risk profiles and limited historical data.

Uncertain Cash Flows: Startups may have unpredictable revenue streams or might still need to be profitable, leading to unreliable cash flow projections.

Time-Consuming: DCF requires detailed inputs and projections, which can be resource-intensive to gather and calculate accurately.

Overlooks Market Sentiment: The model ignores external factors such as market trends, investor sentiment, and comparable company valuations that often influence startup valuations.

When Should You Use DCF Valuation For Your Startup?

When to Use DCF Valuation Method:

Growth-Stage Startups: If your startup has a reasonably predictable revenue model and a clear growth trajectory, DCF can provide valuable insights.

Capital-Intensive Startups: For companies where future cash flows are tied to significant investments, DCF helps quantify returns.

Strategic Planning: Useful when seeking to understand intrinsic value over a long-term horizon for internal decision-making.

When DCF Valuation May Not Be Ideal:

Pre-Revenue Startups: Without a stable cash flow or revenue model, DCF assumptions may be too speculative to offer a reliable valuation.

Early-Stage Ventures: Relative valuation methods like comparable multiples may be more appropriate due to limited historical data.

Volatile Industries: For startups in highly volatile or unpredictable markets, DCF assumptions may not capture true risks.

Recommendations

If you decide to use DCF, ensure the following:

Thorough Assumptions: Base growth rates, margins, and capital requirements on detailed market research or benchmarks.

Scenario Planning: Build multiple scenarios (base, optimistic, pessimistic) to account for uncertainties.

Combine with Other Methods: Use DCF alongside relative valuation methods (e.g., Revenue Multiple & EBITDA Multiple, Berkus Valuation Method, and Pre & Post Money Valuation) to cross-verify results and adjust for market sentiment.

By combining intrinsic valuation with other methods, you can achieve a more balanced and reliable valuation for your startup.

Want to calculate your business valuation using DCF? The first step is developing an accurate and reliable startup financial model. At Excel Business Resource, our customized financial models go beyond just providing DCF valuation. We integrate multiple valuation methods, including:

- Berkus Valuation Method

- Pre & Post-Money Valuation

- Revenue Multiple and EBITDA Multiple Valuation

- Venture Capital (VC) Valuation Method

With these comprehensive tools, you can assess your startup’s worth using various approaches, giving you a more robust and multi-faceted understanding of your business’s value.

Our investor-friendly financial model templates are tailored to help you build rock-solid financial projections, combining insights from all major valuation methods. Get the clarity and confidence you need to analyze your business’s potential from every angle. Let’s bring your vision to life with data-driven results!

Conclusion

The Discounted Cash Flow (DCF) model is a comprehensive and insightful tool for valuing startups, especially when you have a clear understanding of their future potential and risks. By carefully projecting cash flows, selecting an appropriate discount rate, and calculating terminal value, you can arrive at a robust valuation that reflects both the business’s current and future prospects.