Startup Manufacturing Financial Model Excel Template

Fully editable Manufacturing Financial Model Template for Startups in Excel, designed to provide a detailed and professional 5-year financial plan tailored for manufacturing startups. This pre-built model offers extensive features to streamline financial forecasting, investment analysis, and strategic planning.

- Detailed Driver’s Assumptions i.e. Investment, R&D, Revenue & Cost Assumptions

- Upto to 5-Year Forecasting Model

- Financial Projections With P&L, Cash Flow, Balance Sheet

- Detailed Headcount, Expenses & CAPEX Planning

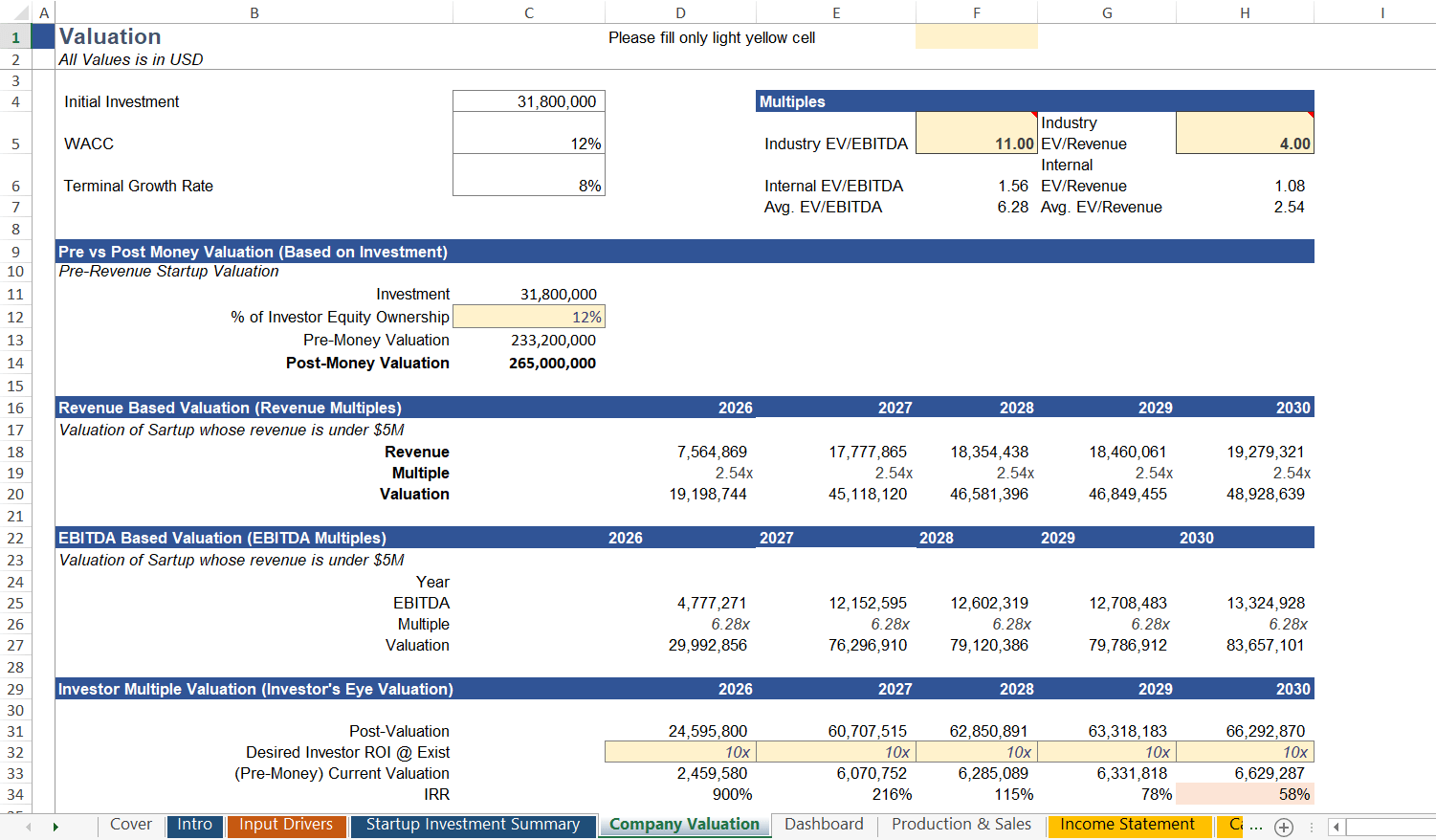

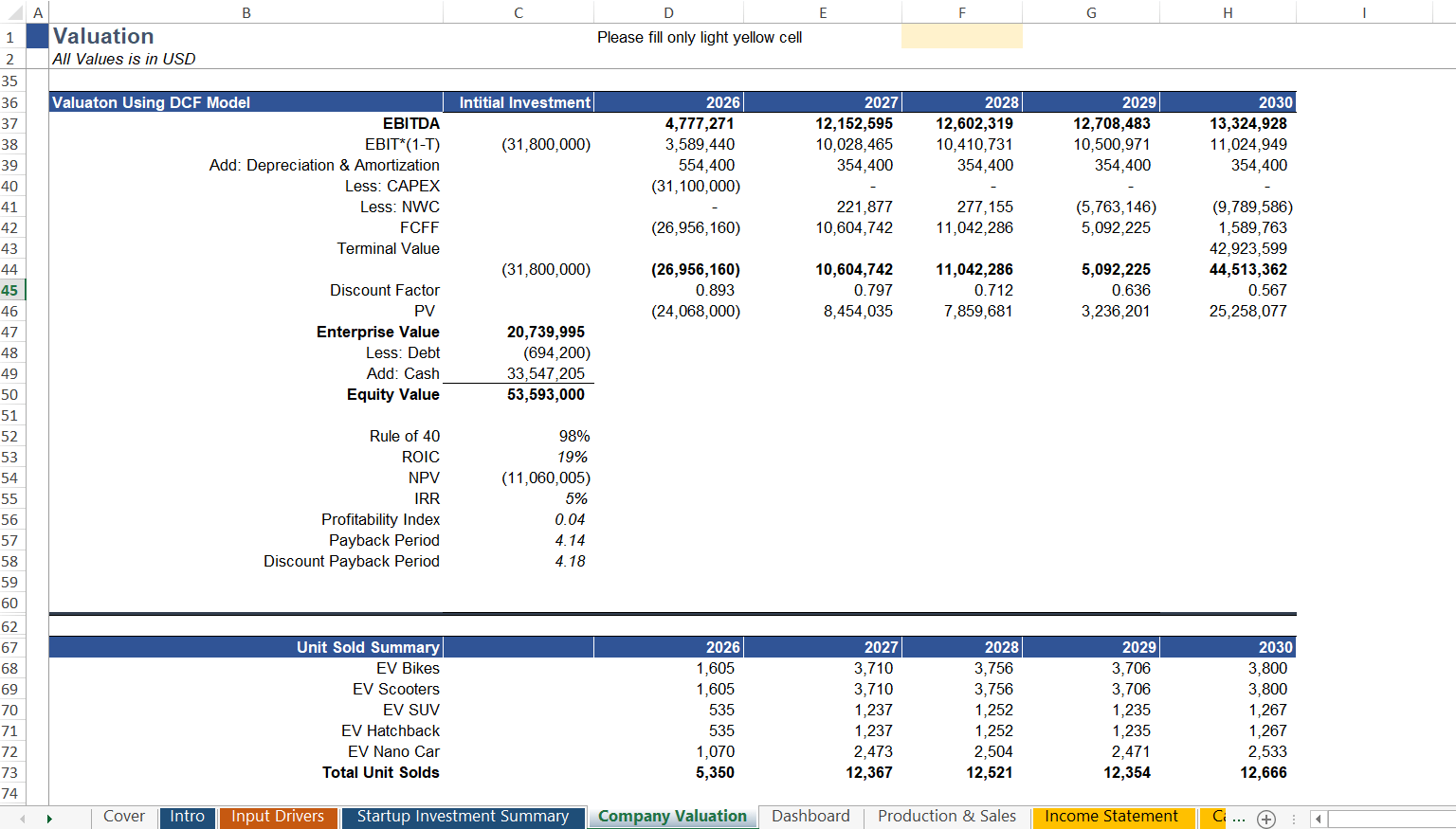

- Detailed Valuation i.e. DCF Valuation, EV/R&D Valuation, EBITDA & Revenue Multiple Valuation, Investor Valuation, Pre & Post Money Valuation.

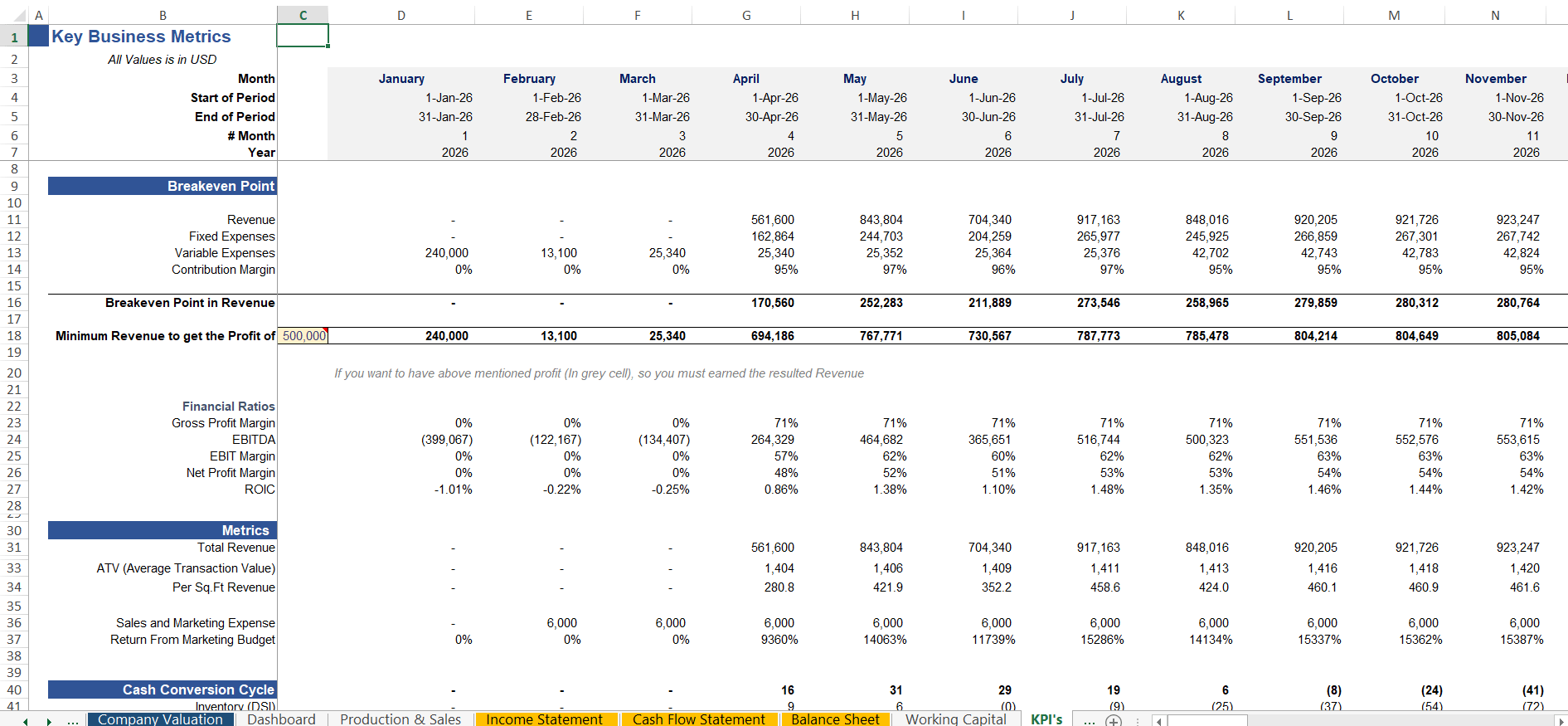

- Breakeven Analysis, NPV, IRR, consolidated and each project

- Sensitivity Analysis, KPIs & Metrics, Burn Rate, Cash Runway

- Fully editable

Why Choose Our Startup Manufacturing Financial Model Excel Template

- Save 40 Hours of Manual Work

- 100+ Customized Assumptions

- Advanced Valuation Methods Applied

- In-depth Financial Projections

- Free Supports & Error Corrections

Description

Comprehensive Startup Manufacturing Financial Forecasting Model 🚀

Discover the ultimate startup manufacturing financial model Excel template designed specifically for emerging manufacturers to streamline financial projections and drive informed decision-making. This dynamic, user-friendly tool crafts comprehensive 5-year monthly financial forecasts, including full 3-statement modeling (Income Statement, Balance Sheet, and Cash Flow Statement) for your manufacturing venture. Whether you’re launching an e-bike production line or scaling factory operations, this template empowers you to simulate production planning, unit sales forecasting, and profitability scenarios with ease.

Tailored for manufacturing startups, the model supports up to multiple product categories (e.g., EVs, machinery outputs) across detailed revenue streams, variable costs tied to production volume, and fixed overheads. It adheres to best-in-class financial modeling standards, featuring built-in instructions, error checks, input validations, and a discounted cash flow (DCF) valuation module to assess enterprise value and investor returns. Perfect for business plan financials, pitch decks, or ongoing strategy refinement, this template turns complex manufacturing financial projections into actionable insights.

Understand:

Avoid These 21 Common Business Plan Mistakes for Startup Success

11 Key Elements For Realistic Financial Projections Of Your Startup

Key Outputs

Unlock powerful visualizations and metrics to evaluate your manufacturing business viability:

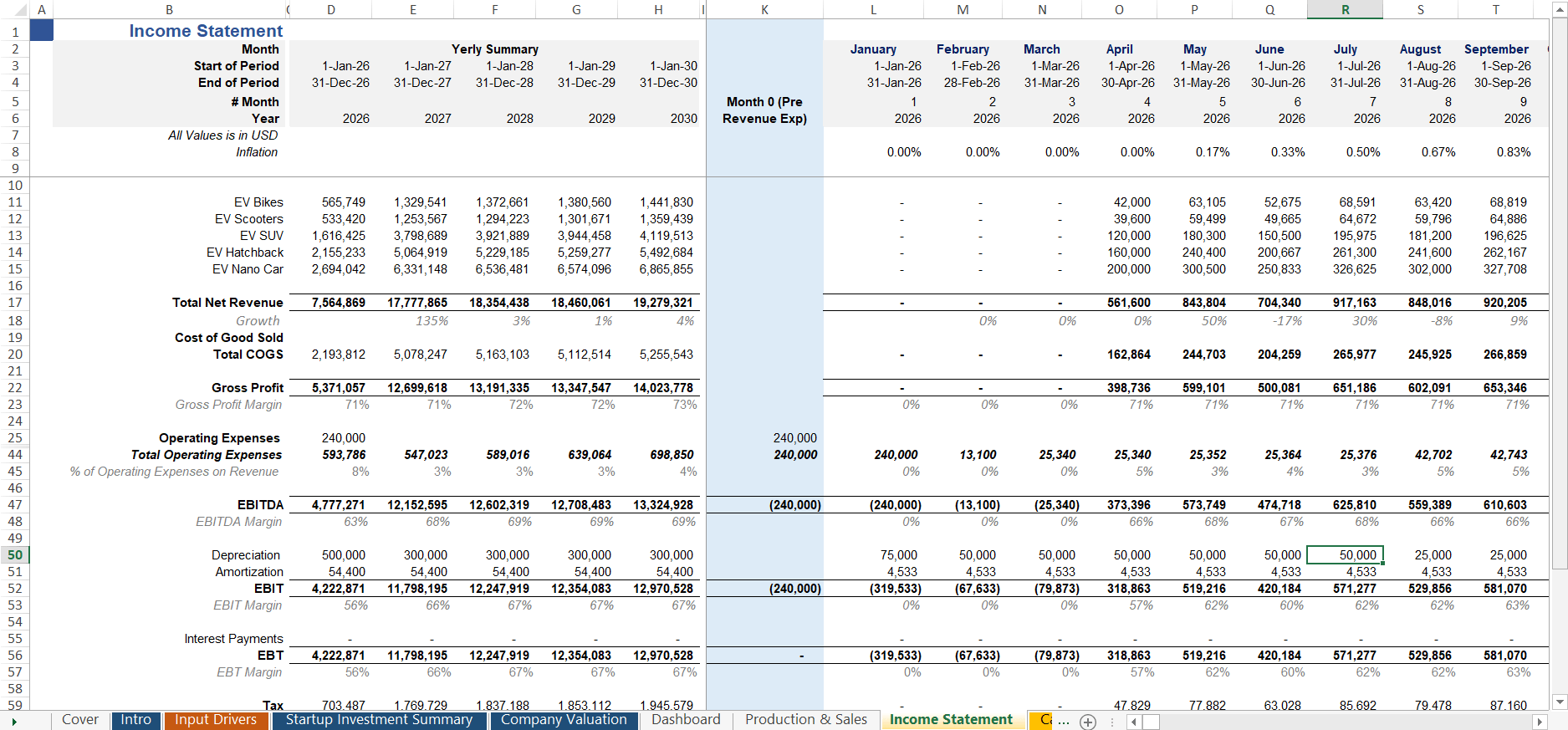

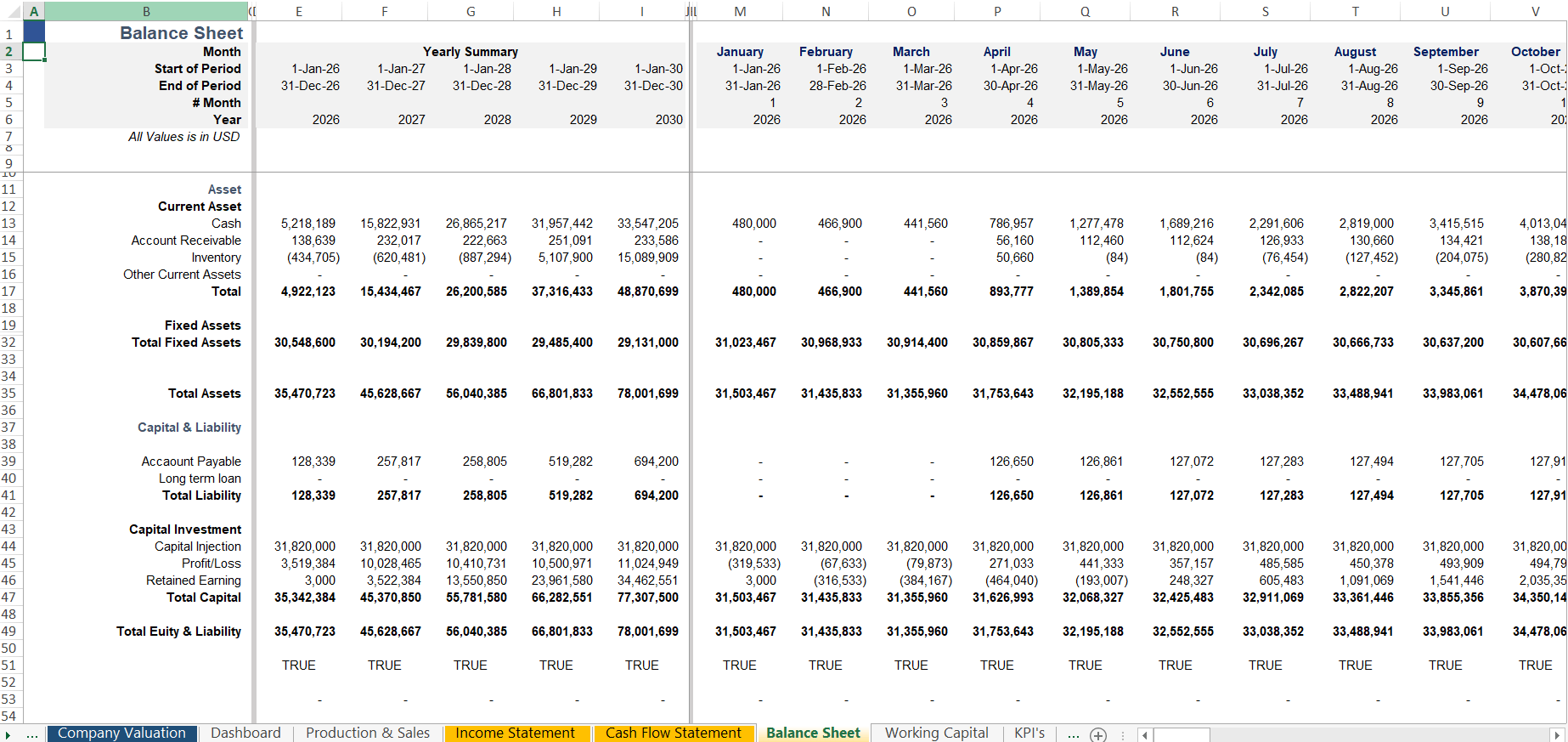

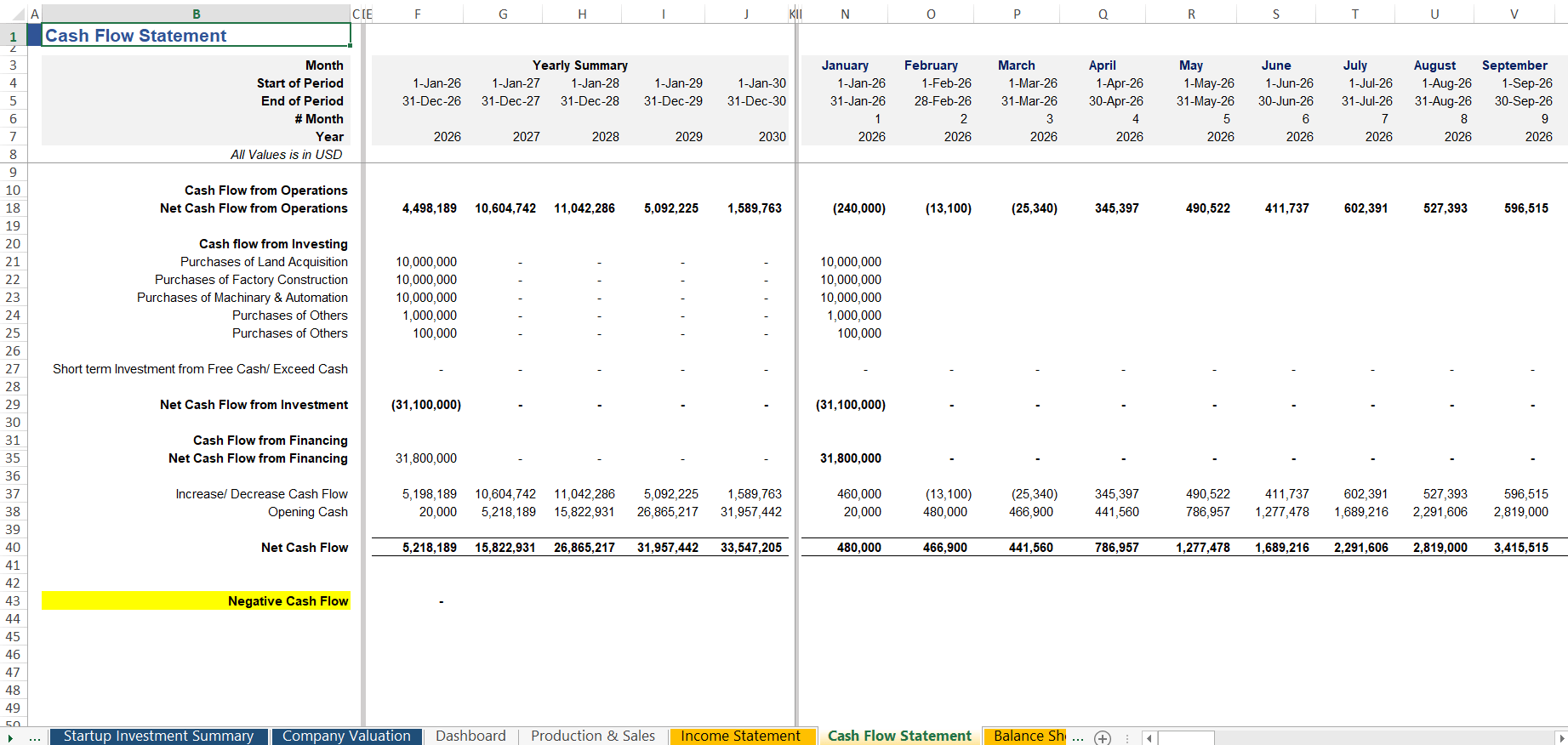

- Full Financial Statements: Projected Income Statement, Balance Sheet, and Cash Flow Statement on monthly and yearly bases for 5 years, highlighting revenue growth, EBITDA margins, and net profitability.

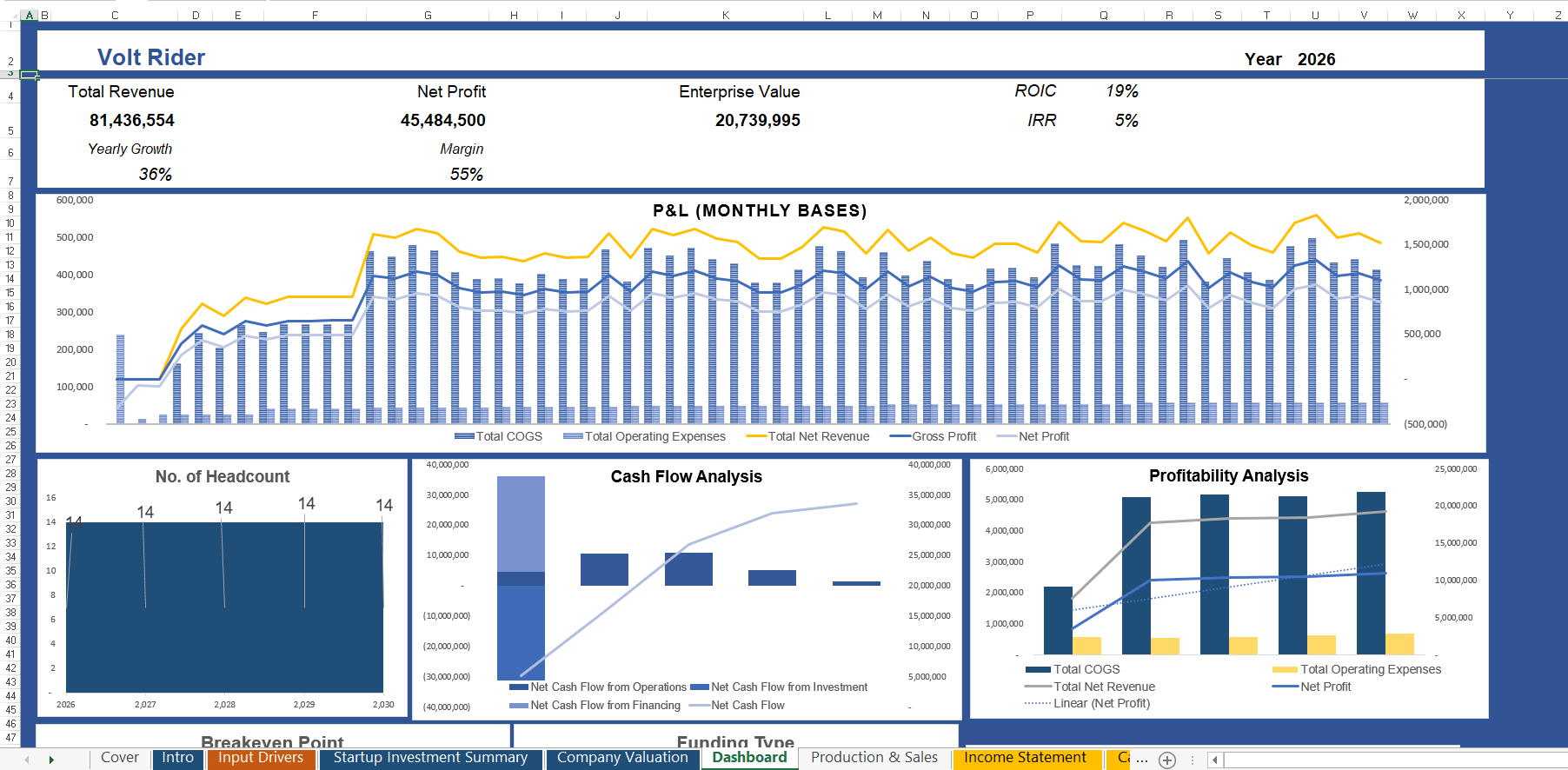

- Interactive Dashboard: At-a-glance summaries of total revenue, net profit, enterprise value (EV), return on invested capital (ROIC), internal rate of return (IRR), and compounded annual growth rates (CAGR) for key line items—ideal for executive overviews or investor presentations.

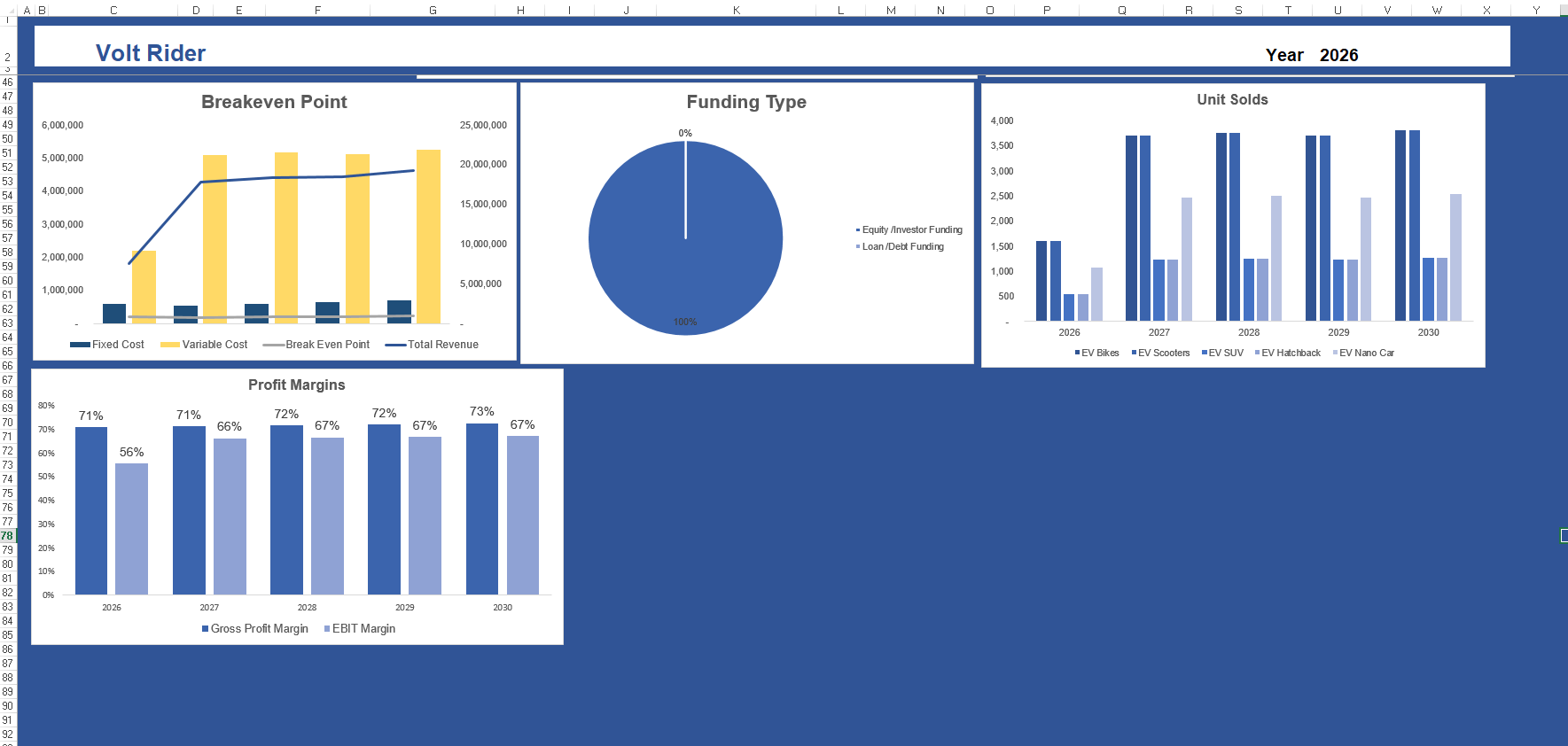

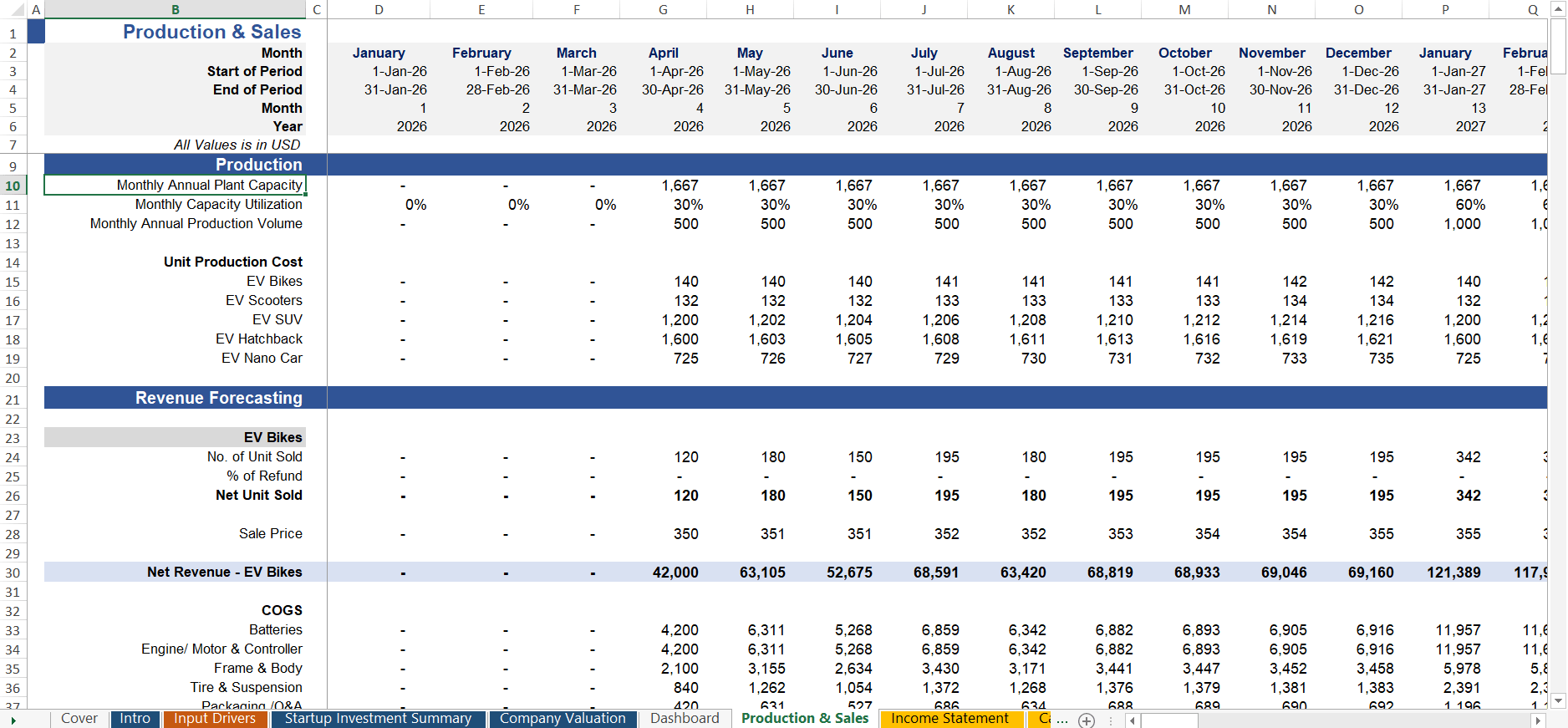

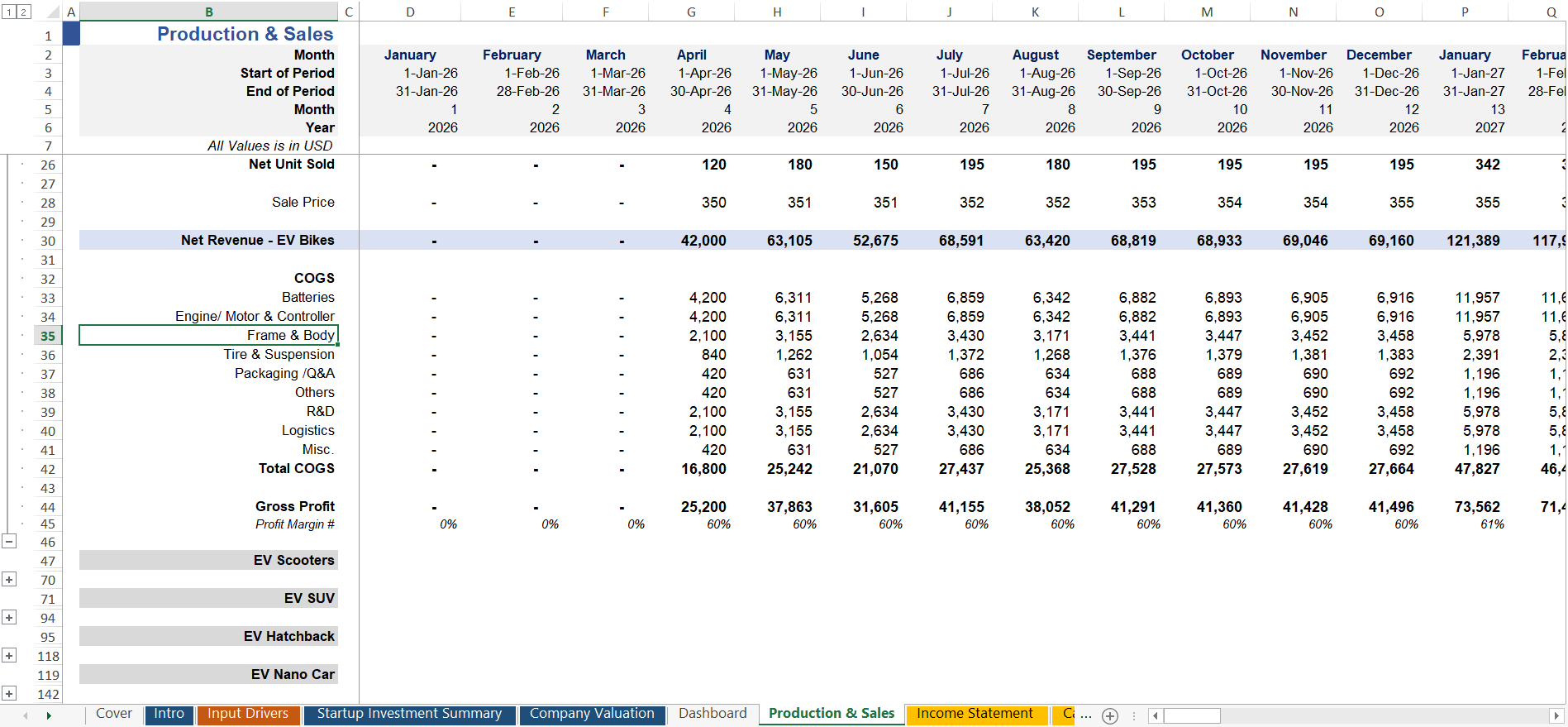

- Production & Sales Analytics: Detailed unit sales forecasts, production volumes, gross profit margins by product category, and break-even points to optimize manufacturing output planning.

- Valuation Insights: DCF-based company valuation using revenue multiples, EBITDA multiples, and exit scenarios; pre- and post-money valuations; investor ROI metrics like payback period and profitability index.

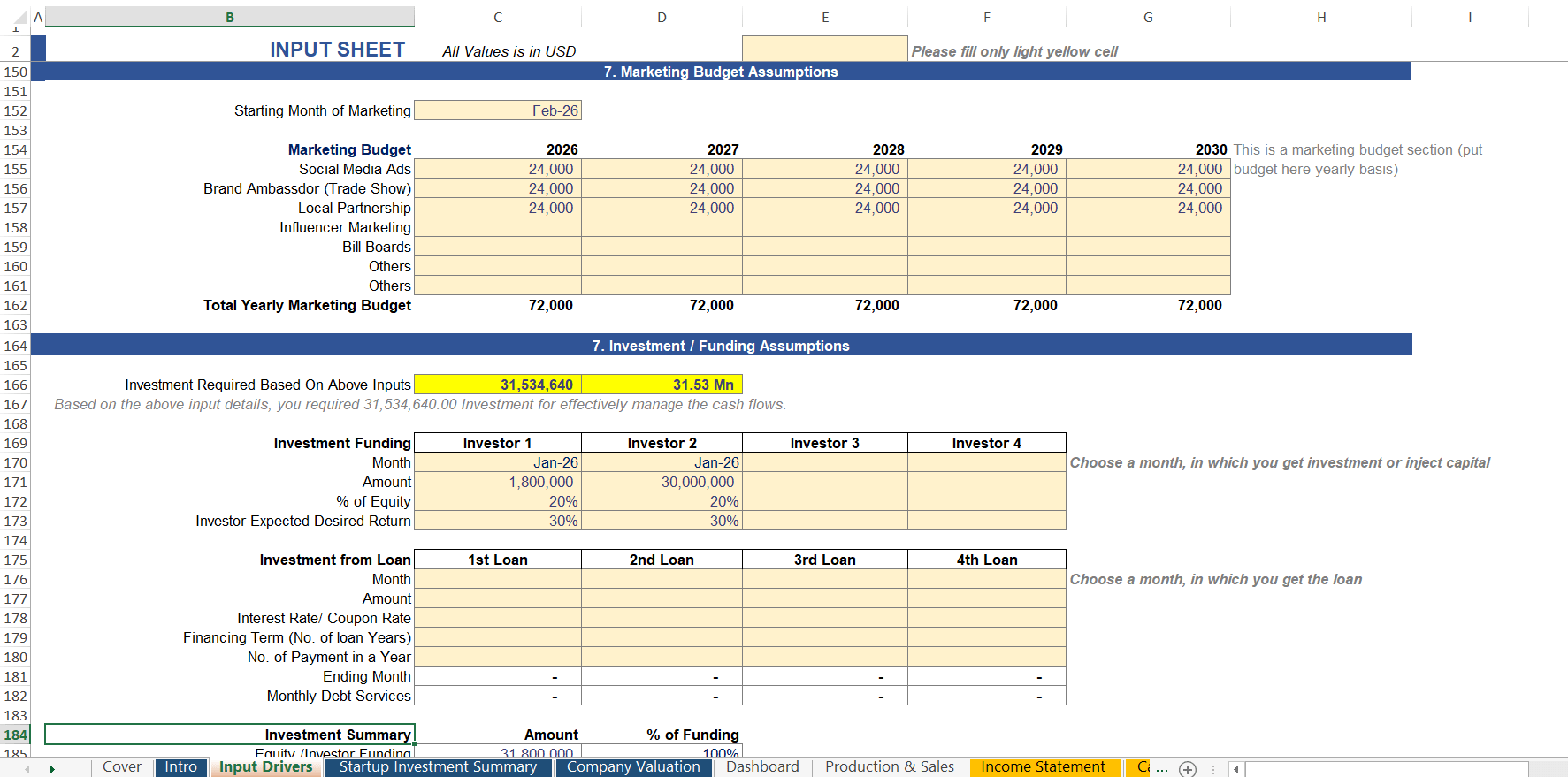

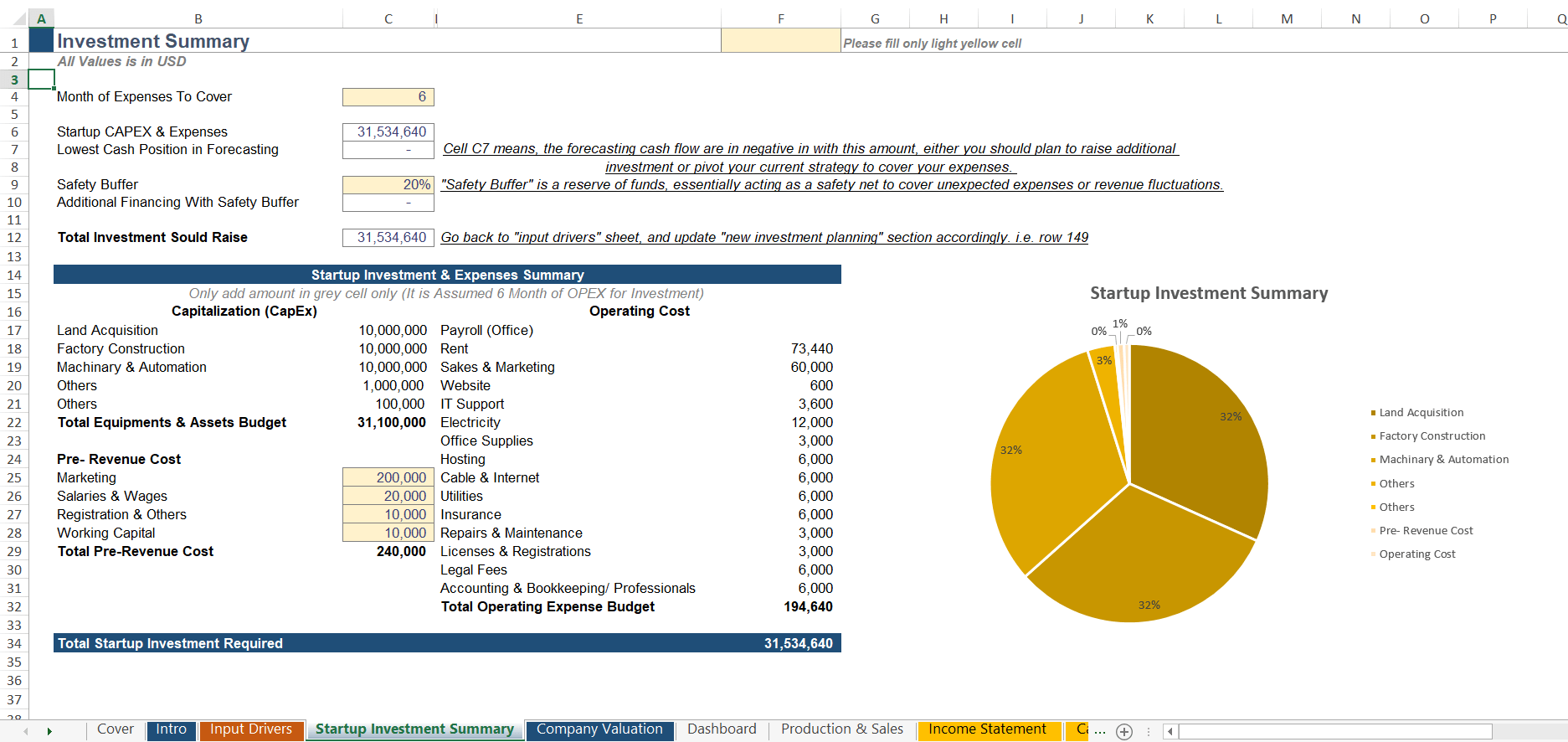

- Investment Summary: Total startup CAPEX requirements, operating expense (OPEX) breakdowns, safety buffers, and minimum funding needs for 1-5 years.

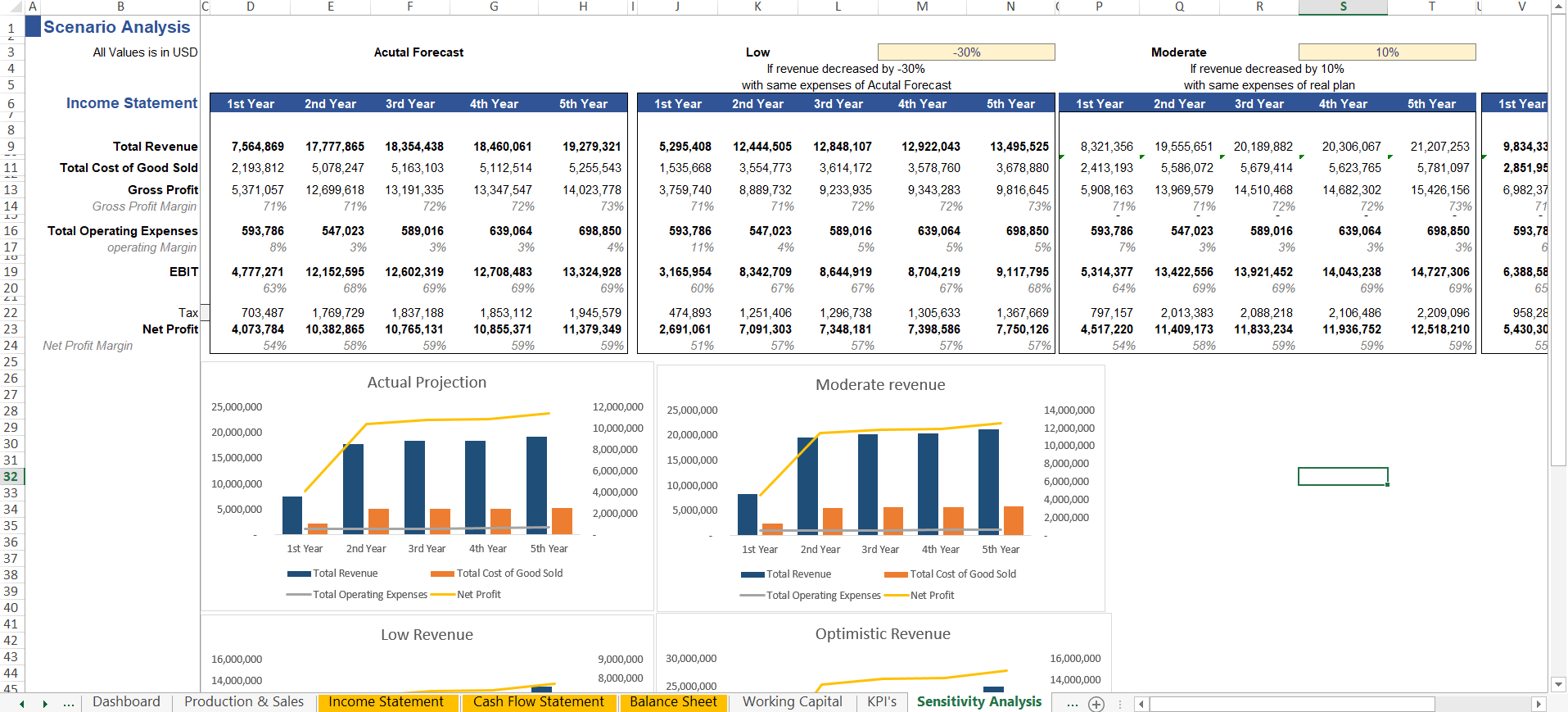

- Sensitivity & KPI Dashboard: Scenario analysis for revenue fluctuations (±30%, ±10%, optimistic growth); key performance indicators (KPIs) such as contribution margins, burn rate, and liquidity ratios.

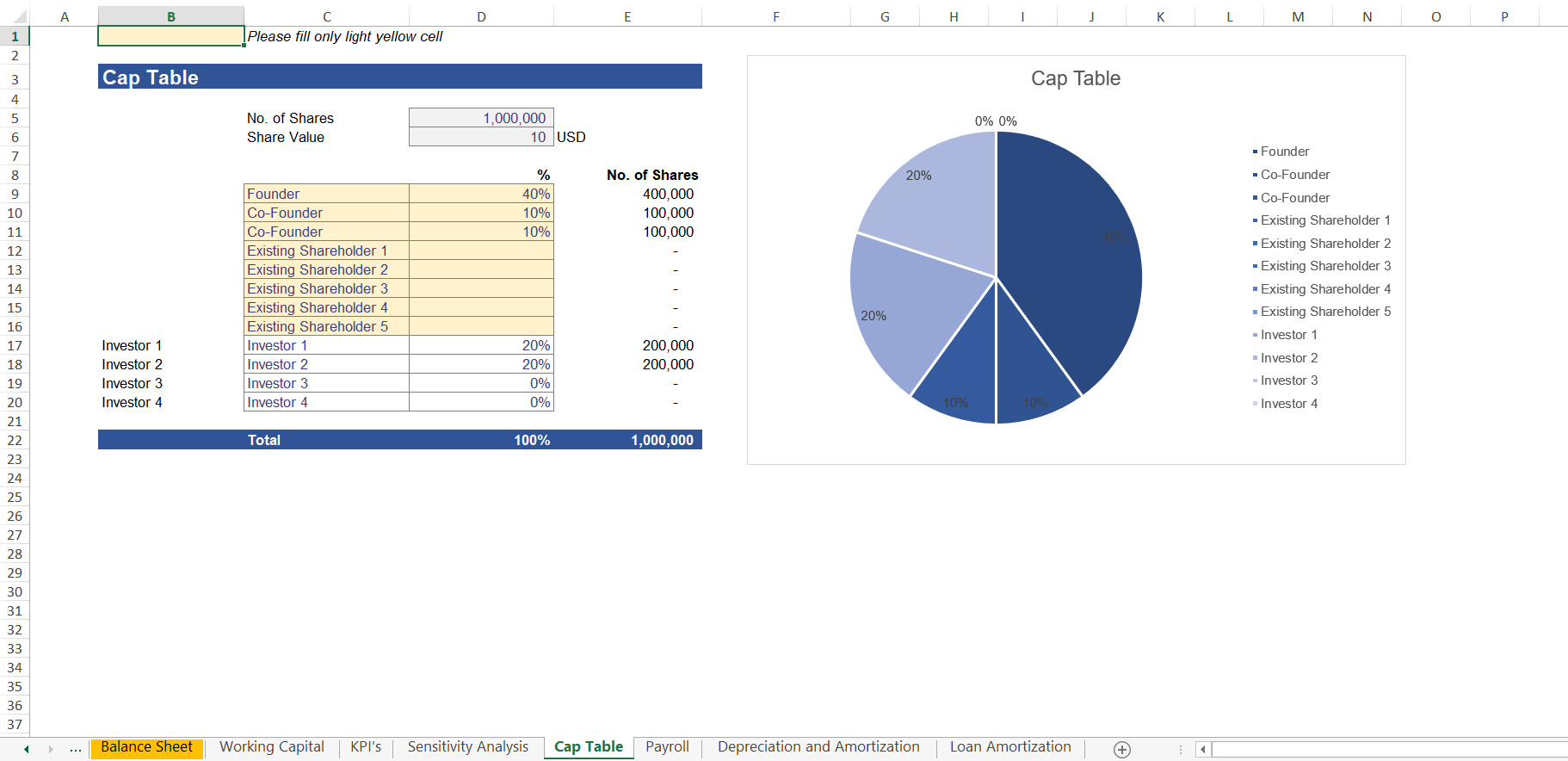

- Cap Table & Equity Structure: Ownership breakdowns, share allocations, and dilution tracking for founders, co-founders, and investors.

These outputs equip you with financial forecasting tools to stress-test assumptions, forecast cash runway, and benchmark against industry standards in manufacturing financial analysis.

Key Inputs

Effortlessly customize your startup manufacturing projections with intuitive, color-coded input sections—all in USD for global applicability:

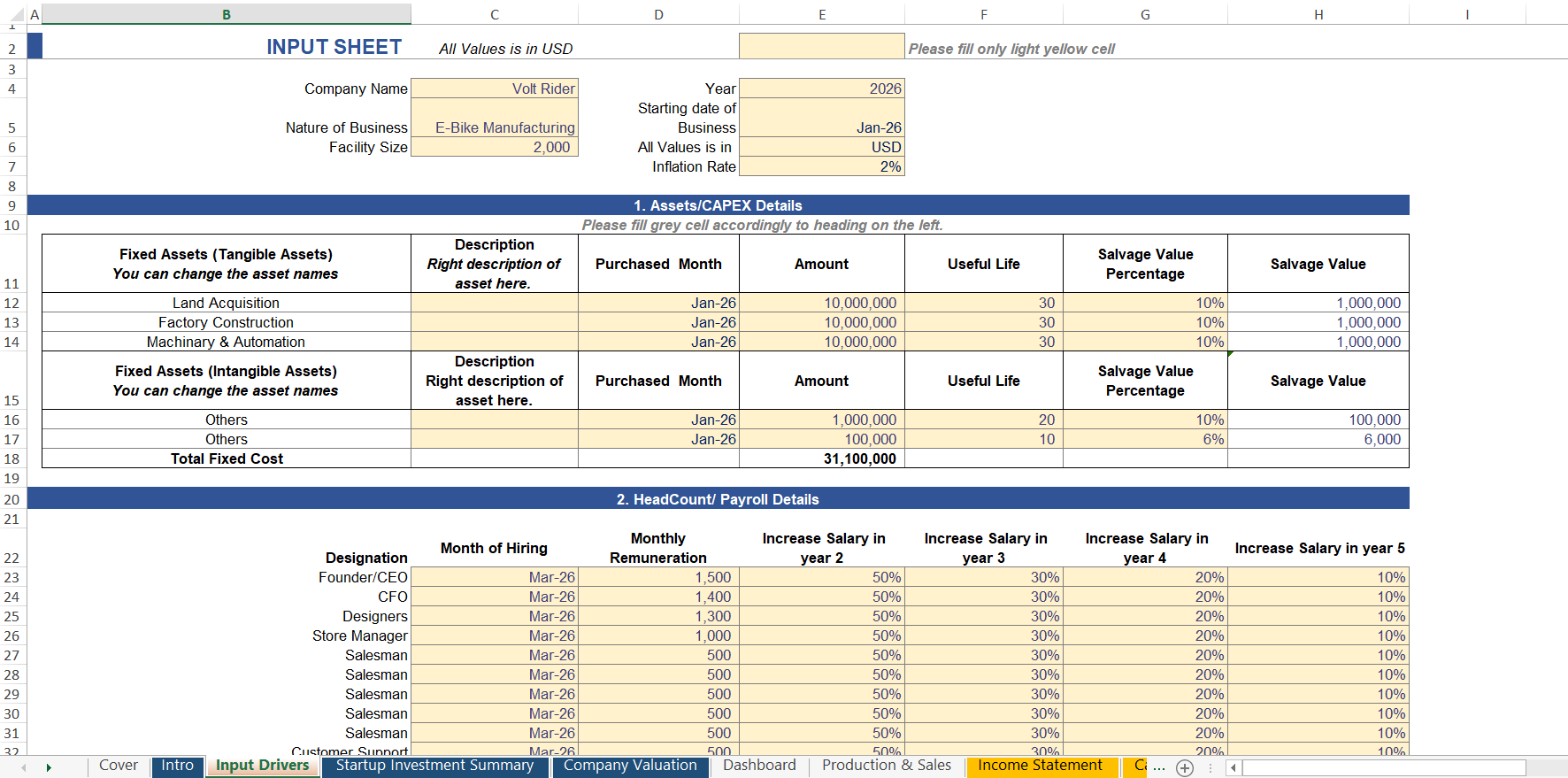

- Setup Basics: Business name, starting date, facility size, inflation rate, and currency settings.

- CAPEX & Assets: Fixed assets (tangible like land, factory construction, machinery; intangible like patents) with purchase months, useful life, salvage values, and depreciation schedules.

- Headcount & Payroll: Employee designations, hiring months, base salaries, annual increases (up to 5 years), bonuses, taxes, and benefits—scalable for teams from founders to production staff.

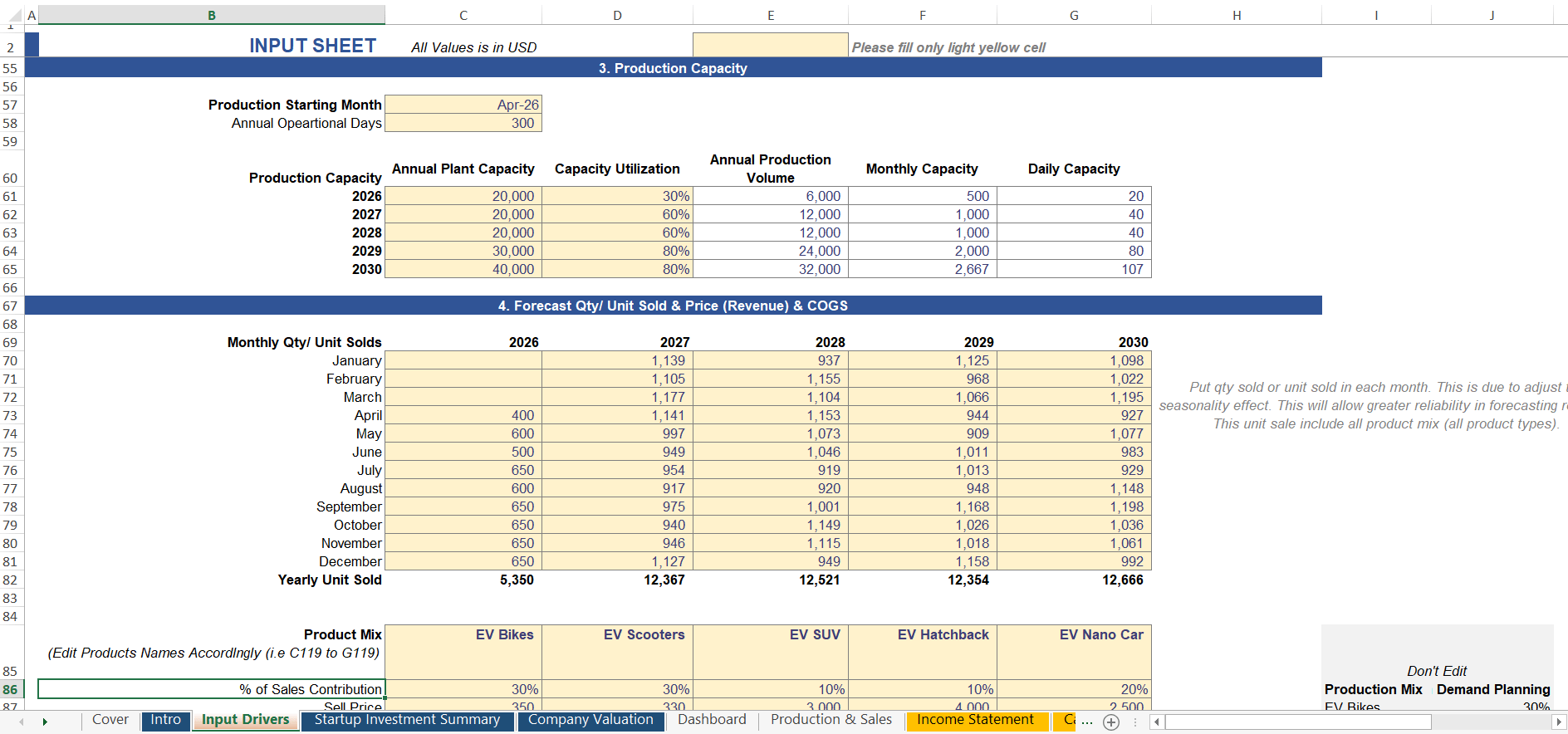

- Production & Revenue Drivers: Monthly unit sales forecasts for multiple product lines (e.g., bikes, scooters, vehicles); pricing, volume growth; revenue categorization by product type.

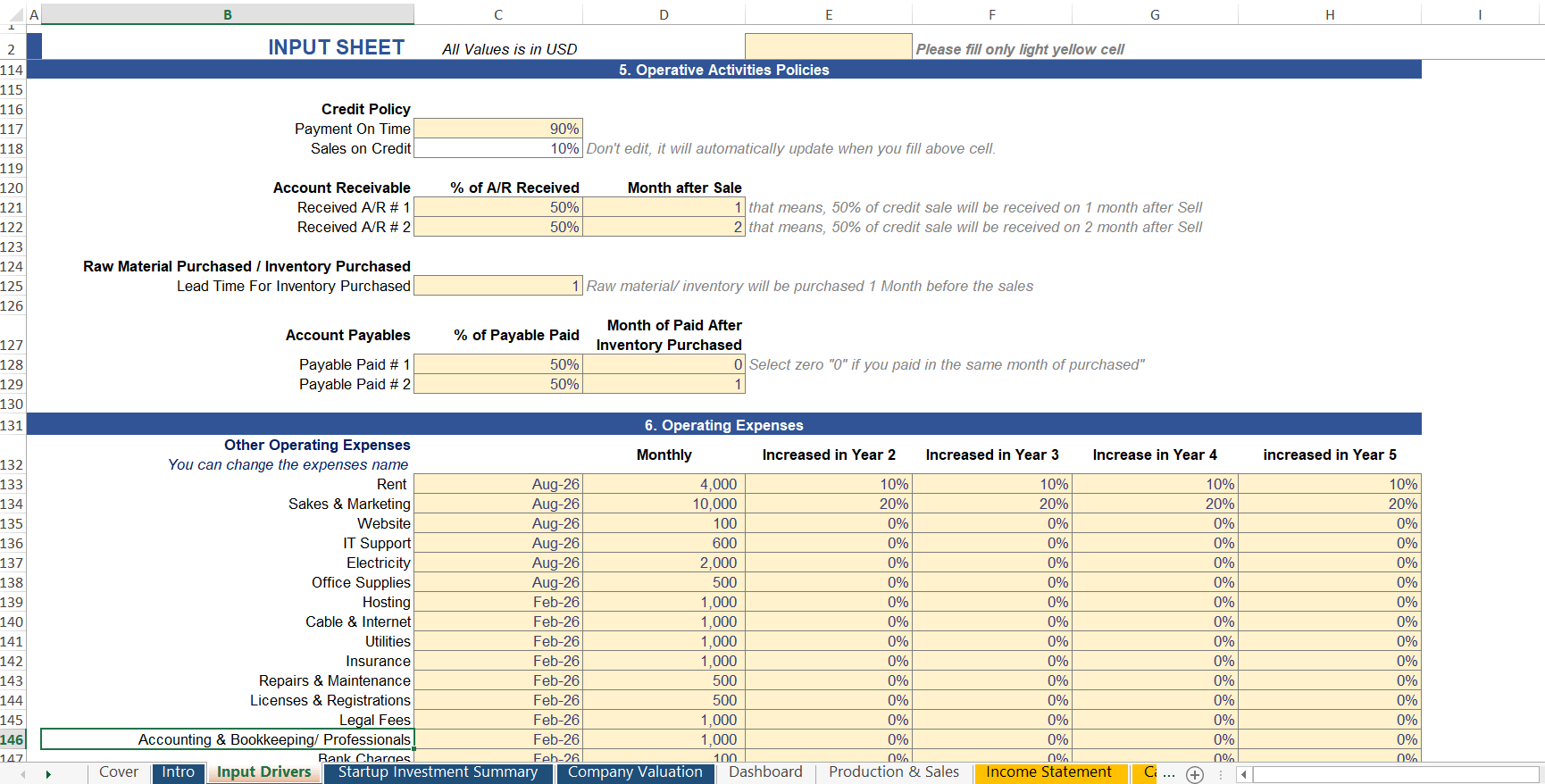

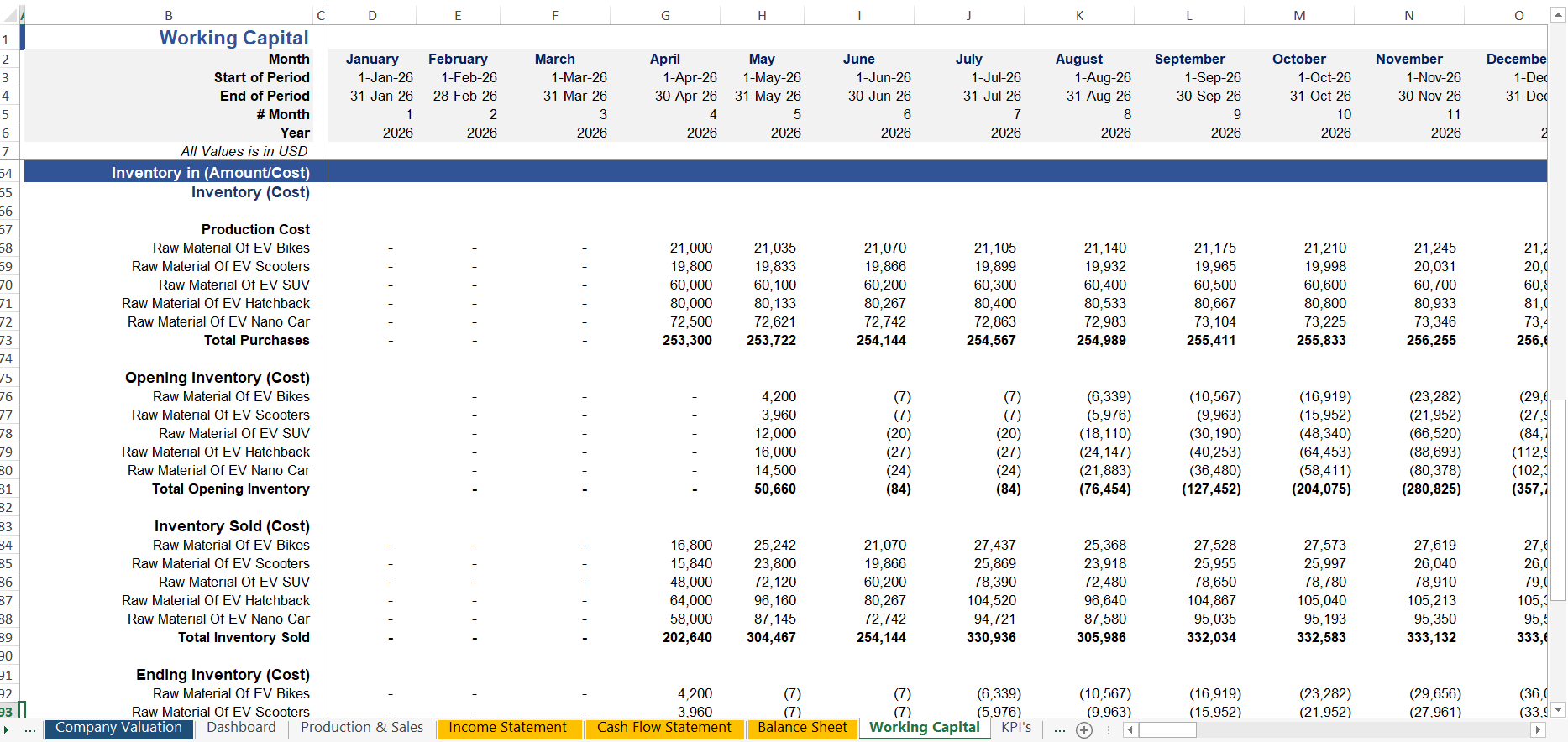

- Costing Structure: Inventory assumptions (stock levels, turnover rates); COGS tied to units produced; variable costs as % of revenue; OPEX categories (rent, utilities, marketing, IT, insurance, legal).

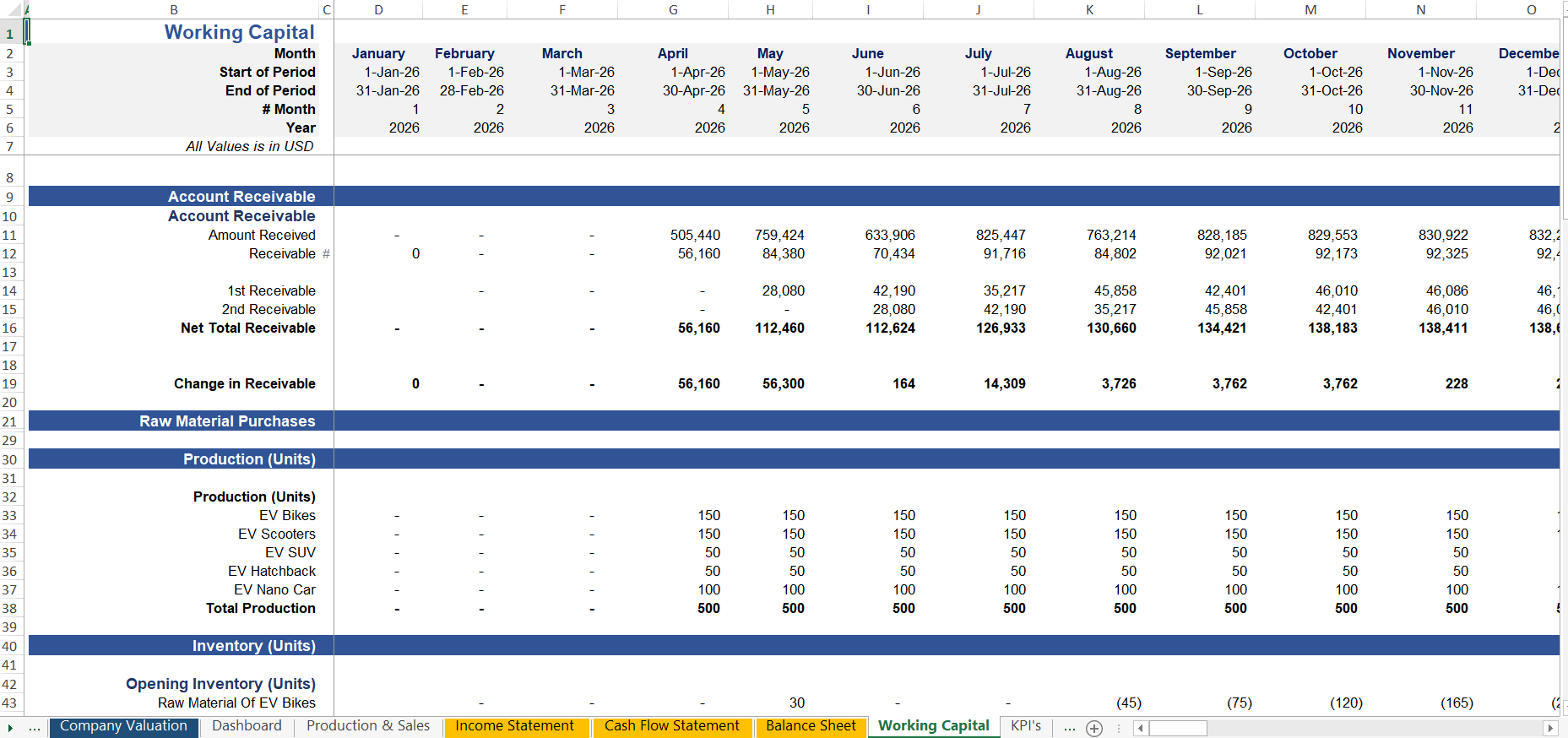

- Working Capital: Accounts receivable/payable terms, inventory safety stocks, and short-term investments from excess cash.

- Funding & Financing: Equity/debt inflows, previous financials (invested amounts, prior revenue/expenses), WACC components (cost of equity/debt), corporate tax rates, terminal growth, and exit multiples.

- Scenarios & Risks: Adjustable growth rates, sensitivity toggles for revenue/expense variances, and loan amortization details (if applicable).

With only light-yellow cells requiring input, this Excel financial model for manufacturing minimizes setup time while maximizing flexibility for revenue forecasting and cost management in startups.

Key Features

Elevate your manufacturing financial planning with these robust capabilities:

- Flexible Timeline & Scalability: 5-year monthly projections auto-adjust based on start date; easily extend for longer horizons or add product lines beyond defaults (e.g., 6+ categories).

- Advanced Modeling: Integrated production planning with unit-based COGS calculation; working capital cycles (AR/AP/inventory); depreciation/amortization schedules; loan repayment trackers for debt scenarios.

- Risk & Scenario Tools: Built-in sensitivity analysis for revenue shocks; break-even calculations; burn rate monitoring; what-if scenarios for optimistic/moderate/low growth paths.

- Investor-Ready Outputs: Pre-built cap table for equity tracking; DCF valuation with IRR/ROI; startup investment summaries including safety buffers and funding gaps.

- Error-Proof Design: Comprehensive checks dashboard flags inconsistencies; input validations prevent errors; no passwords—fully editable post-download.

- Customization Depth: Rename categories (e.g., assets, expenses, products); toggle sales tax/VAT; model up to 5+ staff roles, OPEX lines, fixed assets, and borrowings.

- Visual Enhancements: Dynamic charts for revenue trends, margin evolution, unit sales by category, and balance sheet snapshots—optimized for Excel dashboard templates in business planning.

- Best Practices Compliance: Follows FMVA-aligned guidelines; audited for formula integrity; includes line-item explanations and user guides for seamless adoption.

This financial model template for manufacturing startups supports cash flow forecasting, profitability analysis, and ROI evaluation, helping you secure funding and scale efficiently.

Modifications & Support

We provide complimentary support and error corrections to ensure your startup manufacturing financial model aligns perfectly with your vision. Our team is eager to help with tweaks, custom integrations, or queries—email us to maximize your financial projections for manufacturing success. Download today and transform your startup strategy!

Only logged in customers who have purchased this product may leave a review.

Get started with our Startup Manufacturing Financial Model Excel Template

Our Financial Modeling Services specialize in

Customized Spreadsheets

Tailored to met your unique financial needs.

Comprehensive Training

Empowering you to use models effectively.

Accurate Projections

Make informed decisions with confidence.

We prepare comprehensive plan to launch and grow startup with

Data-Driven Market Research

Detailed market analysis and SWOT insights

Business Model Canvas

Clear visualization of your business structure

Financial Projections

Valuation and forecasts to showcase your potential

What our clients say about us

Most Frequently Asked Questions (FAQs)

Absolutely! The model is designed with a user-friendly interface, clear instructions, and pre-built formulas to help even those without advanced financial expertise use it effectively.

Yes, the template includes both scenario and sensitivity analysis features. You can evaluate the impact of changes in pricing, demand, costs, and more to make informed decisions.

The template is fully compatible with Microsoft Excel & Google Sheet.

Yes, we offer fully customizable templates to fit your specific business needs. If you require additional changes, we also provide customized services—just contact us to discuss your requirements.

We offer a 7-day 100% money-back guarantee. If you’re not satisfied with the model, simply let us know within this period for a full refund.

If you encounter any errors, we’ll rectify them free of charge. Our commitment is to deliver an error-free and reliable financial model for your business

Yes, our financial models are designed to be versatile and work across various industries and business stages, from startups to established companies. You can easily adapt the inputs to reflect your specific business dynamics.

Absolutely! We provide email support to assist you with any questions or issues you may have while using the financial model.

Related products

-

Sale!

Electric Vehicle (EV) Manufacturing Financial Model Template

$250.0Original price was: $250.0.$110.0Current price is: $110.0. -

Sale!

Automobile Manufacturing Financial Model Template

$250.0Original price was: $250.0.$110.0Current price is: $110.0. -

Sale!

Battery Manufacturing Financial Model Template

$250.0Original price was: $250.0.$110.0Current price is: $110.0.

Reviews

There are no reviews yet.