Expert Financial Modeling Consultant & Startup Advisory Services for Fast-Growing Ventures

We transform complex data into investor-ready financial models. Scale your business with precision-driven financial planning and analysis and strategic startup consultancy services.

Trusted by 100+ Startups & SMEs Across 30+ Industries

Our startup consultancy services have helped founders secure over $2 Mn in funding.

We Offer Financial Planning & Analysis (FP&A) & Startup Consultancy Services

Excel Business Resource (EBR) is a global consulting firm specializing in Financial Planning & Analysis (FP&A), and startup advisory services. With years of experience across 30+ industries, we empower entrepreneurs, SMEs, and growing businesses with accurate financial insights, detailed business plans, and data-driven strategies.

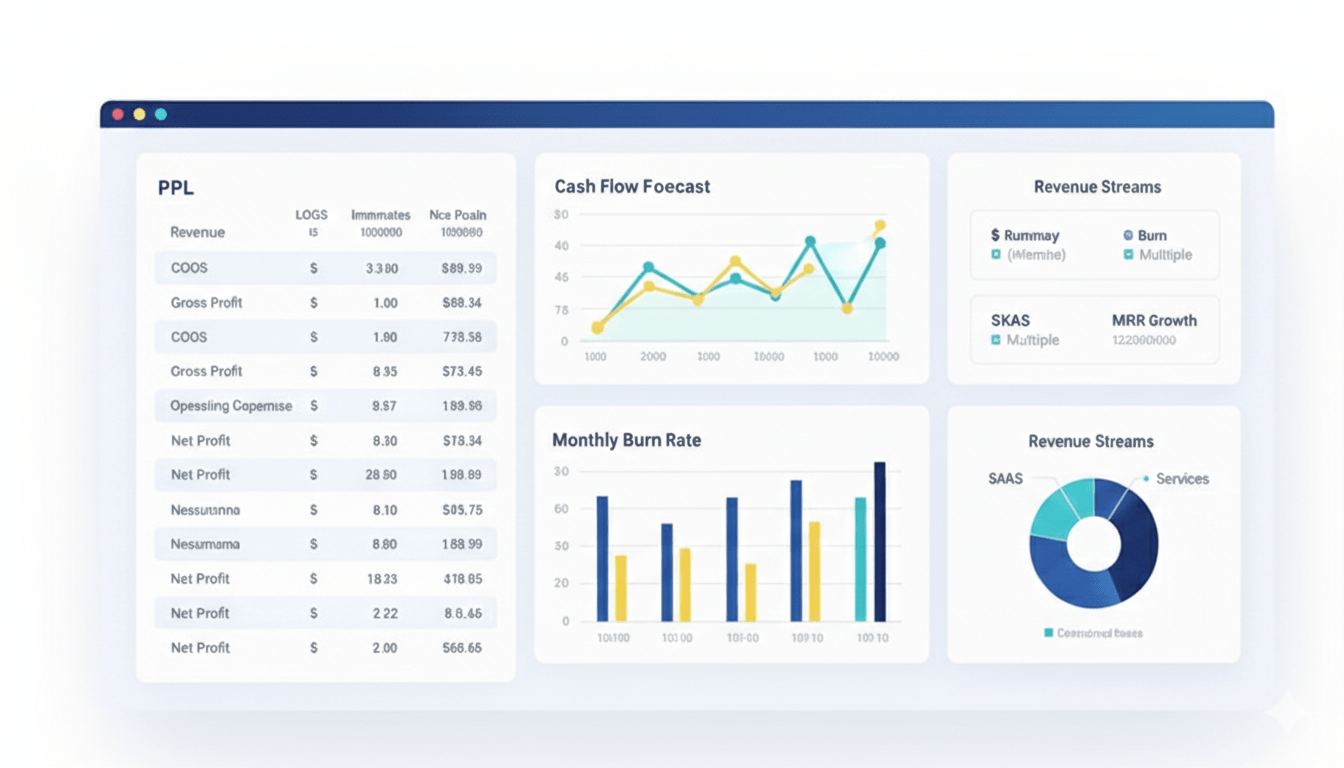

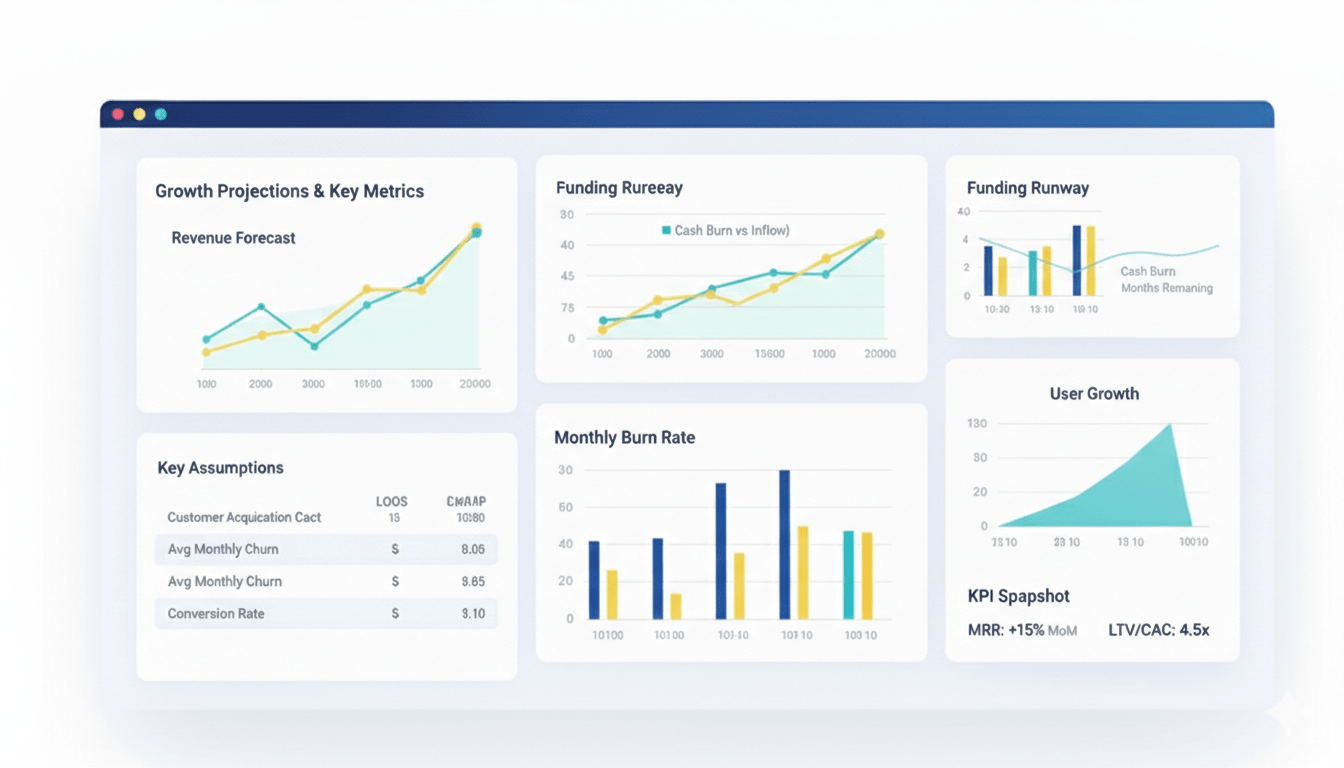

📊 Financial Modeling Services

Custom-built Excel models for startups and SMEs, including revenue forecasting, expense planning, valuations, and scenario analysis. Designed to save time and impress investors.

🚀 Startup Advisory Services

We guide entrepreneurs through business challenges, from strategy and funding preparation to scalability and financial health checks.

💡 Data Analysis

End-to-end financial planning, budgeting, variance analysis, and performance tracking to help you make data-driven business decisions.

📑 Business Plans & Pitch Decks

Professional investor-ready documents tailored to secure funding, supported by clear market research and compelling storytelling.

Bookkeeping

We have certified bookkeeping experts that can manage your daily accounts and provide your monthly in-depth financial reporting and analysis.

🔍 Market Research

Industry insights and financial data analysis to help businesses identify opportunities, risks, and future growth strategies.

Stop Guessing. Start Forecasting

We Are Expert In Financial Planning & Analysis

Most startups fail due to poor cash flow management. As your dedicated financial modeling consultant, we build the “source of truth” for your business, ensuring your financial planning and analysis is bank-ready and audit-proof.

How Financial Modeling Services Works

-

Discovery

We understand your unique business model.

-

Model Build

Our FMVA-certified team builds a dynamic, Forecasting & valuation model.

-

Stress Testing

We run sensitivity analyses for "best-case" and "worst-case" scenarios.

-

Delivery

You get a clean, automated Excel tool to drive your decisions.

Achievements

Let’s start the journey towards success and enhance revenue for your business. Take your company to the next level.

Happy Customers

Project Complete

Investment Raised

Recurring Clients

Client’s Testimonials

Download Free Excel Templates & Tools

These free templates could be the great start of your startup financial planning journey

Ready to Build Investor-Ready Financials?

Let’s work together to create a financial roadmap for your success.