Many founders dream of the day they “hit the milestones”: the first $1 million in revenue, the big launch, the massive seed funding round. They track vanity metrics, celebrate every small win, and yet, the unfortunate reality is that nine out of ten startups still fail.

Why? Because most founders confuse activity with progress.

The milestones celebrated in press releases—the ones that are easily measured and announced—are often the least important indicators of a business’s health and readiness to scale. The truth is, the journey from a brilliant idea to a thriving, scalable business is defined by a set of crucial, often “invisible milestones” that founders, unfortunately, learn about only when it’s too late, usually when a critical investor meeting or partnership opportunity falls flat.

Not all milestones are measurable in dollars and cents. While operational achievements are key, true business milestones are strategic checkpoints that indicate a company’s readiness for growth, funding, or scale—not just time-based achievements.

What Business Milestones Really Mean (Beyond Revenue and Launch)

A milestone is less about what you did and more about what your business is ready for. True business progress is defined by strategic shifts in capability and market acceptance.

- Strategic vs. Operational Milestones: A strategic milestone is validating that your website’s content successfully converts strangers into paying customers at a profitable rate, proving that the operation serves a greater business goal.

- Internal vs. External Milestones: An external milestone is a market validation point, such as getting your biggest competitor’s customer to switch to your product and publicly endorse it. This external proof is what drives valuation.

- Traction-Based vs. Readiness-Based Milestones: Readiness is the underlying structural capability, such as achieving a clear, documented process that allows your team to handle $100,000 in revenue without the founder having to step in.

Investors, banks, and corporate partners look for specific, repeatable signals of stability and potential. These foundational signals remain the same whether you’re working with a financial modeling consultant in the US or seeking startup advisory services in the UK.

The 4 Milestone Layers Framework: A Strategic Progression

The journey from a raw idea to a scalable enterprise is a systematic progression through four interdependent strategic layers. Success in one layer is the prerequisite for viability in the next.

- Founder Readiness Milestones: Focuses on the internal coherence and stability of the founding team, including crystal-clear clarity of the problem and legally binding co-founder alignment.

- Market Validation Milestones: Proving objective, external evidence that people will pay for your solution, including achieving Problem-Solution Fit and calculating rudimentary Unit Economics.

- Operational Stability Milestones: Establishing structure and controls. Milestones involve creating Documented Processes and achieving Financial Awareness.

- Scalability & Funding Milestones: Validating the business’s capacity for hyper-growth and formal institutional investment by confirming Team Scalability and packaging achievements into an Investor Narrative.

Stage 1: Founder Milestones Most People Ignore (But Investors Notice)

The first, and most critical, set of milestones happens before any product is built: in the mind and relationship of the founders.

Clarity of Problem vs. Idea Obsession

The first real milestone is the crucial shift from idea obsession to clarity of problem. This requires the founder to articulate the specific, painful problem the target customer is facing in a single, compelling sentence.

Co-founder Alignment Milestones (Equity, Exits, Decision Rights)

This is effectively the “startup pre-nup.” The milestone is reaching a legally documented, clear agreement that preemptively resolves common internal conflicts, including: Vesting Schedules, Exit Scenarios, and Decision Rights.

Stage 2: Market Validation Milestones That Actually Matter

The second stage is about moving past “we have users” to “we have a business.”

- Problem-Solution Fit Milestone: Achieved when you have solid, qualitative proof that your solution solves the specific problem, and the customer would be unhappy if you took it away.

- First 10 Paying Customers Milestone: Ten distinct, non-related customers paying real money proves the demand isn’t random.

- Willingness-to-Pay Validation: Have you definitively proven the price point at which your customer transitions from “I’d use this” to “I am willing to pay this amount, specifically, for this much value?”

Stage 3: Financial Milestones Founders Avoid (But Can’t Escape)

This stage is about facing the uncomfortable truth about money with sound financial planning and analysis.

Break-Even Awareness Milestone (Not Profitability)

You must know, precisely, how many customers, at what price, at what monthly expense, it takes to hit $0.00 profit.

Unit Economics Clarity

This is perhaps the single most important milestone for investors. Unit Economics Clarity means you know the Customer Acquisition Cost (CAC) and Customer Lifetime Value (LTV) without guessing, and is a core part of developing a robust startup financial model.

Critical Investor Metric: The Unit Economics Clarity Milestone is achieved when your Customer Lifetime Value (LTV) is significantly greater than your Customer Acquisition Cost (CAC), typically aiming for an LTV:CAC ratio of 3:1or better.

Cash Runway Mapping

The milestone is not just knowing your current runway; it’s mapping the changes to that runway under different scenarios.

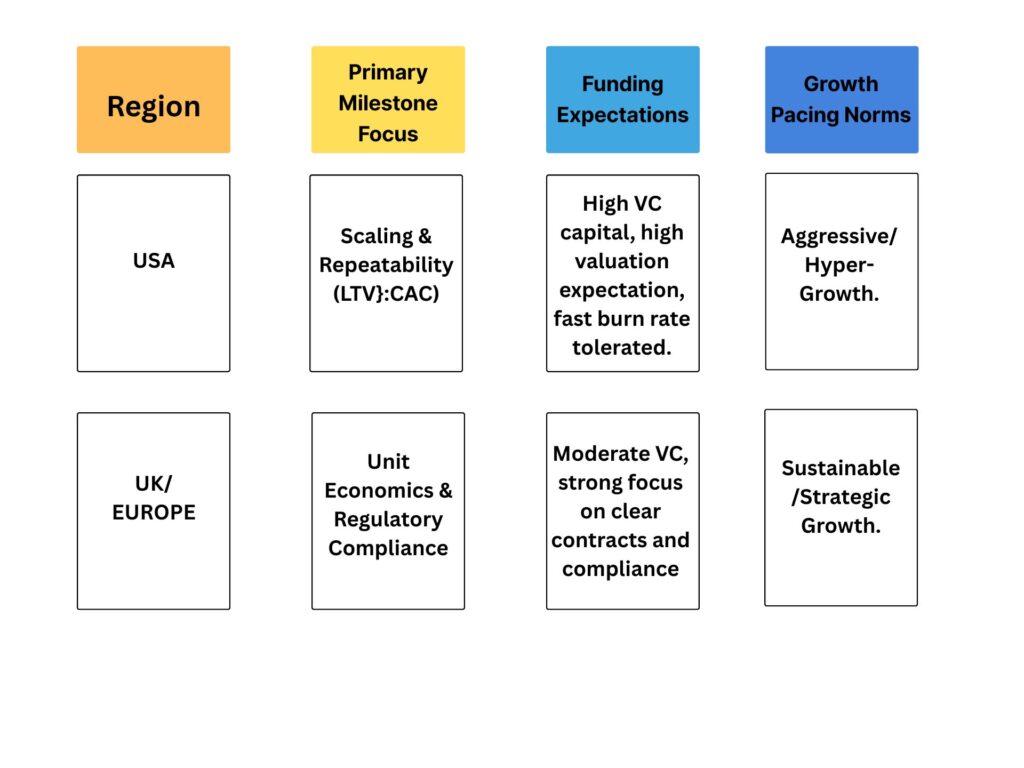

Regional Context: US vs. UK

Funding realities dramatically change this stage. VC-driven markets like the US prioritize rapid growth over early profitability, making the LTV:CAC ratio and cash runway critical. In markets like the UK, there’s a strong focus on clear contracts and bank loan requirements heavily depend on documented, reliable cash flow, pushing founders to achieve real margins much earlier.

Stage 4: Operational Milestones That Separate Startups from Real Businesses

A startup is dependent on the founder; a real business can run without them.

Documented Processes Milestone

The milestone is achieved when you have documented the top five most-repeated tasks to the point where a new hire could perform them with 80% accuracy based solely on your documentation. This is where systems create valuation, not just revenue.

Legal & Compliance Structure Readiness

This milestone is about having the legal house in order: standardized customer contracts, properly registered Intellectual Property (IP), and compliance with regional regulations. For founders, this means having everything ready for due diligence, including compliance with regional laws like US data privacy laws or GDPR in the UK.

Founder Delegation Readiness

The milestone is the founder’s ability to take a one-week vacation without the core business operations grinding to a halt.

Stage 5: Scaling Milestones Most Founders Misjudge

Scaling is multiplying success, not just doing more things.

Repeatable Acquisition Channel Milestone

The most important milestone in this stage is the point where you can say: “For every $1,000 we put into Channel X, we reliably and predictably get Y new customers back.”

Team Scalability Readiness

Can the team handle a doubling of the customer base without needing to immediately double the staff? This proves you have built leverage into your business model.

Stage 6: Funding Milestones Investors Expect (But Rarely Explain)

Hitting revenue targets is one thing; being ready for investment is another.

Investor Narrative Milestone

The milestone is achieved when the founder can tell a clear, concise, and compelling 10-minute story that covers the problem, solution, market size, traction, and the reason why now is the time to invest.

Financial Forecast Maturity and Modeling

Beyond basic revenue projections, this milestone requires a detailed financial model that shows the path to the next round of funding and beyond, along with sensitivity analysis. This demonstrates a deep understanding of the business levers and is a product of professional financial modeling services.

Exit Awareness (Even at Early Stages)

The milestone is the founder’s ability to articulate plausible and aspirational exit scenarios, proving they understand the ultimate goal of institutional capital.

How Business Milestones Differ Across Regions (US & UK)

The core milestones are universal, but the urgency, funding expectations, and tolerance for risk differ greatly:

The Most Common Milestone Mistakes Founders Make

- Chasing Funding Before Readiness: The single biggest mistake. If you haven’t hit the Unit Economics Clarity or Investor Narrative milestones, you’re just wasting time.

- Scaling Without Margins: Scaling without Unit Economics Clarity is the fast track to failure.

✅ Founder’s Business Milestone Checklist

Use this self-assessment to gauge your true readiness to scale.

Layer 1: Founder Readiness

- Do all founders agree, in writing, on equity, decision rights, and commitment level? (Co-founder Alignment)

Layer 2: Market Validation

- Do I have at least 10 non-friend, paying customers?

- Do I know precisely the price point at which the value is fully accepted? (Willingness-to-Pay)

Layer 3 & 4: Stability & Operations

- Do I know the exact number of customers needed to cover all expenses? (Break-Even Awareness)

- Is my LTV at least $3\text{X}$ my CAC? (Unit Economics Clarity)

- Could a new employee start tomorrow and execute the five core tasks using only our documentation? (Documented Processes)

Layer 5 & 6: Scaling & Funding

- Can I reliably predict the outcome of putting $\$1,000$ into a specific marketing channel? (Repeatable Acquisition Channel)

- Do I have a documented financial model that shows what happens if my assumptions change? (Financial Forecast Maturity and Modeling)

- Can I tell a 10-minute story that inspires an investor to write a check? (Investor Narrative Milestone)

Final Thoughts: Mastery Over Speed Wins

The path from idea to scale is a deliberate, measured process of replacing uncertainty with certainty. Startup consultancy services often focus on helping founders systematically achieve these non-vanity milestones.

Embrace strategic patience. Use these milestones as decision-making tools to ensure that when you finally do step on the gas, you have an engine built for endurance, not just a quick sprint.