Starting a biotech startup is one of the most ambitious entrepreneurial journeys you can embark upon. Unlike a software company that can launch with a laptop and a coffee shop Wi-Fi connection, a bioscience startup requires physical infrastructure, highly specialized talent, and a runway long enough to survive years of research without revenue.

For founders in the life sciences, the burning question isn’t just “Will this science work?” It is arguably the more pressing financial query: “How much is this going to cost?”

The answer is complex, but manageable with the right data. Whether you are launching a biopharma startup focused on new therapeutics or a biomedicine startup developing novel diagnostics, understanding your cash burn is critical.

At Excel Business Resource, we’ve helped over 100 startups build financial models, secure funding, and navigate complex FP&A challenges. In this guide, we will break down the actual costs associated with starting a biotech company, strategies to manage your burn rate, and why a solid business plan for biotech startup success is your most valuable asset.

The Financial Reality of Life Sciences Startups

Let’s be direct: Biotech is capital-intensive.

While costs vary wildly depending on your specific niche, a digital health app costs significantly less than a Phase I oncology drug, industry data provides us with reliable benchmarks.

The biotech industry operates on milestone-driven financing. Unlike traditional startups, you can’t rely on early revenue to sustain operations. According to McKinsey & Company, the median Series A raise for biotech companies in 2024 reached $58.7 million, while seed rounds typically range from $2 million to $5 million depending on your asset stage and geography.

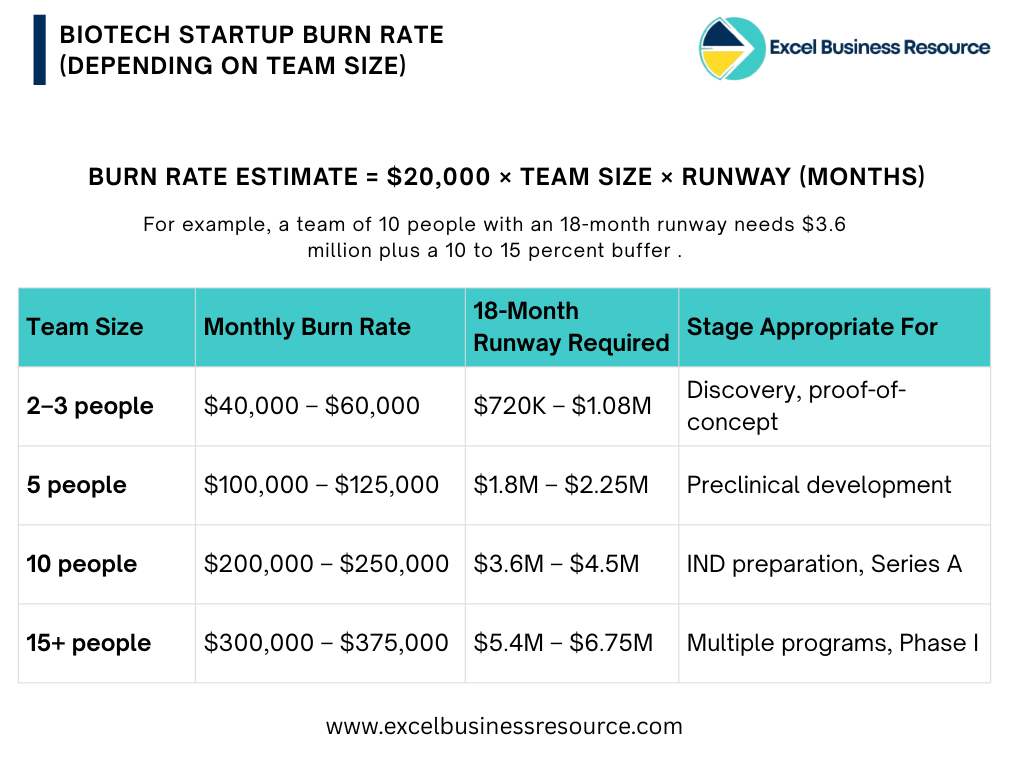

According to research from Pillar VC, a general rule of thumb for early-stage biotech companies is a burn rate of approximately $20,000 per employee per month. This metric is incredibly useful for a biotech startup financial model template because it scales. If you plan to hire five scientists and want a two-year runway to reach your next value inflection point, you are looking at a cash need of roughly $2.4 million just to keep the lights on and the pipettes moving.

However, a financial forecasting model for biomedicine startup success must go deeper than general averages. You need to dissect the anatomy of your expenses.

Core Cost Drivers for a Biotech Startup

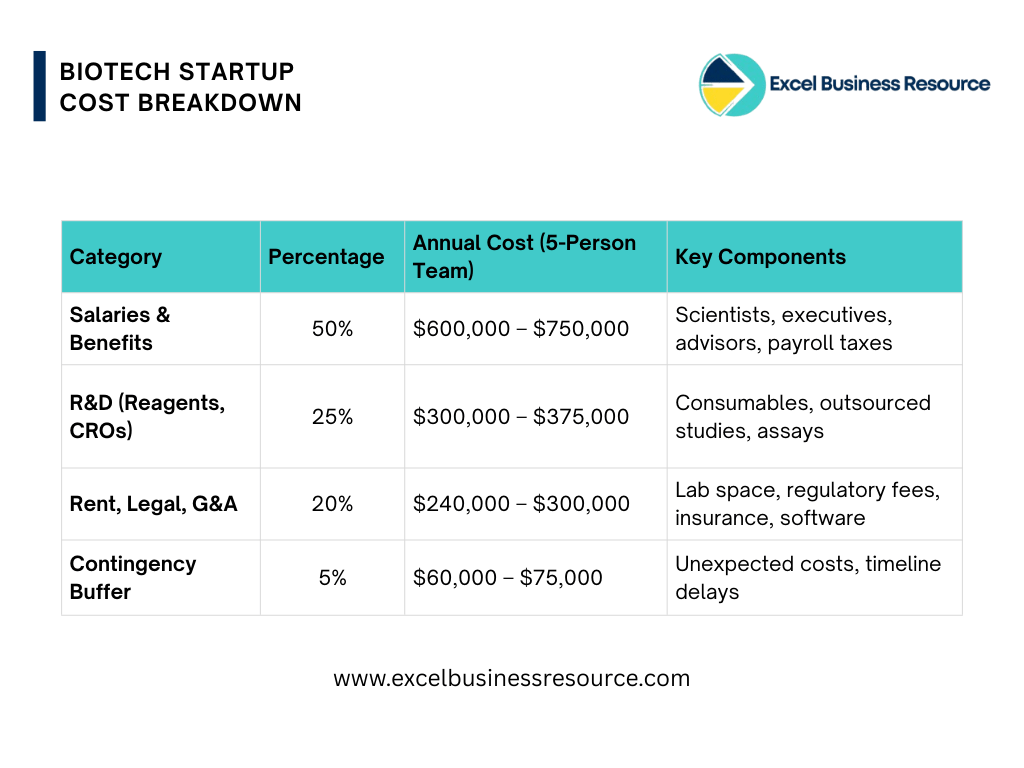

To build an accurate biotech / biopharma financial projection model, you must categorize your spending into four main buckets: Research & Development (R&D), Personnel, Legal/IP, and General & Administrative (G&A).

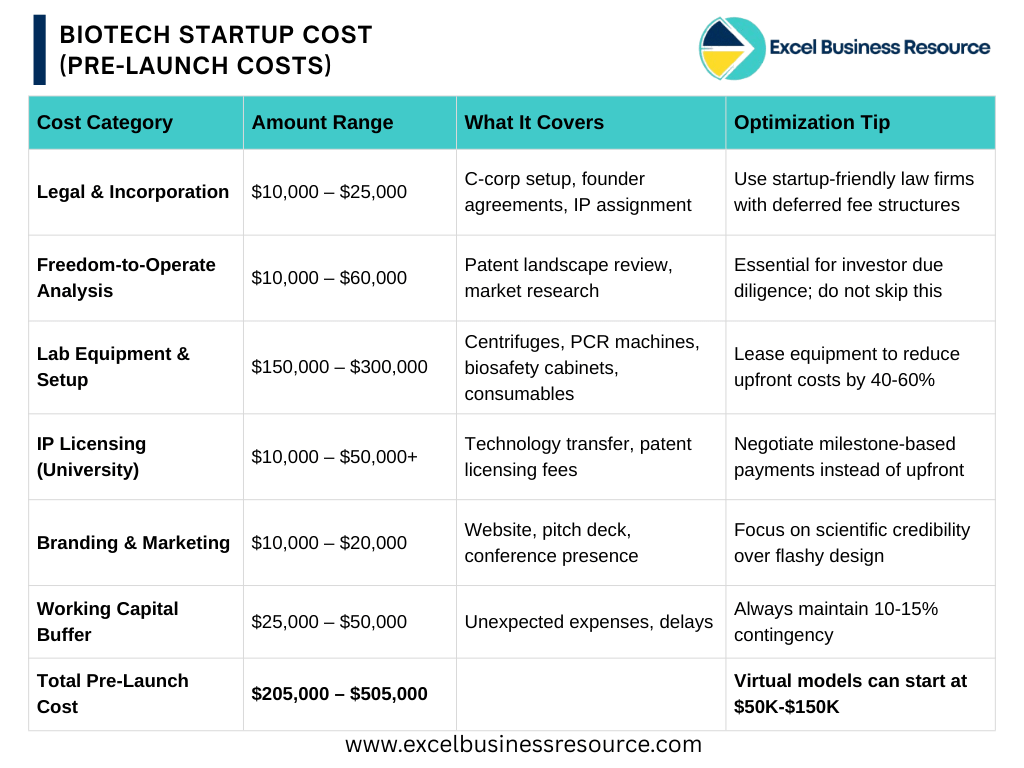

Pre-Launch Costs: Your First 6 Months

Before you hire your first scientist or sign a lab lease, you will face several unavoidable expenses. These foundational costs set the stage for everything that follows.

The wide range in total costs reflects different business models. A virtual biotech startup that outsources all research to CROs can launch lean. A platform company building proprietary infrastructure needs significantly more capital upfront.

Remember Monthly Burn Rate: The $20,000 Rule

Here is a number every biotech founder must memorize: $20,000 per employee per month. That is the industry average burn rate, according to Pillar VC and multiple industry benchmarks. Compare that to software startups at roughly $10,000 per employee, and you see why biotech financial planning is unique.

This figure includes salaries, benefits, lab operations, reagents, and administrative overhead. It does not include one-time equipment purchases or major CRO contracts. For planning purposes, use this formula:

Burn Rate Estimate = $20,000 × Team Size × Runway (months)

For example, a team of 10 people with an 18-month runway needs $3.6 million plus a 10 to 15 percent buffer.

Where Your Money Goes: The 50-25-20-5 Breakdown

Smart budgeting requires understanding typical spend distribution. Based on industry surveys and our experience with 100+ startups, here is how biotech companies allocate their capital:

Typical Biotech Spend Breakdown

You might have notice that talent consumes half your budget. This is why hiring strategy is financial strategy. Bring on full-time employees for core capabilities that drive your competitive advantage. Use consultants and CROs for specialized, short-term needs.

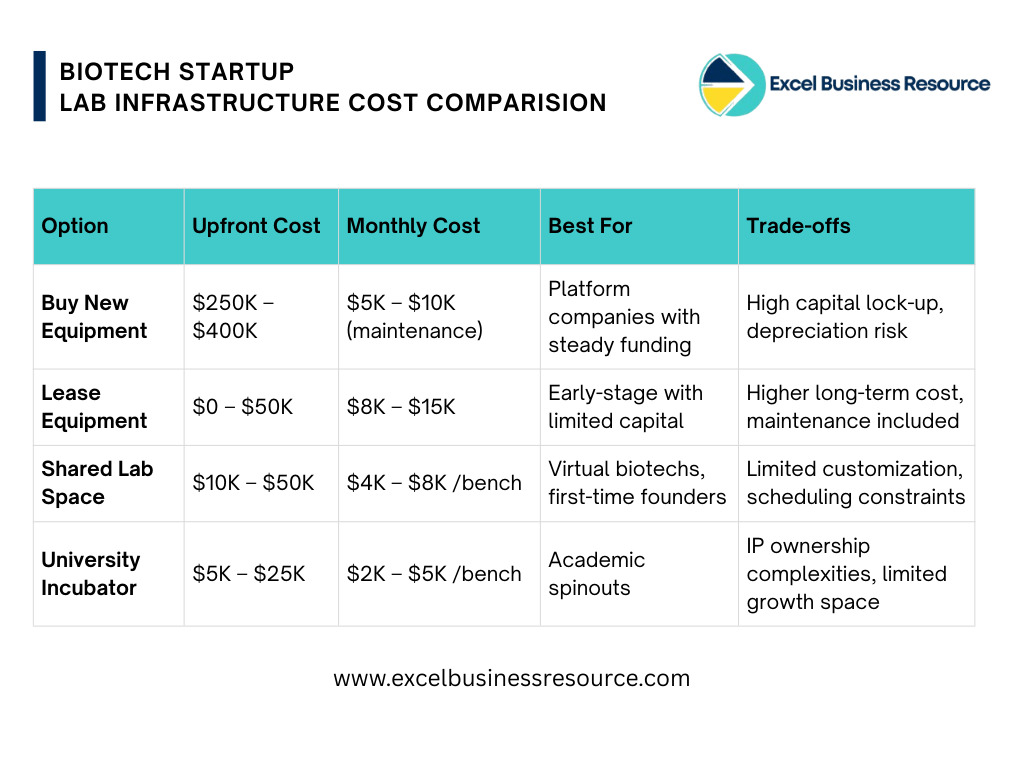

Lab Infrastructure: To Build, Lease, or Share?

One of the first major financial decisions you will make is how to access lab space and equipment. This choice has a massive impact on your upfront capital needs.

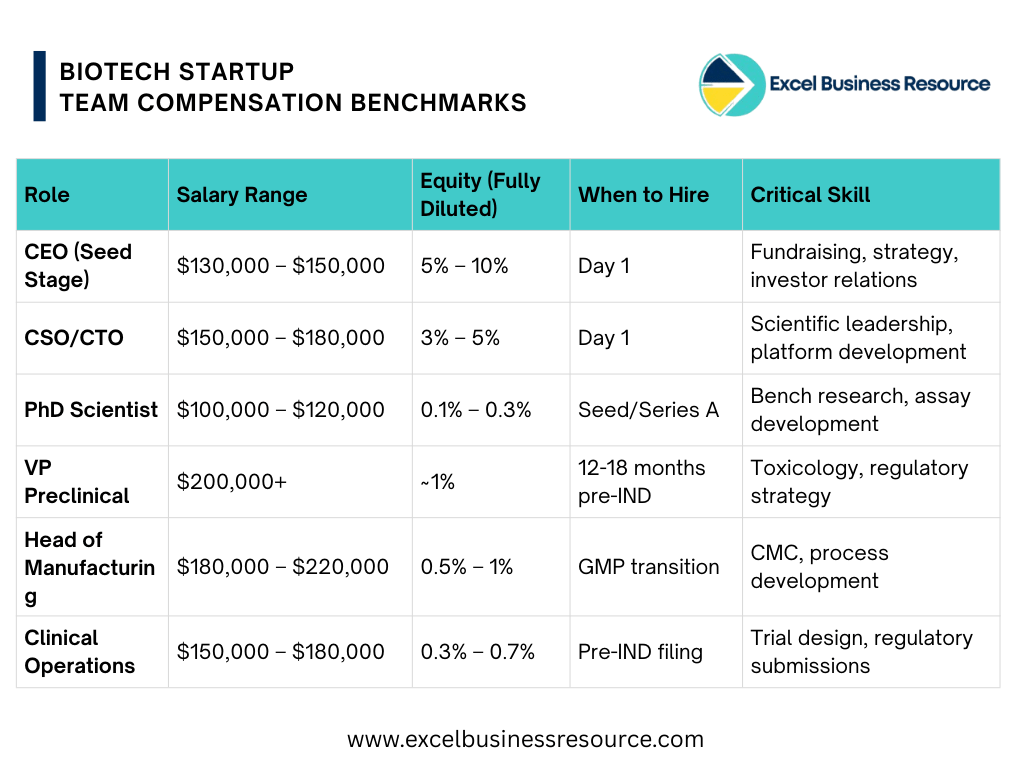

Hiring Strategy: Salaries and Equity Benchmarks

Your team is your biggest expense and your biggest asset. Compensation in biotech follows different patterns than tech startups. Scientific talent commands premium salaries, and equity expectations vary by role and stage.

Key Insight: Plan hiring in phases aligned with scientific milestones and fundraising cycles. Adding headcount too early burns cash without advancing your program. Adding it too late creates bottlenecks that delay value creation.

Strategies to Reduce Biotech Startup Costs

The high costs of biotech innovation can be intimidating, but savvy founders have numerous tools at their disposal to extend their runway. Effective cost reduction strategies for biotech startups are about being resourceful and strategic.

Embrace the Scientific “Sharing Economy”

You don’t need to own every piece of equipment. Leverage shared resources to access millions of dollars in infrastructure for a fraction of the cost.

- Incubators and Accelerators: Programs like JLABS and LabCentral provide fully equipped, ready-to-use lab space. You pay a monthly fee per bench, which gives you access to shared equipment like centrifuges, microscopes, and cell culture hoods. This model can save you hundreds of thousands in upfront capital.

- University Cores: Many research universities offer their core facilities—for services like flow cytometry, mass spectrometry, or next-gen sequencing—to local startups on a fee-for-service basis. This is often cheaper than commercial CROs and provides access to state-of-the-art technology.

- Equipment Marketplaces: Websites like LabX or GovDeals sell used or refurbished lab equipment for 40-70% less than new. This is an excellent way to acquire necessary equipment without draining your bank account.

Strategic Equipment Leasing

Preserve your cash for personnel and experiments. Leasing equipment frees up liquid capital that can extend your runway by months.

If a piece of equipment costs $100,000, paying $3,000 per month is often better for your cash flow than draining your bank account immediately. This is especially true for analytical instruments that require regular maintenance and calibration. Leasing agreements often include service contracts, reducing your operational headaches.

When to Lease vs. Buy:

Raise Non-Dilutive Funding First

Before giving away equity to investors, aggressively pursue non-dilutive funding. This is “free” capital that extends your runway without reducing your ownership stake.

- SBIR/STTR Grants: The Small Business Innovation Research (SBIR) and Small Business Technology Transfer (STTR) programs are a cornerstone of biotech funding in the United States. These government grants can provide millions of dollars across Phase I and Phase II awards. A successful grant award also serves as powerful validation for future venture capital investors.

- Disease Foundations: Organizations like the Michael J. Fox Foundation for Parkinson’s Research or the Cystic Fibrosis Foundation provide significant funding for research aligned with their missions.

- R&D Tax Credits: Many countries and states offer R&D tax credits that provide a cash rebate for a percentage of your qualified research expenditures. This can effectively lower your net burn rate.

Master the Art of Outsourcing

The virtual biotech model, where a small core team manages a network of external CROs and contract development and manufacturing organizations (CDMOs), is a proven strategy for capital efficiency.

A smart outsourcing framework is essential:

- Core Science: Keep your proprietary science and key decision-making in-house. Your competitive advantage should be managed by your team.

- Commoditized Services: Outsource standardized and repetitive tasks. Activities like routine toxicology screens or large-scale compound synthesis are often performed more cheaply and quickly by specialized CROs.

- Capital-Intensive Work: Always outsource activities that require massive infrastructure, such as GLP toxicology studies or GMP manufacturing. Building a vivarium or a GMP-compliant facility is prohibitively expensive for an early-stage startup.

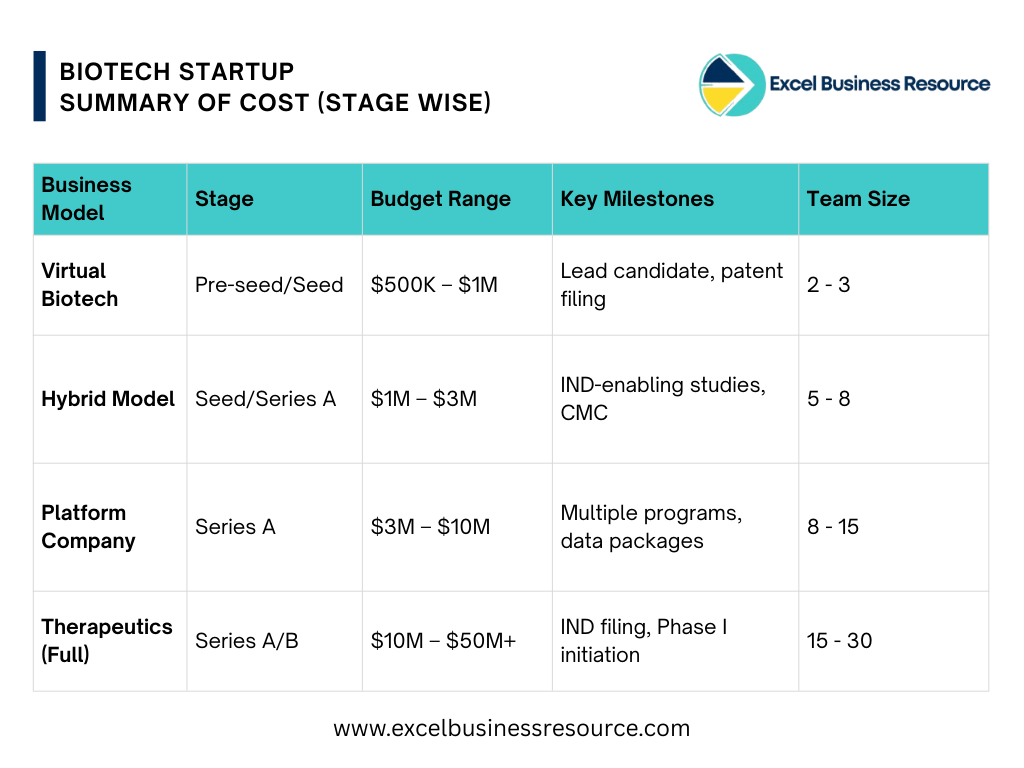

Summary Of Realistic Biotech / Bio Science Startup Budget Ranges by Stage

Putting it all together, here is what you should expect to raise based on your development stage and business model.

Biotech Startup Budget Ranges (12-18 Months)

Critical Success Factor: Investors expect 18 to 24 months of runway from each funding round. Underestimate your needs, and you face a down round or worse. Moreover, forecast 20 to 30 percent contingency for unexpected delays and costs.

The Role of Financial Modeling in Biotech Success

A sophisticated financial model is the single most important document for a biotech founder. It is your operational roadmap, your fundraising tool, and your strategic guide. Investors are not just investing in your science; they are investing in your plan to turn that science into value. Your model must clearly show how you will use their capital to reach key value-inflection milestones.

An investor-ready financial model must include:

- Milestone-Based Forecasts: Link spending to scientific goals (e.g., lead optimization, IND-enabling studies), not just calendar months.

- Headcount Planning: Show a phased hiring plan that aligns with your R&D timeline. When do you need a Chief Medical Officer? When do you add more bench scientists?

- Clinical Trial Budgeting: Model the significant step-up in costs associated with Phase I, II, and III trials, including patient recruitment, site management, and data analysis.

- Capital Allocation Strategy: Clearly detail how funds will be split between R&D, G&A, and personnel.

- Cash Runway and “Zero Cash” Date: The model must calculate your runway and the exact date you will run out of money, so you know when to begin your next fundraising cycle (typically 9-12 months in advance).

- Scenario and Sensitivity Analysis: Show investors you have planned for uncertainty. What happens to your runway if a key experiment is delayed by six months? What if a CRO contract costs 20% more than projected?

Building this from scratch is a formidable task. Using a specialized template designed for biotech can save you hundreds of hours and ensure your projections meet the rigorous standards of venture capital due diligence.

Ready to build investor-ready financial projections for your biotech startup?

Explore our Biotech Financial Model and Valuation Template designed specifically for life sciences founders navigating complex funding landscapes. Join the 100+ startups that have trusted Excel Business Resource for data analysis, FP&A, and financial modeling.

💡 Understand the Critical components For Financial Planning of Biotech Startups

Creating a Business Plan for a Biotech Startup

Your business plan is the narrative that accompanies your financial model. It translates the numbers into a vision that investors can believe in.

A strong business plan template for biotech startup ventures should cover:

- What disease are you curing? Why is the current standard of care insufficient? Be specific about patient populations and clinical outcomes.

- Present data that proves your mechanism of action (MOA). Investors need to believe the biology works before they bet on the business.

- Define your Total Addressable Market (TAM), Serviceable Addressable Market (SAM), and Serviceable Obtainable Market (SOM). Show you understand commercial dynamics.

- How do you get FDA approval? What are the key milestones, risks, and timelines? Demonstrate regulatory sophistication.

- Present the summarized output of your startup financial model template. Show burn rate, runway, and valuation milestones.

Investors invest in the plan as much as the science. They need to trust that you can manage a multimillion-dollar budget responsibly.

Key Takeaways for Biotech Founders

Launching a biotech startup requires sophisticated financial planning from day one. The $20,000 per employee monthly burn rate, the $500K to $3M first-year cost range, and the multi-year path to revenue all demand disciplined capital allocation.

Remember these critical principles:

- Focus on milestone-driven budgeting, not just monthly expenses. Every dollar should advance a specific scientific or regulatory goal.

- Leverage non-dilutive funding where possible. Grants and tax credits extend runway without dilution.

- Maintain 12 to 18 months of cash reserves with a healthy buffer. Running out of money is the fastest way to lose control of your company.

- Align your spending with scientific progress. In biotech, your valuation depends on de-risking your technology, not growth metrics.

- Use strategic outsourcing to preserve capital. Virtual and hybrid models have proven successful.

- Build financial models that can handle uncertainty. Sensitivity analysis and scenario planning are not optional.

The biotech startups that succeed are not necessarily those with the most funding, but those with the most strategic financial planning. Build your financial model with the same rigor you apply to your science, and you dramatically improve your odds of reaching the clinic and the market.