Picture this: You’re a founder with a game-changing idea. Your pitch deck is polished, your team is fired up, and you’re ready to conquer the market. But six months later, you’re out of cash, investors are passing, and your dream is teetering on the edge. What went wrong? For many startups, the culprit is a flawed financial model—a silent saboteur that turns bold strategies into costly mistakes. Industry data paints a grim picture: up to 35% of startups fail due to cash flow issues, often tied to poorly constructed financial models.

Your startup financial model isn’t just a spreadsheet; it’s the compass for your business journey. It shapes your strategy, convinces investors, and keeps you grounded in reality. Yet, hidden pitfalls can undermine even the most promising ventures. In this post, we’ll uncover five critical mistakes that can derail your startup, show how they sabotage your strategy, and share proven fixes to get you back on track. Whether you’re crafting your first financial forecasting template or refining an existing one, these insights will help you avoid disaster and build a model that drives success. Plus, we’ll introduce premium financial model templates crafted by excel business resource to streamline your path to victory. Let’s dive in and transform your financial model from a liability to a superpower.

Why Financial Models Are the Backbone of Your Startup

A financial model is more than numbers—it’s the heartbeat of your startup. It translates your vision into measurable projections, guiding everything from hiring to marketing to fundraising. A strong startup financial model answers critical questions: How much cash do you need? When will you break even? Can you scale sustainably? It’s your pitch to investors, proving you’ve done your homework, and your internal roadmap, ensuring every dollar is spent wisely.

Get it wrong, and the consequences are brutal. Research shows that financial mismanagement, including weak modeling, contributes to nearly a third of startup failures. Without a realistic model, you risk overpromising to investors, misallocating resources, or running out of cash before hitting key milestones. On the flip side, a robust forecasting model aligns your team, secures funding, and keeps you agile in a volatile market. It’s the foundation for turning your big idea into a thriving business. So, what are the traps that turn this asset into a liability? Let’s explore the five biggest pitfalls.

Five Critical Pitfalls in Startup Financial Models

Building a financial model is tricky, especially for first-time founders. Here are five common mistakes that can quietly sabotage your startup, complete with their real-world impacts.

1. Unrealistic Revenue Projections

Dreaming big is great, but projecting $50 million in revenue by Year 2 with no traction is a recipe for disaster. Overly optimistic forecasts often stem from enthusiasm or pressure to impress stakeholders, ignoring realities like market competition, customer acquisition timelines, or economic shifts. For example, a SaaS startup might assume 10,000 paying users in 12 months without factoring in churn or marketing costs, leading to a model that’s more fantasy than strategy.

Impact: These projections mislead investors, who spot the disconnect instantly. Internally, they trigger over-hiring or overspending, draining cash reserves. One tech startup projected 100% monthly growth, only to stall at 10% due to saturated markets, forcing a painful pivot.

2. Overestimating Market Size (TAM)

Claiming a $500 billion total addressable market (TAM) to investors when your realistic share is $5 billion is a classic blunder. Founders inflate TAM to justify sky-high valuations, but this distorts planning and erodes credibility. For instance, a healthtech startup targeting “all hospitals” might ignore regional regulations or entrenched competitors, vastly overestimating their reachable market.

Impact: An inflated TAM leads to chasing unachievable segments, wasting resources on broad marketing instead of focused niches. Investors dismiss pitches that lack grounded market analysis, and internal teams lose focus, diluting efforts across unrealistic goals.

3. Poor Cash Flow Management

Cash is the lifeblood of any startup, yet many models fail to track it rigorously. Founders focus on revenue but overlook outflows like payroll, rent, or unexpected legal fees. A retail startup, for example, might budget for inventory but forget shipping costs, slashing their runway from 18 months to 6.

Impact: Poor cash flow planning leads to sudden shortages, forcing desperate measures like layoffs or high-interest loans. It’s a leading cause of startup failure, with 35% of collapses tied to running out of money. Without a clear cash flow picture, your strategy becomes a game of survival, not growth.

4. Inflated Valuations and Budgets

Seeking a $100 million valuation based on projections alone, or budgeting for lavish founder salaries early on, signals inexperience. A consumer app startup might allocate $200,000 for branding while generating $10,000 in revenue, assuming future funding will cover it. This disconnect between ambition and reality is a red flag.

Impact: Inflated valuations scare off investors who see no justification, while bloated budgets burn cash fast. Early overspending on non-essentials, like premium offices, shortens runway and forces premature fundraising at unfavorable terms, derailing long-term plans.

5. Ignoring Unit Economics

Unit economics—profit per customer or transaction—are the foundation of scalability, yet many models skip them. A food delivery startup might celebrate 1,000 orders without realizing each one loses $5 after delivery and marketing costs. Ignoring metrics like Customer Acquisition Cost (CAC) and Lifetime Value (LTV) hides losses behind growth.

Impact: Poor unit economics make scaling unsustainable, turning growth into a cash pit. Startups expand too soon, hiring or investing in infrastructure without profitability, leading to financial strain or collapse when funding dries up.

How These Pitfalls Derail Your Strategy

These mistakes don’t just mess up your spreadsheet—they unravel your entire strategy. Unrealistic projections (Pitfall 1) lead to overhiring, which compounds cash flow issues (Pitfall 3) and inflates budgets (Pitfall 4). Overestimated TAM (Pitfall 2) pushes resources into unviable markets, while ignoring unit economics (Pitfall 5) masks losses, encouraging premature scaling. The result? A vicious cycle of missteps.

Consider a real-world example: A fintech startup raised $2 million on a $20 million valuation, projecting rapid user growth. Their model assumed a $10 billion TAM and ignored CAC, leading to heavy marketing spend with low conversions. Within 10 months, their runway was gone, forcing a 40% staff cut and a failed pivot. Investors lost trust, and the startup folded. The lesson? A flawed financial model misaligns teams, wastes capital, and turns promising ventures into cautionary tales. It’s not just about numbers—it’s about losing strategic focus and credibility.

How to Fix It: Building a Bulletproof Financial Model

The good news? You can avoid these traps with deliberate steps. Here’s how to address each pitfall and build a financial model that powers your strategy.

- Ground Projections in Data

Base revenue forecasts on historical data, industry benchmarks, or validated customer feedback. Instead of assuming 50% growth, model conservative (10%), base (20%), and optimistic (30%) scenarios. For example, a SaaS startup might use competitor churn rates to estimate realistic retention, ensuring projections hold up under scrutiny. - Validate Market Assumptions

Research your TAM thoroughly, breaking it into SAM (Serviceable Addressable Market) and SOM (Serviceable Obtainable Market). Use third-party reports or customer surveys to confirm demand. A retail startup targeting eco-conscious shoppers should focus on a specific demographic, not “all consumers,” for accuracy. - Prioritize Cash Flow and Runway

Track every dollar in and out daily, using tools to monitor cash flow. Aim for 18-24 months of runway, factoring in unexpected costs like legal fees. Scenario planning—modeling for downturns or delays—helps you stay prepared. A startup with $1 million in funding should allocate no more than 30% to fixed costs to maintain flexibility. - Align Valuations with Milestones

Base valuations on tangible metrics like revenue or user growth, not hype. Keep budgets lean—opt for fractional hires or virtual offices early on. A startup with $50,000 in revenue shouldn’t budget $100,000 for founder salaries; reinvest in growth instead. - Focus on Unit Economics Early

Calculate CAC, LTV, and margins from day one. If your CAC is $100 but LTV is $80, rethink your strategy before scaling. A delivery startup might cut low-margin regions to boost profitability, ensuring each order contributes to sustainability.

Pro Tips:

- Scenario Planning: Build best-case, base-case, and worst-case models to prepare for volatility.

- Regular Audits: Review your model monthly to catch discrepancies early.

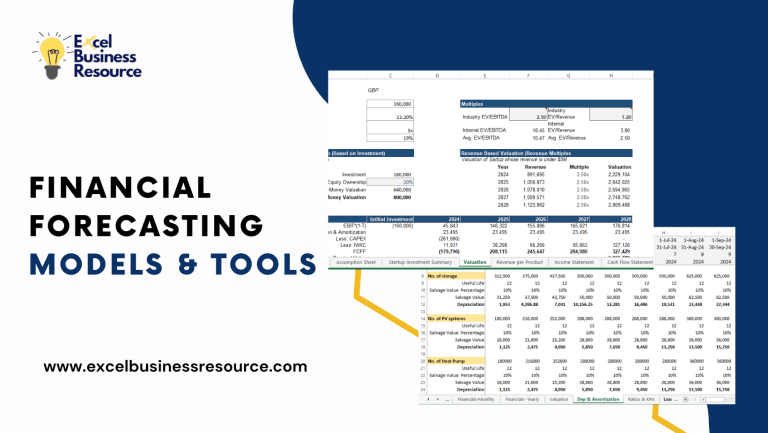

- Use Templates: Financial model templates save time and embed best practices, ensuring accuracy and investor-readiness.

By implementing these fixes, you’ll create a model that aligns with your strategy, impresses investors, and keeps your startup on track.

Success Stories: Turning Models into Wins

Fixing your startup financial model can transform your startup’s trajectory. Take a healthtech startup that initially projected $10 million in Year 1 revenue, ignoring high CAC. After running out of cash in 9 months, they rebuilt their model, focusing on unit economics and a niche TAM. By optimizing marketing and cutting unprofitable channels, they secured $5 million in Series A funding and hit profitability in Year 2.

Another example: A retail startup misjudged cash flow, burning through $500,000 in 6 months. After adopting a lean budget and scenario planning, they extended their runway to 24 months, landing a major partnership. The lesson? Realistic models, rigorous cash tracking, and early focus on profitability turn risks into opportunities. Your startup can do the same with the right approach.

Conclusion

Your startup financial model is your strategic foundation, but common pitfalls like unrealistic projections, inflated TAM, and poor cash management can sabotage your success. By grounding your model in data, validating assumptions, and prioritizing cash flow and unit economics, you’ll build a roadmap that drives growth and wins investor confidence. Don’t let a flawed model hold you back—take control today.

At excel business resource, our investor ready financial model templates and financial forecasting templates are designed to make this easy. These customizable Excel tools cover revenue projections, cash flow analysis, valuations, and unit economics, helping you create investor-ready models without the guesswork. Download now to transform your financial model into a strategic asset and propel your startup to new heights. What’s the biggest challenge you’ve faced with your financial model?