The energy storage market is experiencing explosive growth. Battery Energy Storage Systems (BESS) are no longer just supporting actors in the renewable energy transition, they’re becoming standalone profit centers. But here’s what most entrepreneurs miss that building a BESS business isn’t just about installing batteries and waiting for revenue to roll in. The real money lies in understanding the complex web of revenue streams, market mechanisms, and financial structures that make these projects viable.

At Excel Business Resource, we’ve built Financial Model Templates for Battery Energy Storage System (BESS) businesses for business wants to invest in renewable energy project i.e. BESS. We’ve seen what works, what fails, and where the hidden profits live. This guide breaks down exactly how BESS companies generate revenue, the unit economics that matter, and the financial forecasting models you need to secure funding and scale profitably.

The BESS Revenue Drivers: Multiple Streams, One System

Unlike traditional power plants that rely on single revenue sources, successful BESS businesses stack multiple income streams. This revenue diversification is what makes battery storage financially attractive and what makes your Business Plan for BESS Business critical for investor confidence.

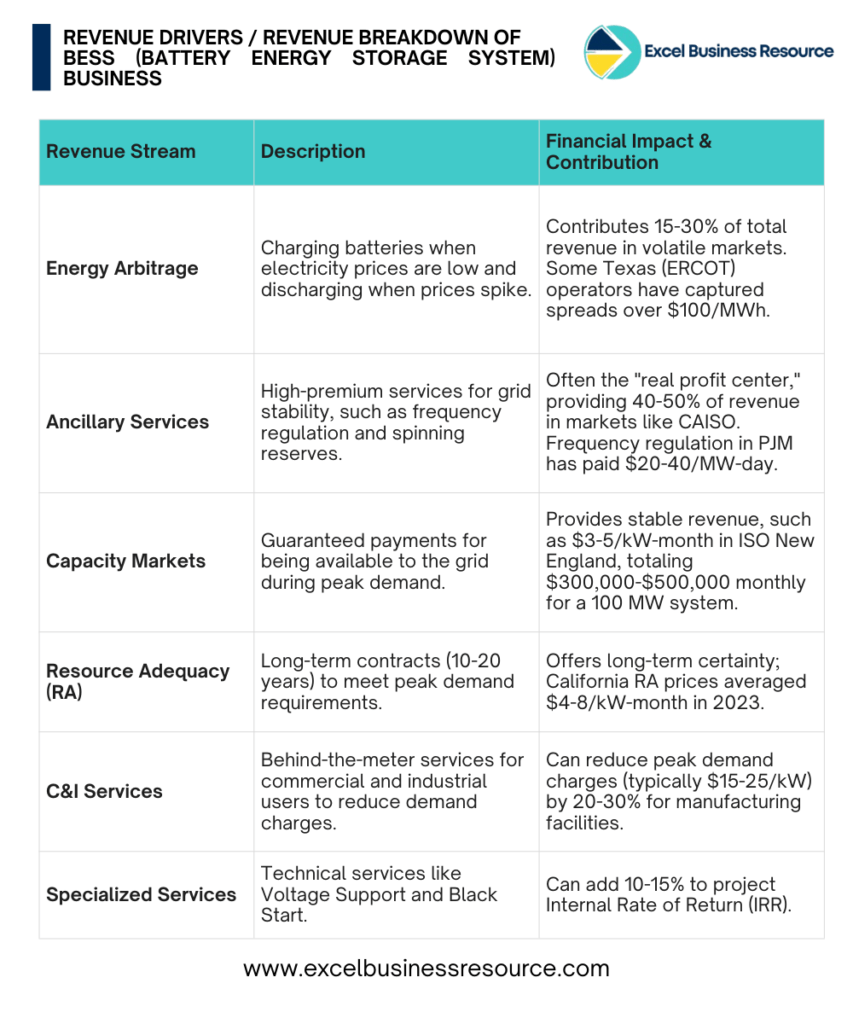

1. Energy Arbitrage: Buying Low, Selling High

The most straightforward revenue driver is energy arbitrage. BESS operators charge batteries when electricity prices are low (typically during midday solar peaks or nighttime wind surges) and discharge when prices spike (evening demand peaks or grid stress events).

According to the National Renewable Energy Laboratory (NREL), energy arbitrage can contribute 15-30% of total BESS revenue in markets with volatile pricing, though this varies significantly by region and market design. In Texas’s ERCOT market, where price volatility is extreme, some operators have captured spreads exceeding $100/MWh during peak events.

However, arbitrage alone rarely justifies project economics. Wholesale electricity markets are becoming more efficient, compressing spreads as more storage enters the market. Smart operators view arbitrage as a baseline revenue layer, not the entire strategy.

2. Ancillary Services: The Real Profit Center

Here’s where BESS businesses make serious money. Grid operators pay premium rates for services that maintain system stability, and batteries are uniquely positioned to deliver these faster than traditional power plants.

Frequency Regulation:

Batteries can respond to grid frequency deviations in milliseconds. In PJM Interconnection (the largest U.S. power market by peak load), frequency regulation payments have historically ranged from $20-40/MW-day, though market reforms have shifted these structures toward performance-based pricing .

Spinning Reserves & Operating Reserves:

When a power plant suddenly fails, grid operators need immediate backup. BESS can provide this within seconds, commanding premium prices. The California Independent System Operator (CAISO) reported that resource adequacy and ancillary services provided roughly 40-50% of BESS revenue in their market during 2023-2024.

Voltage Support & Black Start:

These specialized services pay well but require specific technical configurations and grid interconnection agreements. They’re often overlooked in basic BESS Financial Model Excel Templates but can add 10-15% to project IRR when properly captured.

3. Capacity Markets: Guaranteed Payments for Being Ready

Several U.S. markets operate capacity markets where generators are paid simply for being available during peak demand periods, regardless of whether they’re actually dispatched. This “capacity payment” provides stable, predictable revenue that anchors project finance.

In ISO New England’s capacity market, battery storage resources cleared approximately $3-5/kW-month in recent auctions. For a 100 MW system, that’s $300,000-$500,000 monthly in guaranteed revenue before generating a single kilowatt-hour. Because of this predictability, entrepreneur needs sophisticated Financial Forecasting Models for BESS Business prioritize capacity market participation in revenue projections.

4. Resource Adequacy Contracts: Long-Term Revenue Certainty

California’s Resource Adequacy (RA) requirements mandate that load-serving entities secure sufficient capacity to meet peak demand plus reserve margins. BESS projects can secure multi-year RA contracts, providing the long-term revenue certainty that banks and investors require for project financing.

According to the California Public Utilities Commission, RA contract prices for battery storage averaged $4-8/kW-month in 2023, depending on location and contract duration. These contracts typically run 10-20 years, therefore creating the stable cash flows are essential for BESS Business Valuation and debt service coverage.

5. Behind-the-Meter Commercial & Industrial (C&I) Services

While utility-scale projects grab headlines, the commercial and industrial segment offers attractive margins. Businesses install BESS to reduce demand charges, provide backup power, and participate in utility demand response programs.

For a manufacturing facility facing $15-25/kW monthly demand charges, a BESS can reduce peak demand by 20-30%, delivering immediate utility bill savings. When combined with solar PV, the economics become even more compelling. Wood Mackenzie reported that the U.S. C&I energy storage market grew 43% year-over-year in 2023, driven primarily by demand charge management in high-cost utility territories.

Download Free: Profit & Loss Statement Excel Template For Small Business

Unit Economics Of BESS Business: The Numbers That Determine Success

Revenue is meaningless without understanding the cost structure. The Unit Economics of BESS businesses depend on three critical variables: capital costs, operational efficiency, and degradation management.

Read our unit economics articles, to understand the why unit economics is important for valuation to any business.

Capital Cost Structure

Many entrepreneurs confuse project development with long-term asset ownership. These are distinct business models with radically different capital requirements.

The upfront investment for a BESS project breaks down into several components. The U.S. Department of Energy’s Energy Information Administration (EIA) tracks these costs through their Annual Energy Outlook reports.

Read our article: How much it cost to start a Battery Energy Storage System (BESS business & its Profitability. In this article you will get breakdown of costing of essential components, & timeframe to be in profit & expected IRR.

For a typical 4-hour duration utility-scale system (100 MW / 400 MWh), total installed costs range from $400-600 million depending on location, supply chain conditions, and EPC contract pricing. Due to this complex revenue model & it’s costing structure, It is crucial for BESS business founders to have custom Excel Templates for BESS & renewable energy valuation. Since generic assumptions can destroy accuracy.

The Inverter Replacement Cycle

Inverters typically need replacement every 10-12 years, while batteries might last 15-20 years with proper management.

BESS projects that fail to reserve capital for inverter replacement face cash flow crises in year 10-12, potentially defaulting on debt or missing distributions to equity investors. Therefore sophisticated Financial Metrics of BESS Business analysis includes dedicated replacement reserves from day one.

Degradation and Performance Guarantees

Lithium-ion batteries degrade with each cycle. Most manufacturers guarantee 80% remaining capacity after 10 years or a specific number of cycles. This degradation directly impacts revenue by year 10, your 100 MW system might only deliver 80 MW of reliable capacity.

Performance guarantees from Tier 1 manufacturers (CATL, BYD, Samsung SDI, LG Chem) are crucial for project finance. Banks won’t lend against projects without bankable warranties. Your Budgeting & Forecasting for BESS Business must model degradation curves conservatively and account for potential capacity augmentation investments in later years.

Learn: How to do valuation of a startups using 8 different methods.

Instantly calculate your startup value using: Startup valuation calculator

Building Your Startup Financial Model: What Makes a Template Investor-Ready

After reviewing hundreds of startup financial model templates, we’ve identified the critical components that separate professional-grade models from amateur attempts.

Therefore we pay immense importance for essential components of every industry while building investor ready financial model.

Essential Model Components For BESS Business:

Hourly Dispatch Optimization:

Simple models use monthly averages. Sophisticated models optimize dispatch against historical hourly price data, capturing the extreme price events that drive 30-40% of total revenue.

Degradation Curves:

Linear degradation assumptions are dangerous. Your model should incorporate temperature effects, cycling depth impacts, and manufacturer-specific degradation curves.

Market Price Forecasting:

Revenue projections are only as good as price forecasts. The best models incorporate multiple scenarios (base, high, low) with transparent assumptions about renewable penetration, gas price volatility, and transmission constraints.

Tax Equity Structuring:

BESS projects qualify for Investment Tax Credits (ITC) under the Inflation Reduction Act. Capturing these benefits requires complex partnership flip or sale-leaseback structures that must be modeled explicitly.

Red Flags in Financial Modeling:

Investors and lenders immediately dismiss models that:

– Assume constant capacity prices without market saturation effects

– Ignore inverter replacement reserves

– Use unrealistic availability factors (99%+ is not achievable)

– Fail to model construction delay risks, cash burn rate and cost overruns

– Lack sensitivity analysis on key variables

Download Free Templates:

The Excel Business Resource Advantage

At Excel Business Resource, we don’t sell generic templates. We build industry specific financial forecasting models based on real assumptions of revenue & cost model. Our models have helped startups secure over $200 million from VCs and negotiate better terms with off takers by demonstrating sophisticated understanding of revenue drivers.

In BESS business, whether you’re preparing a Business Plan for BESS Business for investors, negotiating EPC contracts, or optimizing operations for an existing asset, the difference between success and failure lies in financial modeling accuracy. The BESS market is moving fast projects conceived today will operate through 2045 and beyond. Your financial model must capture not just today’s revenue opportunities, but the evolving market dynamics that will determine long-term profitability.

Bottom Line:

The battery storage revolution is here. The question isn’t whether BESS will transform energy markets it’s whether your financial model accurately captures how you’ll profit from that transformation.

Founder Ask Questions

The primary revenue drivers for a Battery Energy Storage System (BESS) business include energy arbitrage (buying low, selling high), ancillary services like frequency regulation and spinning reserves, capacity market payments for grid availability, resource adequacy contracts for long-term stability, and behind-the-meter C&I services for commercial demand charge management. According to CAISO data, ancillary services alone can contribute 40-50% of total revenue in some markets . The most profitable BESS operations stack multiple revenue streams rather than relying on a single source. At Excel Business Resource, we build Financial Model Templates for BESS Business that accurately project revenue from each stream based on your specific market and configuration.

A 100 MW / 400 MWh BESS system can generate between $8 million and $20 million annually depending on market location and revenue stack optimization. Projects in high-volatility markets like ERCOT (Texas) have achieved $150,000-200,000 per MW-year, while more saturated markets like California typically see $80,000-120,000 per MW-year . The variation depends heavily on your ability to capture ancillary services and capacity payments beyond basic energy arbitrage. Our Financial Forecasting Models for BESS Business at Excel Business Resource include hourly dispatch optimization to maximize these revenue opportunities.

An investor-ready BESS Financial Model Excel Template must include hourly dispatch optimization against real price data, explicit degradation curves for lithium-ion batteries, inverter replacement reserves (typically needed at year 10-12), tax equity structuring for ITC capture, and sensitivity analysis on key variables. Red flags that investors immediately reject include unrealistic 99%+ availability assumptions, linear degradation models, and failure to account for construction delays. At Excel Business Resource, we've helped startups secure over $200 million in financing by building models that meet institutional standards for BESS Business Valuation and project finance.

While energy arbitrage contributes 15-30% of revenue in volatile markets, ancillary services often provide higher margins because batteries can deliver grid stability services faster than traditional power plants. Frequency regulation in PJM markets historically paid $20-40/MW-day, while spinning reserves command premium prices for immediate response capability . These services require minimal energy throughput compared to arbitrage, reducing battery degradation while maximizing income. The key is modeling these revenue streams accurately in your Business Plan for BESS Business—which is why our Excel Templates for BESS renewable energy valuation include specific ancillary service revenue modules.

BESS projects require specialized Startup Financial Model Templates because they involve unique variables: battery degradation curves that reduce capacity over time, inverter replacement cycles mid-project life, complex revenue stacking from multiple grid services, and performance guarantees from Tier 1 manufacturers. Generic renewable models designed for solar or wind miss critical elements like round-trip efficiency impacts, cycling depth effects on battery life, and the 10-12 year inverter replacement reserves that can cost $30-50 million for a 100 MW project. At Excel Business Resource, we create custom Battery Energy Storage System (BESS) Valuation Templates that capture these nuances—essential for accurate Unit Economics, Budgeting & Forecasting for BESS Business, and securing project finance.