Building a rental property business is an exciting journey, but it’s more than just collecting rent it’s about launching a real venture that demands smart planning and a rock-solid financial strategy. Whether you’re eyeing your first duplex or scaling a massive portfolio, a professional rental property business plan is your roadmap to success and your best tool for winning over investors.

While you can certainly build a plan on your own using this guide, getting the numbers right is often the hardest part. That is where Excel business resource comes in. We can save you over 100 hours of tedious work with our professional, investor-ready financial model tools. You can choose from our library of ready-made models or have our experts build a customized financial model and business plan tailored exclusively to your project.

This guide serves as your step-by-step rental property business plan template, covering everything from market selection to long-term profitability. By the end, you’ll have the confidence to make smarter decisions and put your venture on a clear path to sustainable success.

1. Executive Summary: The Investor’s Snapshot

The Executive Summary is the concise, one-page distillation of your entire plan. It is designed to quickly inform potential lenders, partners, or even just family members about your strategy, opportunity, and potential returns.

Key Rule: Write this section LAST, after you have completed all your market research and calculated your financials.

What to Include:

- The Opportunity: Briefly describe the specific type of property (e.g., single-family homes, multi-unit apartments) and the geographical area you are targeting (e.g., “The high-growth suburban market of [City Name] where rental demand for three-bedroom homes far exceeds supply.”).

- The Strategy: What is your core business approach? (e.g., “Acquire undervalued properties, renovate them lightly, and manage them professionally for long-term cash flow.”)

- Financial Highlights: State the total capital needed (or loan amount requested), the projected cash-on-cash return, and the expected timeline for profitability.

- Management Team: Briefly state your experience (e.g., “Five years managing personal rental units and certified real estate license.”)

2. Company Description: Your Identity and Goals

This section sets the legal and philosophical foundation for your rental business, establishing clear goals and demonstrating professionalism.

How Should I Structure My Rental Property Business Legally?

Your legal structure affects everything from taxes to liability. You must choose how your business is officially registered:

- Sole Proprietorship: Simplest, but offers no personal protection if you are sued.

- Limited Liability Company (LLC): Highly recommended for rental properties. It separates your personal assets (your house, savings) from your business assets (your rental property), protecting you from liability claims related to the property.

- Partnership/S-Corp: Discuss this if you have partners or plan to scale aggressively.

Crucial Step: Detail your business registration and confirm you will obtain all necessary local licenses and permits required to operate as a landlord in your chosen city or county.

What is the Mission and Vision for My Rental Business?

- Mission Statement: Define your purpose. What do you do every day? (Example: “To provide safe, well-maintained, and desirable housing that respects the needs of both the tenant and the community.”)

- Vision Statement: Define your long-term goal. Where will your business be in 10-15 years? (Example: “To build a portfolio of 50 high-quality residential units, generating passive income and sustained equity growth.”)

- Core Values: The principles that guide tenant relations and property maintenance (e.g., Transparency, Quality Maintenance, Fair Pricing).

3. Market Analysis: Proving Demand and Location

This section shows you’ve done your homework. It proves that there is strong demand for the type of housing you plan to offer in your specific geographic area.

Who are My Ideal Renters and Where Will I Buy?

You must define your target renter, as this dictates the type of property you buy and where you buy it.

Market Segmentation: Are you targeting young professionals, students, small families, or senior citizens?

- Example: If targeting small families, you need 2-3 bedroom homes in good school districts with yards.

- Example: If targeting students, you need units near a university campus with affordable, shared living arrangements.

Location Deep Dive: Why is your chosen neighborhood or city the right choice?

- Look at Vacancy Rates: Low vacancy (under 5%) means high demand.

- Job Growth: Is the local economy growing? New employers bring new renters.

- Median Income: Can your target renters afford the rents you plan to charge?

Who is My Rental Competition, and How Am I Better?

Your competition includes other landlords, large apartment complexes, and even single-family rental owners in your area.

Competitive Comparison: Research 3-5 similar rental units near your target location.

- What are they charging for a similar unit?

- What features do they offer (in-unit laundry, parking, utilities included)?

- What condition are their properties in?

Your Advantage: Why will renters choose your property? (Example: “We offer pet-friendly policies when most local competitors do not,” or “Our properties include high-speed fiber internet and smart home technology.”)

4. Investment Strategy and Management Plan

This defines how you acquire property and how you will run the day-to-day operations.

What is My Acquisition Strategy?

Property Type: Be specific (e.g., “Focus on 4-plex apartment buildings built between 1980 and 2000 that require only cosmetic upgrades.”).

Investment Criteria: Define your target numbers (this links directly to your financial model):

- Target Purchase Price Range: $200,000 – $350,000.

- Target Gross Rental Yield (Gross Rent / Purchase Price): Minimum 10%.

- Target Cash-on-Cash Return (Annual Cash Flow / Equity Invested): Minimum 8%.

Financing Plan: Detail how you will fund the purchase: conventional loans, private lenders, FHA, etc. What down payment will you use?

How Will I Handle Property Management?

Clear management procedures ensure tenant retention, which saves you money.

Self-Management vs. Professional Management:

- Self-Management: You handle everything (rent collection, repairs, tenant screening). This saves money but takes significant time. (Detail your plan for handling late-night calls and maintenance.)

- Professional Management: You hire a local property management company (typically costs 8%–12% of collected rent). This saves time but reduces cash flow. (If using this option, name the target company and its fees.)

Tenant Screening: Detail your process (background checks, credit checks, income verification) to ensure you place high-quality, reliable renters.

Maintenance: How will you handle routine repairs? Do you have a list of reliable contractors (plumbers, electricians)?

5. Marketing and Tenant Acquisition

You need a clear plan to minimize vacancy time, as every day a unit is empty, you lose money.

How Do I Quickly Fill Vacancies?

Listing Strategy: Where will you advertise?

- Online platforms (Zillow Rental Manager, Apartments.com, local Facebook groups).

- Local signage and community bulletin boards.

Key Selling Points: What are the top 3-5 features you will emphasize in your listings? (e.g., recently updated kitchen, free parking, location near public transport).

Leasing Process: How quickly can you move from showing the unit to signing a lease? A fast, easy process reduces the chance of losing a good tenant.

Rental Rate Strategy

You must set a price that is competitive but maximizes your income.

- Comparative Market Analysis (CMA): Base your rent on what comparable units in the immediate area are charging.

- When to Raise Rent: Define your policy for rent increases (usually annually, in line with market averages or CPI).

6. Management Team and Experience

Lenders and partners want assurance that you have the skills to handle the inevitable challenges of being a landlord.

Who is Running the Show?

Your Resume and Experience: If you are the owner/manager, detail your relevant experience. Have you successfully renovated a property? Do you have landlord certifications? Highlight any prior business management experience.

Team Support: Even if you are solo, you rely on a team of professionals:

- Real Estate Agent (for acquisitions).

- Lender/Mortgage Broker.

- Attorney (for drafting leases and handling evictions).

- Accountant/Bookkeeper (for tax preparation and tracking income/expenses).

7. Financial Plan: The Numbers That Matter

This is the most critical and detailed section. It proves your business idea is profitable. If you are seeking a loan, this must be detailed. This forms the essential framework for any rental property business plan sample.

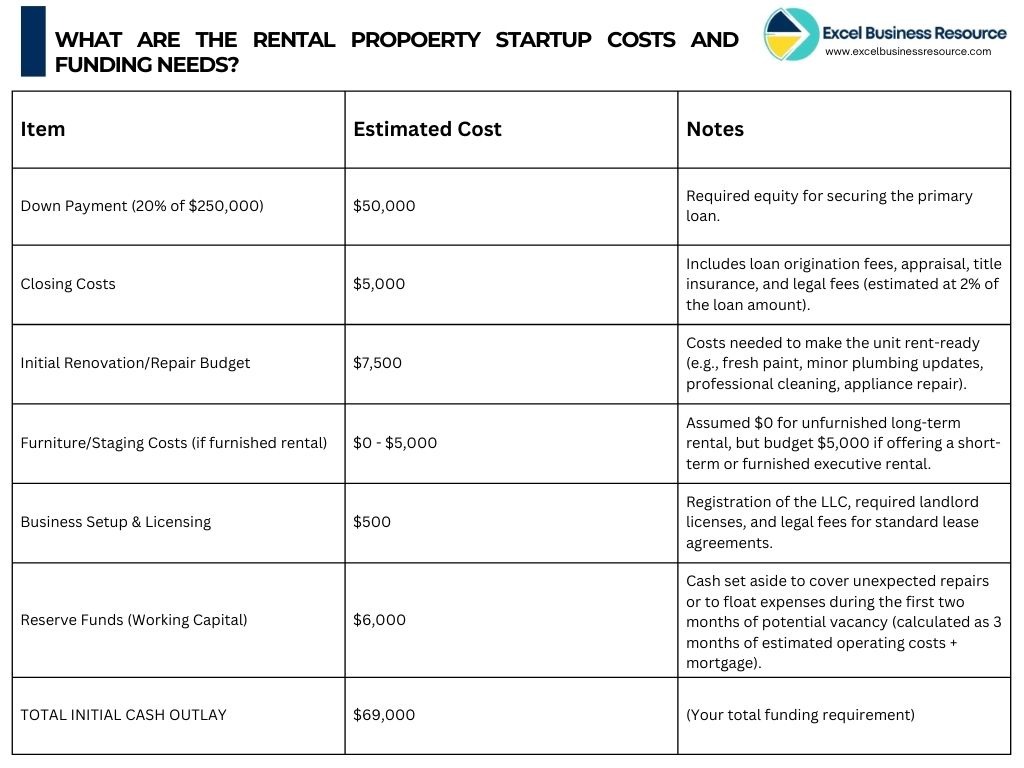

What Are My Startup Costs and Funding Needs?

List of all assets, equipment & expenses with their cost to get your first property operational.

Following figures are based on the assumption of purchasing one residential unit for $250,000 with a conventional loan requiring a 20% down payment.

How to Project Income and Expenses (The Rental Property Financial Plan)

You must project your income and expenses for at least three to five years. This projection proves profitability.

Projected Income:

- Gross Scheduled Income (Total annual rent if the unit were 100% occupied).

- Less: Vacancy Rate (Use a realistic local average, e.g., 5%).

- Equals: Effective Gross Income.

Operating Expenses: Detail your fixed and variable monthly/annual costs:

- Taxes and Insurance (Property and Liability).

- Property Management Fees (if applicable).

- Maintenance and Repairs (Budget 5%–10% of gross rent).

- Utilities paid by the owner (Water, Trash, etc.).

- Capital Reserves (Money set aside for future big repairs like roof or HVAC replacement).

Net Operating Income (NOI):

- Effective Gross Income minus Total Operating Expenses. This is the income before your mortgage payment.

Cash Flow:

- NOI minus Annual Debt Service (Mortgage Payments). Positive cash flow is the money you put into your pocket.

These calculations form your rental property financial plan are essential for securing loans.

Conclusion: Achieving Financial Freedom through Property

Building a strong rental property business plan is the single best predictor of your long-term success as a landlord. By thoroughly researching your market, defining your tenant strategy, and creating a meticulous rental property financial model, you eliminate guesswork and build confidence for yourself and any potential investors or banks.

The financial projections section which calculates everything from cash flow to returns is the most complex part of this plan. For entrepreneurs seeking precision and reliability in this area, resources like Excel Business Resource offer high-quality, customizable rental property financial models. These templates simplify complex calculations for projections, maintenance budgets, and ROI analysis, allowing you to focus on finding and managing great properties.

With this detailed blueprint in hand, you are ready to transition from aspiring investor to successful, organized landlord.