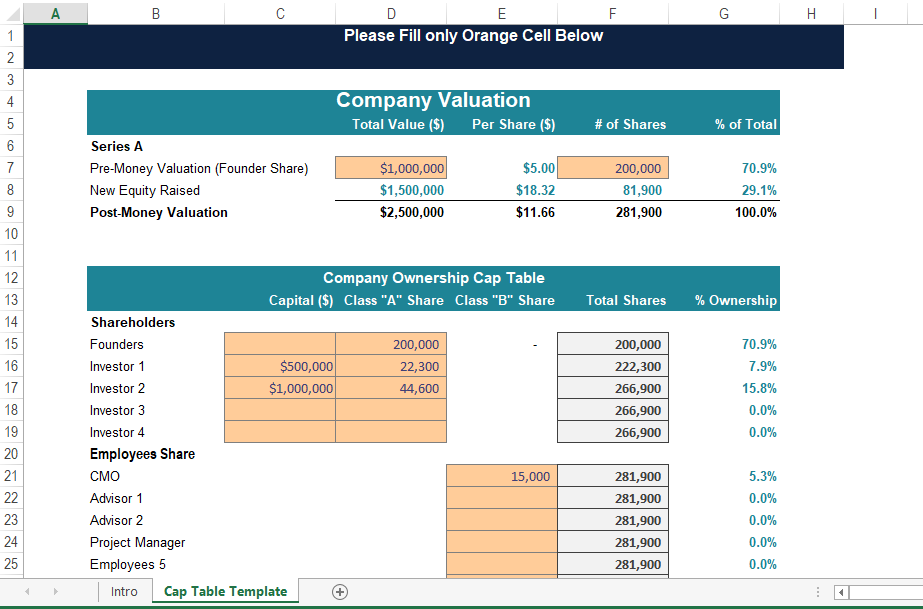

Free Cap table Template

To get started with your Cap Table, download our Excel template for free. It will simplify the process of creating and maintaining your Cap Table, ensuring that you have a clear understanding of your company’s equity distribution.

Why Choose Our Free Cap table Template

- Save 40 Hours of Manual Work

- 100+ Customized Assumptions

- Advanced Valuation Methods Applied

- In-depth Financial Projections

- Free Supports & Error Corrections

Description

Analyze Your Startup Equity with Our Free Cap Table Template

A Cap Table is an invaluable tool for managing equity, especially when attracting investors, issuing employee stock options, or planning for future funding rounds. It provides clarity on ownership and helps with equity-related decisions.

What is a Cap Table for a Startup: A Strategic Asset

A Cap Table for a startup is a strategic asset. It provides clarity on ownership percentages, share classes, and valuations. It is an indispensable tool that helps startups plan their financial strategies and make decisions with confidence.

Why Cap table is important for startup

A Capitalization Table (Cap Table) is critically important for startups for several reasons:

Equity Management: It provides a clear and organized snapshot of the ownership structure, showing who owns how much of the company. This is vital for managing equity, especially when attracting investors or issuing stock options to employees.

Investor Attraction: Investors, such as venture capitalists and angel investors, often request a startup’s Cap Table to assess the company’s ownership and equity distribution. A well-maintained Cap Table can instill confidence in potential investors.

Valuation and Funding Rounds: It assists in determining the company’s valuation and is essential for planning and executing funding rounds. Accurate valuation is crucial when seeking additional funding or negotiating investment terms.

Employee Stock Options: Startups frequently use stock options to attract and retain talented employees. A Cap Table helps in managing these stock options, calculating their impact on ownership, and ensuring that employees are fairly compensated.

Decision Making: Having an up-to-date Cap Table empowers startup founders and management to make informed financial decisions. It helps in strategizing equity distribution, potential dilution, and the impact of various scenarios on ownership.

Legal and Compliance: Maintaining an accurate Cap Table ensures compliance with legal and regulatory requirements, such as reporting to authorities and adhering to securities laws.

Succession Planning: As startups grow, they may undergo changes in ownership and management. A Cap Table helps in planning for these transitions, managing the impact on financial statements and equity stakeholders.

1 review for Free Cap table Template

Only logged in customers who have purchased this product may leave a review.

Our Financial Modeling Services specialize in

Customized Spreadsheets

Tailored to met your unique financial needs.

Comprehensive Training

Empowering you to use models effectively.

Accurate Projections

Make informed decisions with confidence.

We prepare comprehensive plan to launch and grow startup with

Data-Driven Market Research

Detailed market analysis and SWOT insights

Business Model Canvas

Clear visualization of your business structure

Financial Projections

Valuation and forecasts to showcase your potential

What our clients say about us

Most Frequently Asked Questions (FAQs)

Absolutely! The model is designed with a user-friendly interface, clear instructions, and pre-built formulas to help even those without advanced financial expertise use it effectively.

Yes, the template includes both scenario and sensitivity analysis features. You can evaluate the impact of changes in pricing, demand, costs, and more to make informed decisions.

The template is fully compatible with Microsoft Excel & Google Sheet.

Yes, we offer fully customizable templates to fit your specific business needs. If you require additional changes, we also provide customized services—just contact us to discuss your requirements.

We offer a 7-day 100% money-back guarantee. If you’re not satisfied with the model, simply let us know within this period for a full refund.

If you encounter any errors, we’ll rectify them free of charge. Our commitment is to deliver an error-free and reliable financial model for your business

Yes, our financial models are designed to be versatile and work across various industries and business stages, from startups to established companies. You can easily adapt the inputs to reflect your specific business dynamics.

Absolutely! We provide email support to assist you with any questions or issues you may have while using the financial model.

Jeramy –

This free cap table template is a fantastic tool for any founder. It’s clean, simple, and incredibly easy to use, providing a clear and organized view of our company’s ownership in minutes. It’s a perfect, no-cost solution for getting started and gaining confidence. I highly recommend it!