Understanding the lifecycle of startup funding rounds is crucial for every founder, investor, and aspiring entrepreneur.1 This staged approach, from pre-seed to IPO, is the financial backbone of innovation, providing the necessary capital to transform a brilliant idea into a market-dominant business.

This comprehensive guide breaks down the essential startup funding stages, their distinct purposes, the key players involved, and how each round is deliberately structured to build upon the successes of the last, creating a clear path to scale.

The Purpose of Staged Funding: Why Not Raise It All at Once?

Startups raise capital in distinct rounds for several critical reasons, a strategy that is core to both investor risk management and founder efficiency.

- De-Risking & Valuation: Early-stage companies are high-risk. By raising smaller, staggered amounts, a startup reduces the initial financial burden on investors. As the company achieves key milestones (e.g., product launch, first revenue, product-market fit), its perceived risk decreases and its valuation—its worth—increases. This allows the founders to sell less equity for more capital in later rounds.

- Milestone-Based Capital: Each round is tied to specific, measurable milestones. Money from one round is used to achieve the goals that make the company attractive for the next round. This creates a virtuous cycle of growth and efficiency.

- Strategic Partners: Different stages require different types of expertise. Early rounds bring in angels with industry knowledge, while later rounds introduce large Venture Capital (VC) firms that offer connections and operational scaling expertise.

Learn more about: How VC evaluate Startups

Startup Funding Stages: A Linear Progression of Growth

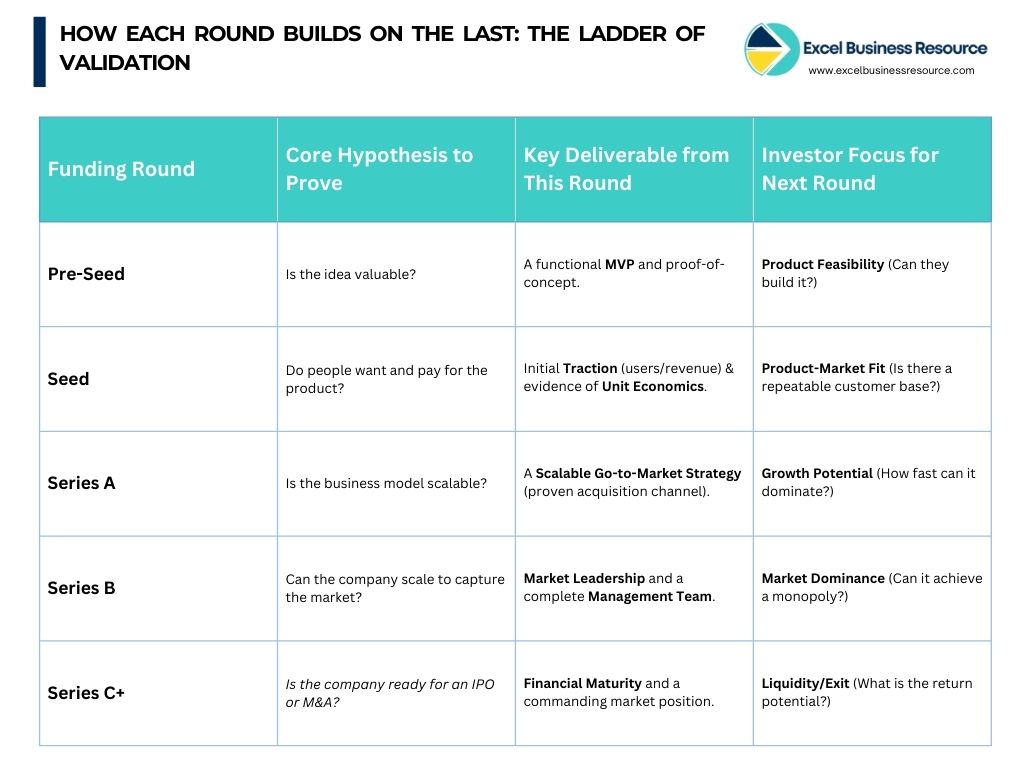

The startup funding journey typically follows a clear, ladder-like progression. Each step up the ladder represents a higher valuation, lower risk, and greater expectations for performance.

Pre-Seed Funding: The Idea Validation Phase

The Pre-Seed round is the earliest stage, often before the company is officially incorporated.

- Purpose: To validate the core idea, conduct market research, and build a Minimum Viable Product (MVP) or prototype.8 It’s about getting the idea off the ground.

- Average Range: Typically, $$$50,000 to $$$1,000,000.

- Key Investors:

- Founders: Initial self-funding or “bootstrapping.

- Friends & Family (“F&F”): Personal network investments.

- Angel Investors: High-net-worth individuals making early, high-risk investments.

- Accelerators/Incubators: Programs that offer a small amount of capital alongside mentorship.

- Milestones for Next Round (Seed): A working MVP, initial user feedback, validation of the core problem/solution, and a clear business model hypothesis.

Seed Funding: Planting the Growth Foundation

The Seed round is the first formal equity round, where the company’s valuation is established, and investors receive a percentage of ownership (equity).

- Purpose: To transform the MVP into a market-ready product, hire the initial core team (engineering, sales, marketing), and achieve initial traction and revenue. This capital is the “seed” for future growth.

- Average Range: Typically, $$$1,000,000 to $$$5,000,000.

- Key Investors:

- Angel Investors: Often in syndicates.

- Micro VCs: Smaller venture capital firms focused on early-stage opportunities.

- Seed-Focused VC Funds.

- Milestones for Next Round (Series A): Demonstrating Product-Market Fit (PMF)—evidence that the product satisfies a market need and can monetize customers efficiently. This is often shown through consistent Monthly Recurring Revenue (MRR) growth and strong unit economics.

Series A Funding: Proving the Business Model

Series A is a critical pivot, moving from proving the product works to proving the business model can scale. Investors here look for a strong, repeatable, and scalable mechanism for acquiring and retaining customers.

- Purpose: To scale the proven model. Funds are directed toward optimizing operations, expanding the sales and marketing funnels, and further product enhancement.

- Average Range: Typically, $$$5,000,000 to $$$25,000,000.

- Key Investors:

- Venture Capital (VC) Firms: Professional investors who typically take a board seat and provide strategic guidance.

- Strategic Investors: Corporate VCs that offer industry-specific advantages.

- Milestones for Next Round (Series B): Significant and defensible market traction, strong growth metrics (e.g., $1M+ in Annual Recurring Revenue, or ARR), and a solid full management team in place.

Series B Funding: Scaling and Market Expansion

The Series B round is focused on scaling the organization to meet the demands of a growing market.

- Purpose: To build out all necessary corporate functions (finance, HR, advanced product development), expand into new markets or product lines, and fend off competition to solidify market position.

- Average Range: Typically, $$$20,000,000 to $$$50,000,000.

- Key Investors:

- Larger VC Firms: Often with a “Growth Equity” focus.

- Late-Stage VC Funds: Firms that invest in companies nearing significant scale.

- Milestones for Next Round (Series C): Establishing clear market leadership, a well-defined competitive advantage, and a clear path to generating a significant revenue volume.

Series C, D, and Beyond: Market Domination and Exit

These later-stage rounds are about moving toward market domination and preparing for a major liquidity event, like an Acquisition or an Initial Public Offering (IPO).

- Purpose: To make “giant moves,” such as acquiring competitors, expanding globally, developing new flagship products, or securing the company’s position as a category leader.

- Average Range: $$$50,000,000 and higher.

- Key Investors:

- Growth Equity Firms.

- Hedge Funds and Investment Banks.

- Late-Stage VC Firms.

- The Exit: The ultimate goal for most venture-backed startups, where investors realize a return on their investment. This is often through an IPO (selling shares to the public) or a Merger and Acquisition (M&A) by a larger company.

How Each Round Builds on the Last: The Ladder of Validation

The entire funding process is a testament to validation, proving a hypothesis at each stage before moving on to the next, higher-stakes challenge.

Conclusion

Funding is one of the most important aspects of building a successful startup. By understanding the different funding sources available and strategically choosing the right ones for your business, you can set your company up for long-term growth and success. From pre-seed funding to venture capital, each funding stage presents its own opportunities and challenges.