What is Valuation

Imagine you’re a SaaS founder on the cusp of raising your next round of funding. You’ve built a product that’s gaining traction, but now comes the big question: What’s your company really worth? This isn’t just about numbers—it’s about unlocking fair deals for everyone involved. SaaS valuation is the process of determining the total worth of a SaaS company. This valuation is not only important for founders but essential for angel investors and VCs as well. Founders want to raise investments based on the valuation, while investors aim to secure fair equity in return. Hence, it creates a win-win situation.

The key question is: How do all stakeholders find the true valuation of SaaS startups? The answer lies in financial modeling. A financial model is a forecasting tool for future earning potential based on various factors that play vital roles in the valuation. Moreover, it’s essential to understand that every industry has different revenue models, growth opportunities, earning multiples, investment required, and costs to execute the business—therefore, the valuation approach differs for every industry. We’ve heard of DCF valuation approach, Comparable Analysis, and Asset-based Valuation, which are widely used. But two critical factors stand out: the startup stage and the SaaS business model.

Valuing a SaaS startup is more challenging than traditional companies. Unlike businesses with physical assets, inventory, or limited markets, SaaS models feature recurring revenue, software infrastructure, intellectual property, value propositions, R&D teams that pivot based on market demand, headcounts, and a global market with quick scaling potential.

In a SaaS financial model, many elements differ when valuing a SaaS company. By understanding SaaS valuation drivers and attributes, you can ensure you’re not making a bad deal or underestimating your company’s worth. At Excel Business Resource, with our years of experience helping startups like yours, we’ve seen how mastering these can lead to successful exits and investments.

Types of SaaS Valuation Methods

Depending on the profitability and maturity of your SaaS business, selecting a valuation method can be strategic, aiming to optimize the multiplier applied to your earnings. Three primary methods exist for valuing a (software-as-a-service) SaaS company based on its earnings:

- SDE (Seller Discretionary Earnings) Based Valuation

- EBITDA Based Valuation

- Revenue or ARR based Valuation

When assessing SaaS business valuations, smaller companies often prioritize SDE, while larger ones lean towards EBITDA. However, for SaaS companies, neither of these approaches may suffice. Let’s delve deeper into this matter.

Revenue based Valuation:

The initial method for valuing a software business involves Annual Recurring Revenue (ARR). ARR-based buyers are inclined to pay multiples of ARR due to the perceived value of recurring revenue, a trend increasingly favored by private equity firms.

While some view this as a secondary valuation approach, we argue that a revenue-based valuation is optimal, particularly if your SaaS Startup has recently attained product-market fit (PMF), is driving T2D3 growth, or has achieved a revenue range of $1 to $100 million ARR.

At Excel Business Resource, we refer to these stages of SaaS growth as ‘Start’ and ‘Scale.’ With SaaS business models relying on subscription-based revenue, they can swiftly reach PMF and generate ARR or MRR (Monthly Recurring Revenue).

To qualify for a valuation based on revenue multiples, your ARR should exceed $2 million, accompanied by year-over-year growth rates exceeding 50%.

If your SaaS company is undergoing hyper-growth or intends to do so, opting for a revenue-based valuation over an EBITDA-based one is advisable, as your revenue is poised to surge, even if profitability may not be immediate. Tools like our SaaS financial model template Excel can help forecast this growth accurately.

SDE based Valuation:

For small businesses valued at under $5 million, the typical approach involves using a multiple of seller discretionary earnings (SDE), also known as seller discretionary cash flow. This method is especially common for businesses with slower growth rates and lacking a formal management team.

SDE (Seller Discretionary Earnings) represents the profit retained by the business owner after subtracting all costs of goods sold and essential (non-discretionary) operating expenses from the gross income. Notably, any owner salary or dividends can be added back to the profit figure.

In simpler terms, SDE can be described as:

SDE: Revenue- Cost of Services – Operating Expenses + Owner’s Compensation

SDE serves as a crucial metric in valuing small businesses, as it reveals the genuine earning potential at their core. Given that many small businesses are operated by their owners and depend to some extent on their involvement, there are associated owner salaries and expenses. Owners often compensate themselves with a salary that might not align with market rates and may also utilize the business for tax-efficient personal expenditures. These adjustments, known as addbacks, are legitimate inclusions to accurately reflect the business’s true earning capacity. For startups, integrating this into a startup business plan template PDF can provide a solid foundation.

EBITDA based Valuation:

Let’s imagine your software company has achieved the rule of 40, indicating a healthy balance between growth and profitability, or you boast a notably low customer acquisition cost (CAC).

In larger corporations, where the organizational structure involves numerous employees and management personnel, ownership tends to become more fragmented, with multiple shareholders often playing less active roles. They might hire a general manager or CEO to oversee day-to-day operations. In such scenarios, any owner compensation or discretionary expenses should be accounted for within the business to accurately depict its true earning potential.

For potential buyers evaluating an EBITDA Valuation in the SaaS realm, the focus lies on the company’s capacity to generate robust cash flows. Private Equity firms, for instance, might seek these strong cash flows to facilitate borrowing.

Moreover, the EBITDA model emphasizes profitability, enabling SaaS companies below the $5 million revenue mark to still command high multipliers. In such cases, opting for an EBITDA-based valuation might yield the most favorable multiplier for your SaaS business.

EBITDA, representing Earnings before Interest, Taxes, Depreciation, and Amortization, proves advantageous for companies with substantial profits.

To calculate your SaaS Company’s EBITDA, utilize the following formula:

Net Income + Interest + Taxes + Depreciation + Amortization

This method considers various factors pertinent to mature, established businesses, making EBITDA valuation a preferred choice for companies boasting earning power exceeding $5 million ARR. Our financial model Excel template can streamline this calculation.

Download Free DCF Valuation Model Template. Perfect for building your own financial modeling Excel templates free.

Now that we’ve discussed valuation methodologies, let’s delve into the main reason you’re here: identifying the SaaS valuation multiplier.

Valuation Multiples

Valuation multiples are key in setting fair prices for SaaS businesses and staying up-to-date with market trends. While the idea is straightforward multiplying average net profits by a specific factor it’s essential to grasp the intricacies and metrics influencing these multiples.

For instance, B2B software companies can be worth anywhere from 3x to 15x their yearly revenue. This depends on various factors, including who’s doing the valuation and what other similar companies are valued at in the industry.

In a business valuation for software companies, the listing price is:

Average net profit for the last year x multiple

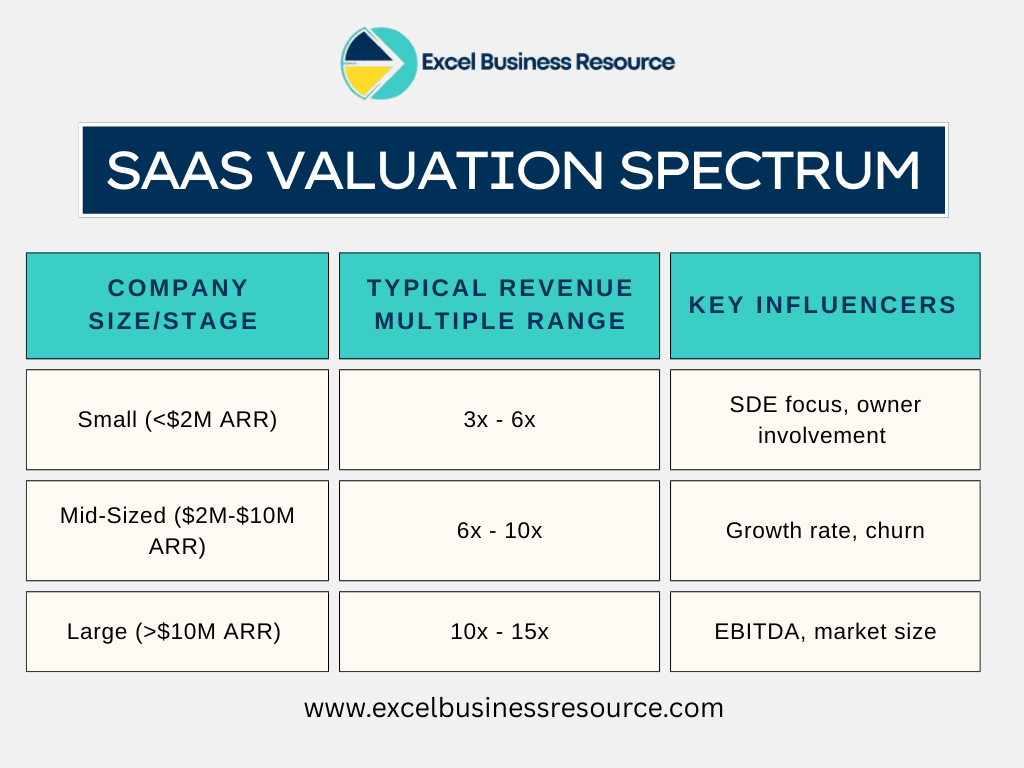

As a general rule of thumb, the B2B SaaS valuation spectrum looks something like this:

But how do you figure out your SaaS multiple? While some factors that influence it might be beyond your control, here are some key valuation attributes to concentrate on:

Choice of Multiple

Choosing the Right Metric: EV/Revenue is the top choice for valuing SaaS companies. This makes sense because, as many SaaS firms prioritize growth over profits, traditional profit-based multiples may not accurately reflect their value. For instance, if a company trades at 5.0x Revenue and forecasts a 30% EBITDA margin, it hints at a future 16.7x EV/EBITDA multiple.

Revenue Multiple:

From our years of experience, we’ve found that basing the revenue multiple on annualized current run-rate revenue gives the most accurate picture of a business’s scale. We steer clear of using trailing or projected revenue. However, it’s important to mention that our analysis excludes B2C SaaS companies and B2B companies with annual revenue per customer under $500 due to their unique customer acquisition and retention strategies.

Public vs. Private Multiples:

Typically, we start the valuation process by looking at the median revenue multiple of public SaaS companies. From there, we adjust to calculate the private multiple based on ARR (annualized run-rate revenue). As a rule of thumb, we subtract 1.3 to account for the risks associated with smaller, private companies and the lack of liquidity in their stock. Over time, this discount of 1.3 times revenue has remained relatively stable.

Growth Premium:

How fast your company is growing compared to others can significantly impact its valuation. Smaller companies often find it easier to achieve rapid growth. As a rough guideline, if your business is growing at double the average rate, its valuation multiple could increase by 50%. So, the quicker your company grows compared to similar-sized SaaS firms, the higher its valuation multiple may be.

Other Important Metrics:

Several key metrics can impact the value of a SaaS company:

Addressable Market Size: Larger markets tend to result in higher multiples.

Retention Rate: Strong customer retention rates can greatly enhance valuation.

Gross Margins: Higher margins typically lead to better valuations.

Capital Efficiency: Using capital efficiently can result in higher multiples.

CLTV vs CAC Analysis: This customer lifetime value vs customer acquisition cost ratio comparison is an essential metric to value a SaaS startup. A higher ratio means a SaaS startup is earning more revenue from each customer than its customer acquisition. Download our free template to analyze CLTV vs CAC for your startup.

What is the rule of 40 in SaaS?

The Rule of 40 in SaaS valuation is a guideline used to evaluate the overall health and attractiveness of a software-as-a-service (SaaS) company. It suggests that a SaaS company’s combined annual growth rate (typically measured as revenue growth) and profit margin (typically measured as EBITDA margin) should sum up to at least 40%.

For example, let’s say a SaaS company has a revenue growth rate of 30% and an EBITDA margin of 15%. To calculate the Rule of 40 number:

30% (revenue growth) + 15% (EBITDA margin) = 45%

Since 45% is greater than the Rule of 40 threshold of 40%, this SaaS Company meets the criteria and is considered an attractive investment opportunity according to the Rule of 40.

Important Metrics To Consider While Valuing A SaaS Company

When valuing SaaS companies, it’s crucial to consider a variety of essential metrics. These metrics provide valuable insights into the company’s performance, potential, and overall value. Let’s delve into each of these metrics in detail:

Gross Margins (GM):

This metric represents the difference between a company’s net sales revenue and its cost of goods sold. A higher gross margin indicates better efficiency in generating profits from sales revenue. Ideally, SaaS companies should aim for gross margins of 80% or more.

Scalability:

Scalability refers to a company’s ability to handle growth efficiently. The Ansoff Matrix is a useful tool for assessing growth opportunities and considering factors such as market size, growth potential, and the cost of expansion. Companies with higher revenue can pursue larger acquisitions or even prepare for an IPO.

Year-over-Year (YOY) Growth Rates:

YOY growth rates measure the percentage change in a company’s performance over the past 12 months. SaaS buyers typically prefer growth rates between 10% and 20%, avoiding rates exceeding 40%, which may indicate potential risks or unsustainable growth.

Total Addressable Market (TAM):

TAM represents the total revenue opportunity available for a specific product or service within a defined market. SaaS companies should target markets with ample growth opportunities, typically with TAMs closer to $1 billion rather than $100 million.

Understand: Why TAM is Important in Startup Valuation

Competitive Landscape and Customer Acquisition Cost (CAC):

The competitive landscape can impact various aspects of a SaaS company, including customer acquisition costs, SEO growth, and intellectual property rights. Understanding your positioning and value proposition is crucial, especially in highly competitive markets.

Download Free: Template to analyze CLTV vs CAC of your Startup.

Owner Involvement:

Owners looking to exit their SaaS company must reduce their operational involvement and ensure the presence of strong technical knowledge within the company. Lack of expertise can hinder operations and diminish attractiveness to investors.

Company Age:

The age of a company can influence its perceived value. Typically, businesses that are at least two years old are preferred by investors, with older companies often commanding premium multiples.

Diversity and Customer Concentration:

Diversification across customer segments and channels is essential to mitigate risk. Relying heavily on a single client or channel can deter investors, as it poses a higher level of risk to the business.

Value Proposition:

A compelling value proposition that addresses significant pain points in the industry is crucial for attracting and retaining customers. Well-defined messaging and positioning validated by the ideal customer profile (ICP) and product-market fit (PMF) are key to driving customer engagement and loyalty.

Customer Acquisition Channels:

The effectiveness of customer acquisition channels, such as inbound and outbound marketing strategies, significantly influences a company’s valuation. Diverse marketing channels allow for expansion opportunities while optimizing existing channels.

Company Assets:

Proprietary technology, data assets, and an experienced management team are valuable assets that contribute to a company’s overall value. These qualities are often overlooked but can significantly impact valuation.

Public Market Valuations:

Public market valuations of SaaS companies can influence private company valuations. It’s essential to consider market trends and valuations of comparable companies when determining a SaaS company’s worth.

By analyzing these metrics in detail, stakeholders can gain a comprehensive understanding of a SaaS company’s value and make informed decisions regarding investments, acquisitions, or exits. For hands-on application, our business plan Excel template integrates these metrics seamlessly.

Navigating SaaS Metrics: A Journey through Company Lifecycle

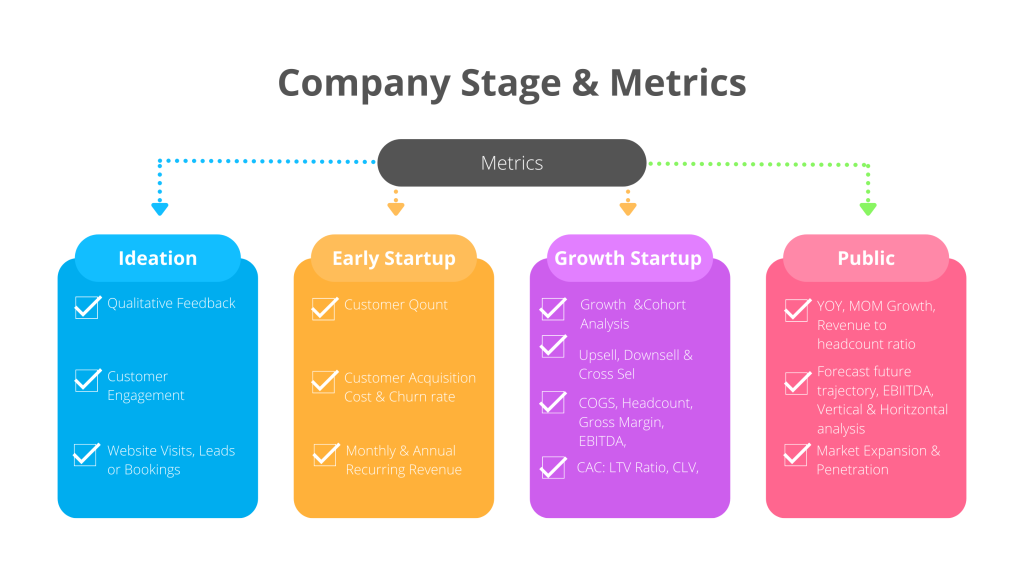

As SaaS companies evolve, understanding various key metrics becomes crucial for assessing organizational health and optimizing business strategies. The importance and relevance of these metrics shift throughout the company lifecycle. Let’s explore the different growth stages and the key metrics associated with each.

Super Early Stage:

In the nascent phase, companies focus on product-market fit with less emphasis on detailed financials. As they progress to Series A funding, key metrics include Monthly Recurring Revenue (MRR) or Annual Recurring Revenue (ARR), No. of Subscriptions, No. Of traffic, Customer Acquisition Cost (CAC), and marketing and sales expenditures.

Early Stage:

As traction builds and the company moves through Series C and D rounds, attention shifts to expansion and efficiency. Key metrics now include Customer Lifetime Value (CLTV) to revenue ratio, gross margin, churn rates, and ARR.

Growth Stage and Beyond:

For companies reaching IPO and beyond, new metrics take precedence as management aims for future visibility. Priorities include overall expenses, deferred revenues, EBITDA, and customer growth over time.

SaaS Valuation Trends in 2025

As we navigate 2025, SaaS valuations are evolving amid economic shifts and technological advancements. The global SaaS market is valued at $247 billion this year, with projections reaching $908 billion by 2030 at a robust CAGR. Median private SaaS valuation multiples stand at 7.0x current run-rate ARR, reflecting a return to more normalized levels seen in 2016-2017, though highs are higher for top performers.

AI-integrated SaaS sectors are commanding premium multiples, with industries like AI-driven analytics seeing elevated valuations due to their growth potential. For fast-growing companies (above 16% median growth), multiples average 10.74x. However, overall medians dipped to 3.0x next twelve months (NTM) revenue in Q2 2025, a 10% decline, signaling caution amid market volatility.

Public comps highlight this: Snowflake trades at 80-100x ARR for its hyper-growth phase, while mature players like Salesforce hover at 6-10x. Venture funding remains resilient, with $22 billion in Q2 for enterprise SaaS. These trends underscore the need for balanced growth and profitability—factors you can model using our SaaS revenue forecast model Excel.

Actionable Steps to Value Your SaaS Company

Ready to put this into practice? Here’s a step-by-step guide to valuing your SaaS business:

- Gather Key Data: Collect your ARR/MRR, growth rates, churn, CAC, CLTV, and gross margins. Use our financial model template Excel for organization.

- Choose a Method: If under $5M ARR, start with SDE. For growth-focused, use revenue multiples. Mature firms? Go EBITDA.

- Apply Multiples: Benchmark against industry comps (e.g., 7x ARR for 2025 medians). Adjust for your growth premium or risks.

- Forecast Future Cash Flows: Build a DCF model to project earnings. Download our free DCF template here.

- Validate with Metrics: Check Rule of 40 compliance and TAM. Run CLTV:CAC analysis.

- Seek Expert Review: Consult professionals for accuracy. At Excel Business Resource, our financial modeling services can refine your model.

This process ensures a robust valuation, whether for fundraising or exit planning.

Real-World SaaS Valuation Examples

To bring this to life, consider Snowflake, a cloud data platform. With hyper-growth, it achieved valuations around 80-100x ARR during its peak, driven by strong retention and a massive TAM in data analytics. Closer to home, imagine a B2B SaaS startup with $3M ARR and 60% YOY growth: Using a 8x multiple (adjusted for 2025 trends), it could value at $24M, factoring in low churn and efficient CAC.

Another example: A mature SaaS like Zoom, post-pandemic, settled at 40-50x ARR, balancing profitability with expansion. These cases show how metrics like growth and margins directly influence outcomes. For your startup, adapt these using our B2B SaaS financial model template.

Bottom Line

Having access to SaaS valuation data is vital for business owners, potential buyers, and management teams alike. Regardless of your position in negotiations, grasping the genuine value of the company is crucial. Without this understanding, there’s a risk of making misguided investments or settling for a sale price significantly below your actual worth.

For small businesses seeking an exit or investment, comprehending how investors value your business empowers you to assess in advance whether pursuing capital is worthwhile or if holding out for a bit longer is a better strategy.

At Excel Business Resource, our team of experts brings decades of experience in financial modeling for SaaS startups, from coworking space business plans to renewable energy financial model Excel. We’ve helped over 50 founders achieve optimal valuations through tailored templates like our startup business plan sample PDF and SaaS financial model template. Trust our authoritative insights to guide your journey—contact us for a free consultation today.

Hammad Hasan

MBA, FMVA, is a CEO & Founder at Excel Business Resource with 5+ years in SaaS financial modeling. His expertise has been featured in industry reports, ensuring trustworthy, data-driven advice.