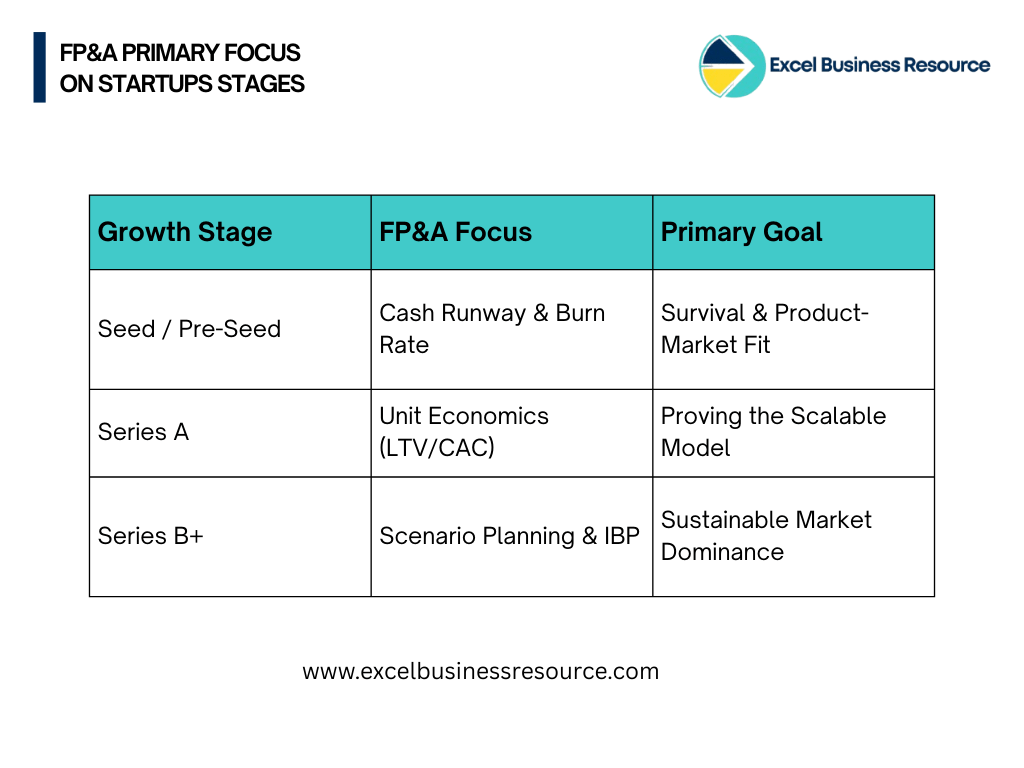

In the early days of a startup, the “financial plan” is often a simple calculation: Cash in bank divided by monthly burn equals months of life. It’s survival math. But as you move from proving a concept to scaling a business, survival math is no longer enough.

At Excel Business Resource, having partnered with 100+ startups through their most volatile growth phases, we’ve observed a consistent pattern: the startups that successfully transition from “scrappy” to “sustainable” are those that treat Financial Planning & Analysis (FP&A) not as a back-office accounting task, but as a strategic co-pilot.

If scaling is about increasing the velocity of your business, FP&A is the dashboard that ensures you don’t run out of fuel or hit a wall at 200 mph.

What is FP&A? Beyond the Spreadsheet

To understand how FP&A helps startups scale, we must first define what it actually means in business landscape.

While traditional accounting looks at the past (reporting what happened last month), Financial Planning & Analysis (FP&A) is obsessed with the future. It is the bridge between your high-level vision and your daily operational reality.

At its core, FP&A is the disciplined process of:

- Planning: Setting measurable, data-backed financial goals.

- Budgeting: Strategically allocating capital to the most efficient growth levers.

- Forecasting: Using current performance to predict where the company will be in 6, 12, or 18 months.

- Analysis: Investigating why reality differed from the plan and how to pivot.

For a startup, FP&A is the “Strategic Truth.” It turns “I think we’re growing” into “We are growing at 12% MoM with a 4:1 LTV/CAC ratio, and we have 14 months of runway.”

How FP&A Helps Startups To Scale

Scaling isn’t just “growing bigger”; it’s growing efficiently. Here is how a robust FP&A function acts as the catalyst for that efficiency.

Mastering Unit Economics Before Pouring Fuel

Scaling a business with broken Unit Economics is the fastest way to go bankrupt. If your Customer Acquisition Cost (CAC) is higher than your Lifetime Value (LTV), every new customer actually moves you closer to failure.

FP&A professionals dive deep into the data to find the “Payback Period.” Once we identify that your unit economics are profitable and repeatable, you can confidently “pour fuel on the fire” by increasing marketing spend or sales headcount.

Scenario Simulation: The “What-If” Engine

In the volatile startup world, your “Plan A” is almost certainly going to change. FP&A provides financial modeling and scenario simulation to prepare for every outcome.

- What if our churn rate increases by 2% next quarter?

- What if our next funding round is delayed by three months?

- What if we pivot our pricing from per-user to usage-based?

By modeling these scenarios, we remove the “panic” from decision-making. You already have a playbook for the best and worst cases.

Resource Allocation & Opportunity Cost

Every dollar spent on a new marketing campaign is a dollar not spent on R&D. FP&A quantifies these trade-offs. By analyzing data analysis and historical performance, we help founders understand where their next dollar will generate the highest ROI. This prevents the “spray and pray” approach to spending that kills most Series A startups.

Investor Readiness & Valuation

When you are raising capital, investors are buying your future, not your past. A sophisticated Financial Forecasting model proves to VCs that you have a professional grip on your business. It justifies your Startup Valuation by showing a clear, data-driven path to profitability or the next major milestone.

How to Know When Your Startup is Ready for FP&A

One of the most common questions we receive at Excel Business Resource is: “When should I stop doing this myself and hire a professional?”

While there is no “magic revenue number,” there are specific behavioral triggers that indicate you’ve outgrown your basic spreadsheets:

- The “Reactive” Runway: If you only talk about your cash runway when it gets dangerously low, you are already behind. FP&A should be telling you your runway 12 months in advance.

- Decision Paralysis: You are faced with a major hire or expansion, but you can’t quantify the financial impact of that choice.

- Data Disconnect: Your sales team reports one set of numbers, your marketing team another, and your bank account shows a third. You lack a “single source of truth.”

- Board Pressure: Your investors are asking for more than just a P&L; they want cohort analysis, burn-rate trends, and variance reporting.

The Most Complex Situation For Startups Is: When startup has moved beyond a single product or a single market. Multi-currency, multi-entity, or multi-channel growth is impossible to track accurately in a standard Business Plan Template.

Tips to Hire the Best FP&A Professional for Your Startup

Hiring for finance in a startup is different than in a corporate environment. You don’t just need a “numbers person”; you need a “business person who speaks math.”

Look for a “Commercial Mindset”

A great FP&A hire won’t just tell you that you’re over budget; they will tell you why and suggest an alternative strategy to hit your goals. They should be a Financial Modeling Consultant in spirit—someone who seeks to solve business problems using data.

Prioritize Systems Thinkers

In a scaling startup, the “system” is often broken or non-existent. You need someone who can build the architecture—integrating your CRM, ERP, and billing systems—so that data flows automatically into your Financial Model Template for Startups.

The “Ambiguity Test”

Interview candidates on how they handle incomplete data. In a startup, you never have 100% of the information. You need someone who is comfortable making high-probability assumptions and refining them over time, rather than someone who gets “stuck” waiting for a perfect audit.

Consider the “Fractional” Route First

For many startups between Seed and Series B, a full-time, high-level FP&A Director is an expensive overhead. This is where Financial Modeling Services or a fractional Startup Advisory Service provides the most value. You get the C-suite expertise and 100+ startup experience of a firm like Excel Business Resource at a fraction of the cost of a full-time hire.

The Future Of FP&A For Startup Scaling

As we move further into 2026, the tools of the trade are evolving. We are seeing a shift from static planning to Integrated Business Planning (IBP), where finance, operations, and sales are linked in real-time.

With the rise of predictive AI, FP&A is no longer just about calculating what might happen; it’s about identifying patterns that the human eye misses—like a slight decay in customer retention before it shows up in the churn metrics.

At Excel Business Resource, we believe that the soul of a startup is its vision, but its heartbeat is its cash flow. By institutionalizing FP&A early, you aren’t just “keeping the books”; you are building the foundation for a legacy company.

Your Next Step toward Scaling

Scaling is hard, but you don’t have to do it in the dark. Whether you need a bespoke Startup Financial Model Template to impress your board or a dedicated Financial Modeling Consultant to guide your next big move, we can help.

With our experience helping 100+ startups navigate these exact waters, we provide the clarity you need to lead with confidence.

People Also Ask

Think of accounting as your "rearview mirror" it records what happened last month to ensure compliance. Financial Planning & Analysis (FP&A) is your "windshield." While an accountant tells you how much you spent on marketing, our FP&A for Startups service tells you how much that spend will return in revenue six months from now. At Excel Business Resource, we move you from simply "keeping the books" to "steering the ship" using predictive data analysis.

It usually happens when your business decisions start carrying higher stakes. If you are preparing for a funding round, hiring your first 10 employees, or launching a second product line, a static Business Plan Template is no longer enough. You need Financial modeling and scenario simulation to stress-test your assumptions. If your current model can’t tell you your exact "Zero Cash Date" under three different sales scenarios, it’s time for a professional upgrade.

Hiring a full-time CFO at the Seed or Series A stage is often an expensive "over-hire." A Financial Modeling Consultant provides the high-level strategic oversight and Startup Advisory Services you need at a fraction of the cost. We’ve worked with 100+ startups, meaning we bring "pattern recognition" to your business—we already know where the typical cash leaks happen and how to fix them before they become terminal.

Investors don't just look at your vision; they look at the integrity of your logic. Our Financial Model Template for Startups is built to be "audit-ready." It clearly separates inputs (assumptions) from outputs (results), features dynamic Unit Economics (LTV/CAC ratios), and includes a professional Startup Valuation based on market benchmarks. This level of transparency builds immediate trust, showing investors that you are a disciplined steward of their capital.

Absolutely. You cannot scale what you cannot measure. Through rigorous data analysis, we identify which customer segments are profitable and which are draining your runway. By pinpointing your "Payback Period" and "Contribution Margin," our Financial Modeling Services help you optimize pricing and marketing spend. We don't just report your numbers; we help you re-engineer them to ensure every dollar you spend on growth is a dollar well-invested.