If you’re building a Gen AI or Agentic AI startup using a “Standard SaaS” financial playbook, you’re likely headed for a margin crunch.

For a decade, the SaaS mantra was simple: Build once, sell many, and enjoy 80-90% gross margins. In the world of traditional software, the cost of serving one more customer was effectively zero—just a tiny sliver of AWS hosting.

AI SaaS has flipped the script. In the world of LLMs, tokens, and agentic workflows, every “click” has a literal cost. If you don’t account for the weight of GPU compute and inference costs in your Cost of Goods Sold (COGS), your “growth” might actually be burning a hole in your bank account.

To help founders navigate this, I’ve developed a specialized Financial Model Template for AI SaaS Startups specifically designed to handle these volatile variables.

Why AI COGS Scaling is Different

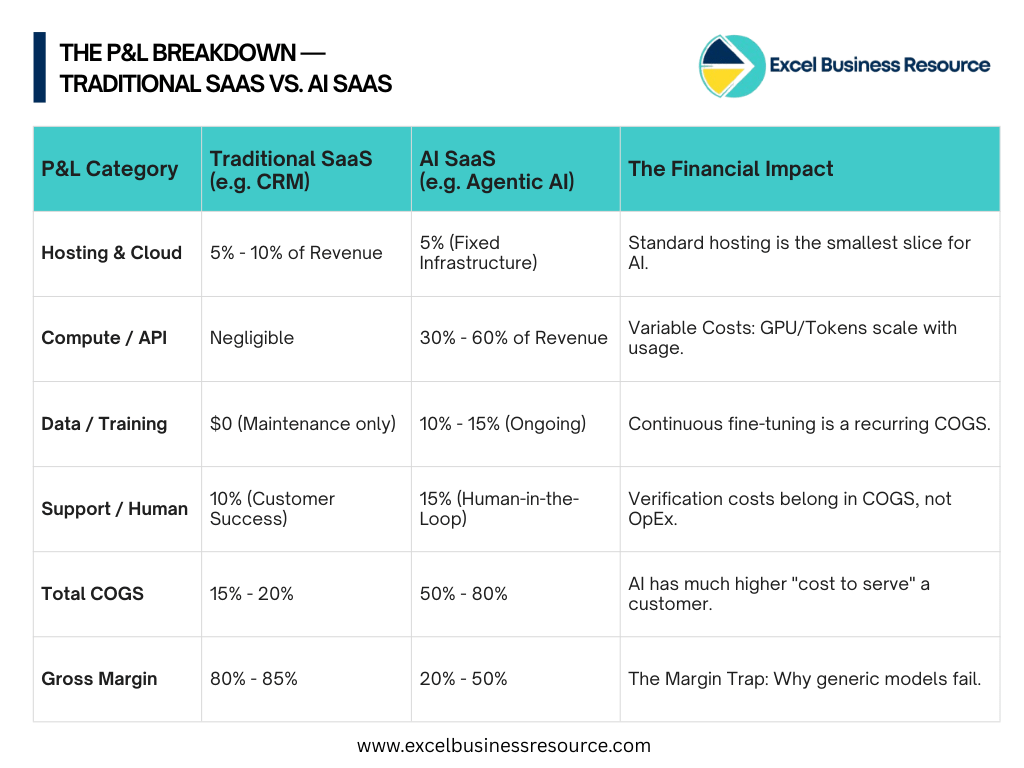

In traditional SaaS (think a CRM or a project management tool), your COGS usually includes hosting, some 3rd party APIs, and customer support. It’s a flat line.

In AI SaaS, your COGS is “alive.” It scales directly with usage.

- The GPU/Compute Tax

Traditional hosting is like renting a house; you pay the rent regardless of how many people walk through the door. AI compute is like running a restaurant; every meal (inference/token) requires fresh ingredients (GPU cycles).

When a user asks an Agentic AI to “Research 50 leads and write personalized emails,” that isn’t just a database query. It’s a high-intensity compute event. If your Financial Model Template for Gen AI startups doesn’t separate “Base Hosting” from “Inference Compute,” your Gross Margin projections will be fiction.

- The Model API Factor

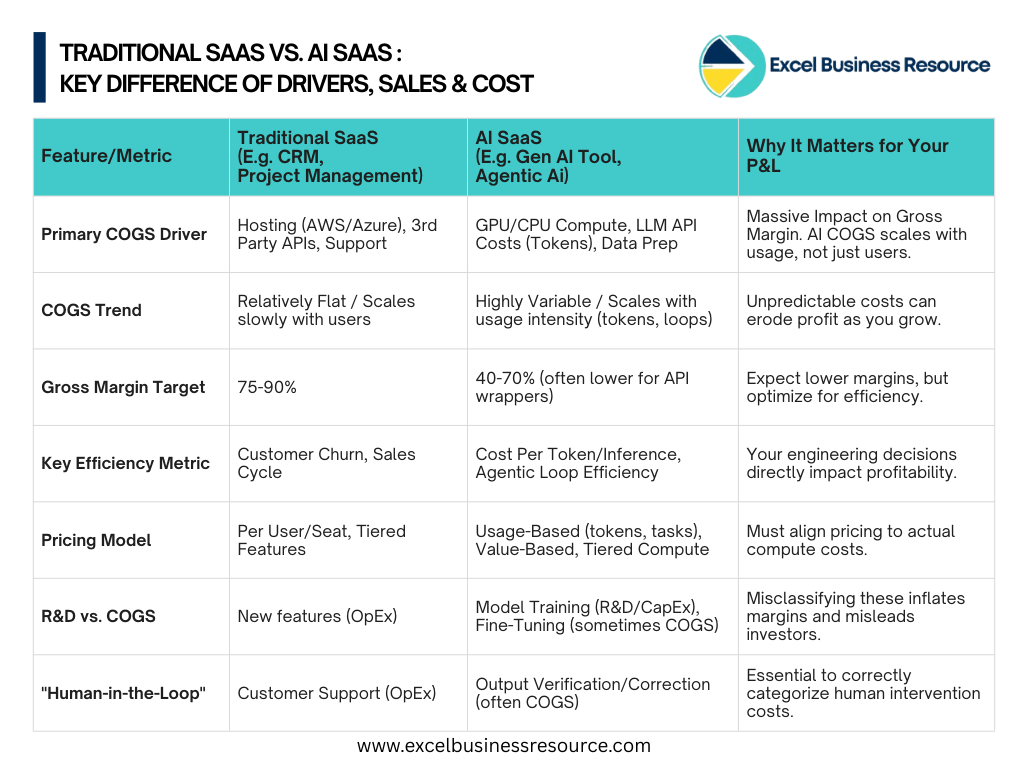

If you are building a wrapper or an application layer on top of OpenAI, Anthropic, or Cohere, you are essentially a reseller of intelligence. Your gross margins are capped by their pricing.

- Traditional SaaS: Gross Margin ~80%

- AI SaaS (API-dependent): Gross Margin ~40% – 60%

Why Gen AI or Agentic AI Kills "Standard" Financial Models

In traditional SaaS, your costs are like a flat monthly gym membership. You pay once, and it doesn’t matter how many times you go. Gen AI or Agentic AI is different. It’s like a high-speed taxi meter that keeps ticking based on how much “thinking” the Agent has to do.

If you use a generic Startup financial model template, you are flying blind. Here is how the “Agentic Loop” can break your P&L if you aren’t careful:

1. The “Agentic Loop”: One Click, Ten Bills

Unlike a simple chatbot that gives a quick answer, a Gen AI or Agentic AI actually works. It researches, writes code, hits an error, and tries again. This “reasoning loop” means one single user request can trigger 10 or 20 hidden API calls.

- The Reality: If your Financial Model Template for Gen AI startups assumes a simple “cost-per-user,” a single “Power User” could accidentally burn through your entire monthly profit in one afternoon. You need to model for Tokens per Task, not just seats.

2. “Brain Tiering”: Your Secret Margin Protector

Smart founders don’t use a “PhD-level” model (like GPT-4o) to do basic data entry. They use Model Routing. They send simple tasks to “Small Brains” (like Haiku or GPT-4o-mini) and only call in the “Big Brains” for complex reasoning.

- The Benefit: Our template helps you calculate a Blended Cost per Task. This ensures your Financial Planning & Analysis (FP&A) reflects how your tech stack actually works, keeping your margins healthy as you scale.

3. Training is an Asset, Not Just an Expense

Fine-tuning your model isn’t just a one-time “oops” on your credit card. It’s an investment in your company’s secret sauce.

- The Shift: A standard Business Plan Template for AI startups just dumps training costs into “General Expenses.” Our specialized model allows you to amortize this “Brain Training.” This keeps your Gross Margins looking clean and professional for investors.

The Bottom Line: In the world of Gen AI or Agentic AI, growth can be your biggest liability if your unit economics are broken. If you aren’t accounting for iteration and routing, you aren’t building a business—you’re building a charity for GPU providers.

The Efficiency Gap: Why Your Engineers Now Control Your Profit Margin

In traditional software, your Financial Planning & Analysis (FP&A) was easy: you spent money on ads (CAC) to get users, and the hosting cost was so small it didn’t matter.

In AI, you can have a million users and still go broke. This is because your Gross Margin is no longer a fixed number—it is a result of how efficient your code is.

The “Margin Gap” Trap

I’ve seen founders pitch a “hockey-stick” growth curve to VCs, only to realize too late that their costs are growing faster than their revenue.

- The Math: If your revenue grows by 100%, but your compute costs grow by 120% (due to “hallucination loops” or inefficient RAG), you are actually losing more money as you scale.

As a Financial Modeling Consultant, I tell my clients: A better prompt or a more efficient RAG pipeline isn’t just a “tech update”—it’s a financial strategy.

- Traditional SaaS: Profit is driven by sales.

- AI SaaS: Profit is driven by Unit Economic Clarity.

If your engineer optimizes a workflow to use 20% fewer tokens, they just instantly increased your company’s valuation. My Startup financial model template is the only one that links these technical efficiencies directly to your EBITDA and Startup Valuation.

How to Build a Sustainable Profit & Loss Statement For AI Startup

To scale effectively, your P&L can’t just be a spreadsheet—it needs to be a strategic map. To compete with the top 1% of AI companies, your financial structure must move beyond “estimated guesses.”

Here is how you build a sustainable AI P&L using the three pillars of modern Financial Planning & Analysis (FP&A):

1. Tiered COGS & Provider Flexibility

In the AI world, your biggest expense is volatile. Your Startup financial model template must be dynamic, not static.

- The Strategy: You need the ability to toggle between LLM providers (OpenAI vs. Anthropic) or compare those costs against self-hosting (vLLM/Ollama).

- The Goal: Seeing how a shift in compute strategy affects your bottom line over 24 months allows you to pivot your tech stack based on margin health, not just performance.

2. Multi-Dimensional Pricing (Beyond “The Seat”)

The “Per Seat” model is dying in AI because value—and cost—is now tied to output, not headcount.

- Usage-Based Pricing: Directly passing token or compute costs to the user to protect your downside.

- Value-Based Pricing: Charging per “Success” or “Task Completed.” If your Agentic AI saves a customer 10 hours of work, that’s where the value lies.

- The Modeling Need: Your Financial Model Template for AI SaaS Startups should help you find the “break-even” point for these complex pricing tiers.

3. The “Human-in-the-Loop” Reality

If your AI requires a human to review or “sanity check” outputs before they reach the client, that isn’t a general office expense—it’s a direct cost of service.

- The Common Mistake: Founders often hide “Human Cloud” costs in OpEx. During due diligence, investors will move this to COGS, instantly tanking your perceived Gross Margins.

- The Expert Move: Categorizing this correctly from Day 1 proves you are a founder who understands the true unit economics of your product.

Download the Ultimate Financial Model Template for AI SaaS Startups

Stop trying to squeeze a Gen AI square peg into a traditional SaaS round hole. If your current spreadsheet doesn’t track the cost of input tokens vs. output tokens, you’re just guessing at your profits.

Whether you need a Financial Model Template for Agentic AI startups or a solid Business Plan Template for AI startups, I’ve built a “ready-to-use” toolkit that does the heavy lifting for you.

Stop wasting time. This template will save you 100+ hours of building complex formulas from scratch. Instead of fighting with Excel, you can spend your time actually growing your business.

Why this is the last template you’ll ever need:

- Master Your Unit Economics: Finally understand your true CLTV (How much a customer is worth) and CAC (What it costs to get them) without the headache.

- Track Your Real Costs: Use the built-in calculator for input/output tokens and GPU expenses so your Burn Rate never catches you by surprise.

- Know Your Startup Valuation: Get professional DCF Valuation and Revenue & EBITDA Multiple models. Be ready to answer any investor’s question during your pitch.

- Predict the Future: Use Sensitivity Analysis to see exactly what happens to your ARR if model prices drop or if your team becomes 10% more efficient.

- Plan Your Growth: A clear hiring roadmap for AI teams—know exactly when you can afford that next ML Ops or Data Science hire.

- Investor-Ready Dashboards: Beautiful, clear charts that show your Burn Rate and ARR in a way that makes VCs want to write a check.

As a Financial Modeling Consultant, I’ve seen too many founders fail because their math was meant for 2015, not 2026. Don’t be one of them.

[Get the Financial Model Template for AI SaaS Startups and save 100+ hours today.]

Final Thoughts: The Consultant Advantage

Financial modeling isn’t just about filling in a spreadsheet; it’s about telling a story to investors that you know exactly how your engine works. As a Financial Modeling Consultant, I specialize in helping founders bridge the gap between “Cool Tech” and “Profitable Business.”

Frequently Asked Questions (FAQ) for AI Founders

No. it’s risky. Standard templates assume your profit margins stay the same as you grow. In AI, your input and output token costs can vary wildly. Our Financial Model Template for AI SaaS Startups is built specifically to handle these fluctuating "compute" costs so you don't accidentally scale a loss-making business.

Investors are now hyper-focused on Unit Economics. They want to see that you understand your CLTV and CAC in the context of high GPU costs. This model includes Investor-Ready Dashboards and Startup Valuation tools (like DCF and Revenue Multiples) that prove to VCs you have a handle on your Burn Rate.

Yes! While it saves you 100+ hours of building from scratch, it’s fully editable. Whether you are B2B, B2C, or an API-first company, you can adjust the Revenue & Cost Drivers to fit your specific product-market fit.

A template is the fastest, most cost-effective way to get your ARR and Burn Rate in order. However, if your business model is highly unique or you are preparing for a Series A+ round, I offer Financial Planning & Analysis (FP&A) consulting to build a custom, iron-clad strategy for your specific tech stack.

Yes. AI startups require different talent than traditional software firms. The template includes a dedicated hiring roadmap for ML Ops, Data Scientists, and Prompt Engineers, including their projected impact on your EBITDA.

If your business model is highly unique perhaps a hybrid of hardware and AI, or a complex multi-layered marketplace, a template might only get you 80% of the way there. As a Financial Modeling Consultant, I can build a bespoke model tailored specifically to your unique revenue drivers and unit economics. This ensures every variable is perfectly aligned with your actual operations.

Absolutely. Many founders have a "working" model that lacks professional formatting or has broken logic. I can take your existing data and "upgrade" it into a professional, investor-ready format. This includes adding Sensitivity Analysis, cleaning up your hiring roadmap, and ensuring your startup valuation (via DCF or Revenue Multiples) is calculated using industry-standard formulas.

Probably not. Sophisticated VCs now look for "Compute-adjusted margins." If your model doesn't show you've thought about inference costs, it's a red flag.

Initial model training is usually R&D (OpEx). However, continuous fine-tuning or "Active Learning" that is required to keep the service running for customers can often be argued as COGS.

Underestimating the "Token-to-Revenue" ratio. Most founders guess their costs and end up with a 20% margin when they promised 70%.