The path a Biotech Startup takes—from discovering a brilliant new idea in a lab to actually getting an approved, life-saving drug to patients—is without a doubt the most difficult and expensive journey in the business world. For anyone starting a biotech company, the Business Plan for Biotech Startups isn’t just a document; it is the single most important tool you have. It must act as a precise, investor-ready strategic roadmap that confidently persuades smart, experienced life science financiers that your company is worth the huge risk because it promises a massive return on investment (ROI).

This comprehensive guide will break down every essential part of creating this plan. We will look beyond simple checklists to focus on the unique, complicated areas that investors focus on: the core science, the government approval process (the regulatory pathway), how you will protect your ideas (Intellectual Property, or IP), the special risk-adjusted financial forecasting needed for drug development, and your ultimate plan for the investors to get paid (a lucrative exit). This detailed narrative is designed to be clear, easy to understand, and engaging, fitting all the necessary key concepts into a smooth, natural flow.

What Really a Biotech Business Plan Is?

A biotech business plan isn’t just a document—it’s the story of how you turn high-stakes science into a high-value reality.

Think of it as your definitive argument for why investors should bet on you. To win them over, your plan must bridge the gap between the lab bench and the patient’s bedside by checking three boxes:

The Roadmap: A concrete, time-bound strategy that moves your discovery through the complex “valley of death” in drug development.

Risk Management: An honest look at the scientific and financial hurdles ahead, paired with a tactical plan to overcome them.

The Payoff: A clear connection between your groundbreaking research and a realistic commercial exit (ROI).

In a world of a thousand ideas, this plan is the proof that you understand both the deep science and the expensive business of saving lives.

Why Business Plan For Biotech Is Important?

At this point, you understand that developing a Biotech Startup Business Plan requires incredible effort—far more than a standard business plan. But the question remains: why is this rigorous document so absolutely vital, particularly for securing Biotech Funding? The importance boils down to three core reasons that speak directly to the investor’s need for confidence and risk mitigation.

Internal Strategic Blueprint:

For the founders and the team, this document forces clarity and alignment. It makes you articulate every assumption, from the science behind your drug’s Mechanism of Action (MoA) to the complexity of the regulatory pathway and the final commercialization pathway. By detailing every Development Milestone and the cost to achieve it, you create a system of accountability. Without this detailed plan, a Biotech Startup simply drifts, wasting precious time and capital.

Risk Management Tool:

Unlike typical businesses, the path to market for a drug is fraught with inevitable failure points. A strong Biotech Business Plan is essential because it forces you to face these risks honestly and develop a systematic Risk Mitigation Framework. You demonstrate that you have thought through potential setbacks—such as trial failure or an IP challenge—and have contingency plans in place. This exercise in foresight transforms uncertainty into a manageable challenge, which is exactly what a sophisticated life science financier needs to see before committing millions of dollars.

Investor-Ready Financial Tool:

It is the direct bridge between your scientific innovation and a credible return on investment (ROI). It houses your specialized financial projections, including the complex Financial Model for Biotech Startups. This is where you use the risk-adjusted financial forecasting to justify your valuation using the rNPV method, typically modeled in a biotech valuation model template xls. By providing this level of detail, you assure the investor that the high-risk gamble is mathematically sound and that their money is being used effectively to reach a clear and valuable Exit Strategy (like an acquisition or IPO). Ultimately, the plan is important because it is the only way to transform groundbreaking science into a fundable, structured business opportunity that speaks the language of capital.

Key Components Of Biotech Business Plan

Regardless of whether you start lean or traditional, every successful Business Plan For Biotech Startups must rigorously address the following ten components. These sections systematically build the case for your massive return on investment (ROI), linking the scientific opportunity to the financial outcome.

The Executive Summary: The Ultimate Hook

As established, this is the most critical section. It must be a powerful two-page distillation of the entire plan, written clearly to define the massive problem, your unique, proprietary solution, the size of the market, the money you are asking for, and the large potential reward (ROI). It acts as the gateway to securing the initial interest from potential life science investors.

Why It Matters in Bullets:

- First Filter: It decides in minutes whether the investor reads the remaining 30+ pages.

- Clarity: It proves you can summarize complex science into a clear, fundable pitch.

- The Ask: It immediately defines the Funding Ask and the Value Inflection Point that capital will unlock.

Company Description: The Why and What

This section goes beyond the summary to detail the why—the founding vision and mission—and the what—the current legal status and history of the company. It explains where the science originated (often from a university) and how the core Intellectual Property (IP) was licensed or developed. It clearly defines the legal structure of the Biotech Startup and its geographical location, providing the essential legal and historical context for the investor.

Why It Matters in Bullets:

- IP Ownership: It confirms clear legal ownership of the core scientific asset and the IP rights.

- Founding Story: It provides the crucial context and vision that drives the mission.

- Legal Structure: It ensures the company is legally organized for future investment and growth.

Company Structure & Management: The Execution Engine

Investors fund people first. This section must showcase the expertise and experience of your core management team. Investors need to see leaders with a proven track record of navigating the difficult regulatory pathway and managing complex clinical trials. Highlight individuals who have brought drugs through to successful Exit Strategy (acquisition or IPO). Detail your Scientific Advisory Board (SAB), showcasing prominent, respected Key Opinion Leaders (KOLs) who validate your science and lend credibility to your entire venture.

Why It Matters in Bullets:

- Execution Risk: It proves the team has the experience to overcome inevitable scientific and clinical challenges.

- Credibility: The SAB lends scientific authority and external validation to your data.

- Operational Capacity: It shows you have the necessary expertise (regulatory, clinical, and financial) to operate a complex Biotech Startup.

Market Analysis: The Opportunity Size

This section proves there is a substantial number of patients who need and can afford your therapy. It involves a detailed breakdown of the total patient population (TAM), the portion you can realistically serve (SAM), and the achievable share you can capture (SOM). Crucially, the Market Analysis must detail the limitations of the current Standard of Care (SoC) and why your drug is a definitive improvement, providing the economic justification for a premium Drug Price and a high potential for Peak Sales.

Why It Matters in Bullets:

- Scalability: It justifies the potential for massive ROI by quantifying the patient need.

- Unmet Need: It validates that the market failure (the SoC gap) is significant enough for a new, expensive treatment.

- Sales Potential: It provides the core inputs needed for the Financial Model for Biotech Startups to calculate Peak Sales.

Products or Services: The Core Asset

This goes deep into the scientific asset, expanding on the data from the Executive Summary. It details the Mechanism of Action (MoA), providing all the relevant, reproducible Pre-Clinical Data (charts, tables, and safety profiles). If your company relies on a platform technology (a method that can generate multiple drug candidates), this section explains how that platform creates multiple “shots on goal,” which is a powerful way to mitigate the Risk of a single drug failure.

Why It Matters in Bullets:

- Scientific Validation: It proves the drug works through reproducible, independent Pre-Clinical Data.

- Safety Profile: It provides early assurance that the drug is safe enough to proceed to human testing.

- Defensibility: It establishes the differentiation from the Standard of Care and strengthens the IP case.

Regulatory Plan: The Path to Approval

This is the detailed roadmap for government approval. It outlines the specific steps required to transition from the laboratory to human testing, including the timeline for the IND Submission and the design of the Clinical Trials (Phase I, II, and III). You must clearly define the primary and secondary endpoints (what constitutes success) for each trial. This section also addresses Manufacturing and CMC (Chemistry, Manufacturing, and Controls)—how the drug will be reliably produced at the required scale for human trials.

Why It Matters in Bullets:

- Timeline and Budget: It provides the critical time and cost estimates for the risk-adjusted financial forecasting.

- De-Risking: It proves you have a clear plan for navigating the toughest part of the regulatory pathway.

- Manufacturing Readiness: It assures investors you can produce a consistent, high-quality drug for trials (CMC).

Marketing, Exits & Sales Strategy: Monetizing the Asset

This section connects the science to the financial return. The Marketing and Sales Strategy focuses on the plan to gain market access—your Reimbursement Strategy—showing how you will convince payers (insurance companies) that your therapy’s value justifies its cost. Most importantly, it clearly articulates the Exit Strategy—how the investor will receive their ROI. Will you pursue an Acquisition (M&A) by a strategic buyer after a successful Phase II readout, or are you planning a massive IPO? Identifying potential buyers and timelines is essential here.

Why It Matters in Bullets:

- ROI Validation: It defines the most likely path to a liquidity event and a massive financial return.

- Payer Acceptance: It addresses the critical question of Reimbursement Strategy and market access.

- Buyer Focus: It proves the company is building an asset with specific Strategic Buyers in mind.

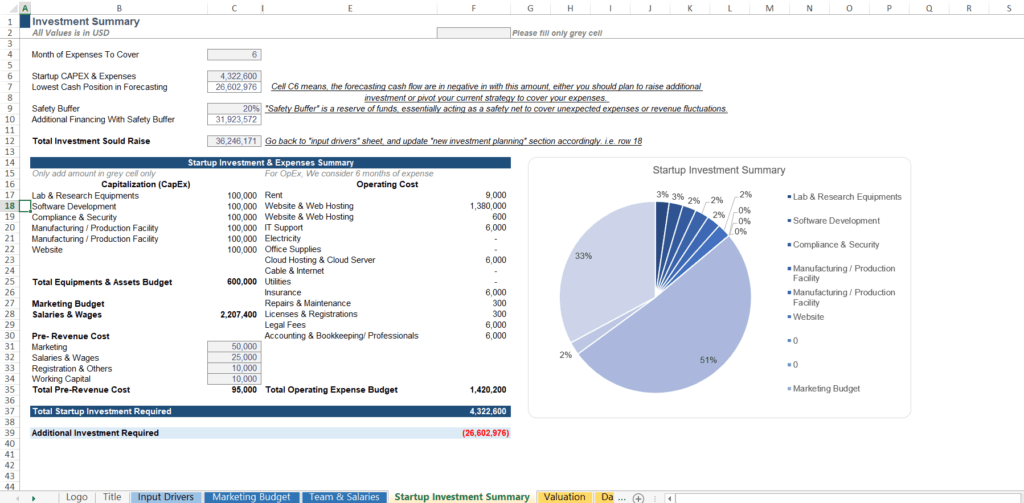

Financial Model for Biotech Startup: The ROI Engine

This is the quantitative heart of the Biotech Business Plan. It includes your detailed Biotech Financial Model template for the next 10–20 years. It must detail the high Burn Rate and R&D Costs, project the long-term Peak Sales or IP sold, with what if analysis, and calculate the advanced valuation. This section leverages the Investor Ready financial forecasting model template to perform the risk-adjusted financial forecasting using the rNPV method, typically presented in a biotech valuation model template xls, which justifies your company’s current worth.

Why It Matters in Bullets:

- Valuation Justification: It uses the specialized rNPV method to scientifically justify the company’s current value.

- Cash Flow: It details the Burn Rate and ensures the Funding Ask provides sufficient Cash Runway.

- Investment Metric: It provides the key ROI metrics (e.g., potential IRR) that VCs use to compare investments.

Building a biotech financial forecasting model that accounts for production lag, IP value, and complex revenue streams can take weeks of manual work.

We’ve done the heavy lifting for you. Our Biotech Startup Financial Model allows you to:

Plug & Play: Use 100+ customized assumptions to see your startup’s worth instantly.

Project Cash Flow: Precisely forecast when you’ll go to market or sell your IP.

Pitch with Confidence: Use advanced valuation methods used by top-tier investors.

[Download the Model Below] and get a head start on your next pitch.

Risk Analysis: Facing Reality Head-On

This entire section is dedicated to the Risk Mitigation Framework. It systematically lists the major risks—Scientific Risk (does the drug work?), Regulatory Risk (will the FDA approve the trials?), Financial Risk (running out of money), and IP Risk (patent challenges)—and provides clear, concrete, budgeted solutions for each one. By demonstrating this high level of preparedness, you significantly increase investor confidence.

Why It Matters in Bullets:

- Credibility: It proves the team is realistic and strategically mature, not just overly optimistic.

- Contingency Planning: It provides budgeted “Plan B” scenarios for major failures, protecting the investment.

- Investor Comfort: It systematically addresses the primary fears of any life science financier.

Milestones & Timeline: The Execution Schedule

This section summarizes the entire plan into a simple, time-bound schedule. The Milestones are the critical, value-creating achievements (e.g., successful IND submission, Phase I data readout) linked directly to the required Funding Ask. This provides investors with a clear tracking mechanism, allowing them to monitor your progress and anticipate future funding rounds, reinforcing the view of a well-managed Biotech Startup.

Why It Matters in Bullets:

- Accountability: It provides a clear, time-bound schedule against which the team’s performance can be judged.

- Funding Tranches: It visually links the investor’s money directly to the creation of value inflection points.

- Future Planning: It allows investors to project when the next large funding round will be necessary.

Learn:

Real Business Milestones Most Founders Learn Too Late

Top Startup Funding Sources to Fuel Success and Business Growth

Why Your Startup Financial Model Might Be Sabotaging Your Strategy (And How to Fix It)

SWOT and Competitor Analysis

Beyond the basic sections, a sophisticated Business Plan For Biotech Startups includes detailed analyses that prove you understand the broader landscape and your position within it.

- SWOT Analysis: The SWOT analysis forces your team to objectively look at internal Strengths (e.g., proprietary IP, exclusive license to a platform technology) and Weaknesses (e.g., high early Burn Rate). It then looks externally at Opportunities (e.g., an expanding patient population) and Threats (e.g., potential patent challenge). This comprehensive view shows the investor that you are realistic about your chances.

- Why It Matters: It ensures that Weaknesses and Threats are proactively addressed within the Risk Mitigation Framework.

- Competitor Analysis: A full Competitor Analysis is a deep dive into the specific companies and drugs that could challenge your market entry. You must analyze not only the existing Standard of Care (SoC) but also other Pipeline Competitors in earlier stages. The goal is to prove, definitively, that your drug offers a superior Value Proposition that justifies a high market share.

- Why It Matters: It justifies your estimated Drug Price and proves your differentiation is real and sustainable against strong rivals.

- SWOT Analysis: The SWOT analysis forces your team to objectively look at internal Strengths (e.g., proprietary IP, exclusive license to a platform technology) and Weaknesses (e.g., high early Burn Rate). It then looks externally at Opportunities (e.g., an expanding patient population) and Threats (e.g., potential patent challenge). This comprehensive view shows the investor that you are realistic about your chances.

Formatting the Business Plan: Clarity is Confidence

In a complex field like biotech, how you present the information is almost as important as the information itself. Your Biotech Business Plan should be professionally bound or digitally formatted for easy navigation. Appendices should contain the scientific papers, detailed contracts, and the complete Biotech Financial Model template—including the tabs for biotech valuation model template xls and risk-adjusted financial forecasting.

- Why It Matters: A professional look signals a mature, organized Biotech Startup team, and clear formatting allows investors to quickly navigate to their areas of concern (e.g., the rNPV calculation).

Update Frequency: Keeping the Roadmap Current

The Biotech Business Plan is not a static document; it is a living blueprint. The core financial projections in the Financial Model for Biotech Startups must evolve as the company moves through its high-risk stages. The plan should be formally reviewed and updated whenever a major Development Milestone is reached—for instance, after completing IND Submission or receiving the final readout from Phase I Trials.

What Makes a Truly Strong Biotech Business Plan?

What separates a funded biotech startup from a failed one? Credibility. Whether you’re pitching in Boston or London, investors don’t just buy your science—they buy your execution.

To win, your plan must excel in three high-stakes areas:

Honest Risk Assessment: Move beyond optimism. Identify your scientific and regulatory hurdles and provide a “Risk Mitigation Framework” with the budget to solve them.

Clear Value Creation: Every dollar you ask for must hit a Value Inflection Point. If the money doesn’t lead to a measurable jump in valuation, it’s not an investment—it’s just an expense.

Financial Rigor: Use the industry’s “language of value.” By applying advanced valuation methods like rNPV (risk-adjusted Net Present Value), you prove that the future Peak Sales justify the risk taken today.

Learn:

How to Do Startup Valuation Using 8 Different Methods

How to do Startup Valuation Using a Discounted Cash Flow Model (DCF Valuation)

Why EBITDA is Important for Startup Valuation

Pre-Money vs Post-Money Valuation

What is the First Chicago Method for Startup Valuation?

The Simple Guide to Unicorn Startups

The Funding Ask: Selling Value, Not Costs

Stop treating your “Funding Ask” as a plea for help. Instead, present it as a timed invitation to create wealth.

To win over investors, your pitch needs three things:

A Clear “Cash Runway”: Don’t just ask for a random number. Ask for enough to last 18–24 months. Show exactly how you’ll spend it (e.g., 40% on Clinical Trials, 30% on Manufacturing).

The “Value Inflection Point”: This is the magic moment where the company’s worth jumps. Instead of “We need $10M,” say: “We are raising $10M to finish Phase I. Success here triples our valuation and sets us up for a massive Series B.”

A Fair Deal: Use your financial models (like rNPV) to explain why your price is fair. Your valuation should reflect the hard work you’ve already done to “de-risk” the science.

Learn:

Why Tracking Cash Runway is Crucial for Startups and VCs

Download Free:

Your Blueprint for Funding Success, Simplified.

You have now mastered the blueprint for creating a successful Biotech Business Plan. As a business plan writing expert, I can assure you that the true differentiators lie in the nuanced strategies that veteran life science financiers prioritize but rarely talk about publicly.

If you are ready to transform your scientific breakthrough into a fundable business opportunity, Excel Business Resource specializes in providing the precise tools and expert consulting required. We offer bespoke services, including the complex, fully integrated Biotech Financial Model template and the comprehensive, compelling Biotech Business Plan customized for your specific technology.

Stop guessing your valuation. Leverage our expertise to build your biotech valuation model template xls with confidence, ensuring your Funding Ask is not just precise, but utterly irresistible. Excel Business Resource is your essential partner in achieving that massive return on investment (ROI).