The Billion-Dollar Blueprint for BESS Investment

The global energy transition is no longer a concept—it’s a massive, multi-trillion-dollar infrastructure buildout. At its core, the most critical component enabling this transformation is the ability to store energy. This is why Battery Energy Storage System (BESS) projects have shifted from niche technology to essential, bankable infrastructure assets, attracting a flood of institutional capital.

As an energy infrastructure consultant and financial modeling expert with hands-on experience in closing multi-megawatt BESS deals, I’ve seen firsthand what separates a profitable project from a non-starter. The key is not just a great location or a competitive EPC bid—it’s an airtight, investor-ready BESS Business Plan.

This article is designed as a practical roadmap for project developers, energy startups, and financial analysts. It cuts through the fluff to detail the exact structure, financial metrics, and strategic insights required to craft a BESS business plan that compels investors, lenders, and equity partners to commit capital. We will explore the nuances of energy storage economics, from CAPEX to sophisticated revenue stacking, and provide a clear framework for your investment plan template for BESS.

If you aim to secure financing, your business plan must speak the language of profit, risk mitigation, and scalability. This guide ensures it does.

What Is a Battery Energy Storage System (BESS)?

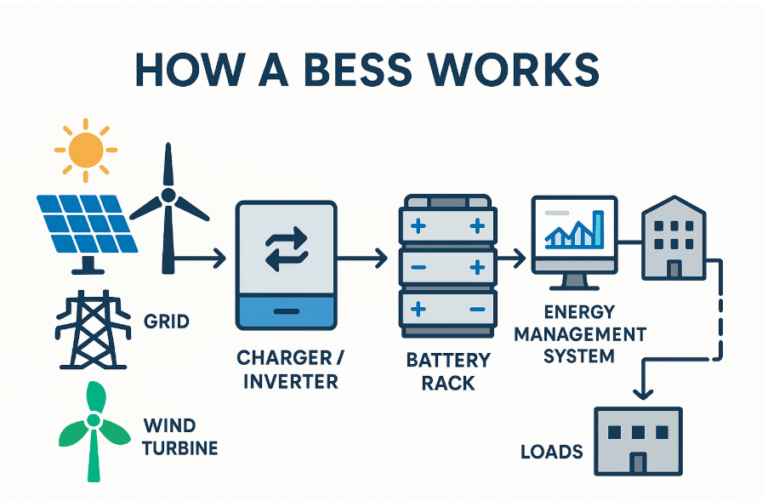

A Battery Energy Storage System (BESS) is a technology that captures energy from the grid, a solar array, or a wind farm and stores it chemically for later use. It’s essentially a giant, intelligent battery pack that provides flexibility and resilience to the power network.

The core technology often uses Lithium-ion batteries (though flow batteries and others are emerging), paired with a Power Conversion System (PCS) and an advanced Energy Management System (EMS).

Grid-Scale vs. Commercial vs. Hybrid Renewable BESS

- Grid-Scale BESS: Typically 50 MW+ projects, connected directly to the high-voltage transmission or distribution network. Their primary function is to support grid stability, defer infrastructure upgrades, and execute large-scale energy arbitrage. These are pure infrastructure plays, often requiring hundreds of millions in capital.

- Commercial & Industrial (C&I) BESS: Smaller systems (100 kW to 5 MW) installed on-site at businesses. The key revenue drivers are peak shaving (reducing peak demand charges) and demand charge management, which are highly attractive in high-tariff geographies like California, New England, or Australia.

- Hybrid Renewable BESS (Solar-plus-Storage): A BESS system co-located and integrated with a renewable generation source, such as a solar farm. The storage allows the project to shift clean energy delivery to high-value periods, capture federal or local incentives (like the US ITC adders), and firm up intermittent power supply.

Refference: coloradostandby.com

Why Investors Care About a Strong BESS Business Plan

Investors, whether private equity, infrastructure funds, or major banks, view BESS as an essential bridge asset in the energy transition. However, they are fundamentally conservative: they are seeking predictable, risk-mitigated, long-term returns.

A robust BESS business plan serves three critical functions for the investor:

- Bankability: It must prove the project can secure debt financing. This means showing a stable revenue profile, a strong Debt Service Coverage Ratio (DSCR), and a financially sound off-take or services agreement.

- Scalability: Investors want to deploy large amounts of capital efficiently. They look for evidence that the first project is a repeatable blueprint that can be scaled across a region or country (e.g., US PJM/ERCOT, UK, Germany, or the UAE).

- Risk Mitigation: The plan must explicitly and intelligently address the three major BESS risks: Technology Risk (battery degradation, fire), Market/Revenue Risk (price volatility in energy services), and Regulatory Risk (changes to interconnection or market rules).

Key Components of a Profitable BESS Business Plan

Your plan is a selling document, structured to guide the investor from the market opportunity to the final projected return.

- Executive Summary: The Investor Hook

This is arguably the most important section. Keep it to one page. Do not summarize the entire document; summarize the opportunity.

- The Ask: State the total capital required, the equity/debt split, and the funding gap you are seeking to fill.

- The Return: Clearly state the projected equity Internal Rate of Return (IRR), the project’s Net Present Value (NPV), and the expected capital stack structure.

- The Edge: What is your unfair advantage? Is it a superior interconnection queue position, a proprietary software platform, a secured long-term contract (PPA/ESA), or a team with deep local expertise?

- Market Opportunity and GEO-Specific Demand

Do not generalize. Your plan must be GEO-friendly and show deep local insight. The need for BESS differs wildly between, say, Texas (ERCOT) and Germany (high renewable penetration).

- In the USA: Focus on specific Independent System Operator (ISO) regions (e.g., PJM, CAISO, NYISO, ERCOT). Detail the capacity market needs, transmission congestion drivers, and the viability of ancillary services (like frequency regulation).

- In Europe: Highlight the grid stability challenges driven by intermittent wind and solar. Focus on capacity mechanism auctions (UK, Ireland) or frequency control market structures (Germany, Belgium).

- In the Middle East & Asia: Emphasize the need for reliable power to support rapid industrial growth and address peak-load challenges in hot climates. Storage can defer multi-billion dollar peaker plant or transmission line investments.

- Technology & System Design

Investors are not engineers, but they need assurance on bankable technology.

- Chemistry & Vendor Selection: Justify your choice of battery chemistry (usually Li-ion NMC or LFP) and your tier-1 vendor (e.g., Tesla, Fluence, CATL, BYD). Vendor track record matters for debt financing.

- Capacity & Duration: Clearly state the Megawatt (MW) and Megawatt-hour (MWh) capacity and the hours of duration (e.g., 100 MW / 400 MWh, or 4-hour duration). Justify the duration based on the dominant revenue stream (e.g., 4-hour is optimal for energy shifting in California).

- Performance Guarantees: Present the guaranteed operational efficiency (round-trip efficiency – RTE) and the battery degradation curve over the project’s life (20+ years).

- Revenue Streams: The Engine of Profitability

This section is the heart of the BESS business plan & for this you would need a professional & detailed BESS financial model template to convince investor on Returns.. Profitable BESS projects utilize revenue stacking, deriving income from multiple services simultaneously (or over the course of a year).

- Energy Arbitrage (Wholesale): Buying cheap power during off-peak hours and selling it during expensive peak hours. This requires accurate price forecasting.

- Capacity Markets: Getting paid to be “available” to discharge when the grid needs it most, often secured via long-term contracts or capacity auctions.

- Ancillary Services (Frequency Regulation): High-value, fast-response services that balance the grid frequency second-by-second. The short, high-cycle nature of this revenue is excellent, but it drives faster degradation.

- Peak Shaving/Demand Charge Management (C&I): Reducing a commercial customer’s monthly peak power usage to dramatically cut their utility bills. Often contracted via a long-term Energy Storage Agreement (ESA).

Expert Insight: Investors prefer at least 50% of the revenue to be secured under a long-term (10+ year) contract (a PPA, ESA, or Capacity Agreement) to mitigate merchant risk. The remaining revenue can be exposed to high-yield ancillary services.

- Regulatory & Grid Interconnection Considerations

Show that the project’s pathway to operation is clear and de-risked.

- Interconnection Status: Detail your position in the interconnection queue. This is a massive de-risking step. A completed study or a signed Interconnection Agreement is a huge advantage.

- Permitting: Outline the zoning, building, and environmental permits required and your timeline for securing them.

- Incentives: Include the value of tax credits (like the US Investment Tax Credit – ITC), local grants, or accelerated depreciation benefits (if applicable in your GEO).

Investment Plan Template for BESS: The Capital Breakdown (The Path to Bankability)

Securing finance for a Battery Energy Storage System (BESS) project hinges entirely on presenting a transparent, defensible, and bankable capital structure. Investors, lenders, and grant providers each have distinct risk-return appetites, and your Investment plan template for BESS must cater to all of them by showing a clear financial hierarchy.

This section details the expected sources of funding and the exit path for equity partners, reinforcing the financial logic underpinning your BESS financial model Excel.

Capital Structure: The Funding Mix

The complexity of BESS revenue streams—often a blend of stable contracted capacity and variable merchant risk—means project financing is highly nuanced. The funding mix must balance the cheaper, but more conservative, debt capital against the higher-risk, higher-return equity capital.

Projects relying heavily on fully merchant revenue (variable market prices) will face lower Debt-to-Equity ratios (closer to 50/50), requiring more expensive equity capital to absorb the increased market risk. Projects with long-term, fixed-price PPAs can achieve higher leverage (up to 75% debt).

Expected Returns and Exit Strategy

Investors are not just buying into a technology; they are buying into a liquidity event. Your plan must clearly define the anticipated return metrics and the proven mechanism for them to realize those gains.

Expected Returns

Equity Internal Rate of Return (IRR): This is the core measure of profitability for the equity investor. The target must be competitive for the level of risk:

Fully Contracted Projects: Target 8% – 12%

Partially Merchant Projects (Typical BESS): Target 12% – 18%

Net Present Value (NPV): A positive NPV confirms that the project creates value above and beyond the cost of capital. The dollar value should be clearly stated.

Payback Period: The estimated time (in years) until the cumulative net cash flow turns positive, recovering the initial equity investment (often 6 to 10 years).

Exit Strategy for Investors

The most common and preferred exit strategy for infrastructure investors is a trade sale after the project reaches stabilization.

Primary Exit (Year 5–8): The asset is sold to a larger, long-term investor, such as a utility, pension fund, or institutional infrastructure fund. By this point, the operational risks are resolved, the initial debt has been paid down, and the cash flows are stabilized and predictable.

Valuation Methodology: The sale price is typically determined by applying a market multiple (e.g., 10x to 14x) to the project’s projected, stabilized annual Cash Available for Distribution (CAD) or EBITDA. The financial model must include this Terminal Value calculation.

Building a Strong BESS Financial Model Template

A visually compelling business plan is useless without a rigorous, dynamic BESS financial model Excel spreadsheet to back it up. This model is the true test of your project’s feasibility.

Key Sheets in a BESS Financial Model Excel

- Inputs & Assumptions: The control panel. Must include all CAPEX (battery cells, PCS, installation, land), OPEX (O&M, land lease, insurance), and technical assumptions (RTE, degradation). Transparency is key—list every single assumption.

- Revenue Model: The engine. This complex sheet calculates revenue stacking, applying prices/tariffs to the available capacity, and factoring in the battery’s state of charge (SOC) and usage profile.

- Financial Statements: Standard integrated P&L, Balance Sheet, and Cash Flow statements.

- Debt & Capital Structure: Calculates the annual debt service, loan drawdowns, and the crucial Debt Service Coverage Ratio (DSCR).

- Valuation & Returns: Calculates Project IRR, Equity IRR, NPV, and presents the cash flow waterfall to all stakeholders.

Expert Insight: Degradation & Efficiency: A fatal error is assuming constant efficiency. Your model must account for battery degradation (the loss of usable capacity over time) and its impact on available revenue and the replacement CAPEX required (the battery ‘re-power’ cost) at year 10-15. This is the single biggest technical risk investors scrutinize.

BESS Financial Model Excel – What Investors Expect

Investors use your BESS financial forecasting model to quantify risk and return. They focus on key metrics:

- Internal Rate of Return (IRR) & Net Present Value (NPV): The primary measure of value creation. IRR shows the percentage return on the capital invested; a positive NPV means the project creates value above the cost of capital.

- Debt Service Coverage Ratio (DSCR): This is paramount for lenders. It measures the project’s ability to cover its debt payments (Cash Flow Available for Debt Service / Debt Service). Lenders typically require a minimum DSCR of $1.30 \times$ to $1.50 \times$ to allow the project to be funded.

- Cash Flow Waterfall: A clear hierarchy of how annual project cash flow is distributed: 1) OPEX, 2) Debt Service, 3) Reserves, 4) Equity/Sponsor Distribution. This ensures the lender is paid first.

- Sensitivity and Scenario Analysis: The ultimate test of bankability. The investor will ask: “What if the wholesale energy price drops by 20%?” or “What if degradation is 2% worse than forecast?” Your model must be able to run these scenarios instantly, showing the impact on the DSCR and the Equity IRR.

Download Professionally Construct BESS Financial Model Excel Template

While a BESS financial model Excel Template can be a starting point, relying on generic templates for a multi-million-dollar project is a critical mistake that immediately signals inexperience to sophisticated investors.

Risks of Generic Templates

- Non-Specific Revenue: Generic models rarely handle complex, geographically-specific revenue stacking (e.g., California’s resource adequacy market or PJM’s frequency regulation).

- Missing Technical Nuance: They often fail to correctly model the technical relationship between battery State of Charge (SOC), Round Trip Efficiency (RTE), and long-term degradation.

- Incorrect Tax & Regulatory Assumptions: Tax structures, depreciation schedules, and incentive mechanisms are highly localized and complex. A free model built for the US market will fail in the European or Asian context.

Therefore utilize EBR’s Professionally crafted BESS Financial Projection Model template to begin your investment joruney.

- Save 40 Hours of Manual Work

- 100+ Customized Assumptions

- Advanced Valuation Methods Applied

- In-depth BESS Financial Projections

- Free Supports & Error Corrections

Common Mistakes in BESS Business Plans (That Kill Investor Interest)

A good consultant’s job is to stop you from making mistakes that waste time and capital.

- Overestimated Revenues (The Merchant Risk Trap): The most common error. Assuming you will capture the maximum possible spread from energy arbitrage 365 days a year is unrealistic. Investors know the high-value market will be saturated quickly. Solution: Discount merchant revenue assumptions heavily, or secure a long-term contract to de-risk.

- Ignoring Degradation & Replacement Costs: Failing to forecast the mandatory battery replacement CAPEX (the ‘re-power’ cost) in year 10-15 ruins the long-term cash flow. This cost is massive and must be factored into the model.

- Weak Market Assumptions (Lacking GEO-Focus): Applying Californian peak shaving economics to a grid-scale project in Ohio. The local grid operator rules, tariffs, and market needs must dictate the entire revenue strategy.

- Underestimating OPEX & Reserves: Forgetting to provision for spare parts, insurance, grid maintenance fees, and, crucially, a mandatory Debt Service Reserve Account (DSRA) required by lenders.

How to Make Your BESS Business Plan Investor-Ready

Your final presentation must convey a sense of control, professionalism, and bankability.

- Professional Formatting: Use high-quality visual data, charts, and a consistent, clean design. The plan should look like an institutional-grade document.

- Clear Assumptions: Dedicate a section to explicitly outlining your core assumptions for pricing, degradation, and OPEX. If an assumption is aggressive, state it clearly and justify it with data or precedent. Transparency builds trust.

- Realistic Financials: Ensure the returns align with the risk profile. A 25% Equity IRR on a 100% contracted project will be flagged as too good to be true. Investors expect high risk/high reward, or low risk/low reward—not both.

Conclusion: Your Roadmap to Financing Success

The opportunity in Battery Energy Storage System investment is historic, but the barrier to entry is high. Investors are sophisticated, demanding, and require proof—not just promises.

The BESS business plan is more than a document; it is the financial DNA of your project. By focusing on verifiable, GEO-specific market demand, demonstrating a rigorous technical understanding of degradation and efficiency, and utilizing a dynamic, transparent BESS financial model, you position your project for success.

Don’t let a reliance on a rudimentary BESS financial model excel download or weak market assumptions be the barrier to accessing capital. Secure financing by crafting a compelling, bankable narrative that speaks directly to the core concerns of every investor: predictable return and mitigated risk.

Let the EBR team help you transform your technical feasibility study into an investor-grade, bankable document. Would you like a consultation on structuring your project’s debt-to-equity ratio and optimizing your revenue stacking strategy?

Frequently Asked Questions (FAQs) on BESS Business Plans

The single most critical metric for equity investors is the Equity Internal Rate of Return (IRR), as it represents the percentage return they earn on their invested capital over the project's life.

For debt providers (lenders), the most critical metric is the Debt Service Coverage Ratio (DSCR), which ensures the project generates enough cash flow to cover its loan payments.

- Target Equity IRR: For fully contracted (lower-risk) BESS projects, targets typically range from 8% to 12%. For projects exposed to high merchant risk (relying heavily on energy arbitrage/ancillary services), targets often need to be higher, ranging from 12% to 18%, to compensate for the market volatility risk.

- Target DSCR: Lenders typically require a minimum DSCR of $1.30 to $1.50 (i.e., the project must generate 130% to 150% of the cash needed for debt service).

Battery degradation is a non-negotiable technical reality that must be explicitly modeled.

- Impact on Revenue: As batteries degrade (lose usable capacity), the available energy (MWh) decreases. This directly shrinks the amount of energy that can be bought and sold (arbitrage) or delivered for capacity and ancillary services, thus lowering revenue over time.

- Impact on CAPEX: Degradation necessitates a "re-power" or "augmentation" cost, typically occurring around year 10 to 15, where a significant portion (or all) of the battery cells must be replaced. This is a massive capital expenditure that must be factored into the 20-year cash flow projections. Ignoring it leads to a fundamentally flawed, inflated IRR.

Revenue stacking is the practice of combining multiple revenue streams from a single BESS asset to maximize financial return and mitigate single-source market risk.

It is essential because, in most major markets (like PJM, CAISO, or ERCOT), a single service (e.g., just energy arbitrage) is often insufficient to justify the high CAPEX of the system.

Example of Stacking:

- Capacity: Secure a 5-year contract to be available as a resource during peak demand (stable income).

- Ancillary Services: Utilize the system for high-speed frequency regulation for a few hours a day (high-yield, short-duration income).

- Arbitrage: Use the remaining charging/discharging cycles to buy cheap power and sell into the day-ahead or real-time energy market.

While a BESS financial model Excel free download can be useful for learning the basic structure (inputs, debt, returns), relying on it for an investor pitch is highly risky.

A project-grade financial model requires:

- Customized inputs for your specific technology (Round Trip Efficiency, degradation rate).

- A sophisticated, localized revenue engine that models the specific tariff structures and market rules of your GEO (e.g., US ISO/RTO markets, specific European capacity auctions).

Dynamic scenario and sensitivity analysis to test assumptions like commodity price changes, which generic models often lack.

Extremely important. The grid interconnection process is one of the longest lead-time and highest-risk hurdles for any energy infrastructure project.

Investors heavily scrutinize your interconnection status because:

- Risk: It de-risks the project. A signed Interconnection Agreement proves the project can connect and operate.

- Cost: The required transmission upgrades, calculated during the interconnection study, can add millions to the project’s CAPEX. Without this data, the CAPEX figures in the business plan are guesses.

Timeline: It defines your Commercial Operation Date (COD). A plan with an early, secure position in the interconnection queue is significantly more valuable than one at the back of a long queue.