The padel court business is booming globally, yet many entrepreneurs focus too heavily on building beautiful facilities without understanding the financial mechanics that actually drive profitability. After building financial models for 100+ startups across data analysis, FP&A, and business planning, I’ve seen what separates sustainable padel clubs from those that burn cash before their first tournament.

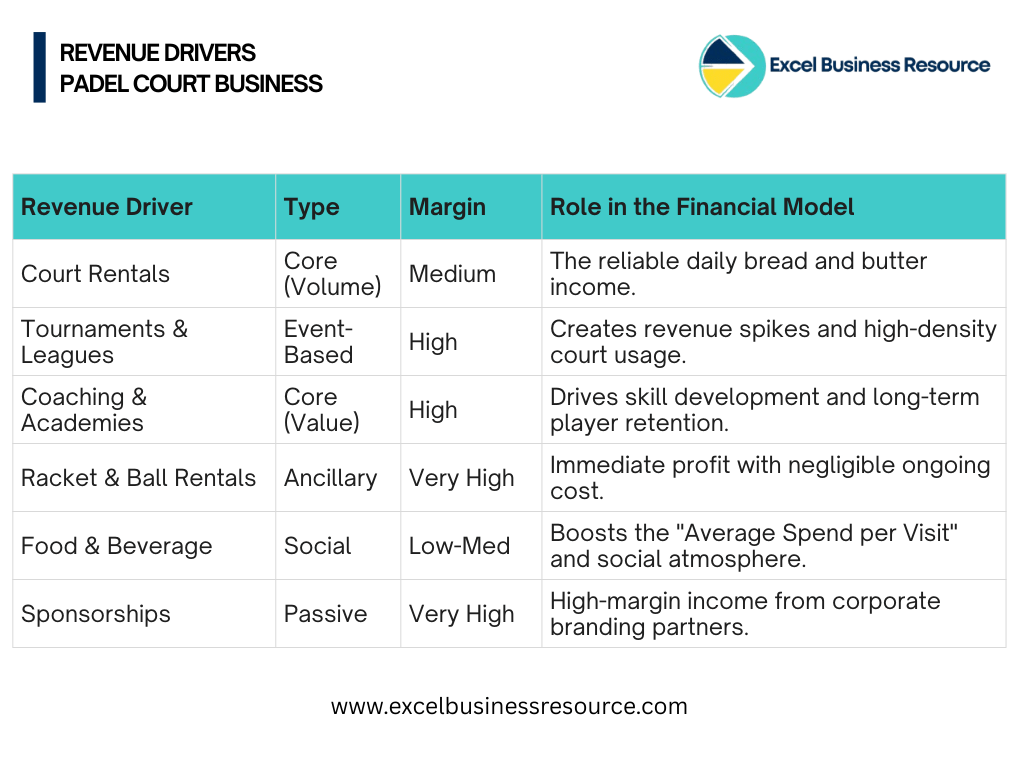

This isn’t just about hourly court rentals. The padel clubs have cracked the code on diversified revenue streams that turn padel from a simple sports facility into a profitable lifestyle destination. Whether you’re drafting your business plan for a padel court or searching for a financial forecasting model template for padel business, understanding these revenue drivers is non-negotiable.

Why Utilization Rate Matters Padel Business

Most operators obsess over occupancy rates and yes, they matter. A 60-70% peak utilization rate is widely cited as the threshold for basic profitability. But this view is too narrow for modern padel economics.

A robust Financial Forecasting Model for Padel Court projects occupancy at 30–40% in year one, scaling to 60–70% as the community grows. According to Padel FYI, peak rates in premium markets like New York can reach $200/hour, while European averages sit between €40-€60/hour.

The Math of Revenue Maximization

If you operate 4 courts for 14 hours a day at an average rate of $50/hour with 50% occupancy, your monthly revenue is approximately $42,000. However, the real profit lies in the 4th player dynamic, padel is almost exclusively played as doubles, meaning the cost is split four ways, making it highly accessible for players but lucrative for owners.

Primary Revenue Streams: Where Padel Business Actually Generate Cash

Court Bookings and Memberships:

Hourly court rentals remain the core transaction, but optimal pricing strategy separates thriving clubs from struggling ones. Dynamic pricing models where peak hours command premium rates and off-peak times offer discounts can increase revenue per available court hour by 15-25%.

- Peak Hours: 5:00 PM – 11:00 PM (Weekdays) and all day weekends.

- Off-Peak Hours: 8:00 AM – 4:00 PM (Weekdays).

Moreover, membership structures provide the predictable cash flow essential for covering fixed costs. Rolling monthly or quarterly memberships reduce churn by 15-25% compared to annual lump-sum commitments. The key is tiered plans:

- Basic access for casual players.

- Mid-tier options with limited peak-hour priority.

- Premium memberships with guaranteed booking windows and additional perks.

In Italy, where padel has matured significantly, Hype Club Centro Padel found that membership packages outperformed pay-to-play options significantly. Their Gold Plan at €150 monthly offers discounted court rentals, booking priority, training discounts, and spa partnerships a model that keeps courts rented even during traditionally slow morning hours through targeted university campaigns.

Coaching and Programming:

This is where margins expand dramatically. Certified coaching programs, clinics, ladders, and leagues monetize your courts multiple times over while building community lock-in. In established markets like Italy, players continuously train with pro-level coaches certified by national federations, making quality instruction a major profit center.

Coaching provides high margins. A club can charge $80–$120 for private lessons or $30 per person for group clinics. In our Padel Club Financial Model, we emphasize coaching as a sticky revenue driver, it improves player skill, which in turn increases their frequency of play.

Similarly, corporate events and team-building activities fill courts during weekday mornings when recreational demand drops. Junior programs create pipeline customers while generating revenue during after-school hours.

Pro-Shop and Equipment Rentals

New players rarely own their own rackets (which cost between $150 and $400).

- Racket Rentals: $5–$10 per session.

- Consumables: Balls (replaced every 2-3 matches) and grips.

- Retail: Branded apparel and high-end rackets.

Ancillary Revenue Of Padel Business: The Real Profit Differentiator

Food and Beverage Operations:

Globally, F&B is considered an essential part of padel culture, yet many U.S. operators underutilize this stream. The social nature of padel it’s played in doubles, creating natural four-person groups makes post-match food and drinks almost inevitable.

Successful clubs integrate café operations not as an afterthought but as a central social hub. The goal isn’t just selling sandwiches; it’s extending dwell time. The longer people stay, the more they spend across all categories. Clubs like Padel Social Club in London and Padel Haus in New York have built their brands around hospitality, offering saunas, bars, and lounges alongside courts. When padel is framed as a lifestyle experience rather than just a sport, customers accept higher price points and stay longer.

A small cafe or sports bar within the facility can increase the Average Revenue Per User (ARPU) by 15–20%.

Retail and Pro Shops:

Equipment sales like rackets, balls, shoes, sports wear offer attractive margins when managed correctly. However, inventory discipline is crucial.

Beyond basic equipment, branded merchandise builds community identity while generating revenue. Exclusive collections and heritage ranges create additional touchpoints with members who want to identify with your club’s culture.

Events and Tournaments:

Tournaments transform court utilization from hourly rentals to multi-day revenue events. During tournaments, courts run at maximum capacity while generating additional income through sponsorships, ticket sales, and media exposure.

Sponsorships extend beyond traditional sports brands. Clubs positioning themselves as community hubs attract “non-endemic” sponsors from automotive, finance, and wellness sectors looking to reach affluent, health-conscious demographics. Naming rights, banner advertising, and branded activations during events create revenue without requiring additional infrastructure.

Corporate bookings for team-building events represent another underutilized stream. These often occur during off-peak hours and command premium pricing for exclusive facility access.

Operational Excellence: Smart Booking Systems

In order to successfully capture your players or increase utilization rate, you must give easy access of booking slot, because if player don’t able to see available slots or don’t able to book slot on time. You would lose your revenue 100%.

Therefore modern platforms like Playtomic function as revenue management tools, not just scheduling software. They increase occupancy through real-time availability, automated waiting lists, and level-based matchmaking. Dynamic pricing integration, coaching service management, and league organization capabilities significantly increase average spend per customer.

However, over-reliance on third-party apps creates risk. When players feel more loyalty to their booking app than to your specific venue, your club becomes interchangeable. The solution is hybrid: use technology for discovery and efficiency while building direct relationships through internal leagues, social sessions, and community events.

Financial Metrics Of Padel Business That Actually Matter

As financial modeling and valuation experts, we encourage investors and operators to move beyond headline revenue figures and focus on the core KPIs of padel court operations. These metrics reveal true unit economics, highlighting profit drivers, cost inefficiencies, and areas for sustainable revenue growth.

Customer Acquisition Cost (CAC) vs. Lifetime Value (LTV):

Clubs with strong community cultures gain pricing power and lower churn. The cost of retaining existing members is far more efficient than constantly acquiring new trial users.

Revenue Per Available Court Hour (RevPACH):

This hospitality metric adapted from hotel management reveals your true earning potential. It combines court rates, F&B spend, and retail attachment to show how effectively you’re monetizing your fixed assets.

Member Contribution Margin:

Track which membership tiers actually generate profit after accounting for court time allocation, coaching costs, and facility usage. Sometimes premium tiers subsidize basic members in ways that hurt overall profitability.

The Investment Reality: What It Takes to Launch

When looking at Padel Club Valuation, investors typically use an EBITDA multiple (usually 5x to 8x for established clubs) or a DCF (Discounted Cash Flow) analysis.

A high-performing club doesn’t just sell court time; it sells a membership ecosystem. Implementing tiered memberships such as a Founder’s Member or Weekly Warrior package provides predictable monthly recurring revenue (MRR), which significantly boosts the valuation of the business.

If you’re evaluating whether to start a padel court business, the financial requirements are substantial but manageable with proper planning. Based on current market data, expect initial capital needs of $560,000 for construction and fit-out, plus working capital reserves of $353,000 to cover the 14-month average ramp-up to breakeven.

Funding typically combines 50-60% secured debt against court assets, founder equity of at least 10%, and seed investment for the remaining buffer. Debt service coverage ratios must exceed 1.25x by month nine to satisfy lenders.

The payback period ranges from 18-30 months for well-run facilities, though pre-sale strategies and early community engagement can accelerate this timeline. First-mover advantages in underserved U.S. markets offer premium pricing potential compared to saturated European markets.

Creating a comprehensive financial forecasting model for your padel court isn’t optional, it’s essential for securing funding and managing operations. Your model needs to account for seasonality in court usage, ramp-up curves for membership acquisition, and the lag between facility completion and revenue stabilization.

At Excel Business Resource, we’ve developed a specialized Padel Club Financial Model Template that incorporates these revenue drivers, seasonal adjustments, and sensitivity testing for variables like occupancy rates and pricing power. The model includes investor-ready valuation metrics, 5-year projections, and break-even analysis specifically calibrated for padel operations.

For entrepreneurs still in the planning phase, our comprehensive guide on how to write a business plan for a padel club provides the strategic framework for turning these revenue concepts into a fundable document.

Review: Sports & Fitness Financial Model Templates, If you are in other Sports Facility or Gym business.

Conclusion: Beyond the Trend

Padel represents both a cultural opportunity and a genuine economic opportunity but only for operators who understand the business model beyond court construction. The clubs winning in this space treat padel as a platform for community and lifestyle revenue, not just a sports rental business.

Success requires diversifying beyond hourly bookings into coaching, F&B, retail, and events while maintaining the operational discipline to manage fixed costs during the critical ramp-up phase. With proper financial modeling and strategic revenue planning, padel clubs can achieve sustainable profitability and significant valuation multiples as the sport continues its global expansion.

The question isn’t whether padel is a good business. The question is whether you have the financial infrastructure and revenue diversification strategy to capture that value over the long term.

Ready to build your padel club financial foundation?** Download our Padel Club Financial Model Excel Template for a complete 5-year forecasting tool built specifically for padel court operations, investor presentations, and loan applications.

Founder Ask Questions:

Based on our work with over 100+ startups, most Padel Clubs see a payback period of 24 to 36 months. This depends heavily on your Unit Economics specifically the balance between your initial CAPEX (construction and land) and your court utilization rates. High-performing clubs in urban areas can hit the break-even point even sooner by maximizing Revenue Drivers of Padel Court such as premium memberships and high-margin coaching clinics.

The total startup cost typically ranges from $250,000 to $600,000 for a standard 4-court facility. This includes court installation (roughly $35,000–$65,000 per court), turf, lighting, and essential amenities like changing rooms and a pro-shop. To avoid undercapitalization, founders should use a Startup Financial Model Template to account for "soft costs" like permits, marketing, and initial working capital during the first six months of operation.

While court rentals generate the most total volume, Equipment Rentals and Coaching usually offer the highest net margins. Racket rentals, for example, involve a one-time purchase and nearly zero ongoing cost, making them almost 100% profit after the first few uses. When we build a Financial Model template For Padel Court owners, we prioritize these ancillary streams to buffer against seasonal fluctuations in court bookings.

A Padel Club Valuation is typically calculated as a multiple of EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization), usually ranging between 5x and 8x for established facilities. To secure a higher valuation, you must demonstrate "sticky" revenue through recurring memberships and a high retention rate. Investors look for a detailed Financial Forecasting Model for Padel Court that proves your revenue isn't just based on hype but on sustainable player habits.

A basic spreadsheet often misses the nuances of the sports industry, such as seasonality, court maintenance cycles, and player churn. Our specialized Padel Court business financial model at Excel Business Resource is built on real-world data from 100+ successful projects. It allows you to stress-test your assumptions like "What happens if my occupancy drops by 10%?" & tools like sensitivity analysis, giving you the confidence to pitch to landlords and investors with data-backed authority.